SHAME ON U.S. REGULATORS

Consider the following:

In 2017 SEC issued the DAO. Then 2017-19 there were 57 enforcement actions 🆚 crypto companies, involving ICOs (#KIK, #Telegram, etc).

In 2018 we got the Hinman Speech.

In 2019 the SEC issued its Framework for Digital assets.

Consider the following:

In 2017 SEC issued the DAO. Then 2017-19 there were 57 enforcement actions 🆚 crypto companies, involving ICOs (#KIK, #Telegram, etc).

In 2018 we got the Hinman Speech.

In 2019 the SEC issued its Framework for Digital assets.

https://twitter.com/coinbase/status/1653385513011740672

Also in 2019, former Chairman Clayton publicly agreed with Hinman’s speech stating the token itself is NOT a security and that a token can, at first, start out or be issued as a security, but later transform so that subsequent sales of the token no longer meet the Howey test.

Yet, here we are FOUR years later, moving backwards regarding regulatory clarity. And for you crypto Critics that say Hinman and Clayton’s comments are immaterial b/c their statements were only personal opinions, I say hogwash (I actually say something else but I’m being polite).

It’s an absolute shame our regulators won’t sit down and establish a regulatory framework - even if it’s a framework many in the industry believe too harsh.

For example, establish sufficiently decentralized markers that must first be met to be a commodity.

It’s not 🚀 science.

For example, establish sufficiently decentralized markers that must first be met to be a commodity.

It’s not 🚀 science.

The @Ripple / #XRP case is the perfect example. If Ripple owning 50% of the tokens is an issue, then establish a standard that no one entity can own more than a certain percentage of the outstanding tokens as part of the sufficiently decentralized paradigm.

As for #XRP itself, OBJECTIVELY consider the following:

In 2014 (yes, almost a DECADE ago), the @USGAO described #XRP as a “virtual currency utilized in a decentralized payment protocol called Ripple.”

It certainly didn’t describe it as a security.

In 2014 (yes, almost a DECADE ago), the @USGAO described #XRP as a “virtual currency utilized in a decentralized payment protocol called Ripple.”

It certainly didn’t describe it as a security.

Also consider, in 2015, FinCEN declared #XRP “convertible virtual currency” and forced Ripple to comply with U.S. Banking laws, not securities laws.

The SEC was informed (through an info sharing agreement with FinCEN) and didn’t step in and say these were also securities.

The SEC was informed (through an info sharing agreement with FinCEN) and didn’t step in and say these were also securities.

Also consider, in his speech, Hinman basically said any network that is equal to or more decentralized than #ETH isn’t a security.

Consider that Ripple wasn’t sued during those 57 prosecutions.

Now also consider what the SEC’s 2019 Framework literally states:

Consider that Ripple wasn’t sued during those 57 prosecutions.

Now also consider what the SEC’s 2019 Framework literally states:

If a token can be used as a payment or as a substitute for fiat, it is “unlikely to satisfy Howey.”

That’s the very use case for #XRP. @TapJets & @Spend_The_Bits use #XRP that way. Hell, there was an #XRPTipBot on Twitter long ago allowing p2p payments.

Look at what @coinbase👇

That’s the very use case for #XRP. @TapJets & @Spend_The_Bits use #XRP that way. Hell, there was an #XRPTipBot on Twitter long ago allowing p2p payments.

Look at what @coinbase👇

Now also consider, that the 2019 FSOC annual report highlighted #XRP NOT as a security but as a “virtual currency” - a report that was signed by ALL the top financial regulators in the United States, including Clayton and Jerome Powell.

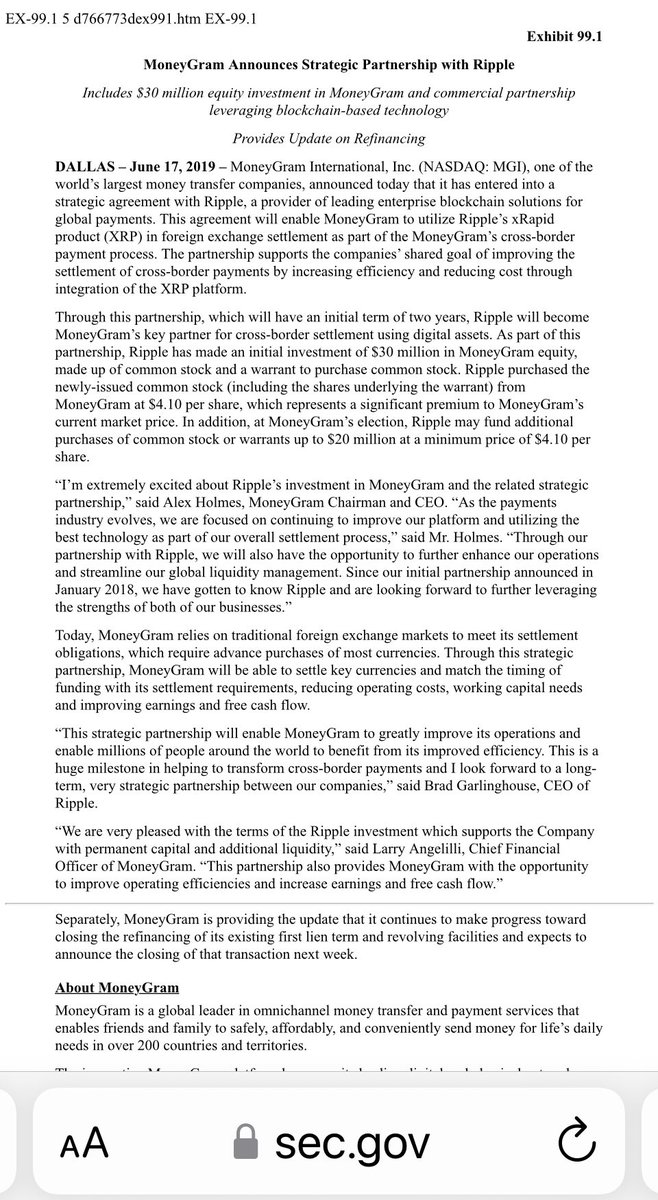

Also consider in 2019 @MoneyGram filed documents w/the SEC 👇disclosing how MoneyGram would be using #XRP in its cross border payments business. The SEC knew MoneyGram would sell #XRP to the public on Coinbase - the company it approved to go public over two years ago!

It has been a DECADE since the @USGAO report in 2014 describing #XRP as a virtual currency utilized in a decentralized payment system.

We have a Chairman @GaryGensler who won’t answer the basic question of whether #ETH is a security despite @CFTCbehnam saying its a commodity.

We have a Chairman @GaryGensler who won’t answer the basic question of whether #ETH is a security despite @CFTCbehnam saying its a commodity.

You can credibly make the case that a lot of Crypto is a ponzi or scam.

You can credibly believe, like I do, that all altcoins satisfy Howey at the time of their origin and initial sales or distribution (including #ETH and #XRP). Hell, arguably #BTC satisfied Howey in 2011-2013.

You can credibly believe, like I do, that all altcoins satisfy Howey at the time of their origin and initial sales or distribution (including #ETH and #XRP). Hell, arguably #BTC satisfied Howey in 2011-2013.

But one thing you CANNOT credibly argue, is that the @SECGov is even remotely protecting investors.

Not only has it failed miserably to protect investors, it certainly hasn’t maintained “fair, orderly, and efficient markets” nor “facilitated capital formation.”

Absolute shame!

Not only has it failed miserably to protect investors, it certainly hasn’t maintained “fair, orderly, and efficient markets” nor “facilitated capital formation.”

Absolute shame!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter