The #FOMC meeting is happening TOMORROW, and it could have a big impact on your investments! 💸

With 18% of the market expecting a pause and others anticipating a 25-point hike, you'll want to understand what's going on to make smart decisions. So, let's dive into this 👇

With 18% of the market expecting a pause and others anticipating a 25-point hike, you'll want to understand what's going on to make smart decisions. So, let's dive into this 👇

The FOMC is a group of important people from the Federal Reserve who make big decisions about how money works in the US. They meet ~8 times a year to decide on "monetary policy." Their main tool? Interest rates!

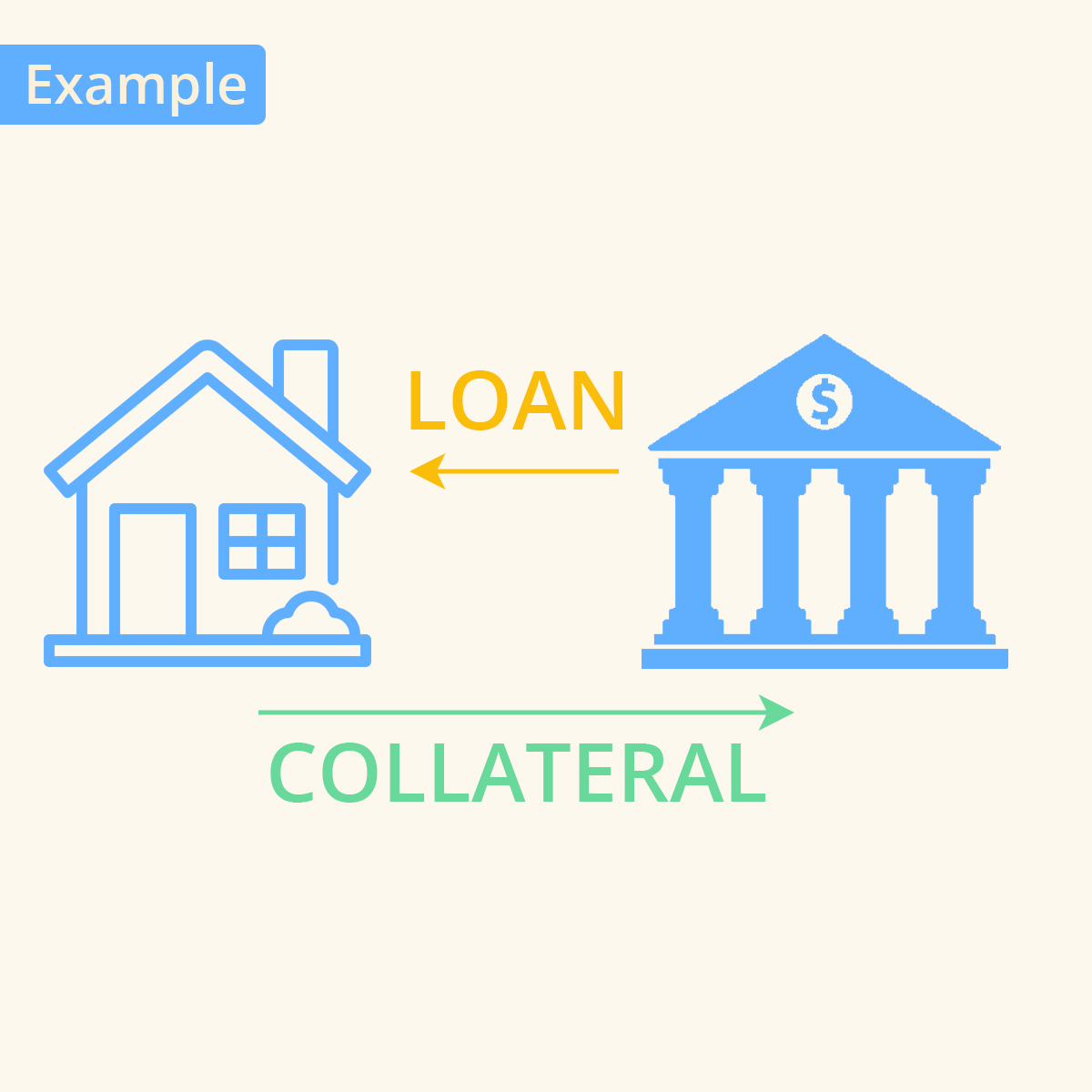

When the FOMC raises interest rates, borrowing money becomes more expensive. When they lower rates, borrowing gets cheaper. They adjust rates to control inflation and help the economy grow steadily.

How do interest rates affect the stock market? Higher rates can lead to slower company growth and lower stock prices. Lower rates can lead to faster growth and higher stock prices.

FOMC meetings also impact crypto markets!

When interest rates change, investors may shift between stocks, bonds, and cryptocurrencies. Higher rates can cause crypto prices to drop as investors seek higher returns elsewhere.

When interest rates change, investors may shift between stocks, bonds, and cryptocurrencies. Higher rates can cause crypto prices to drop as investors seek higher returns elsewhere.

In the past year, the FOMC raised interest rates to 4.5%. Now, they're considering either pausing or doing a 25-point hike. The market is divided - 18% expect a pause, while others anticipate a hike.

If the FOMC pauses, it could signal concerns about the economy and hint at a future "U-turn" (lowering interest rates). This could lead to higher stock prices as investors anticipate cheaper borrowing costs and more growth.

The #Crypto market might also benefit from a pause or U-turn. Investors seeking higher returns in a lower-interest-rate environment could turn to cryptocurrencies, boosting their prices. 🚀

So now you know what to watch for in tomorrow's FOMC meeting! Stay informed, make smart decisions, and good luck with your investments🎓

Don't forget to like this post if you learn something!

Don't forget to like this post if you learn something!

Are you new to trading and looking for the best exchange to do so? I would recommend PrimeXBT bit.ly/Prime-Voes if you use this link and send me a DM, I will give you a code for a free bonus of 7% on each deposit!

Would you like to read more why and how the Federal Reserve uses interest rates as a tool? 👇

https://twitter.com/cryptovoes/status/1638521522653364225?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh