@gaborgurbacs @Tether_to @tethergold @paoloardoino I agree #Tether $Gold aka $XAUT is a great product. When compared to $USDT $XAUT is by far the better option.

Why is does no one use it?

Why is does no one use it?

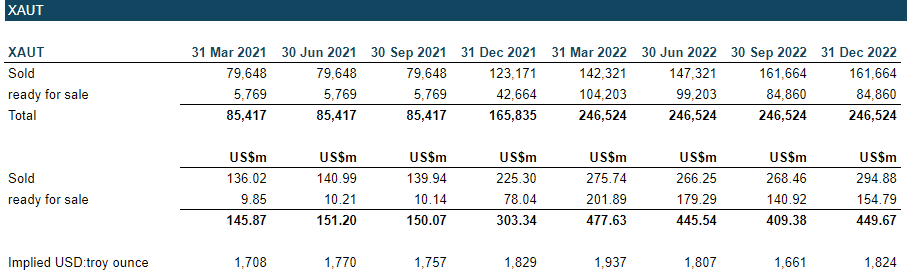

@gaborgurbacs @Tether_to @tethergold @paoloardoino In the last 12 months only 19k has been sold and only 82k since beginning of 2021.

@gaborgurbacs @Tether_to @tethergold @paoloardoino Since the beginning of 2021 #tether themselves have purchased and increased inventory ready for sale by more than 79k ounces (which is almost as much as sold over that period). But zero interest.

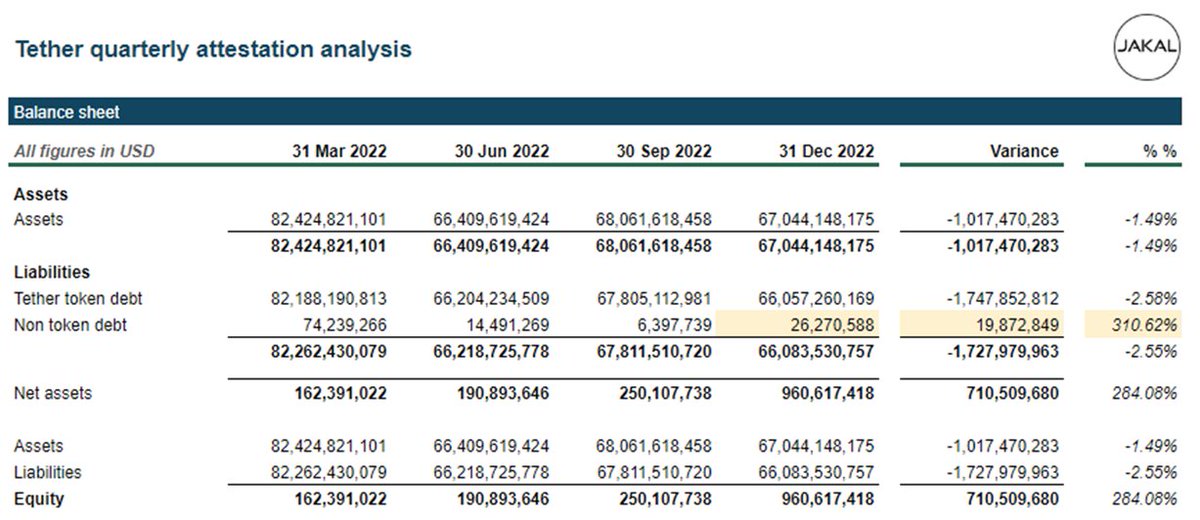

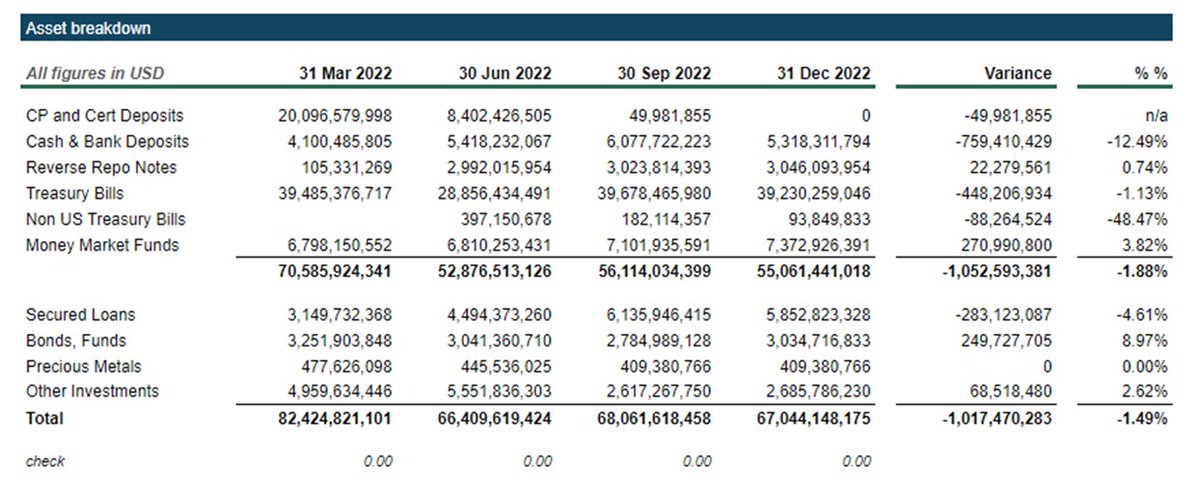

@gaborgurbacs @Tether_to @tethergold @paoloardoino You know what else is really unusual. That $XAUT held for sale represents 83% of all digital token's held and owned by the #tether group.

@gaborgurbacs @Tether_to @tethergold @paoloardoino Which is kinda unbalanced....since $XAUT is only 0.67% of total digital assets.....

especially considering with $5.8B of secured loans (aka lent assets) maximum of $32m of other tokens that could be lent out ...ie there is 183x more tokens lent than available to lend.

especially considering with $5.8B of secured loans (aka lent assets) maximum of $32m of other tokens that could be lent out ...ie there is 183x more tokens lent than available to lend.

@gaborgurbacs @Tether_to @tethergold @paoloardoino maybe I'm reading the attestations incorrectly and there is only $2.93B of tokens lent at an LVR of 50% but that would mean the headroom of the asset held as security have had $2.93B tokens issued against it. Happy to be told which is right.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter