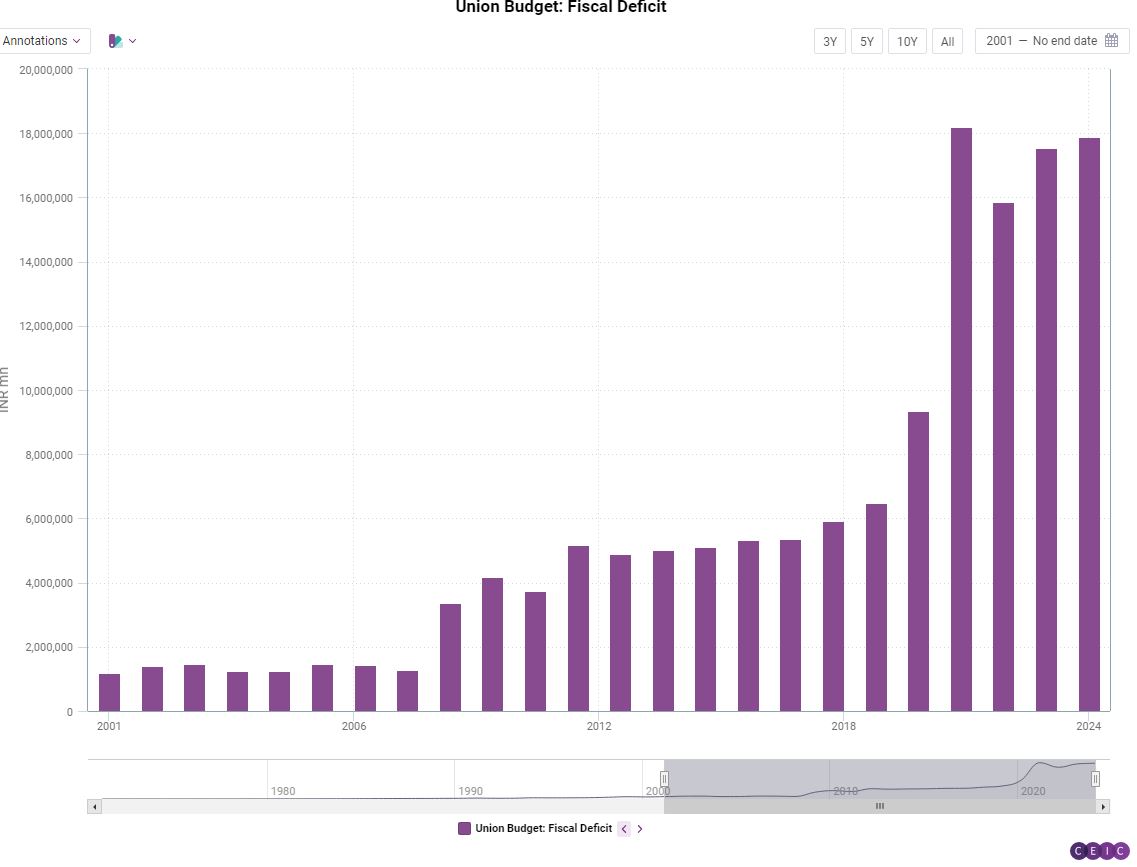

#BRILLIANT Example of #Modigovt CAPEX !

Rs20000 per Plate of Food for #G20 comes as No Surprise

#Modinomics CAPEX is GOLD PLATED thereby costing us at-least 50-100% More than what a Frugal Govt should spend or what has been spent by the same institutions in the past.

Rs20000 per Plate of Food for #G20 comes as No Surprise

#Modinomics CAPEX is GOLD PLATED thereby costing us at-least 50-100% More than what a Frugal Govt should spend or what has been spent by the same institutions in the past.

This is precisely why your Road Cost you Rs75 LACS per 10 Meters of Road (Bangalore- Mysore Expressway) or the User Development Fee at your Airports are being raised by 500% etc

I have written Several Detailed Threads on this subject

I have written Several Detailed Threads on this subject

All about the GOLD PLATED #BangaloreMysore Expressway

https://twitter.com/TheFactFindr/status/1635244910797553667?s=20

Comparing #VandeBharat vs Existing #Shatabdi - JUST ANOTHER EXAMPLE of GoldPlating

https://twitter.com/TheFactFindr/status/1596574992342618113?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter