On a journey to excel in trading? Follow me for educational threads, with practical tips, market insights, and clear explanation of trading terms & indicators📚

How to get URL link on X (Twitter) App

2/ Position sizing is the practice of deciding how much money to put into a single trade. It's especially crucial in the crypto market, where prices can see wild swings. By managing your risk, you can protect your capital and maximize your gains. Let's see some examples.

2/ Position sizing is the practice of deciding how much money to put into a single trade. It's especially crucial in the crypto market, where prices can see wild swings. By managing your risk, you can protect your capital and maximize your gains. Let's see some examples.

Centralized Exchanges 🏢

Centralized Exchanges 🏢

Before we continue, if you would like to learn more about what the FOMC is doing and the impacted on the market. You can read my thread from yesterday. Just follow the link:

Before we continue, if you would like to learn more about what the FOMC is doing and the impacted on the market. You can read my thread from yesterday. Just follow the link: https://twitter.com/cryptovoes/status/1638122771636002818

The FOMC is a group of important people from the Federal Reserve who make big decisions about how money works in the US. They meet ~8 times a year to decide on "monetary policy." Their main tool? Interest rates!

The FOMC is a group of important people from the Federal Reserve who make big decisions about how money works in the US. They meet ~8 times a year to decide on "monetary policy." Their main tool? Interest rates!

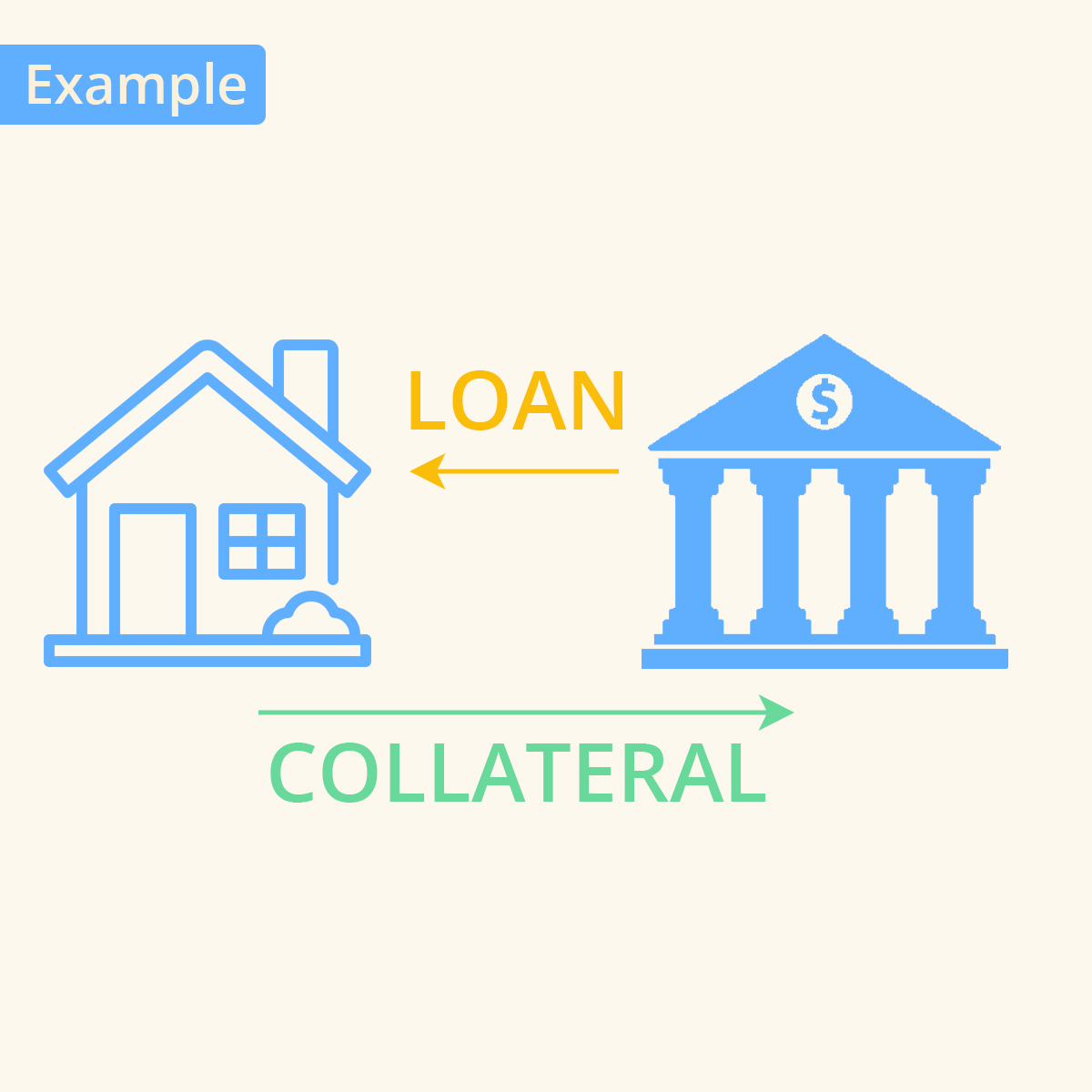

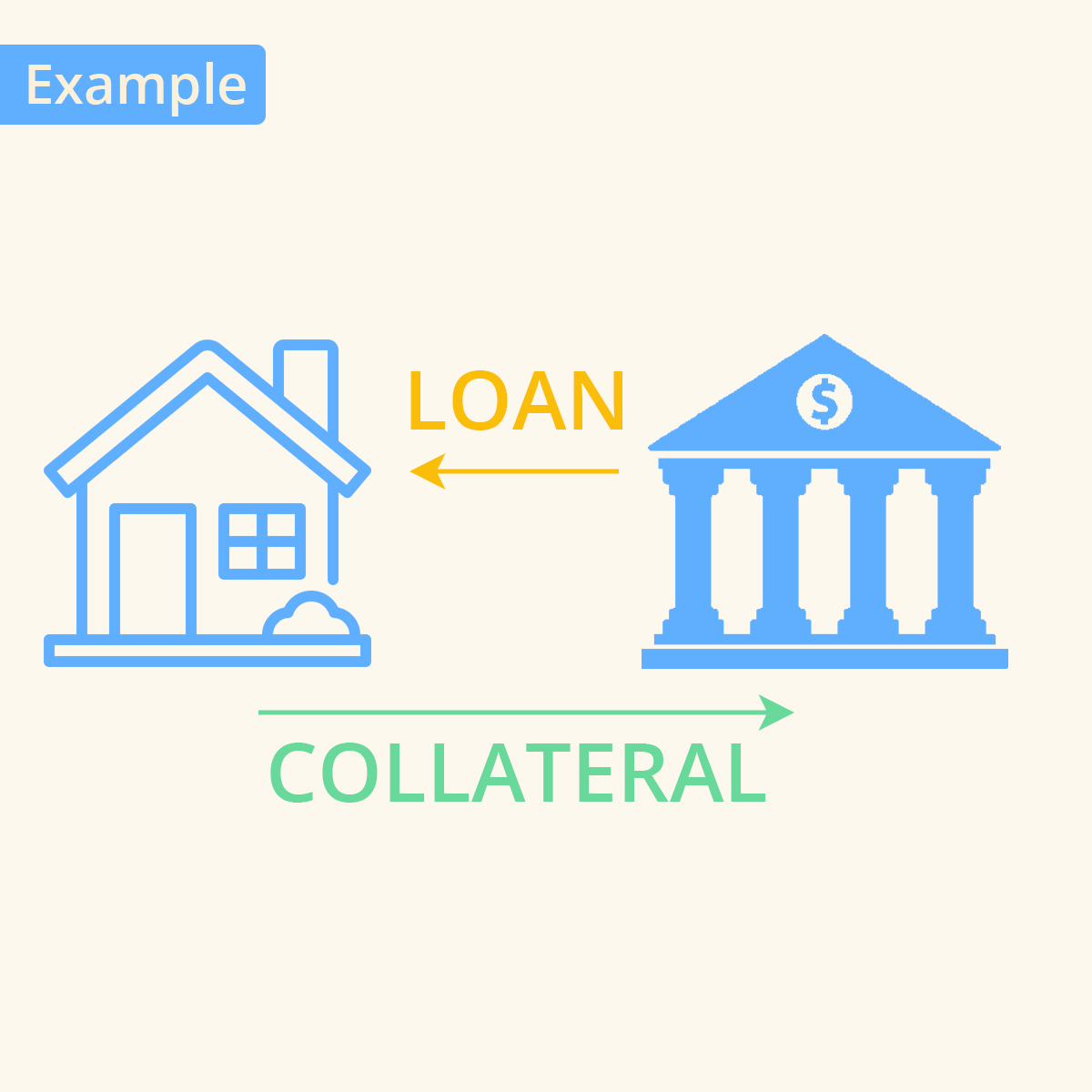

Imagine you need a short-term loan, and you have valuable items to use as collateral. You give the items to a friend, and they lend you the money. After a short period, you return the money plus some interest and get your items back. 🔄

Imagine you need a short-term loan, and you have valuable items to use as collateral. You give the items to a friend, and they lend you the money. After a short period, you return the money plus some interest and get your items back. 🔄

What is RSI? It's a tool that helps track how fast and how much the price of an investment changes. The RSI score goes from 0 to 100, and it shows when the market might be ready for a change by showing if an investment is too popular (overbought) or too unpopular (oversold)

What is RSI? It's a tool that helps track how fast and how much the price of an investment changes. The RSI score goes from 0 to 100, and it shows when the market might be ready for a change by showing if an investment is too popular (overbought) or too unpopular (oversold)