🧵 Gulf Marine Services #GMS.L - A deleverage story in a rapidly improving offshore market

Below a short analysis made with @Magnus12316

#rigs #shiptwit #oil #oott #offshore

1/n

Below a short analysis made with @Magnus12316

#rigs #shiptwit #oil #oott #offshore

1/n

THE FLEET

#GMS.L has a fleet of 13 advanced self-propelled, self-elevating support vessels, mainly in the AG (and one vessel in the North Sea).

These are accommodation units for workers servicing offshore oil fields.

2/n

#GMS.L has a fleet of 13 advanced self-propelled, self-elevating support vessels, mainly in the AG (and one vessel in the North Sea).

These are accommodation units for workers servicing offshore oil fields.

2/n

Unless fields are "closed" permanently, they need to be serviced.

The dayrate is the basic income of the vessels, then there are add-ons (VSAT, catering, etc)

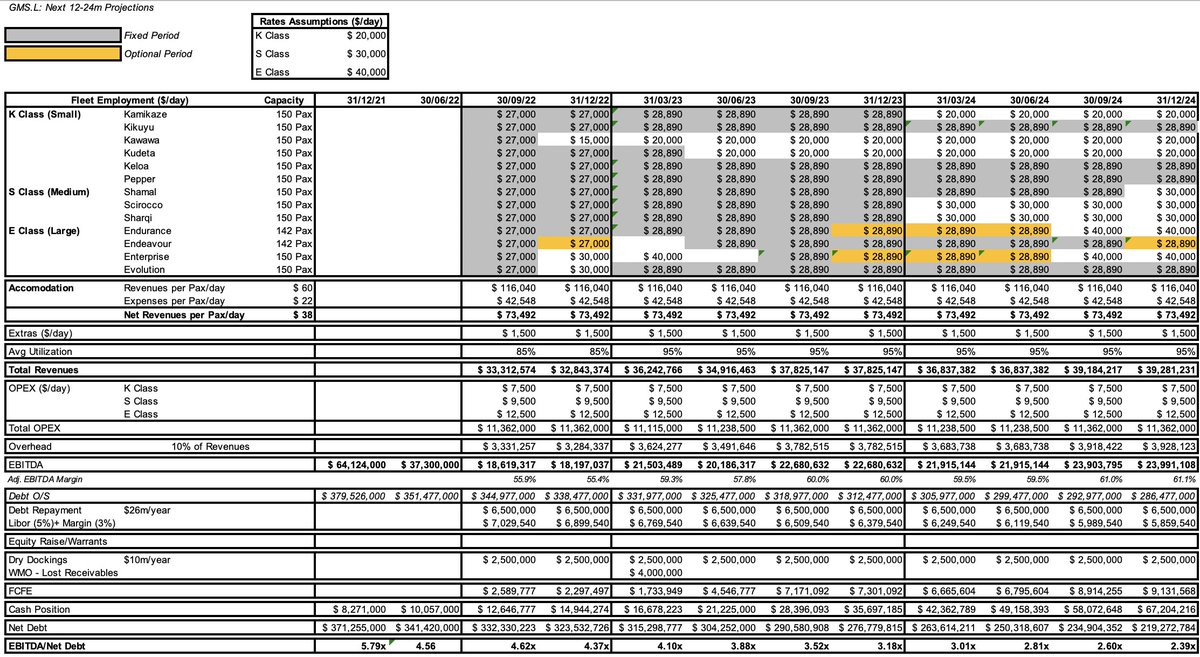

GMS has 6x K-Class (Small), 3x S-CLass (medium) and 4x E-CLass (large).

3/n

The dayrate is the basic income of the vessels, then there are add-ons (VSAT, catering, etc)

GMS has 6x K-Class (Small), 3x S-CLass (medium) and 4x E-CLass (large).

3/n

BACKGROUND

#GMS, is one of the leading players in the Gulf region. As many cos in the sector, it went through a debt restructuring process the past few years and came out of it in 2020 with a still highly leveraged balance sheet.

4/n

#GMS, is one of the leading players in the Gulf region. As many cos in the sector, it went through a debt restructuring process the past few years and came out of it in 2020 with a still highly leveraged balance sheet.

4/n

New mgmt has been in place with a priority to deleverage quickly. As per restructuring agreement the goal is to reach an EBITDA/Net Debt ratio <4.0x. According to the company and our projections, this should be achieved in 2023 (most probably by June '23).

5/n

5/n

As soon as the 4.0x ratio is reached, then the company will be much more flexible financially and without any dilution overhang.

Below restructuring terms. The understanding is that, no more equity raises are required to satisfy debt terms.

6/n

Below restructuring terms. The understanding is that, no more equity raises are required to satisfy debt terms.

6/n

THE DEBT

In H1 '22 the company had Net Debt of $341m and and an EBITDA/Net Debt of 4.56x (it was 5.79x for FY '21).

Considering Debt repayments of $6.5m/quarter, DD expenses, Int payments, Net Debt at Dec '22 should be around $325m and EBITDA/Net Debt at around $.3-4.4x.

7/n

In H1 '22 the company had Net Debt of $341m and and an EBITDA/Net Debt of 4.56x (it was 5.79x for FY '21).

Considering Debt repayments of $6.5m/quarter, DD expenses, Int payments, Net Debt at Dec '22 should be around $325m and EBITDA/Net Debt at around $.3-4.4x.

7/n

As per company commentary the mkt has improved quickly (we'll talk later about it) and this will push EBITDA (and cash) higher in '23, and we expect the ratio to fall to 3.25 - 3.50x by year end.

8/n

8/n

As can be seen per above, one of GMS clients (in the North Sea) has filed for bankruptcy and we assumed these receivable will not be recovered. To be noted the vessel has already found alternative employment.

9/n

9/n

THE MARKET

#GMS expects:

- increased utilization for 2023 to 94% vs 88% in 2022 and 84% in 2021, driven by more investments in offshore fields

- increase in day rates

- EBITDA of $75m - $83m

rigzone.com/news/offshore_…

10/n

#GMS expects:

- increased utilization for 2023 to 94% vs 88% in 2022 and 84% in 2021, driven by more investments in offshore fields

- increase in day rates

- EBITDA of $75m - $83m

rigzone.com/news/offshore_…

10/n

Speaking with some people in the sector, there has been a substantial pick up in rates and it is expected that rates will remain elevated for the foreseeable future due to a lack of supply of "GMS-type" of ships (this is demonstrated by ADNOC buyout of Zakher, a competitor)

11/n

11/n

We believe in the continued strength of the market in the AG region, pushed by investments from NOCs in offshore drilling, and this should allow #GMS to deleverage quickly and re-price.

We expect '23 EBITDA to be on the higher range of the company guidance i.e. $83 - $87m.

12/n

We expect '23 EBITDA to be on the higher range of the company guidance i.e. $83 - $87m.

12/n

In my personal opinion, this could be a multi-bagger opportunity, or an acquisition target from a bigger player/NOC (like happened with Zakher recently), which would probably limit the upside.

13/n

13/n

DOWNSIDE/RISKS

- It is still a highly leverage company operating in a very cyclical business

- Given the uncertainties in the banking sector, banks could "make it difficult" for #GMS.L (e.g. requiring equity raises, etc.)

14/n

- It is still a highly leverage company operating in a very cyclical business

- Given the uncertainties in the banking sector, banks could "make it difficult" for #GMS.L (e.g. requiring equity raises, etc.)

14/n

- Oil price volatility could negatively affect operations/profitability (indirectly)

- Geopolitical instability in the area (potential war in Iran, etc)

- Further increase in interest rates, would increase debt service, decreasing profitability

15/n

- Geopolitical instability in the area (potential war in Iran, etc)

- Further increase in interest rates, would increase debt service, decreasing profitability

15/n

DISCLAIMER: the above is not investment advice, but just our opinion on the company.

I have a long position in #GMS.L

16/n

I have a long position in #GMS.L

16/n

Forgot to mention in the Risks section that this is a highly illiquid stock.

Do your own DD.

Do your own DD.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter