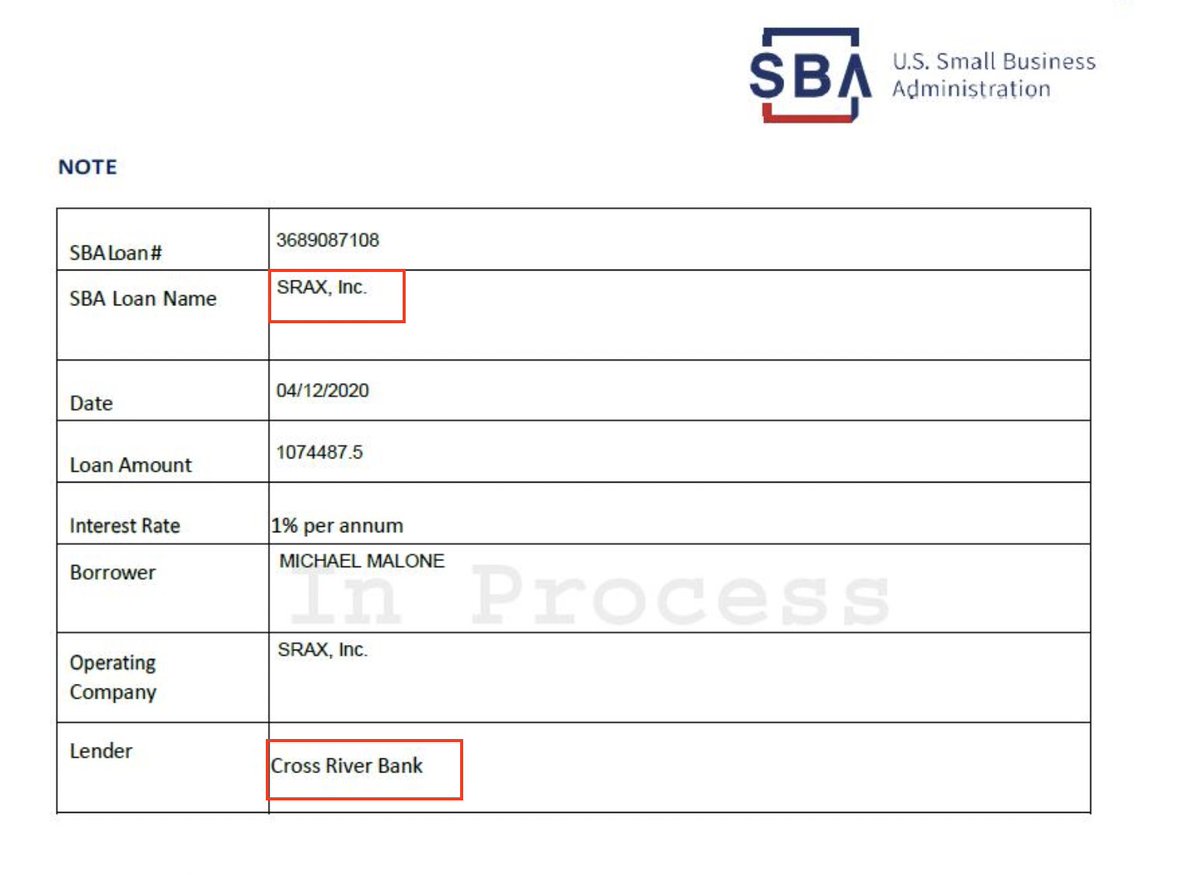

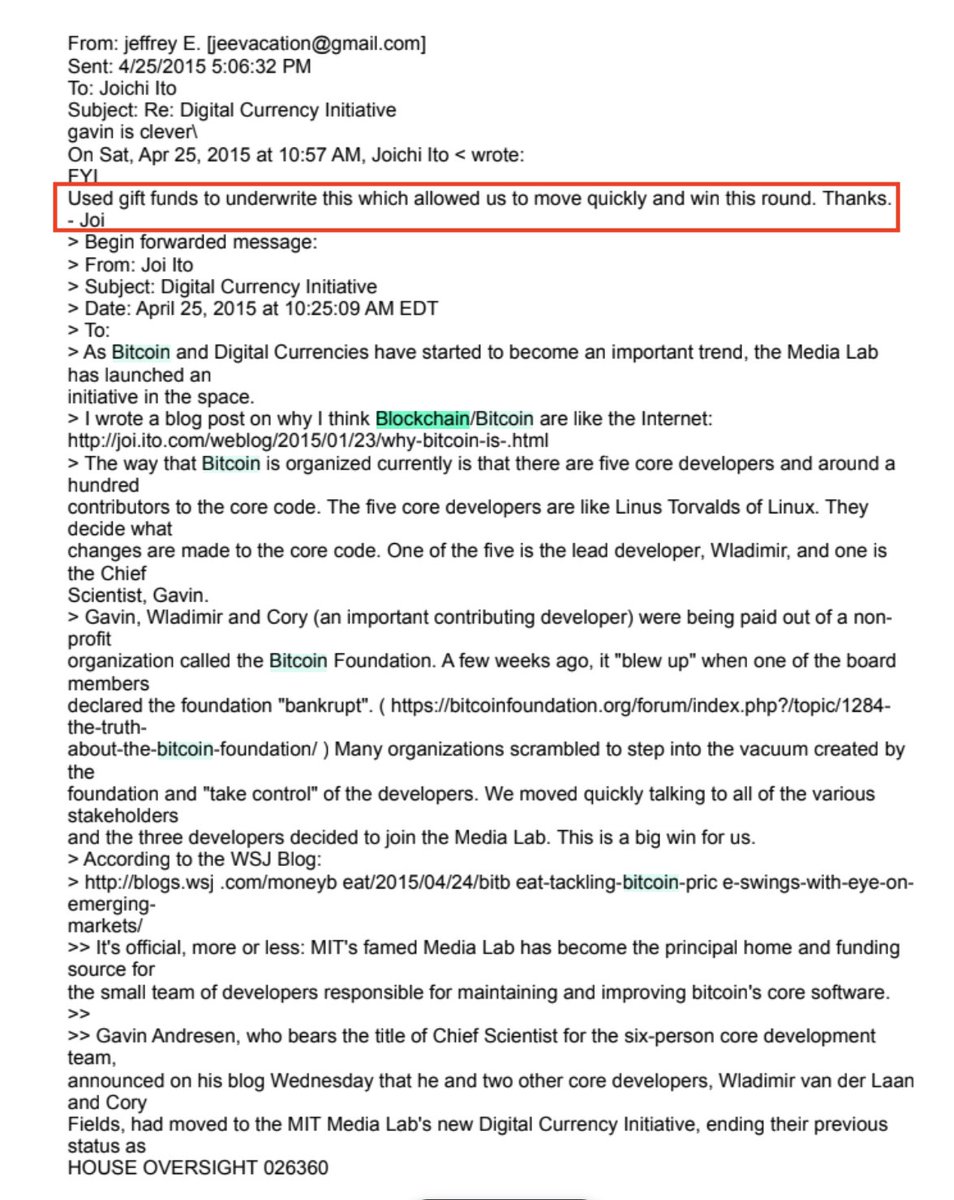

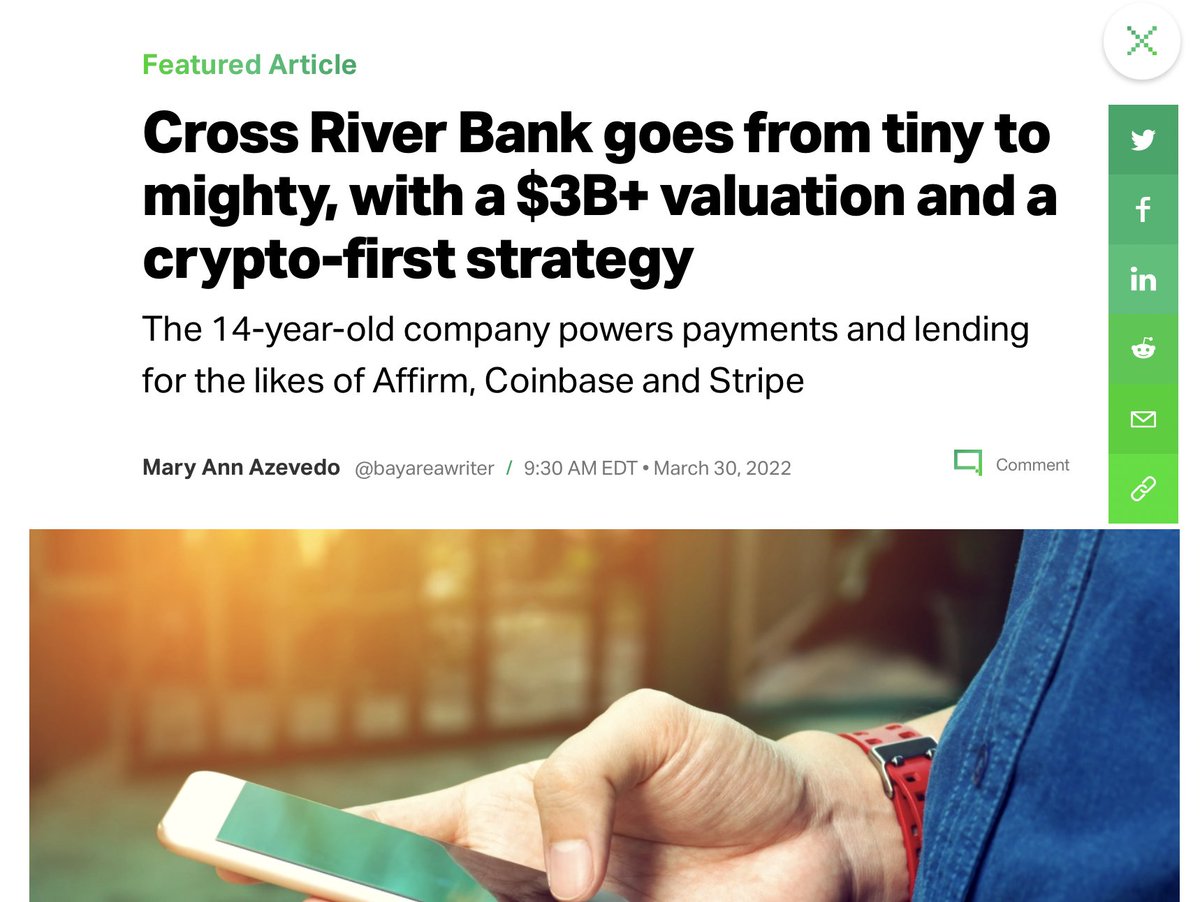

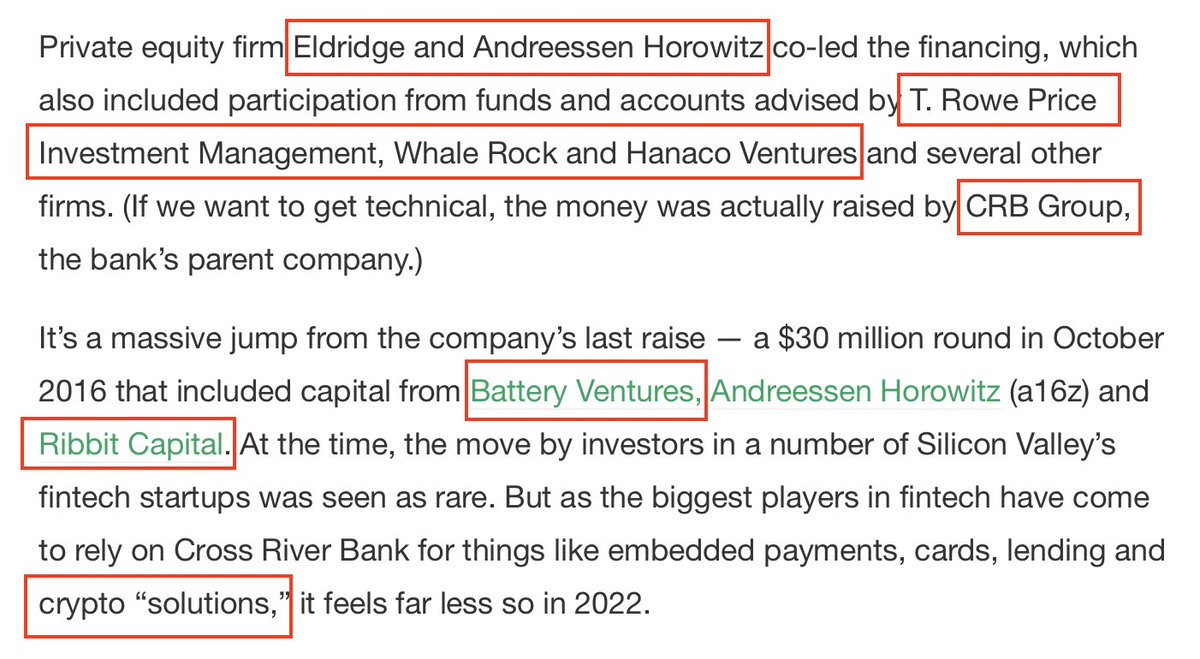

🧵1/Ω A few things about @crossriverbank, a tiny #a16z funded lender that originated more #PPP loans for "small businesses" than anyone besides Chase, BofA, and Wells Fargo, mostly for people who were not their customers.

Also @coinbase's preferred bank.

techcrunch.com/2022/03/30/cro…

Also @coinbase's preferred bank.

techcrunch.com/2022/03/30/cro…

🧵2/Ω They paid @McKinsey a bunch of money to tell the world that "while most banks originated PPP loans to their own customers, Cross River leads in originations to new customers"

mckinsey.com/industries/fin…

mckinsey.com/industries/fin…

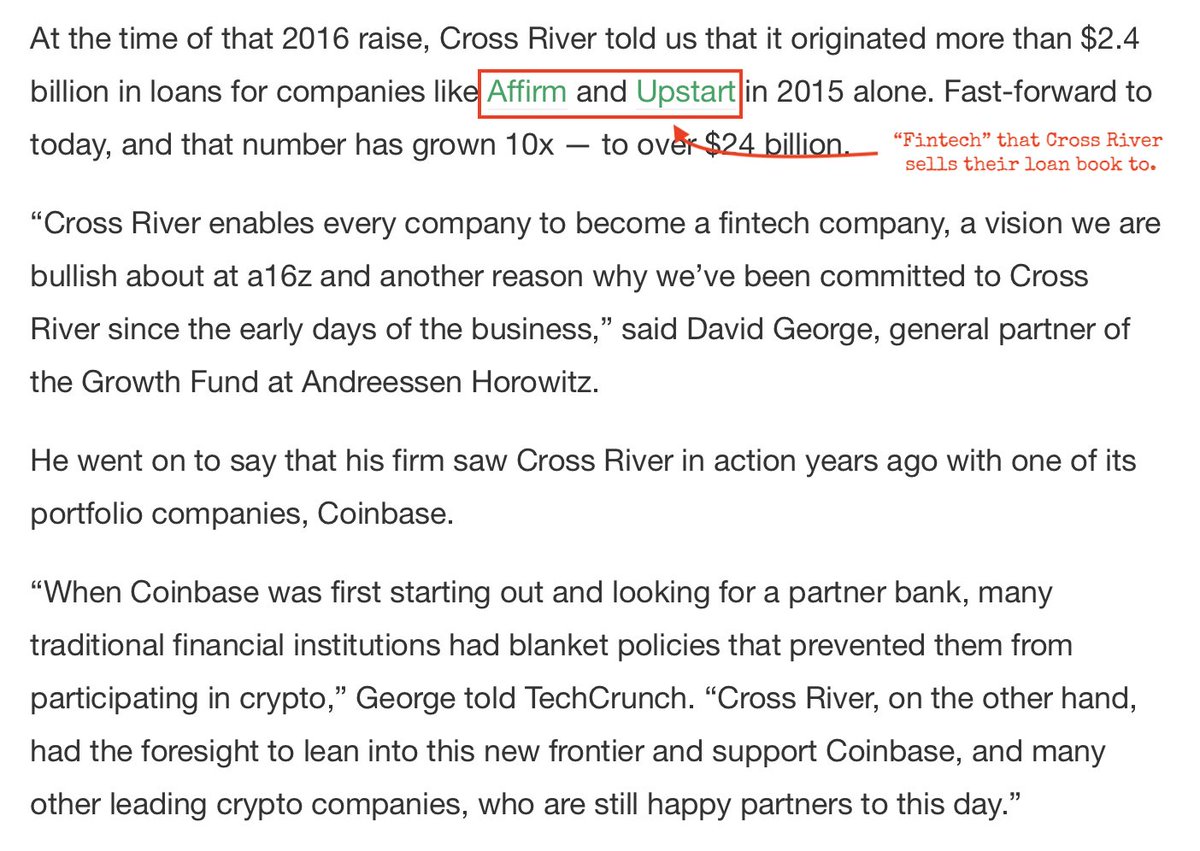

🧵3/Ω Unlike other banks that blew up on "fund banking" recently (*cough* $SBNY $SIVB *cough*) @crossriverbank does their "fund banking" differently:

They package all the loans and sell them to weird "fintech" companies like @Upstart. @mikulaja

They package all the loans and sell them to weird "fintech" companies like @Upstart. @mikulaja

🧵4/Ω

100,000 #PPP / covid relief loans, mostly to new customers, processed by a super tiny bank @crossriverbank

Basically claiming to have the most incredibly skilled and fastest fraud prevention team at any bank on the planet by orders of magnitude 🚩

nytimes.com/2020/06/23/bus…

100,000 #PPP / covid relief loans, mostly to new customers, processed by a super tiny bank @crossriverbank

Basically claiming to have the most incredibly skilled and fastest fraud prevention team at any bank on the planet by orders of magnitude 🚩

nytimes.com/2020/06/23/bus…

🧵5/Ω

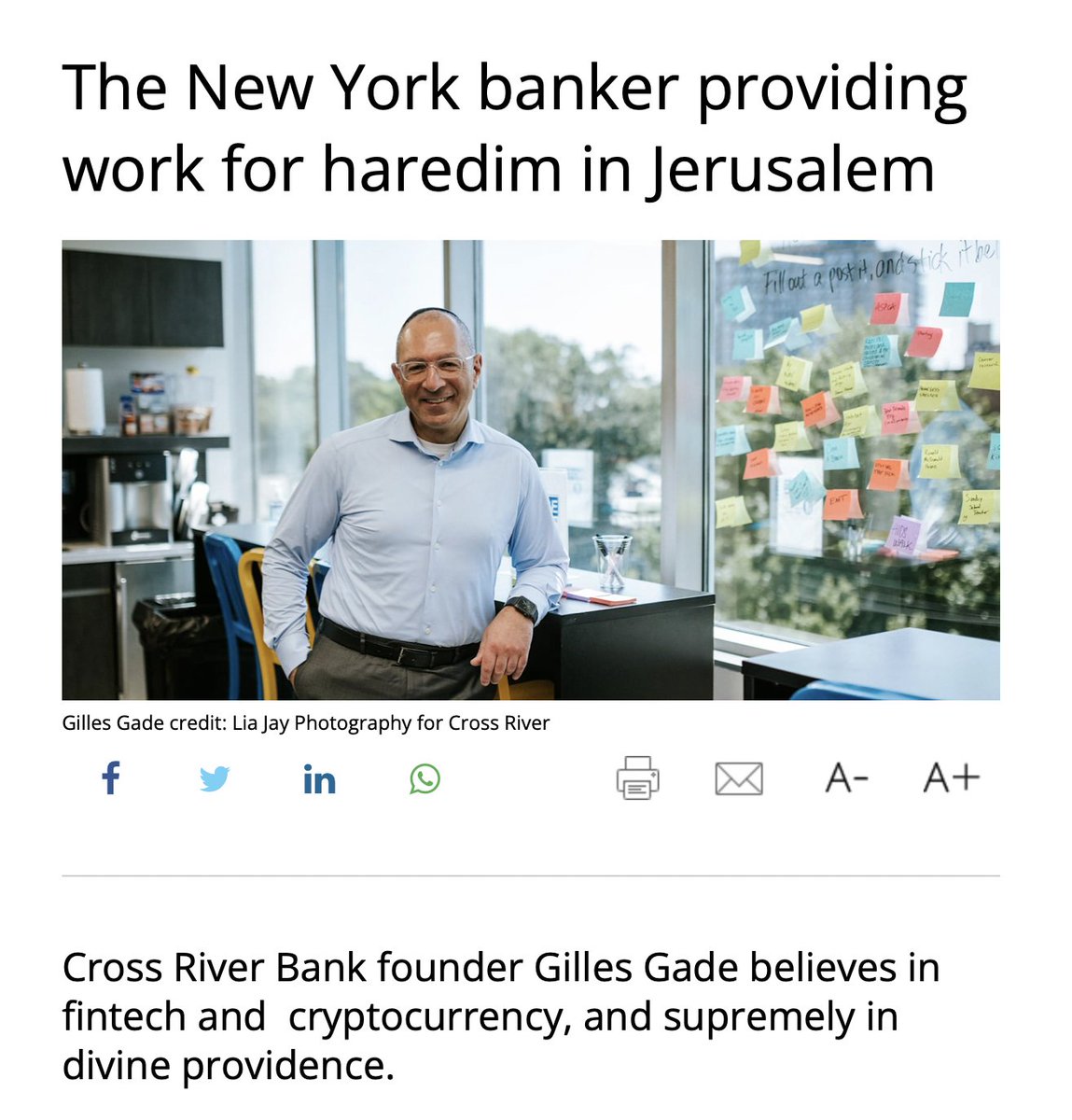

Much like criminal mastermind Alan Lane (CEO of $SI) and noted theologian #ScottShay (president of $SBNY), the CEO is deeply religious (and wants you to know it).

They also employ a lot of Haredim, a historically undereducated population in Israel.

en.globes.co.il/en/article-The…

Much like criminal mastermind Alan Lane (CEO of $SI) and noted theologian #ScottShay (president of $SBNY), the CEO is deeply religious (and wants you to know it).

They also employ a lot of Haredim, a historically undereducated population in Israel.

en.globes.co.il/en/article-The…

🧵6/Ω

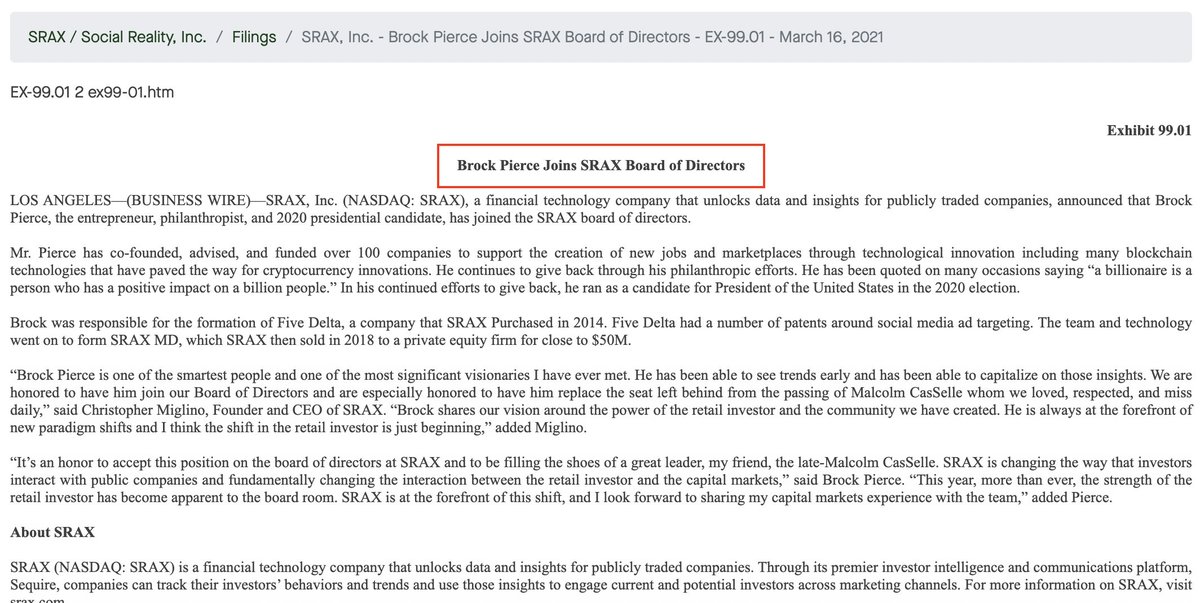

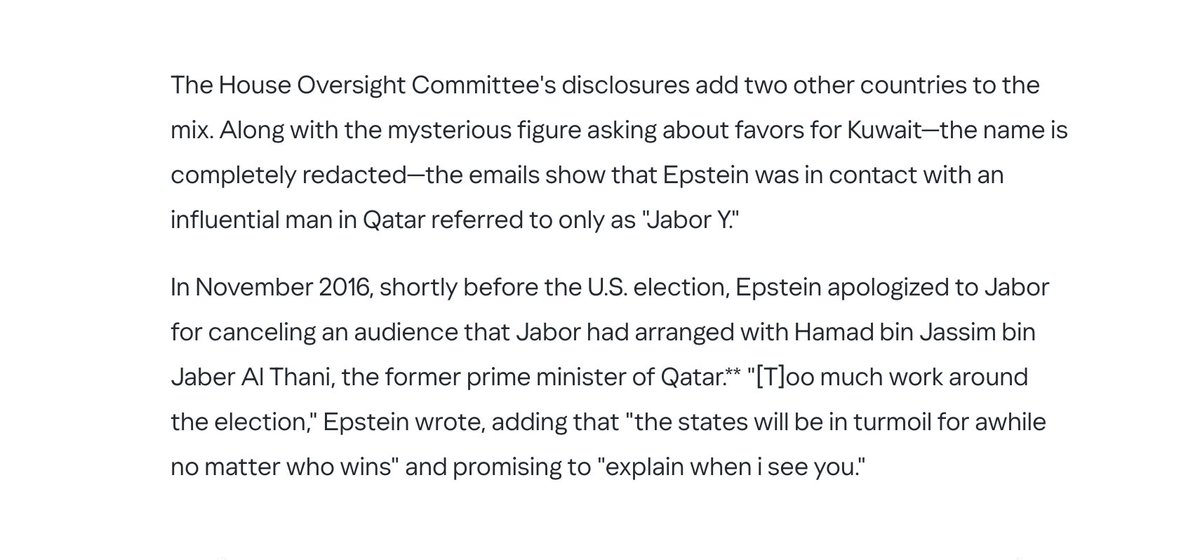

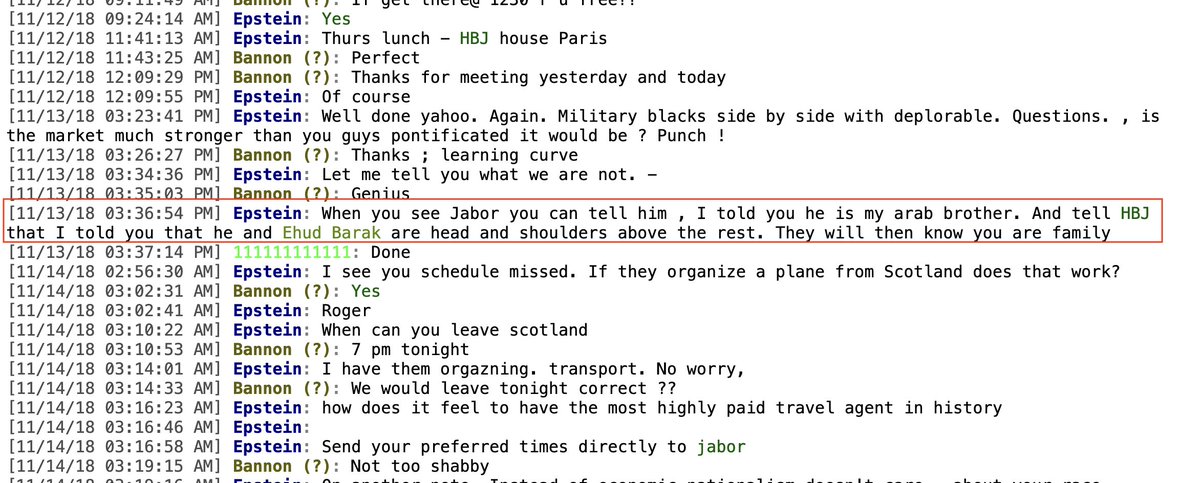

It is interesting to note that #BrockPierce, founder of #Tether and part owner of one of the most infamous pedophile rings in Hollywood history (#DigitalEntertainmentNetwork), also employs a team of Haredim.

jpost.com/business-and-i…

It is interesting to note that #BrockPierce, founder of #Tether and part owner of one of the most infamous pedophile rings in Hollywood history (#DigitalEntertainmentNetwork), also employs a team of Haredim.

jpost.com/business-and-i…

🧵9/Ω

$SRAX also was just apparently de-listed from the @Nasdaq for failure to comply with filing requirements last week. 🚩

sec.gov/ix?doc=/Archiv…

$SRAX also was just apparently de-listed from the @Nasdaq for failure to comply with filing requirements last week. 🚩

sec.gov/ix?doc=/Archiv…

🧵10/Ω

@crossriverbank is also now the main banking partner for @circle of recently de-pegged stablecoin $USDC fame now that their other banks have all blown up.

(@circle banked with 3 out of 4 blown up banks - $SBNY, $SI, and $SIVB, which is amazing).

finance.yahoo.com/news/cross-riv…

@crossriverbank is also now the main banking partner for @circle of recently de-pegged stablecoin $USDC fame now that their other banks have all blown up.

(@circle banked with 3 out of 4 blown up banks - $SBNY, $SI, and $SIVB, which is amazing).

finance.yahoo.com/news/cross-riv…

🧵11/Ω

Here's another example of #CrossRiverBank's extensive due diligence on those 100,000 #PPP covid loans: #SoberServicesLLC, which stopped existing in 2018, was given a $466,847 loan by @crossriverbank in March 2021. (h/t @BP77California)

Here's another example of #CrossRiverBank's extensive due diligence on those 100,000 #PPP covid loans: #SoberServicesLLC, which stopped existing in 2018, was given a $466,847 loan by @crossriverbank in March 2021. (h/t @BP77California)

https://twitter.com/BP77California/status/1636782109531713537

Was pointed out by @MikeBurgersburg that @Upstart might just be doing the BaaS front end and @crossriverbank is the original bank, but I have been told by others that #CrossRiverBank ALSO sells loans to @Upstart. Deserves a closer look.

Either way CRB loans arrangement is weird

Either way CRB loans arrangement is weird

🧵12/Ω

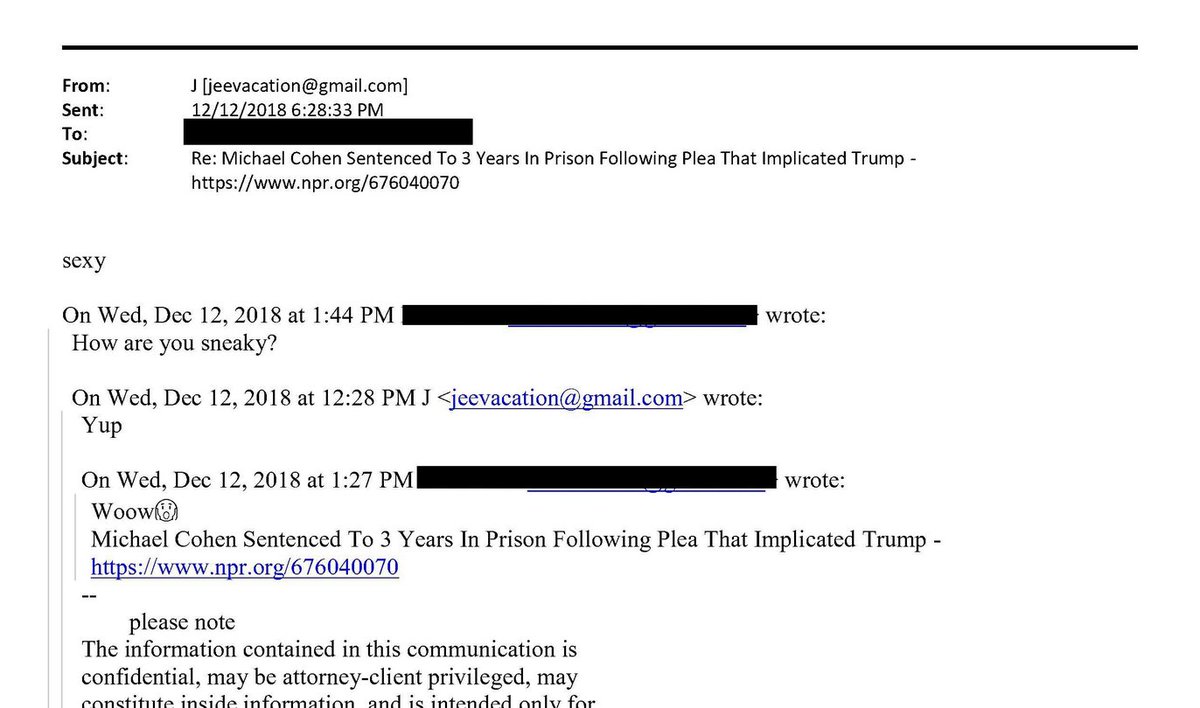

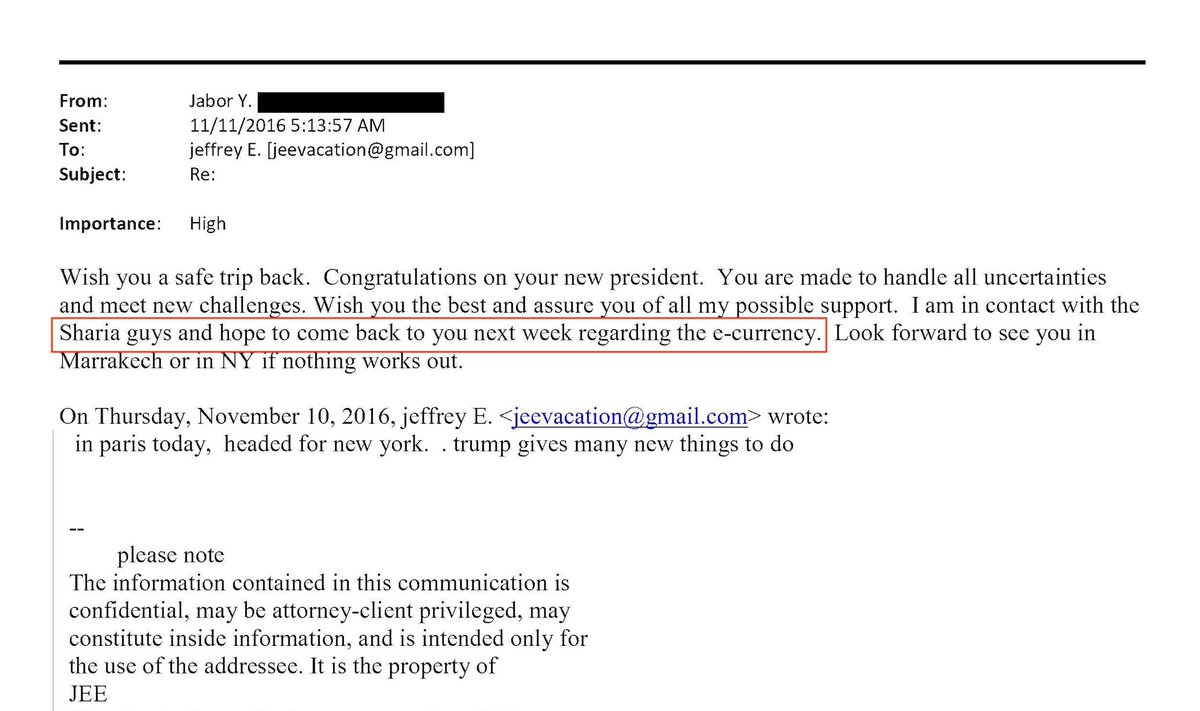

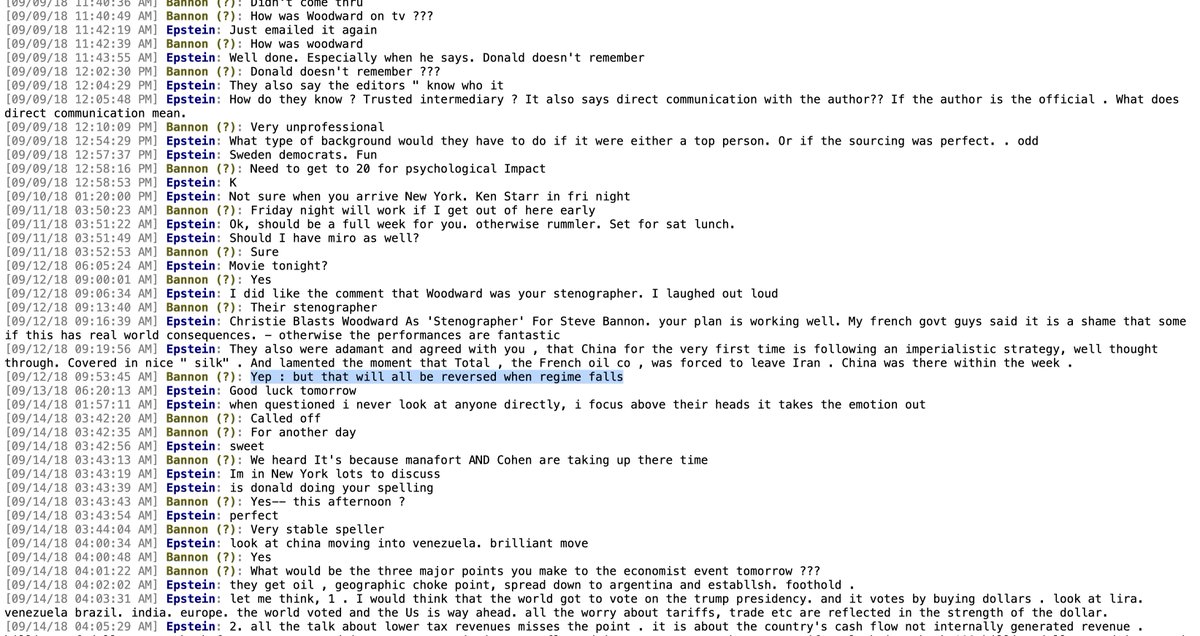

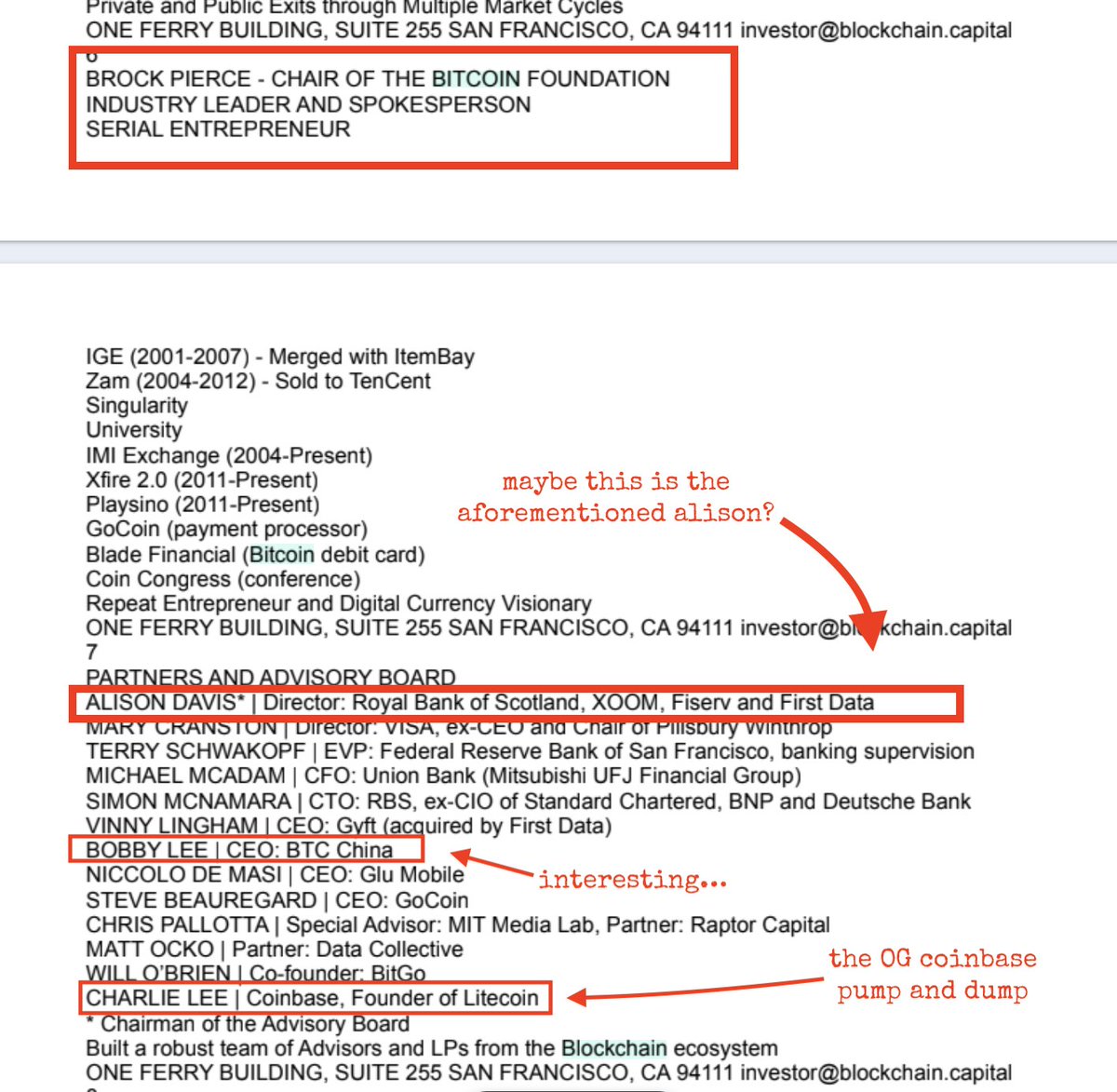

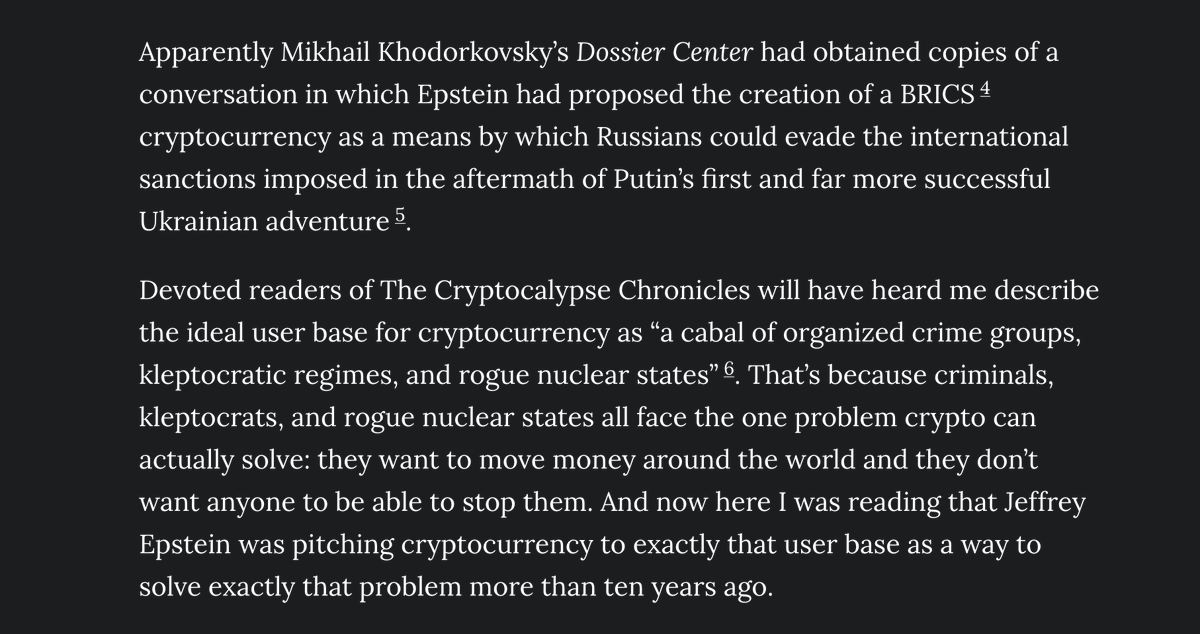

So the story of @crossriverbank has a lot of drama. It's got #BrockPierce for the pedo connection, #Tether for some Putin, what appears to be massive #PPP / covid relief fraud for the $ part...

Why not sprinkle in a little Ukraine for good measure?

So the story of @crossriverbank has a lot of drama. It's got #BrockPierce for the pedo connection, #Tether for some Putin, what appears to be massive #PPP / covid relief fraud for the $ part...

Why not sprinkle in a little Ukraine for good measure?

https://twitter.com/SilvermanJacob/status/1636700846913191938

🧵13/Ω

If anyone's looking for stuff to dig through, here's @propublica's list of all #PPP loans originated by @crossriverbank.

This thread has no doubt just scratched the surface.

projects.propublica.org/coronavirus/ba…

If anyone's looking for stuff to dig through, here's @propublica's list of all #PPP loans originated by @crossriverbank.

This thread has no doubt just scratched the surface.

projects.propublica.org/coronavirus/ba…

🧵14/Ω

If you wonder why a tiny bank like @crossriverbank might shovel fraudulent #PPP / covid relief loans out, maybe it's because they collected ~$233 million in fees according to NYT

ps the fact that NYT took this at face value is one of many reasons it's a national disgrace.

If you wonder why a tiny bank like @crossriverbank might shovel fraudulent #PPP / covid relief loans out, maybe it's because they collected ~$233 million in fees according to NYT

ps the fact that NYT took this at face value is one of many reasons it's a national disgrace.

🧵15/Ω

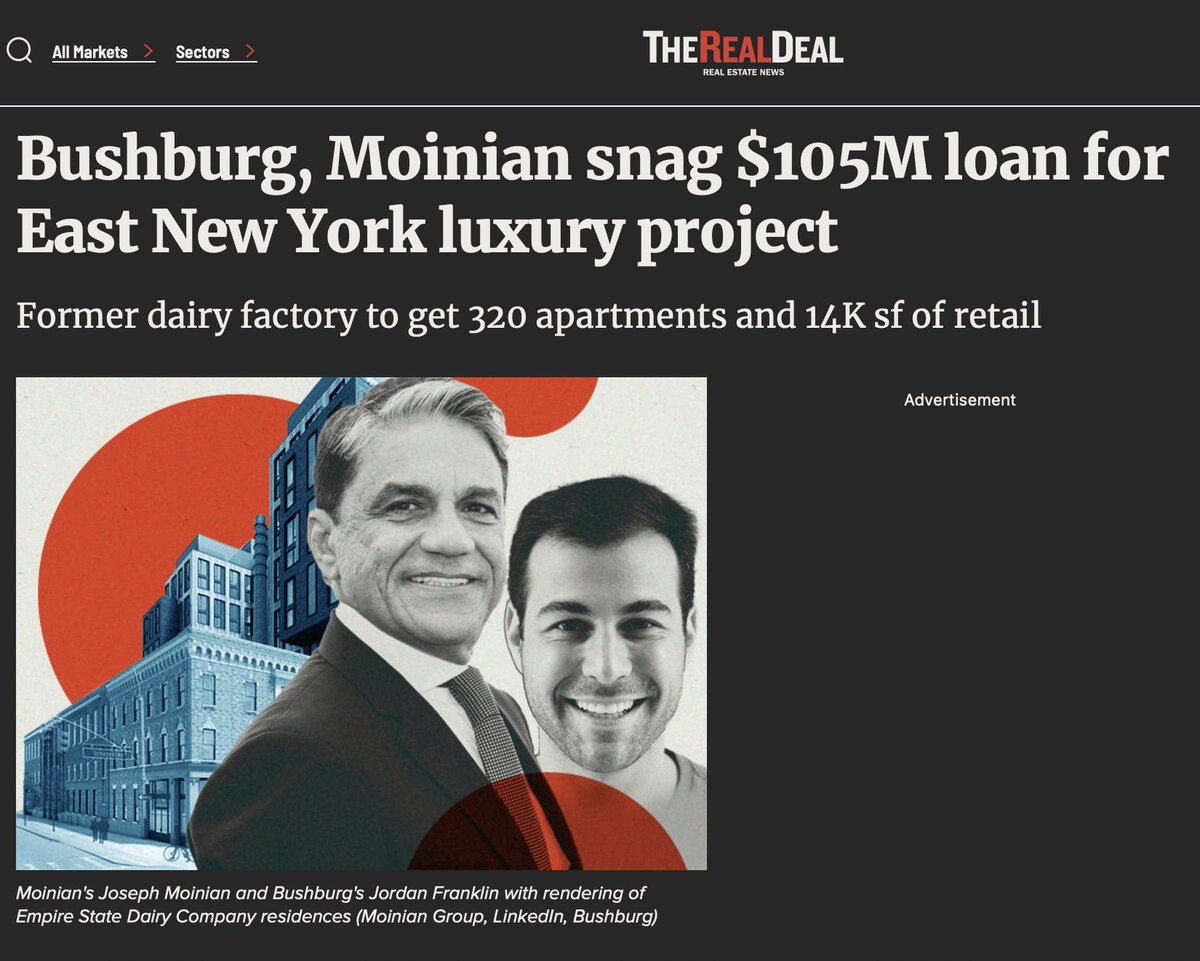

#CrossRiverBank has biz lines other than crypto. e.g. in 2022 they loaned $105mm to a luxury condo by shady developers #Bushburg and #Moinian deep in the lowest income neighborhood in all of NYC.

"deal makes no sense" - NY RE reporters.

if economy turns loan will fail.

#CrossRiverBank has biz lines other than crypto. e.g. in 2022 they loaned $105mm to a luxury condo by shady developers #Bushburg and #Moinian deep in the lowest income neighborhood in all of NYC.

"deal makes no sense" - NY RE reporters.

if economy turns loan will fail.

🧵16/Ω

CrossRiver is also one of the only banks besides @silvergatebank / $SI (R.I.P.) to make loans and take crypto as collateral.

They also marketed $WAVES / $USDN, a now collapsed fraud, to customers.

any Waves bag holders need someone to sue?

crossriver.com/weekly-crypto-…

CrossRiver is also one of the only banks besides @silvergatebank / $SI (R.I.P.) to make loans and take crypto as collateral.

They also marketed $WAVES / $USDN, a now collapsed fraud, to customers.

any Waves bag holders need someone to sue?

crossriver.com/weekly-crypto-…

🧵17/Ω

@AmerBanker: A bank originating #PPP loan fraud, doing fraudulent round robin lending with $UPST, banking crypto, and lending out actual $ for crypto collateral is "best place to work" 5 yrs in a row.

Remind you of an "innovative" energy company?

"Let us build."

@AmerBanker: A bank originating #PPP loan fraud, doing fraudulent round robin lending with $UPST, banking crypto, and lending out actual $ for crypto collateral is "best place to work" 5 yrs in a row.

Remind you of an "innovative" energy company?

"Let us build."

🧵18/Ω

So what does the @coinbase / Cross River relationship look like? Well.

Apparently the company that shoveled out fraudulent #PPP loans is in the "compliance" business.

Does @crossriverbank still do compliance for $COIN? Because if so lol.

So what does the @coinbase / Cross River relationship look like? Well.

Apparently the company that shoveled out fraudulent #PPP loans is in the "compliance" business.

Does @crossriverbank still do compliance for $COIN? Because if so lol.

🧵19/Ω

By number of #PPP loans @crossriverbank was #4 in the country. But by dollar figure?

🥈 2nd 🥈

As an aside this brochure seems to be marketed at "woke" which is interesting bc their Haredi employees are among the least "woke" people on the planet

crossriver.com/sites/default/…

By number of #PPP loans @crossriverbank was #4 in the country. But by dollar figure?

🥈 2nd 🥈

As an aside this brochure seems to be marketed at "woke" which is interesting bc their Haredi employees are among the least "woke" people on the planet

crossriver.com/sites/default/…

🧵20/Ω

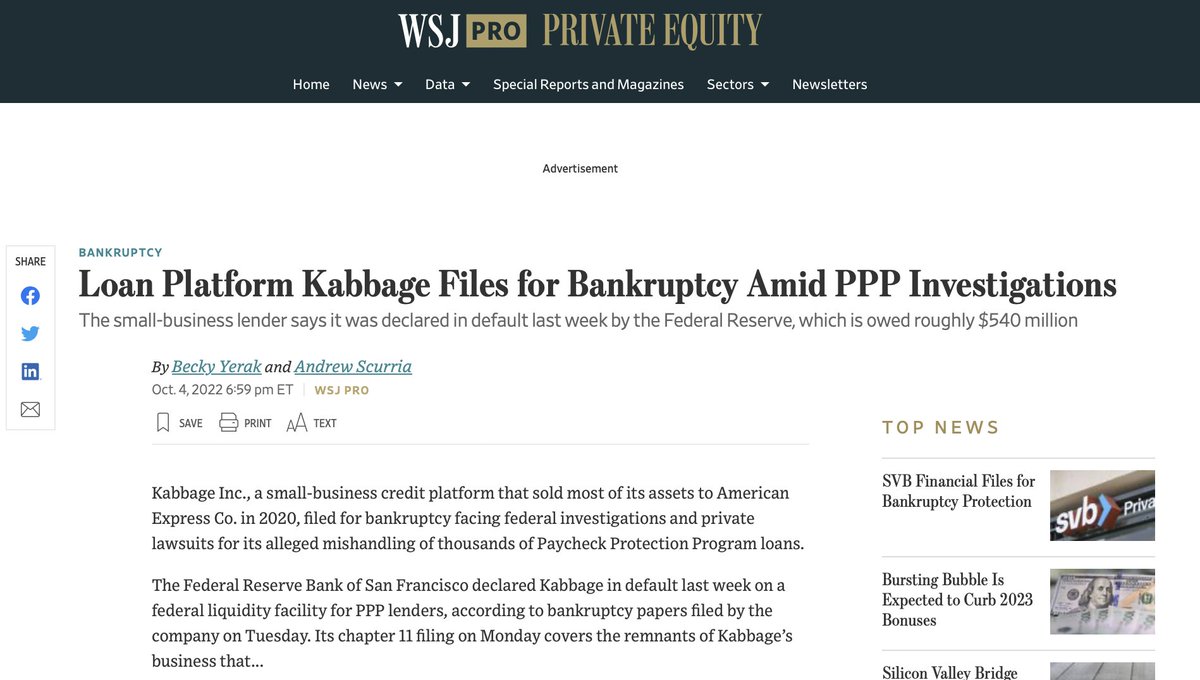

Apparently @KabbageInc (R.I.P.) did some actual customer facing work w/r/t the enormous number of fraudulent loan applications @crossriverbank processed.

#Kabbage got bought by #AmEx but is now under federal investigation & bankrupt

Sounds like that #Frank "fintech" scam

Apparently @KabbageInc (R.I.P.) did some actual customer facing work w/r/t the enormous number of fraudulent loan applications @crossriverbank processed.

#Kabbage got bought by #AmEx but is now under federal investigation & bankrupt

Sounds like that #Frank "fintech" scam

🧵21/Ω

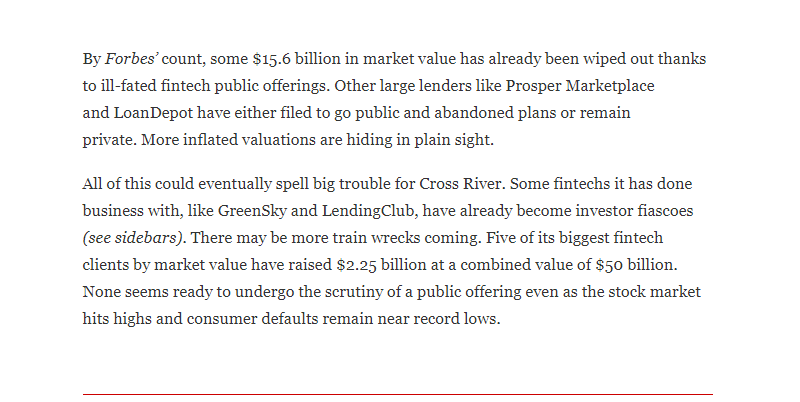

Here's some money quotes about @crossriverbank from Forbes courtesy @finhstamsterdam who knows way more about banks and fintech than I do

Reminds me of criminal mastermind Alan Lane's quote about services $SI (RIP) provided. $SI wasn't a bank it was a "liquidity provider"

Here's some money quotes about @crossriverbank from Forbes courtesy @finhstamsterdam who knows way more about banks and fintech than I do

Reminds me of criminal mastermind Alan Lane's quote about services $SI (RIP) provided. $SI wasn't a bank it was a "liquidity provider"

🧵22/Ω

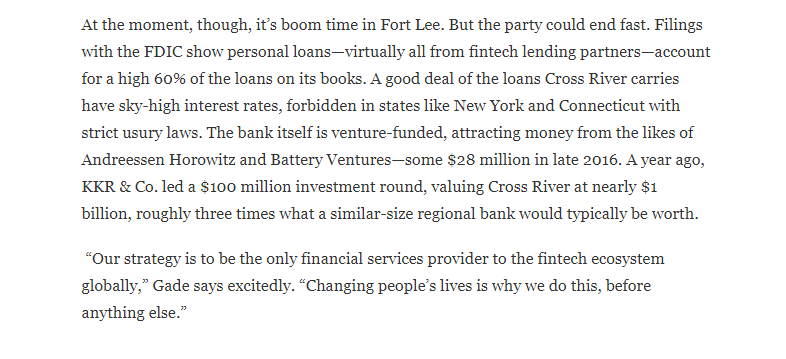

The @crossriverbank reviews on @Glassdoor are pretty good actually... though I have to say the bad ones are pretty revealing.

Words you see a lot:

➤ "disorganized" (even in good reviews!)

➤ "incompetent"

➤ "nepotism" (remember how that worked out for $SI?)

The @crossriverbank reviews on @Glassdoor are pretty good actually... though I have to say the bad ones are pretty revealing.

Words you see a lot:

➤ "disorganized" (even in good reviews!)

➤ "incompetent"

➤ "nepotism" (remember how that worked out for $SI?)

🧵23/Ω

Some more reviews of #CrossRiverBank on @Glassdoor I found interesting.

Remember how the c-suite at $SI was family of the CEO? Seems similar.

Also disorganized tech startups are a thing but this isn't a startup. It's a bank. "Move fast, break things" is not OK.

Some more reviews of #CrossRiverBank on @Glassdoor I found interesting.

Remember how the c-suite at $SI was family of the CEO? Seems similar.

Also disorganized tech startups are a thing but this isn't a startup. It's a bank. "Move fast, break things" is not OK.

🧵24/Ω

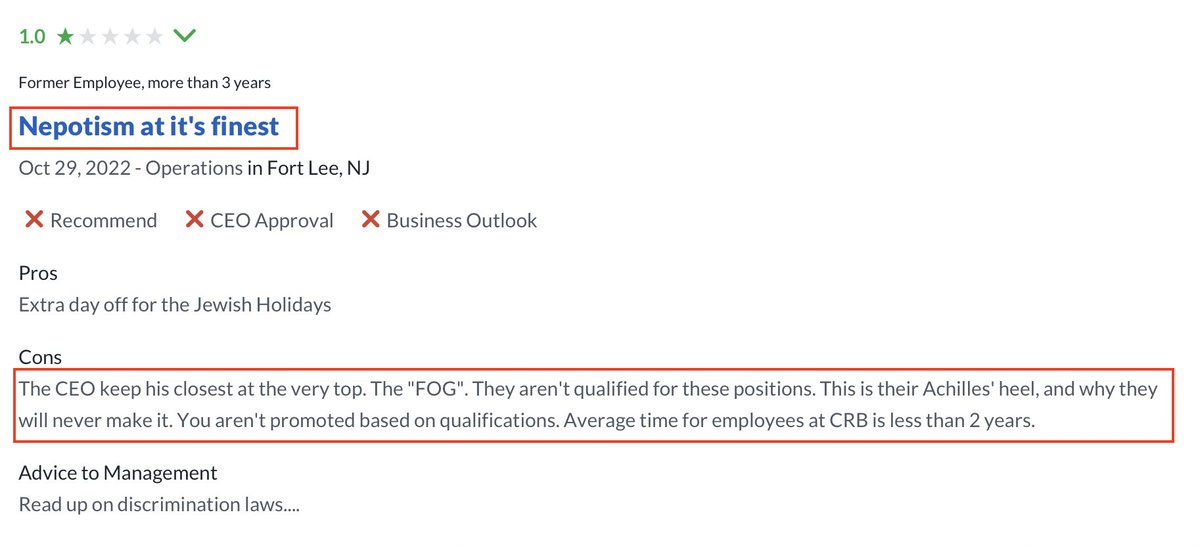

@crossriverbank has been in some hot water in the pre-Jurassic era of a few years ago with not just one but two government agencies that protect consumers: the #FDIC and the #CFPB. (h/t @RasooliSheida, @finhstamsterdam)

➤ fdic.gov/news/press-rel…

➤ files.consumerfinance.gov/f/documents/cf…

@crossriverbank has been in some hot water in the pre-Jurassic era of a few years ago with not just one but two government agencies that protect consumers: the #FDIC and the #CFPB. (h/t @RasooliSheida, @finhstamsterdam)

➤ fdic.gov/news/press-rel…

➤ files.consumerfinance.gov/f/documents/cf…

🧵24/Ω

Perhaps now is a good time to mention that a recent study found that 5-14% of all emergency covid #PPP relief funds ended up being "invested" in crypto, particularly among the less educated.

Discuss.

Perhaps now is a good time to mention that a recent study found that 5-14% of all emergency covid #PPP relief funds ended up being "invested" in crypto, particularly among the less educated.

Discuss.

https://twitter.com/Cryptadamist/status/1624108294548725762

🧵25/Ω

Or that #CrossRiverBank was chosen as one of the banks that will test @federalreserve's new #FedNOW system

That's right folks, you heard it hear first.

They're gonna plug a crypto bank straight into the fed (maybe bc it was so good at #PPP loans)

Or that #CrossRiverBank was chosen as one of the banks that will test @federalreserve's new #FedNOW system

That's right folks, you heard it hear first.

They're gonna plug a crypto bank straight into the fed (maybe bc it was so good at #PPP loans)

https://twitter.com/cowboycrypto313/status/1636127595266818054

🧵26/Ω

Really helps to hire the right people with the right political connections sometimes.

Really helps to hire the right people with the right political connections sometimes.

https://twitter.com/Cryptadamist/status/1636085447037206528

🧵27/Ω

So @crossriverbank has connections to #PPP, famous pedos, ultra-orthodox Israelis, and #Tether.

But tbh it's the last two that really mystify me. Because why are a bunch of ultra orthodox hanging around a guy whose co. laundered money for #Hamas?

So @crossriverbank has connections to #PPP, famous pedos, ultra-orthodox Israelis, and #Tether.

But tbh it's the last two that really mystify me. Because why are a bunch of ultra orthodox hanging around a guy whose co. laundered money for #Hamas?

https://twitter.com/Cryptadamist/status/1631867518791868417

🧵25/Ω

Perhaps now is a good time to mention that a recent study found that 5-14% of all emergency covid #PPP relief funds ended up being "invested" in crypto, particularly among the less educated.

Discuss.

Perhaps now is a good time to mention that a recent study found that 5-14% of all emergency covid #PPP relief funds ended up being "invested" in crypto, particularly among the less educated.

Discuss.

https://twitter.com/Cryptadamist/status/1624108294548725762

🧵26/Ω

Or that #CrossRiverBank was chosen as one of the banks that will test @federalreserve's new #FedNOW system

That's right folks, you heard it hear first.

They're gonna plug a crypto bank straight into the fed (maybe bc it was so good at #PPP loans)

Or that #CrossRiverBank was chosen as one of the banks that will test @federalreserve's new #FedNOW system

That's right folks, you heard it hear first.

They're gonna plug a crypto bank straight into the fed (maybe bc it was so good at #PPP loans)

https://twitter.com/cowboycrypto313/status/1636127595266818054

🧵27/Ω

Really helps to hire the right people with the right political connections sometimes, especially if they're ready for their turn at the trough.

Really helps to hire the right people with the right political connections sometimes, especially if they're ready for their turn at the trough.

https://twitter.com/Cryptadamist/status/1636085447037206528

🧵28/Ω

So @crossriverbank has connections to #PPP, famous pedos, ultra-orthodox Israelis, and #Tether.

But tbh it's the last two that really mystify me. Because why are a bunch of ultra orthodox hanging around a guy whose co. laundered money for #Hamas?

So @crossriverbank has connections to #PPP, famous pedos, ultra-orthodox Israelis, and #Tether.

But tbh it's the last two that really mystify me. Because why are a bunch of ultra orthodox hanging around a guy whose co. laundered money for #Hamas?

https://twitter.com/Cryptadamist/status/1631867518791868417

🧵29/Ω

tfw you wasted time researching & screenshooting examples that @crossriverbank's #PPP covid lending was sus af to tweet when you could have just checked the nj biz news and found out #CrossRiverBank is currently under investigation for money crimes.

njbiz.com/cross-river-ba…

tfw you wasted time researching & screenshooting examples that @crossriverbank's #PPP covid lending was sus af to tweet when you could have just checked the nj biz news and found out #CrossRiverBank is currently under investigation for money crimes.

njbiz.com/cross-river-ba…

@crossriverbank 🧵30/Ω

So @coinbase / @circle / $USDC's bank is under investigation for money crimes (probably because it committed money crimes).

No wonder $COIN is looking for a new office.

Heard Uzbekistan is nice. Has lots of sun and no extradition treaties.

coindesk.com/business/2023/…

So @coinbase / @circle / $USDC's bank is under investigation for money crimes (probably because it committed money crimes).

No wonder $COIN is looking for a new office.

Heard Uzbekistan is nice. Has lots of sun and no extradition treaties.

coindesk.com/business/2023/…

🧵31/Ω

"@crossriverbank's less hands-on approach ... may have led it to approve riskier loans... U. of Texas graph shows ~20%¹ of CRB's loans had at least 1 suspicious indicator."

Next highest? 10%

¹ ~$2.6 billion in #PPP $ 😱 (h/t @finhstamsterdam)

"@crossriverbank's less hands-on approach ... may have led it to approve riskier loans... U. of Texas graph shows ~20%¹ of CRB's loans had at least 1 suspicious indicator."

Next highest? 10%

¹ ~$2.6 billion in #PPP $ 😱 (h/t @finhstamsterdam)

https://twitter.com/finhstamsterdam/status/1636995673575899137

🧵32/Ω

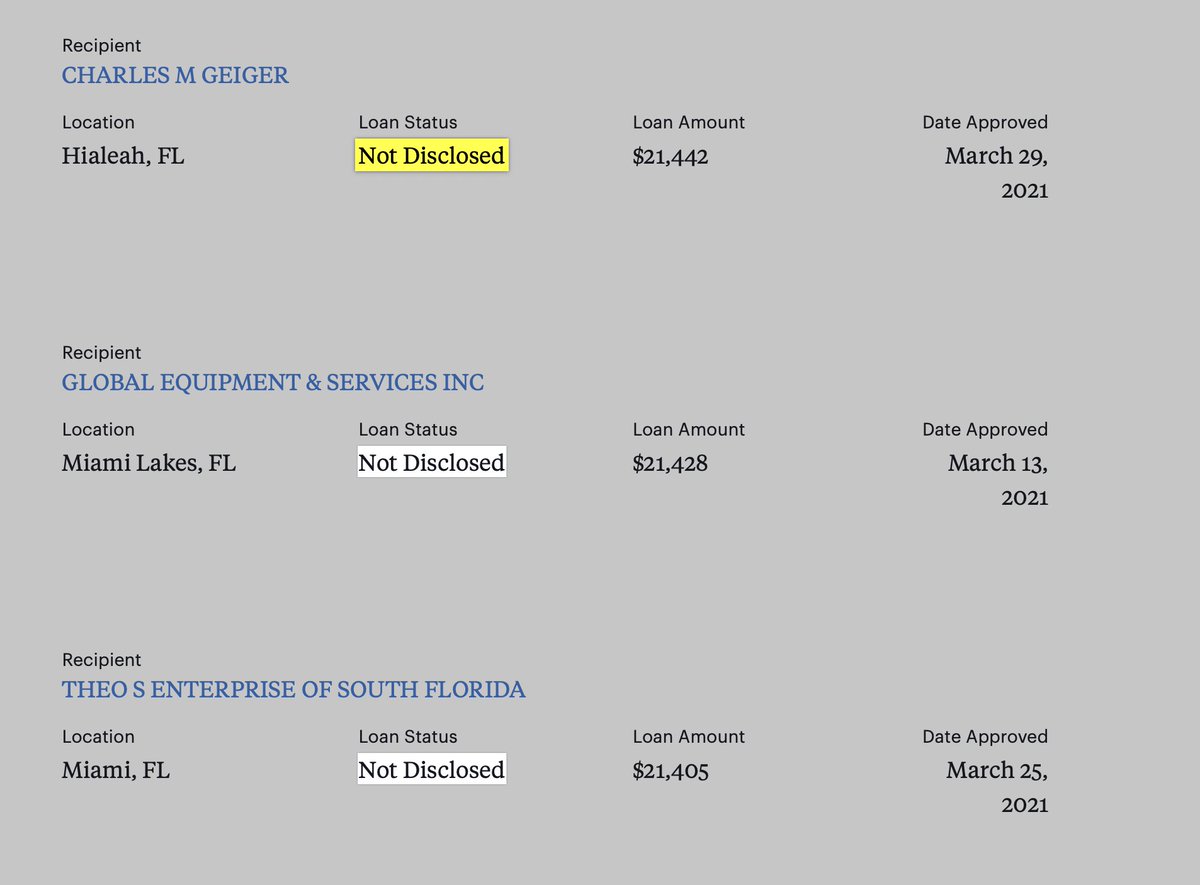

😱WOW😱 missed this part about @crossriverbank: The US Government owes Cross River $300 million (⁉️) in loan forgiveness... that it's not willing to forgive.

No wonder so many CRB #PPP loans' status is "Not Disclosed" instead of "forgiven": they have a $300m hole.

#ngmi

😱WOW😱 missed this part about @crossriverbank: The US Government owes Cross River $300 million (⁉️) in loan forgiveness... that it's not willing to forgive.

No wonder so many CRB #PPP loans' status is "Not Disclosed" instead of "forgiven": they have a $300m hole.

#ngmi

🧵33/Ω

I did a whole other thread about the Congressional report on how fintechs (including @crossriverbank) had facilitated fraudulent #PPP / covid relief loans and are now under investigation.

I did a whole other thread about the Congressional report on how fintechs (including @crossriverbank) had facilitated fraudulent #PPP / covid relief loans and are now under investigation.

https://twitter.com/Cryptadamist/status/1637211823203123201

🧵34/Ω

Then I did a whole *other* thread going through @crossriverbank's holding company's annual income statements filed with the state of New Jersey.

Then I did a whole *other* thread going through @crossriverbank's holding company's annual income statements filed with the state of New Jersey.

https://twitter.com/Cryptadamist/status/1637241690820845568

🧵35/Ω

One thing that's weird here is that some of these job listings come up as being for something called #CrossTheRiver but logo and address are #CrossRiverBank.

One thing that's weird here is that some of these job listings come up as being for something called #CrossTheRiver but logo and address are #CrossRiverBank.

https://twitter.com/Cryptadamist/status/1637290617033113600

• • •

Missing some Tweet in this thread? You can try to

force a refresh