1/10 🐄 Alert! 🐄

Our research shows 🥪 MEV’s impact on @CoWSwap is one magnitude lower than on any other DEX.

It’s time to Moo-ve your attention to this report and milk all the buttery details!🥛

drive.google.com/drive/u/1/fold…

Our research shows 🥪 MEV’s impact on @CoWSwap is one magnitude lower than on any other DEX.

It’s time to Moo-ve your attention to this report and milk all the buttery details!🥛

drive.google.com/drive/u/1/fold…

2/10 In the report, 🧐 we cover revenue💰, frequency 📊, and volume of all the sandwich MEVs attacking @CoWSwap. On top of these, we also compare 🥪's impact on different aggregators, DEXs & protocols. And we list all the top CoW Swap solvers under attack and many juicy data👇

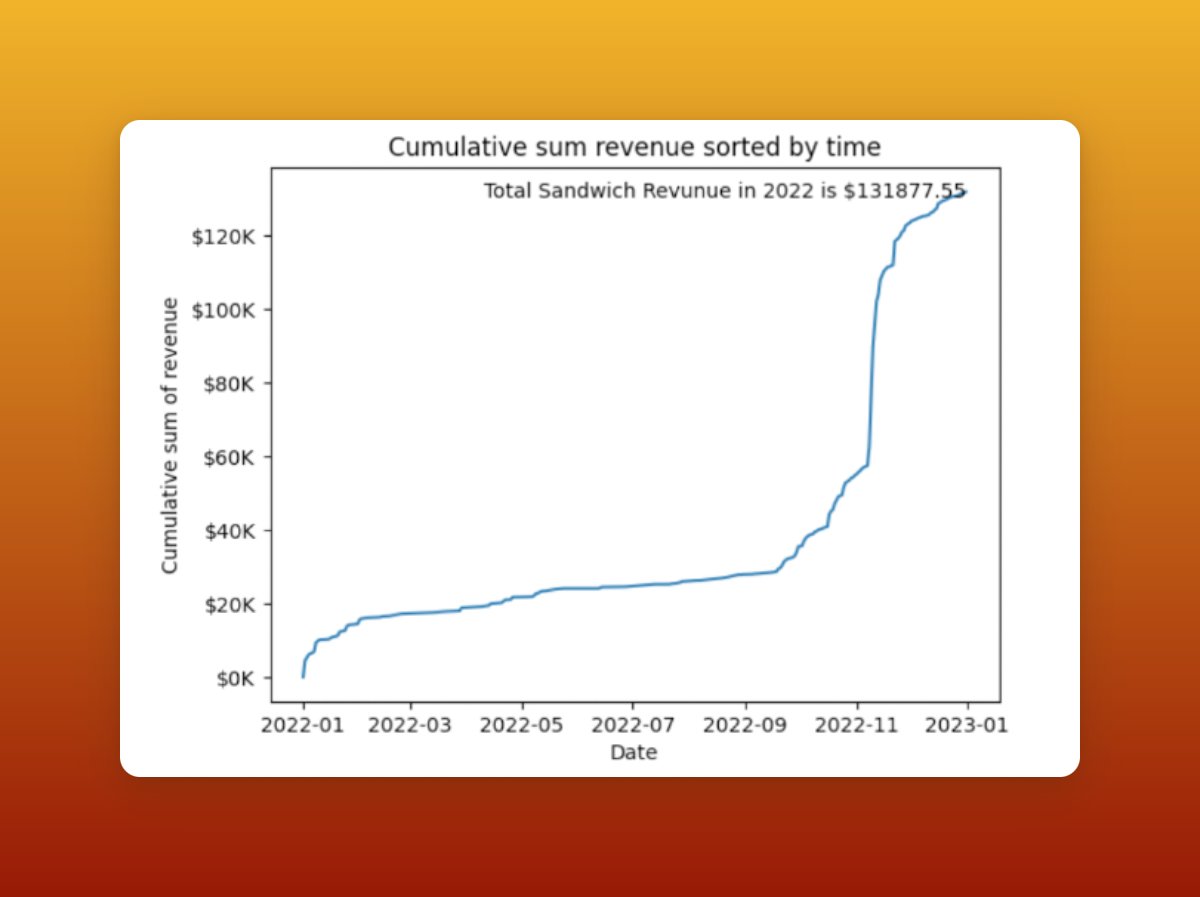

3/10 #Uniswap and @CoWSwap, which protocol is more resistant to 🥪attacks? In terms of 🥪 revenue for 2022, it's $0.13M from CoW Swap solvers. Compared to total fee revenue: $8.55M, sandwich attacks only accounted for 1.5%, one magnitude lower than #Uniswap.

4/10 In 2022, CoW Swap executed approximately 282K trades through Uniswap, 1.3K of which suffered 🥪 attacks in Uniswap pools. The percentage of attacks is 0.047%. In contrast, Uniswap had 39.6M trades in 2022, with attacks on 0.5M. The rate of trades attacked is 1.26%.

5/10 How about aggregators? 🥪 impacted around 2.7% of all txs through #1inch, attacked volume at 3.2%. @matchaxyz suffered 1.9% on all trades, w/t attacked volume at 6%. Only 0.7% of trades and volume were attacked through @CoWSwap, the least exploited among the 3 aggregators.

6/10 Volume of 🥪: $0.12B in vol was affected by 🥪, which accounts for 0.79% of Cow Swap's total vol, w/t orders mostly ranging between $1K-$10K. In addition, the volume of CoW Swap batched value attacked was only 0.78% of the total, also one magnitude lower than other DEXs.

7/10 Sandwich MEV frequency: in 2022, 1.9K 🥪 attacked CoW Swap's 239K trades, meaning sandwich MEV only accounted for about 0.8% of all the transactions on CoW Swap.

8/10 Wen @CoWSwap got sandwiched, it's actually their solvers suffering. After the Merge, the daily # of solvers attacked ⬆️. 27 solvers under attack in 2022 based on our data. They are ranked based on the # of attacks they have experienced and the total volume attacked.

9/10 @CoWSwap matches orders among all protocols. There have been a total of 8 protocols that attackers have targeted via 🐮. Uniswap v2 and v3 have been the most frequently attacked protocols, as they have a higher total trade volume from CoW Swap than other protocols.

10/10 🤠 All righty! If you wanna churn out all the cream🧴, don’t be 🐄 staring at a new gate. Take the bull by the horns and read the research on @CoWSwap. It’ll be udderly informative, buttery, and beef-tonguely tender and juicy! 👅drive.google.com/drive/u/1/fold…

Like our daily #MEV analysis? Go visit eigenphi.substack.com

and typefully.com/Eigenphi for more!

Follow @EigenPhi_Alert for real-time MEV 🚨

and typefully.com/Eigenphi for more!

Follow @EigenPhi_Alert for real-time MEV 🚨

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter