🧵 Quick thread going through $COIN's ludicrous "legal arguments" about why a product called #CoinbaseEarn:

1. is not an investment

2. has no expectation of profit

3. is not a communal activity

4. does not depend on the actions of @coinbase

1. is not an investment

2. has no expectation of profit

3. is not a communal activity

4. does not depend on the actions of @coinbase

https://twitter.com/iampaulgrewal/status/1638048375793758210

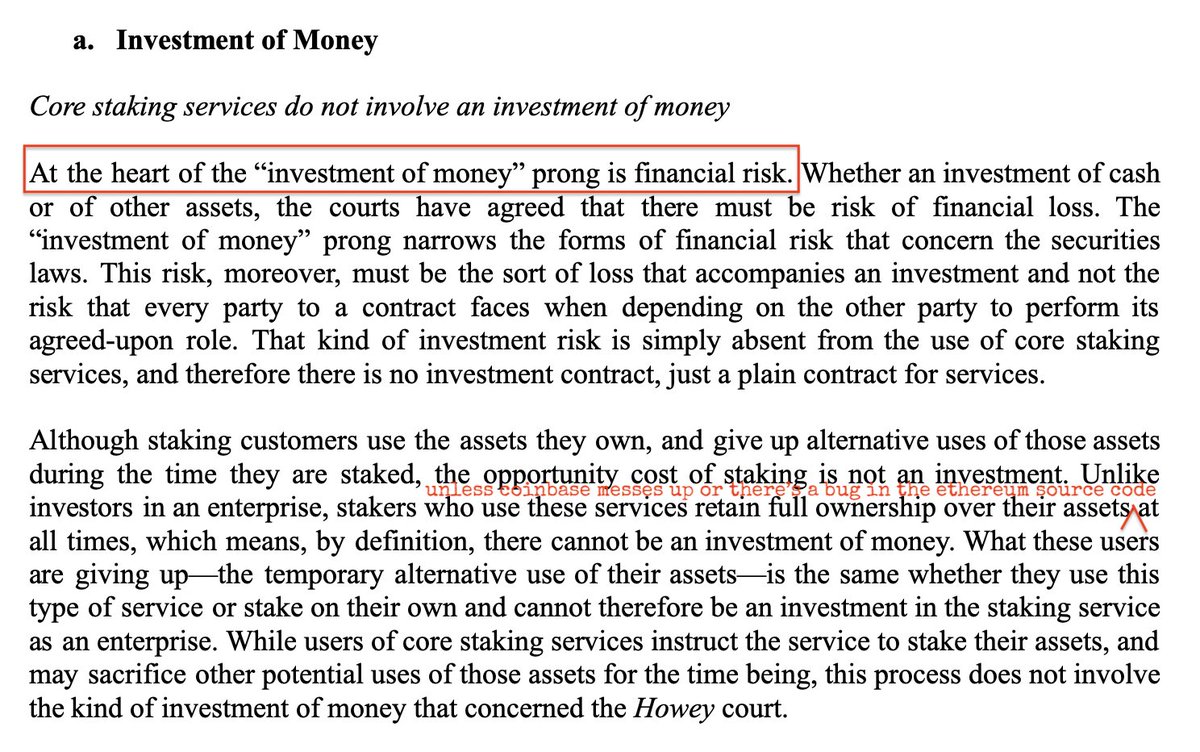

1. "not an investment"

According to Coinbase there is no way for users to lose their ethereum even if

1. @coinbase gets hacked (user keys gets compromised, etc)

2. there's a bug in the ethereum source code (are lawyers even allowed to comment on this?)

According to Coinbase there is no way for users to lose their ethereum even if

1. @coinbase gets hacked (user keys gets compromised, etc)

2. there's a bug in the ethereum source code (are lawyers even allowed to comment on this?)

2. "not a common enterprise"

Here #Coinbase admits that there is a gathering together of assets, then makes up some nonsense about how bc you can sell them it doesn't count (nvm that the same is true for stocks), then pretends users won't lose if Coinbase makes a mistake (lies).

Here #Coinbase admits that there is a gathering together of assets, then makes up some nonsense about how bc you can sell them it doesn't count (nvm that the same is true for stocks), then pretends users won't lose if Coinbase makes a mistake (lies).

3. "no reasonable expectation of profit"

bro It's called #CoinbaseEarn. This argument is so disingenuous I'm not even going to bother disproving it.

bro It's called #CoinbaseEarn. This argument is so disingenuous I'm not even going to bother disproving it.

4. "not dependent on efforts of other"

So you're saying that if Coinbase's servers stopped working tomorrow people would still get paid their "service fees"?

So you're saying that if Coinbase's servers stopped working tomorrow people would still get paid their "service fees"?

I'll take this chance to remind you that Coinbase's crack legal team of utterly depraved worshippers of Mammon recently got KOed by an appellate court for 'unconscionable legal gimmicks'.

right now (literally today) they're trying again at SCOTUS.

ngmi

right now (literally today) they're trying again at SCOTUS.

ngmi

https://twitter.com/Cryptadamist/status/1637930488735342592

🧵 And I'll also take this chance to point out that #Coinbase's Chief Legal Officer, @iampaulgrewal, has sold over $19 million worth of $COIN stock just in the first 2.7 months of 2023. (h/t @Bitfinexed)

"Disingenuous" is just the beginning...

Ω👇Ω

"Disingenuous" is just the beginning...

Ω👇Ω

https://twitter.com/Bitfinexed/status/1638284660319965185

• • •

Missing some Tweet in this thread? You can try to

force a refresh