Thought of the day:

We are often wrong....15% for cycle bottoms, but right 85% of the time. Often 50% initial draw downs bag 10x, as the sitting proves out in our favour. We can't be right unless we are wrong in the very short term.

We are often wrong....15% for cycle bottoms, but right 85% of the time. Often 50% initial draw downs bag 10x, as the sitting proves out in our favour. We can't be right unless we are wrong in the very short term.

Theme and Position sizing is key...

Each new asymmetric theme has a 5-7% weighting

Each position within the theme has a 1-2% weighting

Most themes produce 8-13x returns on average

Each new asymmetric theme has a 5-7% weighting

Each position within the theme has a 1-2% weighting

Most themes produce 8-13x returns on average

If we are extremely compelled, which is very irregular, but is aligned with putting the buckets out, we will go to 20% in a theme and up to 5% in a position.

This would be for a repeatable asymmetric theme we have been successful in multiple times in the last 40 years.

This would be for a repeatable asymmetric theme we have been successful in multiple times in the last 40 years.

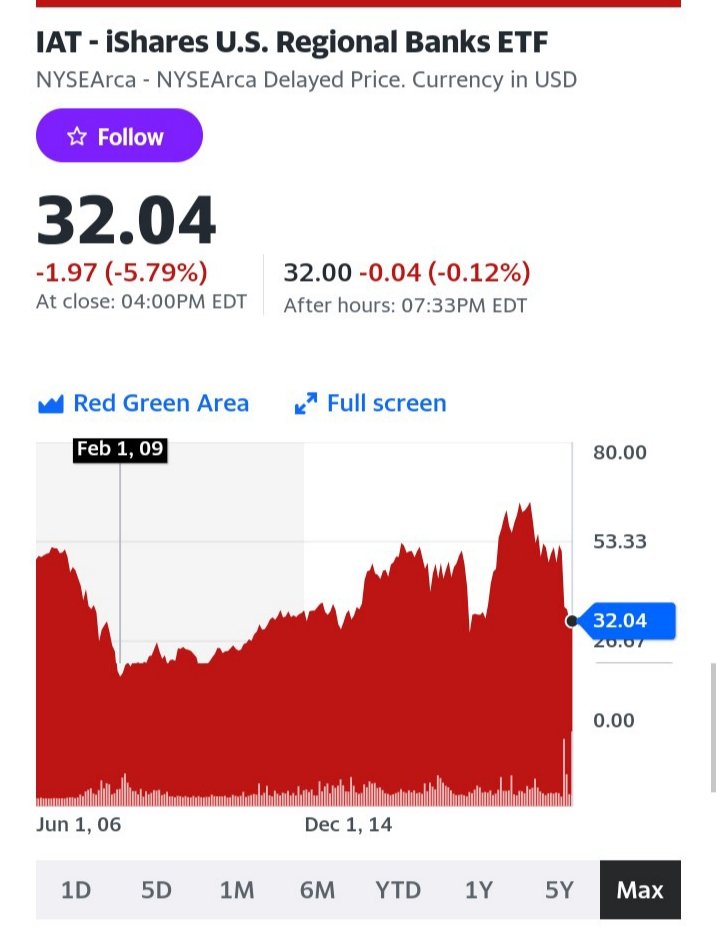

A repeatable theme for us is near global market crashes:

1987 generally worldwide

1997 Asian financial crisis

2001/02 Post tech bubble and Tightening cycle

2008 GFC

2023/24 Tightening cycle

= 95% success rate for 10x returns within 60 months of the market bottom.

1987 generally worldwide

1997 Asian financial crisis

2001/02 Post tech bubble and Tightening cycle

2008 GFC

2023/24 Tightening cycle

= 95% success rate for 10x returns within 60 months of the market bottom.

Why is this a 95% success rate?

- entry valuations are extremely depressed

- often 15-20yr stockprice lows in high beta stocks/sectors

- extreme hate & negative expectations are built in near cycle bottoms

- massive wealth destruction from peak to lows of 75% for beta chasers

- entry valuations are extremely depressed

- often 15-20yr stockprice lows in high beta stocks/sectors

- extreme hate & negative expectations are built in near cycle bottoms

- massive wealth destruction from peak to lows of 75% for beta chasers

Since we build up our dry powder in 2021, where has deployment occurred since:

#Russianstocks March 2022 +7x (expect 12x through 2026, $SBER >35x)

#Bitcoinminers Dec 2022 +2-3x (expect 15x through 2025)

#Goldstocks 4Q 2022 through 1Q 2023 Flat (expect 8x plus through 2026)

#Russianstocks March 2022 +7x (expect 12x through 2026, $SBER >35x)

#Bitcoinminers Dec 2022 +2-3x (expect 15x through 2025)

#Goldstocks 4Q 2022 through 1Q 2023 Flat (expect 8x plus through 2026)

Other smaller deployments

#Vietnamstocks 3Q 2022 lows - for 150% gains, then exited

#bitcoin at 40% plus discount near lows in $GBTC

$pacw for recent 2x gains, exited 65%

#Vietnamstocks 3Q 2022 lows - for 150% gains, then exited

#bitcoin at 40% plus discount near lows in $GBTC

$pacw for recent 2x gains, exited 65%

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter