Starting yesterday, the Ripple Effect of #SVBCollapse has come to #MEV area, creating tons of opportunities for both arb and 🥪 🤖, and it's a developing story.

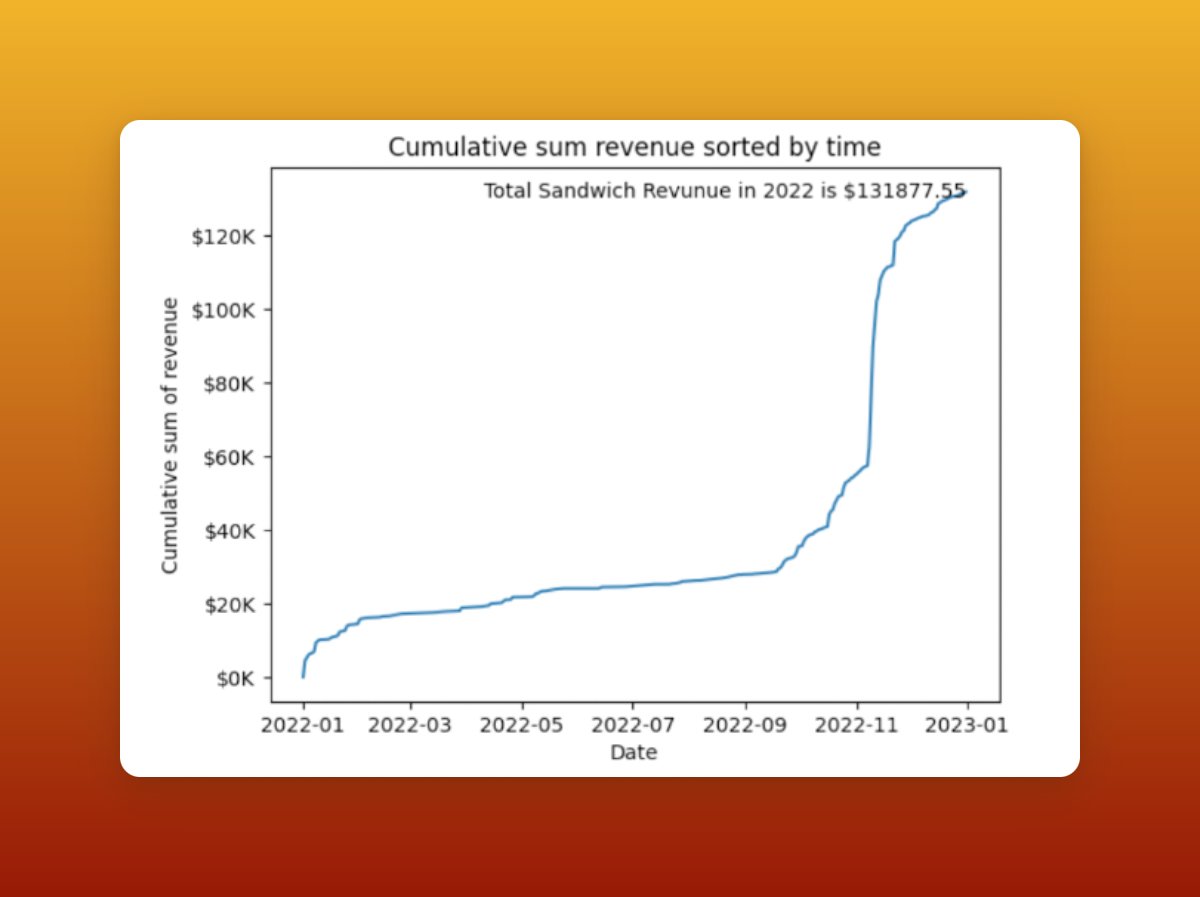

Profit of arb from Mar 9 to 11 : $260K, $697K, $3.46M.

🥪: $50K, $311K, $2.14M. eigenphi.io

Profit of arb from Mar 9 to 11 : $260K, $697K, $3.46M.

🥪: $50K, $311K, $2.14M. eigenphi.io

This crisis has impacted the oldest decentralized stablecoin: DAI. It was affected by this USDC bank run crisis and fell as low as $0.9.

The main reason is that 54% of the DAI currently in circulation is minted on a 1:1 basis through the collateral USDC. When the USDC becomes severely de-anchored, the underlying assets of the DAI depreciate, causing a shock to its market price.

USDC was introduced as collateral after the 3-12 bankruptcy in 2020 to alleviate the bottleneck in funding size that existed for over-collateralized lending, increasing the liquidity of DAI, and avoiding liquidation due to lack of liquidity. blog.makerdao.com/usdc-approved-…

USDC itself, as the most trusted reserve-based stablecoin at the time, had the advantage of being more transparent in anchoring the USD compared to USDT.

In this de-pegging event, USDC runners sold tons of USDC to AMM asset pools such as Curve's 3Pool, and another liquidity channel is to mint DAI through MakerDAO's PSM module. 1.17 Billion (increased by 60.6%) of new DAI has been supplied to the market in the past 24-hr.

Since the minting process is a 1:1 exchange, these new additional DAIs are devalued assets. Possibly fearing that the DAI will not eventually withstand the pressure of a further run on USDC after more redemption channels open on Monday, the PSM module has now been suspended.

This episode shows that even though it is a mature decentralized stablecoin for many years, there are certain hazards in extreme situations. This once again can be analyzed by the tokenomic trilemma framework proposed by EigenPhi Research previously. eigenphi.io/report/the-tok…

A token has a trilemma in simultaneously achieving three conditions of free tradability, anchored price, and independent issuance, and an attack on one condition often poses a risk.

In this case, DAI sacrifices an independent issuance strategy to satisfy the two conditions of free tradability and anchored price. The issuance mechanism is the vulnerable point of this token.

At a stage when it had not yet introduced credit assets such as reserve-based stablecoins as collateral, the model of issuing debt through over-collateralized mainstream tokens suffered a liquidity crisis in the 3-12 event, leading to a failure of the clearing system.

While the issuance mechanism after the introduction of USDC was subject to third-party credit risk implication and could, in turn, undermine the price anchoring condition of this token.

Another 3-12 is coming soon. Let's hope DAI can survive this liquidity crisis!

Another 3-12 is coming soon. Let's hope DAI can survive this liquidity crisis!

Let's look at the biggest "winner" of these past 3 days: starting from this🤖 who is picking money in a crisis! Using only $ 1.45, An arbitrage bot back-runs a poor guy to swap out more than $ 2 million under pressure. eigenphi.io/mev/eigentx/0x…

The MEV 🤖0xd8c07491cAA1eDF960db3Ceff387426d53942ea0 quickly extracted this value by back-running at the same UNI-V2 pool 0x7d36, which was an old abandoned liquidity pool with little liquidity available for the swap user. In the back-run transaction is eigenphi.io/mev/eigentx/0x…

Crises are often accompanied by great MEV opportunities. Take a look at the performance MEV transactions involving USDC, and Curve 3pool!

As I mentioned, it's a developing story. Please stay tuned, but most importantly:

STATUS UPDATE:

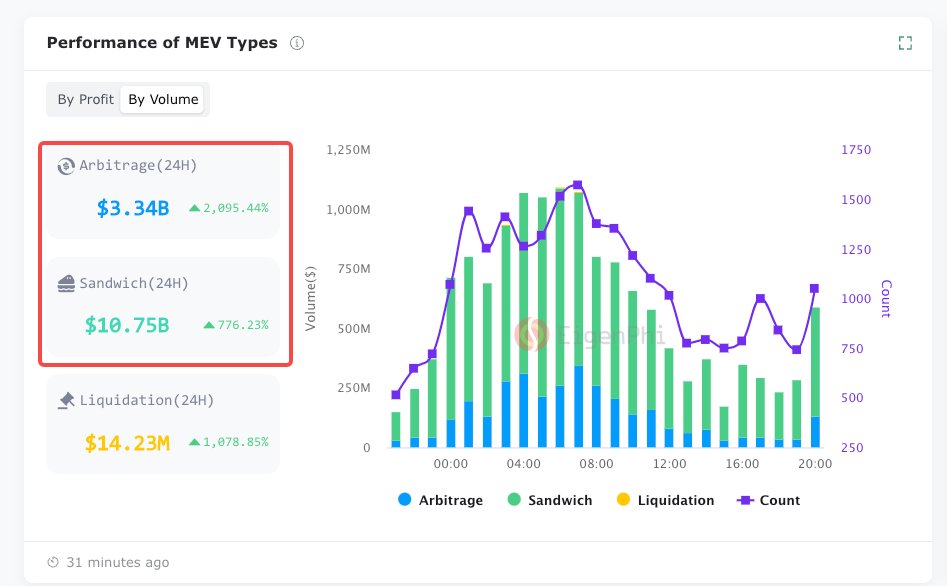

$317K profit added by sandwich front-running. In the past 24hrs, 20x arb volume reaching $3.34B; 7.7x 🥪 volume reaching $10.75B; 11x liquidation volume reaching $14.23M.

$317K profit added by sandwich front-running. In the past 24hrs, 20x arb volume reaching $3.34B; 7.7x 🥪 volume reaching $10.75B; 11x liquidation volume reaching $14.23M.

Here are the top 10 #MEVs in the last 24 hrs; 7 out of 10 are sandwiches.

The 🤖 who got $2M out of one single arb has been active all the time. eigenphi.io/mev/ethereum/c…

Another arb got it $16K profit, paying 4ETH as miner tips. bit.ly/3LoUaGC

His secret receipts include these pools: 5 on #curve, and 5 on #uniswap v3.

eigenphi.io/mev/ethereum/c…

eigenphi.io/mev/ethereum/c…

you can find the top 10 MEV regarding $USDC here: eigenphi.io/mev/ethereum/t…

For the 🔥 liquidity pools, here are the comparison of volumes between 24h and 7d. Not surprisingly, most of the volumes happened during the last 24 hours.

Wanna know any other #MEV data regarding #usdcdepeg? Leave your comment!

• • •

Missing some Tweet in this thread? You can try to

force a refresh