#BustingMyths #ForexReserves #Modinomics #MUSTREAD

Judging a Country based on its #ForexReserves is like Judging a Persons Networth based on his #SavingAccount balance & not his #LoanAccount balance.

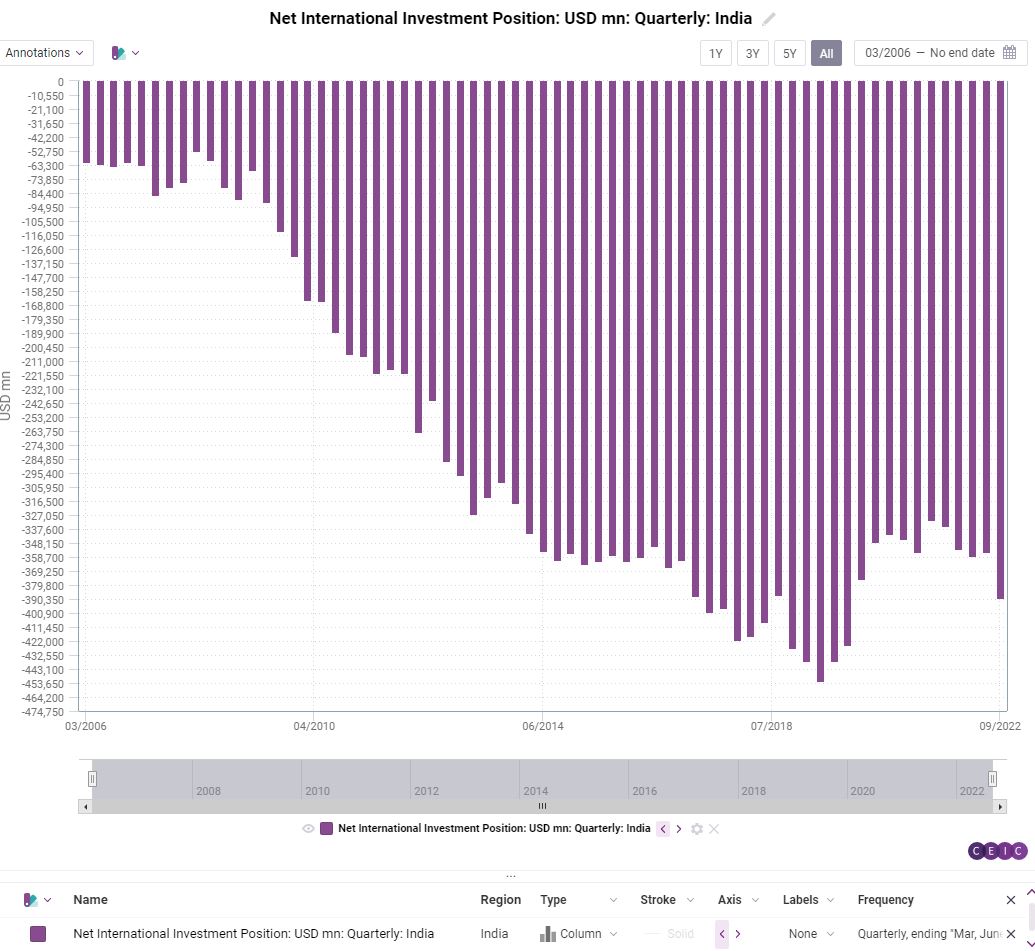

Judge #Modinomics on #NIIP (-ve $390bn)

And Not on FX Reserves (+ve $506bn)

Judging a Country based on its #ForexReserves is like Judging a Persons Networth based on his #SavingAccount balance & not his #LoanAccount balance.

Judge #Modinomics on #NIIP (-ve $390bn)

And Not on FX Reserves (+ve $506bn)

So what is #NIIP or Net International Investment Position. Let me quote @FinMinIndia Economic Survey

NIIP is the difference b/w an Economy’s External financial Assets & Liabilities.

If Economy = Person, NIIP is Assets (Property, Deposits, Investments) less Liabilities (Loans)

NIIP is the difference b/w an Economy’s External financial Assets & Liabilities.

If Economy = Person, NIIP is Assets (Property, Deposits, Investments) less Liabilities (Loans)

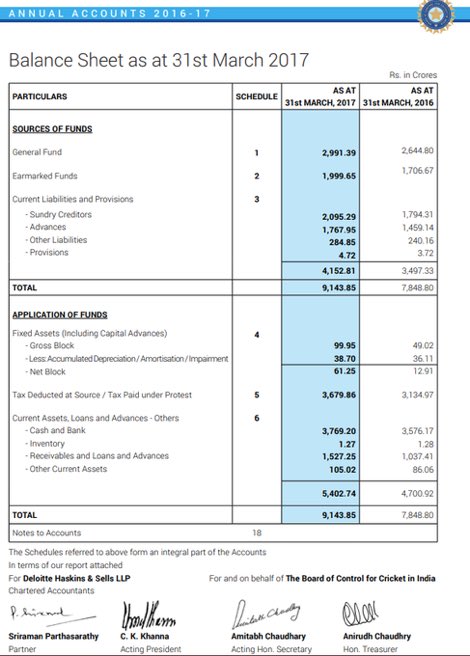

As per FY23 Economic Survey released by @FinMinIndia before budget, India's overseas financial ASSETS at US$ 847.5bn but India's International LIABILITIES was higher at US$ 1,237.1Bn

Assets ($847.5) LESS Liabilities ($1237.1Bn) = NEGATIVE $389.6Bn

STOP LOOKING AT FX RESERVES

Assets ($847.5) LESS Liabilities ($1237.1Bn) = NEGATIVE $389.6Bn

STOP LOOKING AT FX RESERVES

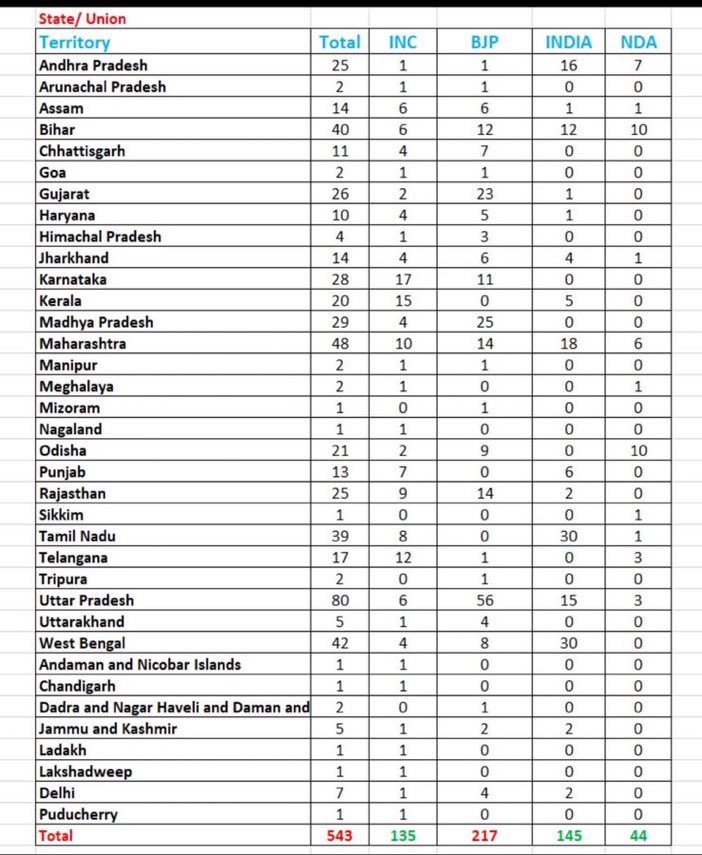

NIIP: When compared to other Countries like

China,

Japan,

S Korea,

Singapore

Germany

UK

US

Russia

Brazil

Indonesia

Bangladesh

Brazil is the Worst, Followed by India.

China,

Japan,

S Korea,

Singapore

Germany

UK

US

Russia

Brazil

Indonesia

Bangladesh

Brazil is the Worst, Followed by India.

NOTE: Forex (FX) Reserves is like CASH in your Savings or Current Account. Its a sign of how much LIQUIDITY you have. It does NOT show you how much your NET WORTH is. For that you have to consider External Loans or Liabilities.

Since some of these LOANS or LIABILITIES might have to be paid immediately,

Another way to look at our FX Reserves is to look at HOW MANY MONTHS of IMPORT COVER India have. Here is a long Term Chart.

As you can see, Indias Months of Import Cover has fallen in to 10 months.

Another way to look at our FX Reserves is to look at HOW MANY MONTHS of IMPORT COVER India have. Here is a long Term Chart.

As you can see, Indias Months of Import Cover has fallen in to 10 months.

Now Lets Look at the Months of IMPORT cover (Purple) along with the Foreign Exchange (Green) ..... Hope you get the point.

• • •

Missing some Tweet in this thread? You can try to

force a refresh