@ParrotCapital It doesn't help when the regulator makes mistakes in their filings.

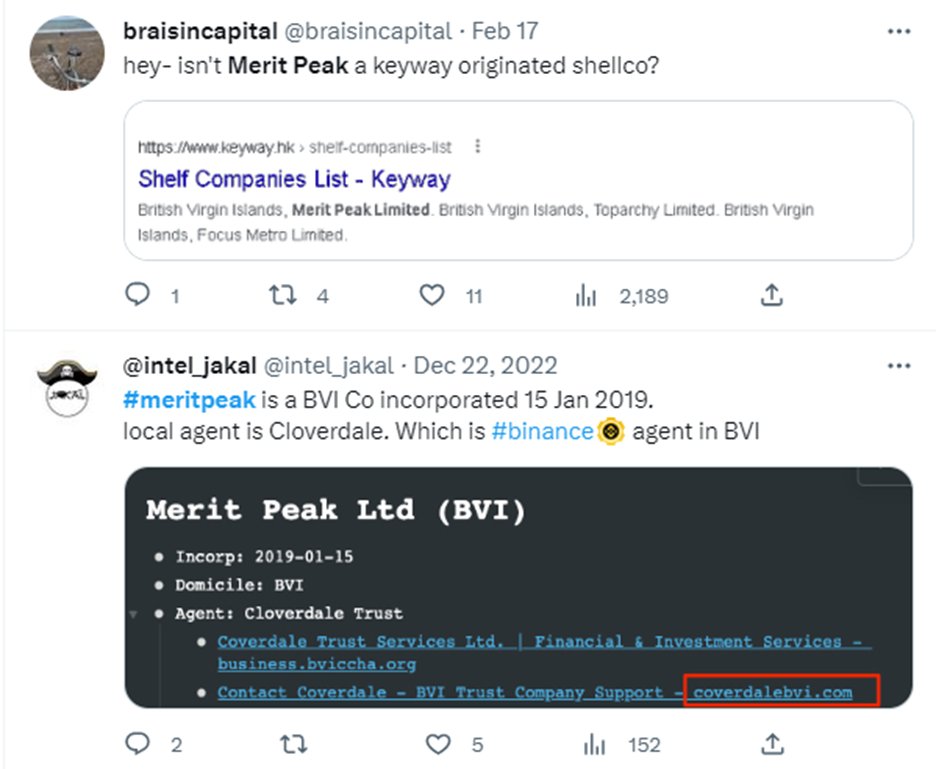

#meritpeak is #BVI company not Caymans.

#meritpeak is #BVI company not Caymans.

@ParrotCapital Its not like its a fkn secret. We even know that the current #BVI agent for #meritpeak is #cloverdale which is #binance BVI agent.

@ParrotCapital And if you are going to reference a company you should probably use its current name

Binance UAB name was changed to #bifinity UAB (although #binance never really told anyone that)

Binance UAB name was changed to #bifinity UAB (although #binance never really told anyone that)

@ParrotCapital its not like the dots haven't been joined for you

@ParrotCapital Also you don't need to speculate as to if CZ's ownership in Bifinity UAB (aka Binance UAB) is direct or indirect....its definitely direct...in his name personally. What's more important is to find out if CZ is 100% beneficial owner....and not holding % on behalf of others.

@ParrotCapital I did find this amusing...a) makes a mockery of the shock and surprise feigned by @cz_binance ....refusing to comply with an "investigative subpoena" should tell you that things are going to shit.

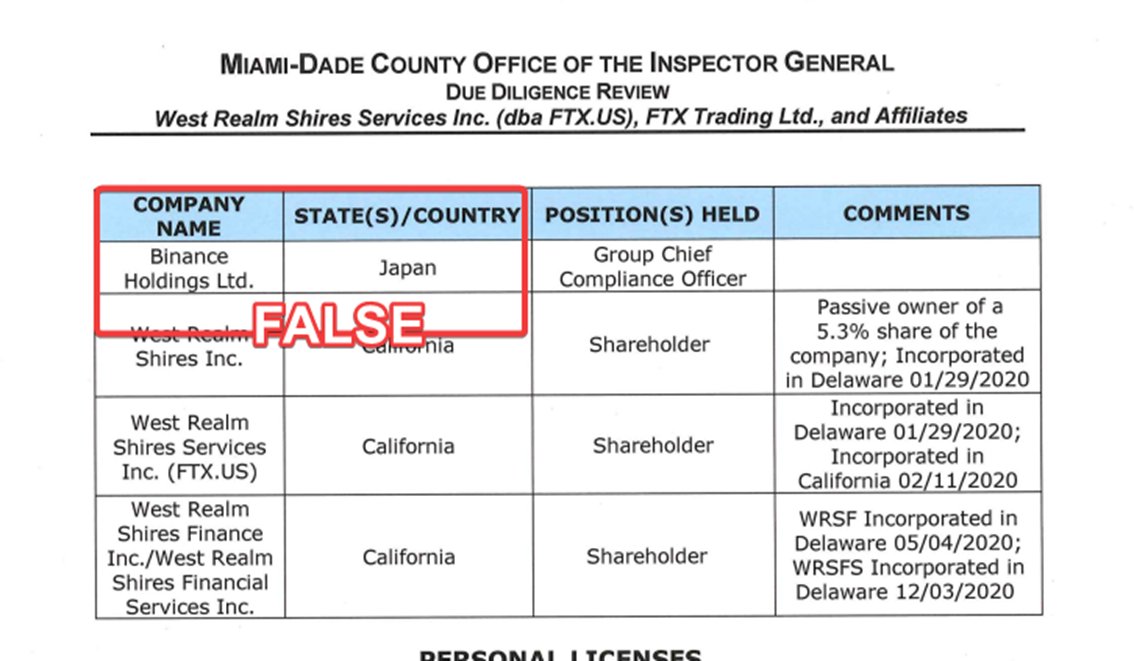

b) its reminds me of the #FTX #DD for #miamistadium

b) its reminds me of the #FTX #DD for #miamistadium

@ParrotCapital @cz_binance As I've said literally 10000 times....there were many false statements provided during #DD for #FTX #miamistadium signing rights. Including those specifically relating to #binance

Binance Holdings is a Cayman Island entity and not Japan.

Binance Holdings is a Cayman Island entity and not Japan.

@ParrotCapital @cz_binance In fact we know that when #binance claimed to operate in #japan it did so illegally without an actual entity nor a license to operate (busted not once but twice).

Note: June 2021 is only a few months after FTX falsified their Binance related submissions for the FTX arena DD.

Note: June 2021 is only a few months after FTX falsified their Binance related submissions for the FTX arena DD.

@ParrotCapital that's all from me today....I've got real world shit to do....Im sure I'll have more commentary on this later....after all I haven't yet read the whole document.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter