The #NFT space has enjoyed renewed growth and interest since 2022, as new models seek to unlock liquidity within these assets through “NFTFi”. What are some of the latest developments and how are they faring?

Let’s dive into the NFT Marketplaces and Lending sectors.

🧵👇

Let’s dive into the NFT Marketplaces and Lending sectors.

🧵👇

1/ NFT Marketplaces

Existing marketplaces such as @opensea adopt the auction and marketplace models where users trade individual NFTs. However, more recently, we witnessed the emergence of Leveraged Trading and #AMMs where users can be exposed to NFTs without direct ownership.

Existing marketplaces such as @opensea adopt the auction and marketplace models where users trade individual NFTs. However, more recently, we witnessed the emergence of Leveraged Trading and #AMMs where users can be exposed to NFTs without direct ownership.

2/ Leveraged Trading

On @nftperp, users can adopt a leveraged position of up to 10x, to long or short NFT collections with minimal capital outlay. Although it is still in beta phase, the protocol has generated significant interest with a high daily trading volume.

On @nftperp, users can adopt a leveraged position of up to 10x, to long or short NFT collections with minimal capital outlay. Although it is still in beta phase, the protocol has generated significant interest with a high daily trading volume.

3/ Pooled Liquidity

@sudoswap adopted the AMM model where users trade NFTs using on-chain pools through bonding curves. It enhances the price discovery process for projects as liquidity providers are incentivised to provide tight liquidity to earn fees.

@sudoswap adopted the AMM model where users trade NFTs using on-chain pools through bonding curves. It enhances the price discovery process for projects as liquidity providers are incentivised to provide tight liquidity to earn fees.

4/ While both introduce new features that are different from the traditional notion of NFT trading, fierce competition from @blur_io eclipse these given spotlight on recent airdrops. As such, these protocols have yet to gain widespread adoption.

5/ NFT Lending

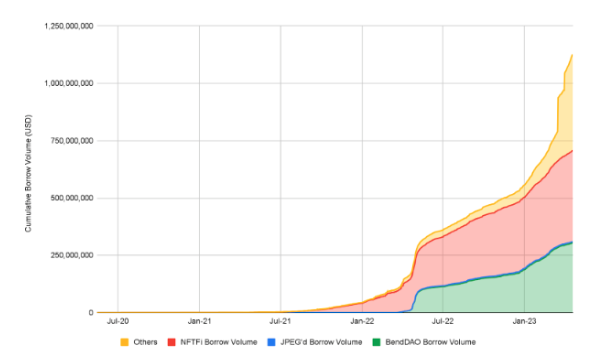

In capital markets, holders can collateralize their NFTs to borrow crypto. This enables them to access capital without selling their unique digital assets. Though in its infancy, the market has seen a steep rise in borrowing volumes, crossing the US$1B mark.

In capital markets, holders can collateralize their NFTs to borrow crypto. This enables them to access capital without selling their unique digital assets. Though in its infancy, the market has seen a steep rise in borrowing volumes, crossing the US$1B mark.

6/ P2P

P2P encompasses a direct relationship between a lender and borrower where both parties agree to certain loan conditions. @NFTfi has dominated the space with its proven track record and consistently high monthly loan volumes.

P2P encompasses a direct relationship between a lender and borrower where both parties agree to certain loan conditions. @NFTfi has dominated the space with its proven track record and consistently high monthly loan volumes.

7/ P2Pool

This adopts the AMM model, where borrowers list NFTs to borrow from a pool. @BendDAO trailblazes with its intuitive design, by redesigning its risk parameters to ensure healthy liquidity dynamics. It has gained popularity by leading in user activity and volumes.

This adopts the AMM model, where borrowers list NFTs to borrow from a pool. @BendDAO trailblazes with its intuitive design, by redesigning its risk parameters to ensure healthy liquidity dynamics. It has gained popularity by leading in user activity and volumes.

8/ P2Protocol

Inspired by @MakerDAO, borrowers lock NFTs in a collateralized debt position to receive synthetic assets on @JPEGdio_69. It actively integrates its native coins ($pUSD, $pETH) with @CurveFinance to drive adoption - creating decentralized assets backed by NFTs.

Inspired by @MakerDAO, borrowers lock NFTs in a collateralized debt position to receive synthetic assets on @JPEGdio_69. It actively integrates its native coins ($pUSD, $pETH) with @CurveFinance to drive adoption - creating decentralized assets backed by NFTs.

9/ Future Opportunities

As the NFT market matures, it’ll be interesting to see how the space evolves to unlock liquidity with different collections. This includes better pricing methods, enhanced security and risk management frameworks to strengthen the ecosystem.

As the NFT market matures, it’ll be interesting to see how the space evolves to unlock liquidity with different collections. This includes better pricing methods, enhanced security and risk management frameworks to strengthen the ecosystem.

10/ To learn more about the The Financialization of NFTs and future trends in the space, be sure to check out the full report below.

research.binance.com/en/analysis/fi…

research.binance.com/en/analysis/fi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter