1/ SVB—WHAT WENT WRONG

* mgmt: debauched its balance sheet

* depositors >$250k: thought their deposit at a fractional-reserve bank wasn’t an unsecured loan to a leveraged borrower (it is)

* Fed as regulator: that morning, the top cop said Fed-supervised banks don’t have bank runs

* mgmt: debauched its balance sheet

* depositors >$250k: thought their deposit at a fractional-reserve bank wasn’t an unsecured loan to a leveraged borrower (it is)

* Fed as regulator: that morning, the top cop said Fed-supervised banks don’t have bank runs

2/ * Fed FOMC: created the “gap risk” now kneecapping community banks (which met their bank capital rqmts by buying long-term bonds)

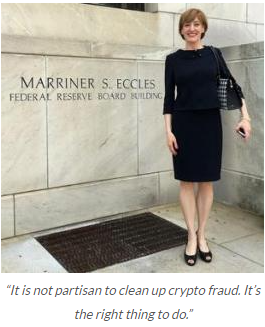

* bank risk managers: didn’t realize such gap risk (unhedged risk of a spike in interest rates) would morph into big liquidity risk amid a bank run

* bank risk managers: didn’t realize such gap risk (unhedged risk of a spike in interest rates) would morph into big liquidity risk amid a bank run

3/ * the existence of fractional-reserve banking: means the system is inherently unstable & prone to bank runs bc it’s insolvent as a whole

* banks: didn’t raise equity capital at first sign of trouble

* bond mkt: who knows where true interest rates wld be if not manipulated?

* banks: didn’t raise equity capital at first sign of trouble

* bond mkt: who knows where true interest rates wld be if not manipulated?

4/ * The DC politicians & regulators who are cheering the bank failures (the anti-tech, anti-crypto crowd): you started all this & you own it

* The so-called “free mkt defenders” in Congress: created an unstable banking system & gave US bank regulators the tools to politicize it

* The so-called “free mkt defenders” in Congress: created an unstable banking system & gave US bank regulators the tools to politicize it

5/ SO NOW WHAT?

* loud calls for bailouts🤢🤮

* the rest depends on whether bank run becomes systemic (FDIC insurance fund isn’t big enuf to handle a systemic run)

* community banks need to repair their balance sheets—can happen via lower interest rates &/or fresh equity capital

* loud calls for bailouts🤢🤮

* the rest depends on whether bank run becomes systemic (FDIC insurance fund isn’t big enuf to handle a systemic run)

* community banks need to repair their balance sheets—can happen via lower interest rates &/or fresh equity capital

6/ * on interest rates—mkt action Thurs/Fri means bond mkt already smells end of Fed QT, which disproportionately sucked deposits out of community banks. Recognize, tho, that a Fed pivot wld keep inflation running hot. Trade-off btwn systemic bank run vs hot inflation—hot potato

7/ * on banks raising fresh capital—that’s not easy for most banks to do fast (bc restrictive rules on who can invest in banks block huge pools of capital from investing in banks). Bank mergers take ~9 mos (+ the same crowd in DC that started all this hates bank mergers)

8/ Again, that DC crowd wanted to bring to heel the few tech & crypto friendly banks (incl @custodiabank), but didn’t understand how fragile the underlying system was. They’ve been v public abt their plans to rein in fintech (incl crypto)—well, they did it, & look at the mess.

9/ Last, if you think bank runs are happening fast (in <2 days for SVB), just wait until the Fed’s new real-time payment system comes online later this yr. Runs will happen even faster. Banks need to hold A LOT more cash to back deposits—but regulators aren’t requiring that yet🤷♀️

10/ Today, here’s how long it takes to withdraw your demand deposits from your bank: hours (Fedwire), 1-3 days (ACH), up to $10k instantly (physical cash). The new #FedNow system will let you move money near-instantly 24/7/365 (limited initially to $100k).

11/ It should be obvious that banks will need to hold more cash to back their demand deposits & be less leveraged than they are today, once withdrawals can happen in near real-time. The banking system will be inherently more stable once banks hold more cash—will be a good thing.

12/ I’ll end this 🧵with 2 thoughts. First, many people yesterday asked “why can’t banks just be money warehouses & charge a fee for holding my money”? That’s what banks used to be, before the system got hijacked, leveraged & financialized over years. Mkts will return us there💪

13/ That will happen by people voting w/ their feet to use better systems that are developing outside of banks. They’re improving every day. Already today 8bn people can create & use US$ on their phones w/o permission by simply running code—nascent, but it’s just a matter of time

14/ So, second, here’s a beautiful meme that went viral (27m views in 14hrs since @elonmusk tweeted it). Bank regulators have a real problem on their hands—tech is overtaking an inherently unstable banking system—and it is largely one of their own making.

/END

/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh