Let's talk about buying a 🏠 in #Markham #Ontario.

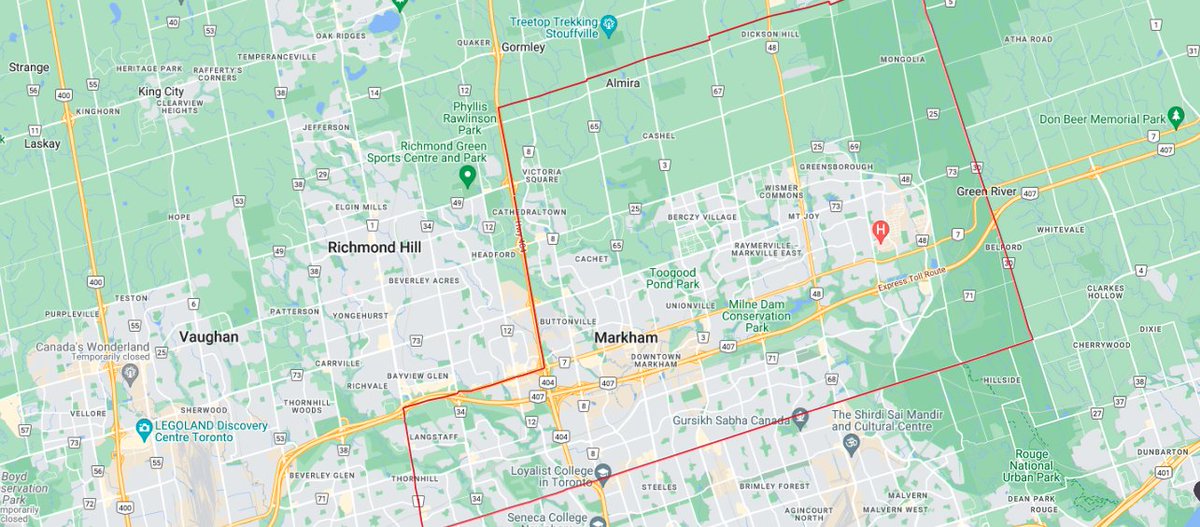

At today's fixed rates of 4.5% & a 30 year amortization, a 750k house with 20% down will give approximately a $3000 per month mortgage. Currently, there are ZERO houses in Markham available for 750k.

At today's fixed rates of 4.5% & a 30 year amortization, a 750k house with 20% down will give approximately a $3000 per month mortgage. Currently, there are ZERO houses in Markham available for 750k.

Notice there are also zero properties available in #RichmondHill & #Vaughn. So let's up it to $850k. The result is....yup, still ZERO!

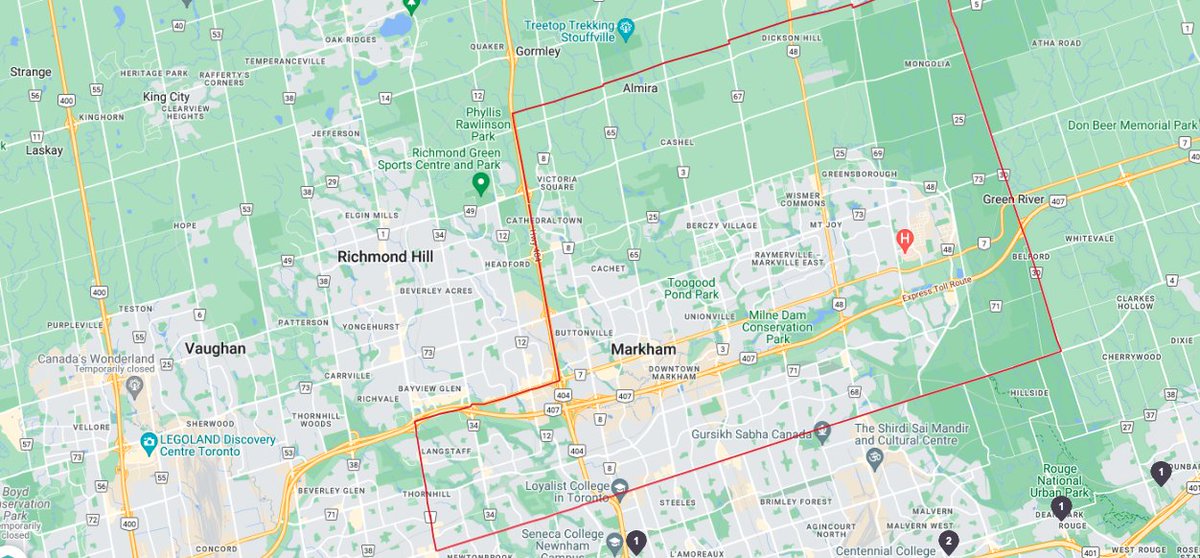

Let's try a $1 million. In #Markham, there are 8 properties to look at.

For a $1 mill house, using the same 4.5%, 30 yr amortization, & 20% down, our mortgage payment now balloons to $4050. Or to put another, the average #ontarians take home pay after taxes!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter