#FTXUS shareholder analysis thread part 2

Yesterday I punched out a bunch of tweets re: the ownership of FTXUS aka #wrssilo I'm still working through the filings. I'm just going to post as and when I've got time....its going to be untidy but you know ...thats the I roll.

Yesterday I punched out a bunch of tweets re: the ownership of FTXUS aka #wrssilo I'm still working through the filings. I'm just going to post as and when I've got time....its going to be untidy but you know ...thats the I roll.

One thing I've scratched my head about is how did the FTX muppets end up with the shares in WRS directly in their name....since its the US operations of #FTX?

I haven't worked out why but I think I've worked out how.

I haven't worked out why but I think I've worked out how.

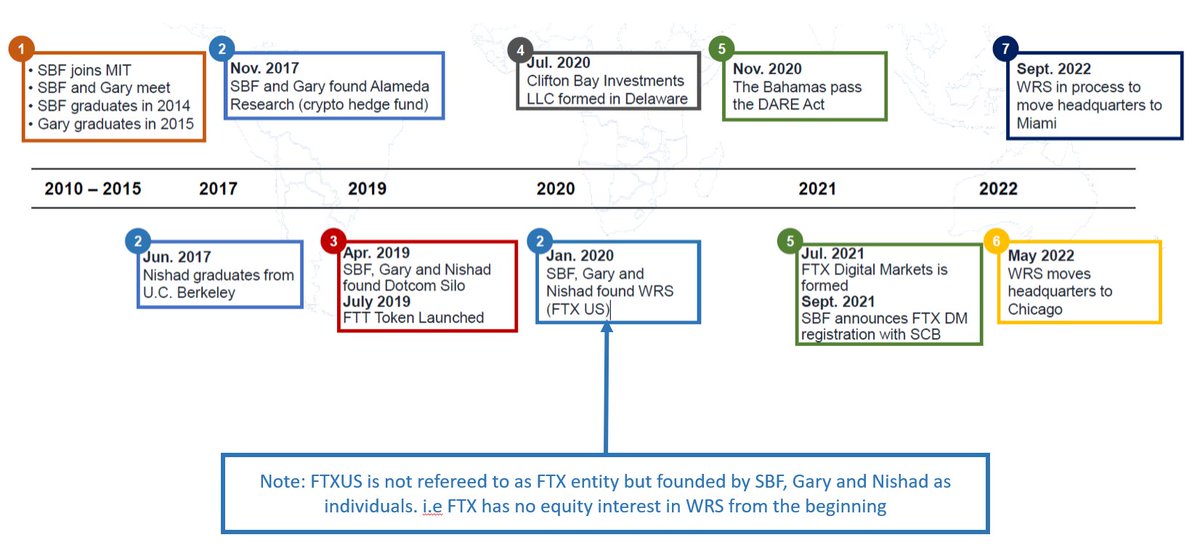

Kroll scratched out a timeline and note that SBF, Gary and Nishad founded WRS (FTX US) in Jan 2020.

Not as a subsidiary...not as a branch office, majority owned/controlled entity...nope just straight up new shares to the Bro's.

Not as a subsidiary...not as a branch office, majority owned/controlled entity...nope just straight up new shares to the Bro's.

and at bankruptcy the #FTXUS Bros ownership of WRS #SBF 52.99%, Wangster 16.93% and babyface Singh 7.83% with 'third party investors' holding 22.25%

So how did they get their equity...what cash did they invest and why didn't #FTX own a shit ton of #FTXUS since well they are piggybacking off the ahem brand, infrastructure, intellectual property etc.

Well that's what I've been scratching my head trying to understand.

Well that's what I've been scratching my head trying to understand.

Trying to piece things together from the documents is pretty slow and it wasn't until I read through the incomplete and heavily redacted list of contracts that I could see one pathway they might have used (a shit one of course).

On 12 Jan 2021 all three #FTXUS Bros executed the same docs - technology assignment, stock purchase agreement (don't know why only the wangster was listed with an investors rights agreement).

It looks (on face value) that the Bros founded #FTXUS by 'vending' their IP (individually or collectively who the fk knows). lol No one is crypto gives a shit about tax deliberately structure to be as tax inefficient as possible. #MuppetsMayhem

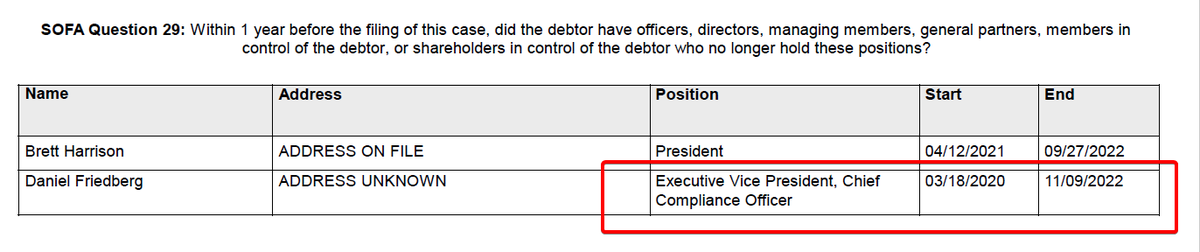

With #danfriedberg as their legal eagle...who could expect anything better

Ironically since the date of the DF's contract is well before incorp I'm guessing the contract is in fact an FTX contract.

Ironically since the date of the DF's contract is well before incorp I'm guessing the contract is in fact an FTX contract.

Stay tuned for part 3

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter