#US #BankingCrisis In abt 4 weeks, you will forget that a US regional Banking Crisis even happened. But IF AM WRONG, it will be WORSE IN EUROPE. A quick thread.

(1) US Banks Total Assets is at a current level of $23.8trn & $20.7 trn in liabilities. SVB, First Republic & Signature together is abt $500bn ~4% of Assets. Not Small.

But given this is more liquidity rather than Insolvency, I would not fret

Source: fred.stlouisfed.org/series/TLAACBW…

But given this is more liquidity rather than Insolvency, I would not fret

Source: fred.stlouisfed.org/series/TLAACBW…

(2) US BANKS are far more liquid these days. Back in 2008, banks had 23:1 ratio of deposit liabilities to liquid cash. QE & New regulations lead to a a fall in this ratio more like a 5x or 6x ratio these days

(3) chart shows banks’ holdings in terms of CASH & US Treasuries. SEE how its changed vs 2008 when banks were primarily doing highly risky loans.

Vs 2008, the US banks today not only have a lower exposure to "loans", within Loans, exposure to "Sub-prime" is very small.

Vs 2008, the US banks today not only have a lower exposure to "loans", within Loans, exposure to "Sub-prime" is very small.

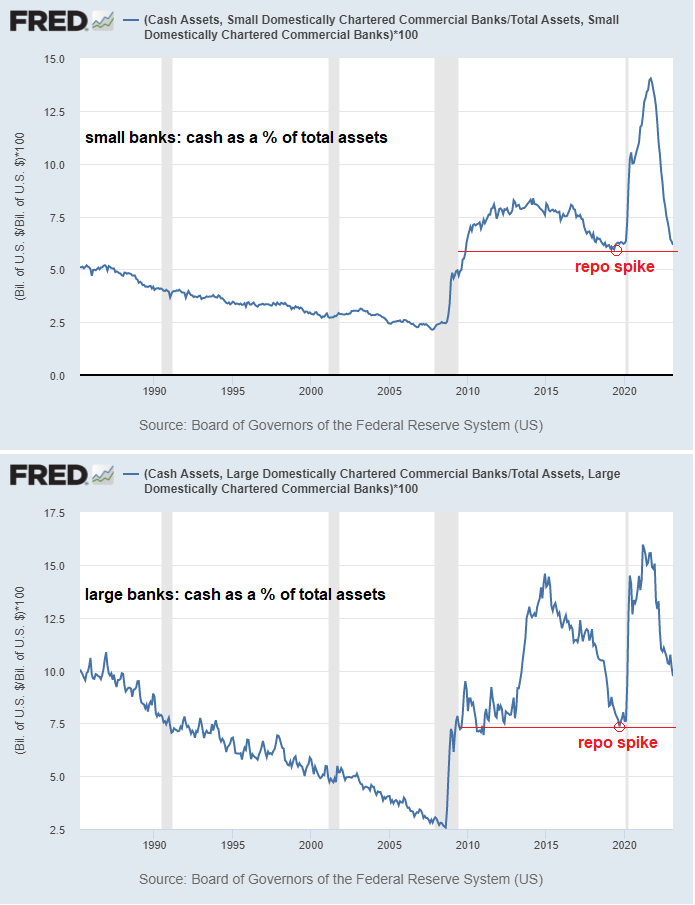

(4) With QT, the fed sucks money out of the banking system by letting securities mature off of their balance sheet, and retire those reserves. However every bank is not equal - small banks that were drained of cash more quickly vs larger peers.

(5) The two charts here compares Small Banks vs Large Banks in the context of the REPO spike that happened in 2019. This is precisely why the FED introduced Bank Term Funding Program “BTFP” on Sunday to tide over the problem

IMPORTANT (6) Now lets come back to my Initial Point. US vs EUROZONE Banks.

> US Banks are sitting on $5.5trn of treasuries (24% of GDP).

> Eurozone bank holdings of bonds holdings (other than shares are €3.86trn. Incl shares and other equity. Total is €5.47trn = 40% of GDP

> US Banks are sitting on $5.5trn of treasuries (24% of GDP).

> Eurozone bank holdings of bonds holdings (other than shares are €3.86trn. Incl shares and other equity. Total is €5.47trn = 40% of GDP

(7) Besides that

> US Banks are more profitable and generally better Teir 1 capital ratios

> EU has ONLY $110k for deposit insurance. US offers depositors $250k of Insurance

> US Banks are more profitable and generally better Teir 1 capital ratios

> EU has ONLY $110k for deposit insurance. US offers depositors $250k of Insurance

So if there was a risk of MTM impact on the banks or a run on the banks, EU banks would be far worse than US banks.

This is important for Emerging markets since most of the EM external funding comes via EU banks

This is important for Emerging markets since most of the EM external funding comes via EU banks

I know this tweet might be a bit complicated. If you has any questions pls ask. If you like it, #RETWEET it

Bottom-line, its likely you will forget about the US bank problems in the next 3 weeks...

One more point on EUROZONE Banks

https://twitter.com/stevenarons/status/1635565621529174016

#FLASH : EUROPE BANKS COLLAPSING Yesterday I mentioned in this thread I explained that US Banks are NOT as bad as EURO BANKS

Trading halted for French banking group #BNP Paribas after the stock plunged 8%. #CS CDS spread @ 1500bps …. Going Going gone !

Trading halted for French banking group #BNP Paribas after the stock plunged 8%. #CS CDS spread @ 1500bps …. Going Going gone !

• • •

Missing some Tweet in this thread? You can try to

force a refresh