Join us for the 3rd episode of our cosmic adventure through the @Entanglefi multiverse! 🚀

Get an in-depth look at the protocol's unique approach & discover the innovative liquidity solutions it brings to DeFi

#DeFi #LSD #Omnichain #ReHash

/1

Get an in-depth look at the protocol's unique approach & discover the innovative liquidity solutions it brings to DeFi

#DeFi #LSD #Omnichain #ReHash

/1

Before we move forward, please note that this thread merely aims to share our understanding of the topic and should not be taken as financial advice.

Disclosure: This post is under a partnership with the @Entanglefi team

/2

Disclosure: This post is under a partnership with the @Entanglefi team

/2

Table of Contents

🟣 What is Entangle?

🟣 Synthetic Vaults

🟣 How SV work

🟣 Distributed Oracle Solution

🟣 Entangle Blockchain

🟣 High-level overview of Entangle Products

🟣 Use-Cases

🟣 Revenue Model

🟣 $ENTGL Token

🟣 Development Roadmap

🟣 References

/3

🟣 What is Entangle?

🟣 Synthetic Vaults

🟣 How SV work

🟣 Distributed Oracle Solution

🟣 Entangle Blockchain

🟣 High-level overview of Entangle Products

🟣 Use-Cases

🟣 Revenue Model

🟣 $ENTGL Token

🟣 Development Roadmap

🟣 References

/3

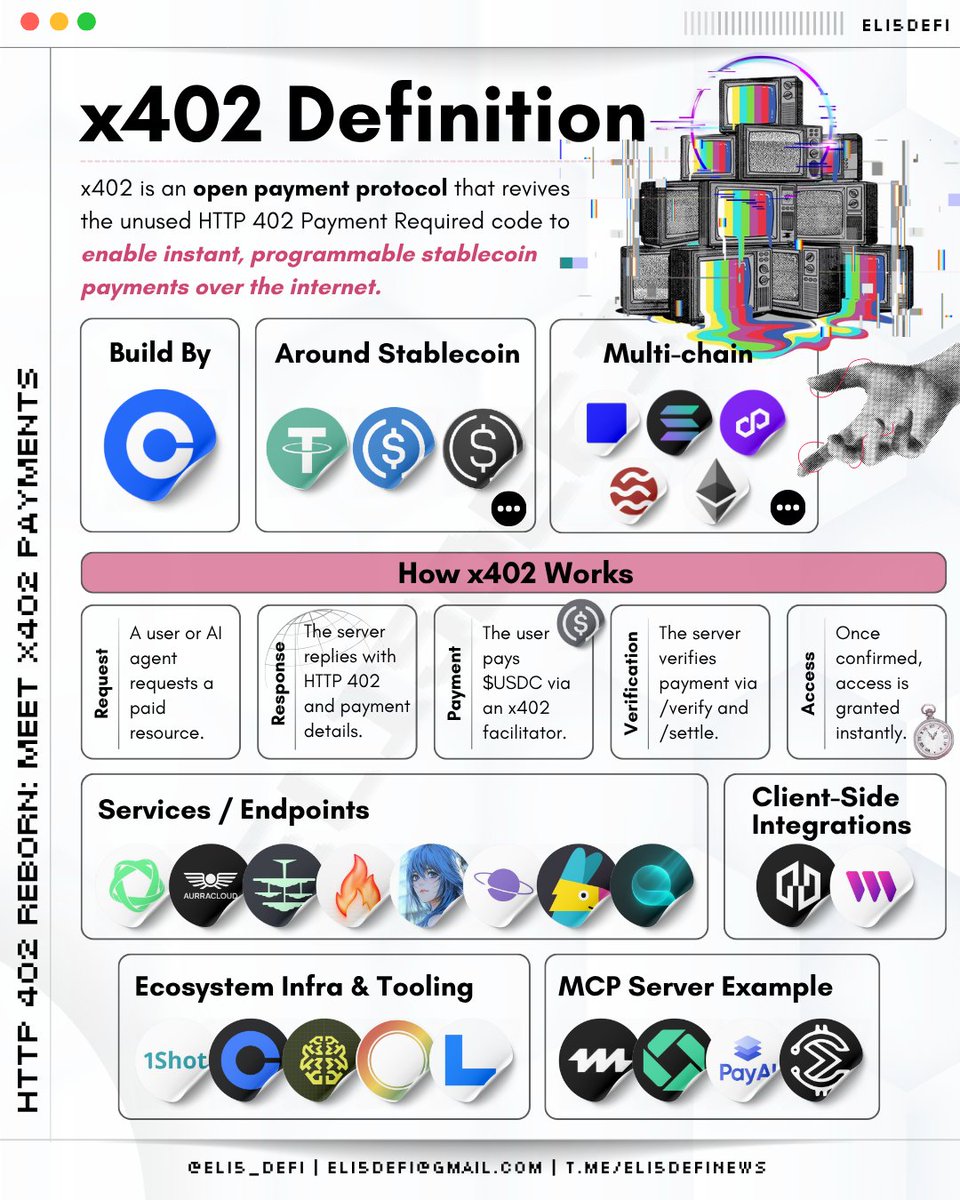

@Entanglefi seeks to address liquidity challenges by linking protocols through a distinct liquidity sub-layer that extends across multiple chains.

This achieved by utilizing Synthetic Vaults, a Liquid Staking Derivatives (LSD) complete with it's own oracle and blockchain.

/4

This achieved by utilizing Synthetic Vaults, a Liquid Staking Derivatives (LSD) complete with it's own oracle and blockchain.

/4

Synthetic Vaults interoperate with intra- and cross-chain partner protocols; in the example below, we use a yield-bearing asset originating from the @0xPolygonLabs Chain.

/5

/5

Entangle's Synthetic Vaults enable a innovative solution in liquidity problem, transforming yield-generating assets into transferable LSD equivalents.

This will unlocks liquidity across omni-chain networks, boosting revenue potential & capital efficiency.

/6

This will unlocks liquidity across omni-chain networks, boosting revenue potential & capital efficiency.

/6

Entangle's E-DOS serves as a foundation for cross-chain capabilities of Synthetic Vaults.

It excels in contract automation, handling data acquisition, validation, processing & storage, this further enhance scalability & cost efficiency when utilizing E-DOS' oracle.

/7

It excels in contract automation, handling data acquisition, validation, processing & storage, this further enhance scalability & cost efficiency when utilizing E-DOS' oracle.

/7

The Entangle Blockchain, designed for processing and validating oracle transactions, boasts low gas fees and 2-second block times.

With EVM compatibility and DPoS, it uses Tendermint and ensuring omni-chain interoperability for native and external dApps through E-DOS.

/8

With EVM compatibility and DPoS, it uses Tendermint and ensuring omni-chain interoperability for native and external dApps through E-DOS.

/8

This diagram shows high-level overview on how Entangle Synthetic Vaults built upon E-DOS and being utilized across different chain to optimize liquidity.

/9

/9

The Entangle Infrastructure opens up innovative use-cases for dApps and Builders, for example:

🟣 Bridges between any chains

🟣 Expand Cross-Chain dApps offering

🟣 Build innovative cross-chain products

🟣 Yield opitimization strategies

🟣 Many more!

/10

🟣 Bridges between any chains

🟣 Expand Cross-Chain dApps offering

🟣 Build innovative cross-chain products

🟣 Yield opitimization strategies

🟣 Many more!

/10

The Entangle Protocol earns revenue from multiple sources & distributes it among stakeholders as "Real-Yield.

Income is used to acquire $ENTGL tokens, based on predefined percentages.

This promotes balanced, sustainable revenue distribution, fueling ecosystem growth.

/11

Income is used to acquire $ENTGL tokens, based on predefined percentages.

This promotes balanced, sustainable revenue distribution, fueling ecosystem growth.

/11

The Entangle Ecosystem operates on $ENTGL, which can be acquired through Staking as a Validator or Delegator, or operating Oracle Keepers.

/12

/12

This roadmap reveals that v2 testnet is in preparation, it will also undergoing rigorous testing and audits before being released to the public.

/13

/13

This concludes our @Entanglefi protocol multiversal series.

We're eager to see how their product tackles liquidity challenges across DeFi and blockchain.

#DeFi #LSD #Omnichain #ReHash #Oracle #CrossChain

/15

We're eager to see how their product tackles liquidity challenges across DeFi and blockchain.

#DeFi #LSD #Omnichain #ReHash #Oracle #CrossChain

/15

Please check our previous visual guide that explained in details how Synthetic Vaults work.

/16

/16

https://twitter.com/eli5_defi/status/1638254180224860163

To understand more about @Entanglefi E-DOS, please check below

/17

/17

https://twitter.com/eli5_defi/status/1641847865516650497

Tagged DeFi Researcher

@LouisCooper_

@ThorHartvigsen

@blocmatesdotcom

@Slappjakke

@Route2FI

@rektdiomedes

@JiraiyaReal

@crypto_linn

@SimplifyDeFi

@jake_pahor

@Only1temmy

@Louround_

@2lambro

@DeFiMinty

@DefiIgnas

@launchy_

@Cryptotrissy

/18

@LouisCooper_

@ThorHartvigsen

@blocmatesdotcom

@Slappjakke

@Route2FI

@rektdiomedes

@JiraiyaReal

@crypto_linn

@SimplifyDeFi

@jake_pahor

@Only1temmy

@Louround_

@2lambro

@DeFiMinty

@DefiIgnas

@launchy_

@Cryptotrissy

/18

I hope you've found this thread helpful.

Like/Retweet/Follow @eli5_defi to support us. Also, please share your thoughts and suggestions in the comments.

$ENTGL #LSD #DeFi #Omnichain #ReHash #Oracle #CrossChain

/19

Like/Retweet/Follow @eli5_defi to support us. Also, please share your thoughts and suggestions in the comments.

$ENTGL #LSD #DeFi #Omnichain #ReHash #Oracle #CrossChain

/19

https://twitter.com/eli5_defi/status/1650182770801651713

• • •

Missing some Tweet in this thread? You can try to

force a refresh