Kotak Flexicap has become the BIGGEST actively-managed #equity fund.

Its performance is impeccable.

In 10 years it has delivered 16.8% annualised returns.

It has never underperformed except for in 2020 and 2021.

We review its performance.

A thread 🧵

Its performance is impeccable.

In 10 years it has delivered 16.8% annualised returns.

It has never underperformed except for in 2020 and 2021.

We review its performance.

A thread 🧵

The fund was launched in Sep 2009.

Its assets have grown four times since March 2017.

As of Mar 31, 2023, @KotakMF Flexicap’s AUM was Rs 36,056 crore.

What’s so great about its performance that it became so popular?

Let’s explore 👇

Its assets have grown four times since March 2017.

As of Mar 31, 2023, @KotakMF Flexicap’s AUM was Rs 36,056 crore.

What’s so great about its performance that it became so popular?

Let’s explore 👇

First, some basic comparison.

Kotak Flexicap’s long-term track record is spectacular.

For a 10-year period, it’s among the top two Flexicap funds.

@quantmutual Flexicap is at the top with 20.7% returns.

Kotak Flexicap follows with 16.8%.

Kotak Flexicap’s long-term track record is spectacular.

For a 10-year period, it’s among the top two Flexicap funds.

@quantmutual Flexicap is at the top with 20.7% returns.

Kotak Flexicap follows with 16.8%.

Now, let’s compare its return with the category.

In over 13 years of its existence, Kotak Flexicap has given better returns than the Flexicap category in 11 years.

2020 and 2021 were the only two calendar years when it underperformed.

In over 13 years of its existence, Kotak Flexicap has given better returns than the Flexicap category in 11 years.

2020 and 2021 were the only two calendar years when it underperformed.

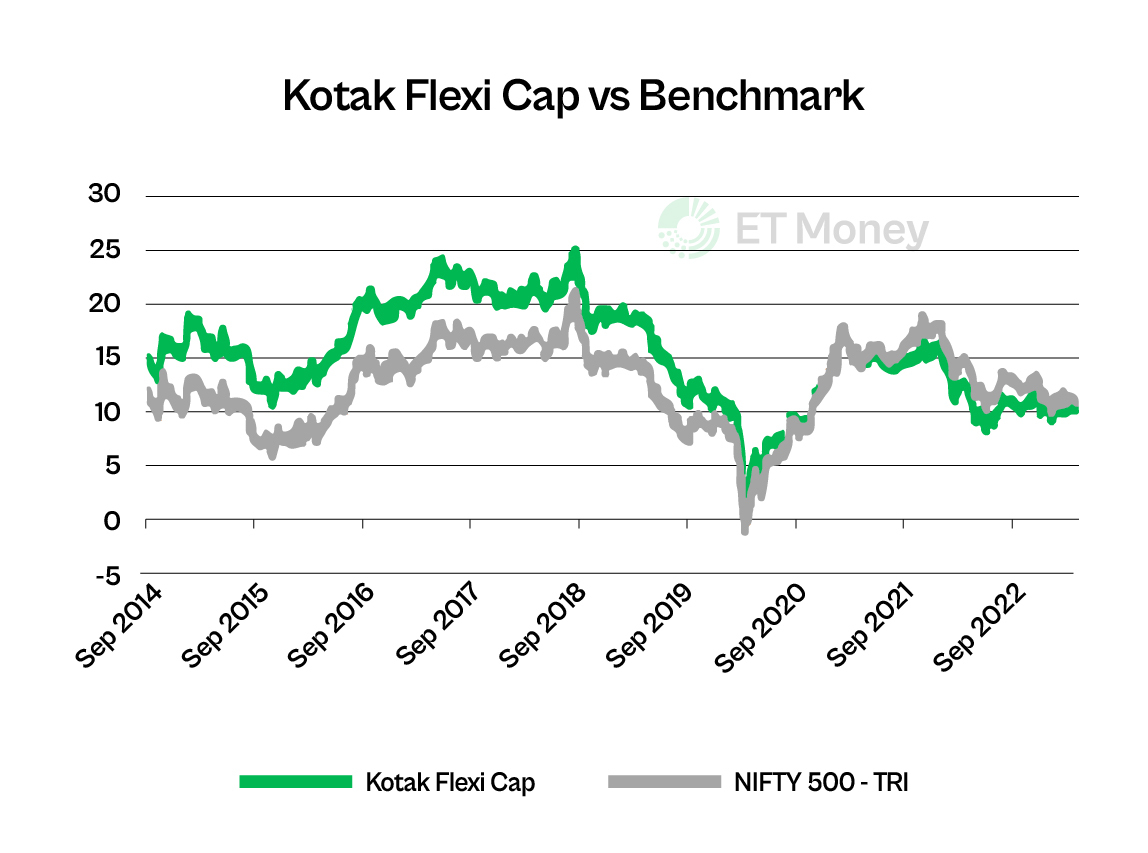

Now, let’s look at its performance against the benchmark.

Even in this case, its track record is impressive

On 76% of occasions, it has delivered a higher 5-year return compared to NIFTY 500 TRI.

See the graph below.

Even in this case, its track record is impressive

On 76% of occasions, it has delivered a higher 5-year return compared to NIFTY 500 TRI.

See the graph below.

Now, let’s talk about the fund’s behaviour when markets fell.

The fund’s consistency is remarkable in all market conditions.

Kotak Flexicap has not only delivered during rising markets but has provided better downside protection compared to benchmark and category.

The fund’s consistency is remarkable in all market conditions.

Kotak Flexicap has not only delivered during rising markets but has provided better downside protection compared to benchmark and category.

Since the launch of Kotak Flexicap, NIFTY 500 TRI has been in the red in 20 quarters.

The fund has done better than its peers and benchmark in 16 out of 20 quarters.

How did it manage this?

Well, it’s because of the fund's large-cap bias.

The fund has done better than its peers and benchmark in 16 out of 20 quarters.

How did it manage this?

Well, it’s because of the fund's large-cap bias.

Flexicap funds are allowed to invest across market caps.

But the fund manager, Harsha Upadhyaya, has maintained a large-cap tilt.

And it may not be due to a huge AUM. Upadhyaya has always preferred a large-cap tilt.

Let’s check some numbers.

But the fund manager, Harsha Upadhyaya, has maintained a large-cap tilt.

And it may not be due to a huge AUM. Upadhyaya has always preferred a large-cap tilt.

Let’s check some numbers.

Over 70% of Kotak Flexicap’s portfolio has been in large caps since July 2017.

It meant a lower allocation to mid & small-caps compared to peers.

The strategy has helped the fund fall less than its peers.

But, it was also responsible for the below-par returns in 2020 & 2021.

It meant a lower allocation to mid & small-caps compared to peers.

The strategy has helped the fund fall less than its peers.

But, it was also responsible for the below-par returns in 2020 & 2021.

Upadhyay takes a top-down approach and supplements it with bottom-up stock picking

He goes by his conviction and takes concentrated bets.

Kotak Flexicap currently holds 48 stocks in its portfolio, as against the category average of 53 stocks.

He goes by his conviction and takes concentrated bets.

Kotak Flexicap currently holds 48 stocks in its portfolio, as against the category average of 53 stocks.

Kotak Flexicap’s current allocation to its top sectors and stocks also shows the high conviction of the fund manager.

The fund’s top 3 sectors account for 45% of its total corpus, while the top 10 stocks account for 50% of the portfolio.

The fund’s top 3 sectors account for 45% of its total corpus, while the top 10 stocks account for 50% of the portfolio.

How do you sum up all this analysis?

Upadhyaya has maintained a large cap bias.

And the fund has acted more like a Large and Mid-Cap fund rather than a Flexi Cap fund.

It’s not a nimble-footed fund that moves across market caps.

Upadhyaya has maintained a large cap bias.

And the fund has acted more like a Large and Mid-Cap fund rather than a Flexi Cap fund.

It’s not a nimble-footed fund that moves across market caps.

Kotak Flexicap has an excellent track record.

Upadhyaya has been managing the fund for over a decade.

So, if you are looking for a fund to build the core portfolio, this can be an option.

Upadhyaya has been managing the fund for over a decade.

So, if you are looking for a fund to build the core portfolio, this can be an option.

We put a lot of effort into creating such informative threads.

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the first tweet.

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the first tweet.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter