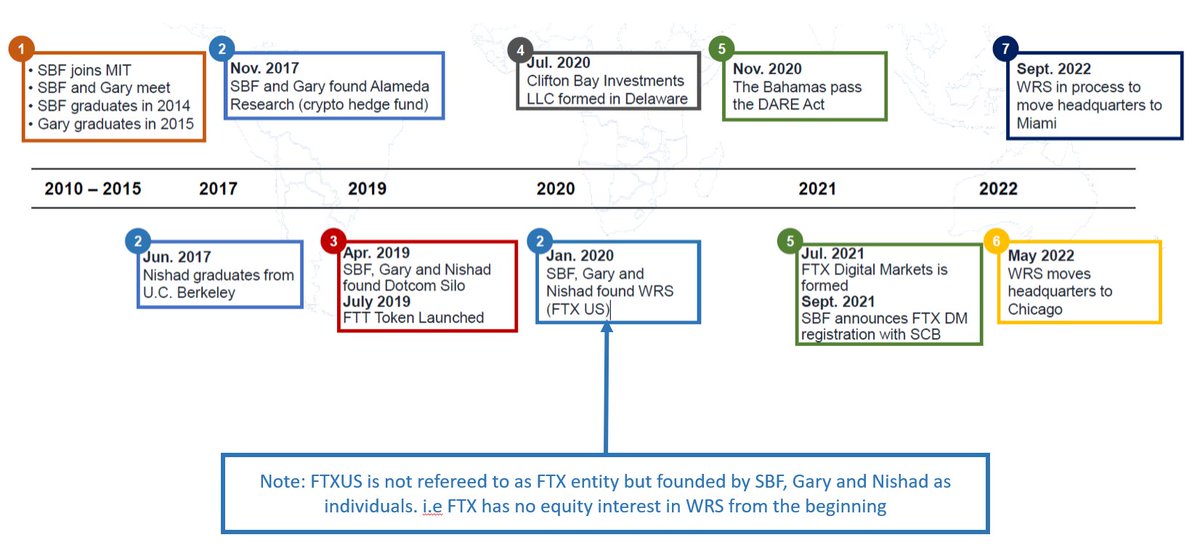

#FTXUS Analysis - Thread 3

Following on from yesterday. Todays thread will focus on payments to #insiders made in the last 12 months prior to bankruptcy. Every time I look through the docs...I'm just amazed how spellbindly outrageous this whole shit show is.

Following on from yesterday. Todays thread will focus on payments to #insiders made in the last 12 months prior to bankruptcy. Every time I look through the docs...I'm just amazed how spellbindly outrageous this whole shit show is.

In 12 months just over $25m was paid to insiders. I've summarised by quarter. 48% of payments went to undisclosed parties but since they are insiders and SBF only clipped a lazy $500k in his name...lets assume its him.

The stand out insider is the former CFTC commissioner #markwetjen who was paid $3.7million

This bloke has the best timing of anyone ever. As he managed to get #FTXUS to cut him a $1.93million cheque on the 9 November 2022.....2 days before bankruptcy.

How's many questions does that raise?

What happened ....was there a water cooler moment Wetjen overhead the #mooch talking shop with SBF Snr....and then hoofed it over to accounts with a box of chockys to sweet talk accounts into cutting him a cheque?

What happened ....was there a water cooler moment Wetjen overhead the #mooch talking shop with SBF Snr....and then hoofed it over to accounts with a box of chockys to sweet talk accounts into cutting him a cheque?

While you busy working out how many years salary at the CFTC #markwetjen FTX final cheque was...

Lets have a look at #brettharrison ...I didn't know, had no powers, no one listened and they threatened me with the sack...oh and I don't know wtf #FDIC is

Lets have a look at #brettharrison ...I didn't know, had no powers, no one listened and they threatened me with the sack...oh and I don't know wtf #FDIC is

#brettharrison sits in second place behind Wetjen with a tidy $2.876million for 12 months. Walking with $2.38m when he exited in Sep 2022....so much for fear of being sacked....his payout was 10x salary.

But actually....he didn't just get $2.8m. He actually got almost $4million. because he was paid another 2 payments of $534k from Paperbird, Inc in October 2022 after his exit.

#ftxus

#ftxus

For a self proclaimed innocent victim...he sure dgaf about customers or shareholders....anyone that forgives, backs this #muppet or uses any service he is involved in needs their head read.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter