#Logistics is emerging as one of the major trends for the coming decade.

In today’s thread we will understand the business of #ShreejiTranslogistics - A micro cap that is a major player in this sector.

CMP - ₹ 59

Like and retweet for maximum reach!!

In today’s thread we will understand the business of #ShreejiTranslogistics - A micro cap that is a major player in this sector.

CMP - ₹ 59

Like and retweet for maximum reach!!

1. Company Overview:

•The company was started in 1976 as a brokerage firm and in 1984, they entered into the transport business by providing parcel services. The business has grown a lot since then and today the company provides completely integrated services like

•The company was started in 1976 as a brokerage firm and in 1984, they entered into the transport business by providing parcel services. The business has grown a lot since then and today the company provides completely integrated services like

full truck load transport (FTL), parcel and part truck load services/less than truck load (LTL), import-export services, Over Dimensional Cargo (ODC) and bonded trucking

•The company has a fleet of 300 trucks that are owned by them and 4500 trucks that they lease.

•The company has a fleet of 300 trucks that are owned by them and 4500 trucks that they lease.

2. Business Segments:

The company has 6 business segments:

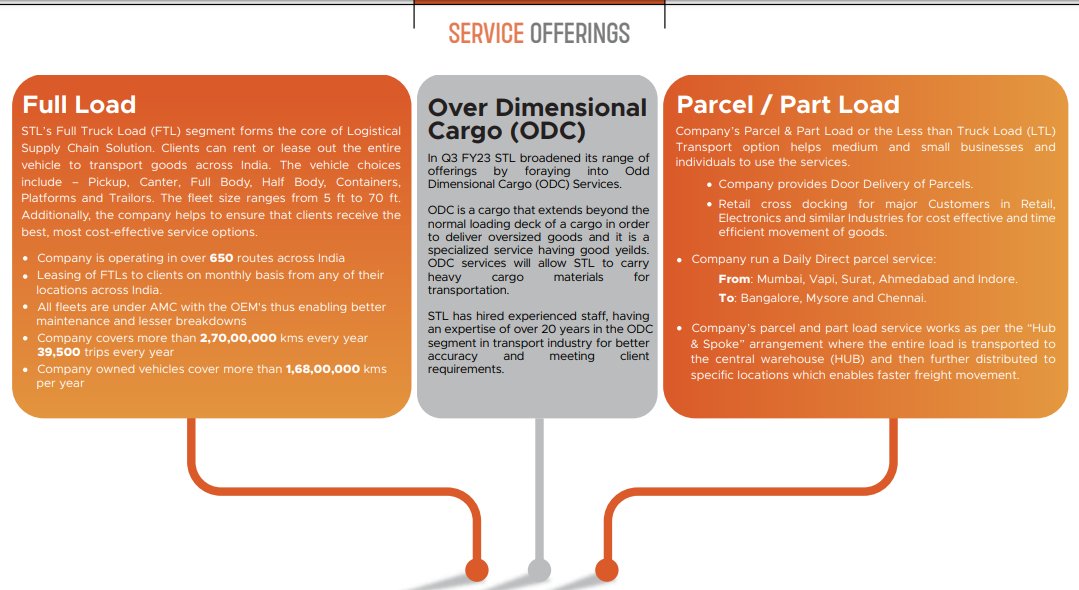

•Full Truck Load - This is their core business and their biggest segment. In this segment, clients can rent or lease out the entire vehicle to transport goods across India. The vehicle choices include – Pickup, Canter,

The company has 6 business segments:

•Full Truck Load - This is their core business and their biggest segment. In this segment, clients can rent or lease out the entire vehicle to transport goods across India. The vehicle choices include – Pickup, Canter,

Full Body, Half Body, Containers, Platforms and Trailers.

•Parcel/ Less than Truck Load: Under this segment, the company does transportation of goods from the West to the South. They also provide last mile delivery services and door-to-door pickup and delivery,

•Parcel/ Less than Truck Load: Under this segment, the company does transportation of goods from the West to the South. They also provide last mile delivery services and door-to-door pickup and delivery,

•Over Dimensional Cargo: Under this segment, the company provides specialized transportation of of oversized and heavy cargo.

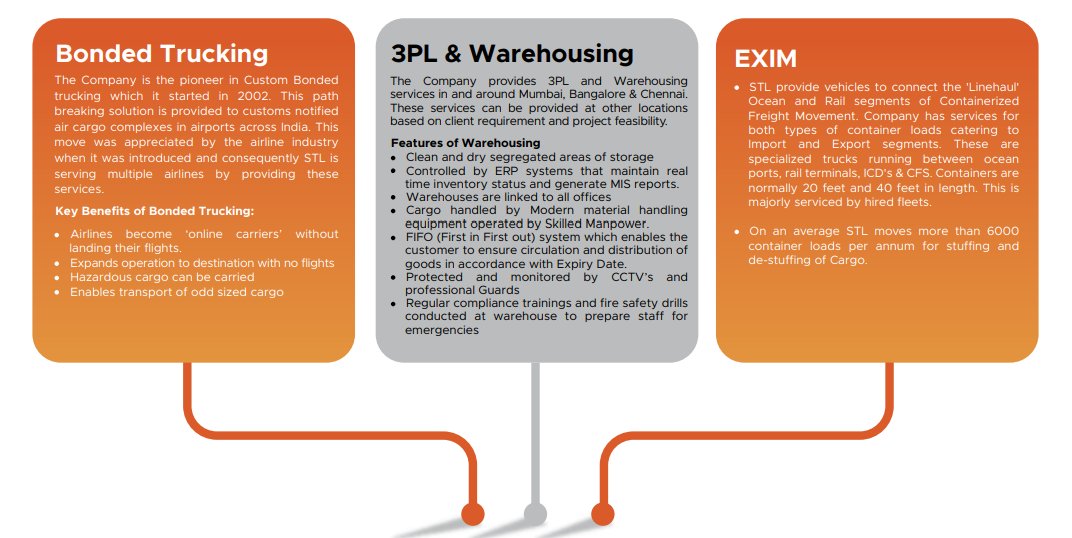

•Bonded Trucking: The company is a pioneer in Custom Bonded Trucking. In this segment, the company provides services to airlines for the

•Bonded Trucking: The company is a pioneer in Custom Bonded Trucking. In this segment, the company provides services to airlines for the

transportation of goods and services.

•Export Import - In this segment, the company delivers goods from ports to the customer using 20 foot and 40 foot containers.

•Warehousing: In this segment, the company operates warehouses in Mumbai, Chennai and Bangalore.

•Export Import - In this segment, the company delivers goods from ports to the customer using 20 foot and 40 foot containers.

•Warehousing: In this segment, the company operates warehouses in Mumbai, Chennai and Bangalore.

4. Geographical Presence

•The company has major presence in the West and South of India and some presence in the North

•The company has major presence in the West and South of India and some presence in the North

5. Use of Technology

•They have been implementing the use of technology over the past few years. They have implemented ERP system which gives them real time data like which vehicles offer better returns, which routes are more profitable and which customer gives better payment.

•They have been implementing the use of technology over the past few years. They have implemented ERP system which gives them real time data like which vehicles offer better returns, which routes are more profitable and which customer gives better payment.

•They have implemented digital locks which can only be opened with an OTP. So the issue of theft and pilferage has been eliminated.

•Their containers are also made of domex steel, which is a high strength steel. So the damage to the vehicle and the goods is minimal in case

•Their containers are also made of domex steel, which is a high strength steel. So the damage to the vehicle and the goods is minimal in case

of an accident. They only buy chassis from the OEMs and fabricate their own containers.

•They are also looking to tie-up with OEMs for Electric Vehicles and CNG vehicles for their last mile delivery. This will be mostly intra-city. This is expected to reduce fuel

•They are also looking to tie-up with OEMs for Electric Vehicles and CNG vehicles for their last mile delivery. This will be mostly intra-city. This is expected to reduce fuel

costs in the future.

•They have also acquired TKD Communications LLP, which has an app named TKDost on Google Play Store to build a bridge between Transporters, Truck Owners and Agents and helps in arranging loads/ vehicles from anywhere in India

•They have also acquired TKD Communications LLP, which has an app named TKDost on Google Play Store to build a bridge between Transporters, Truck Owners and Agents and helps in arranging loads/ vehicles from anywhere in India

6. Competition

•The logistics industry is very competitive. They face competition from both the organized players and unorganized players.

•Management has said that the unorganized players still hold over 85% of market share in this industry.

•The logistics industry is very competitive. They face competition from both the organized players and unorganized players.

•Management has said that the unorganized players still hold over 85% of market share in this industry.

7. Clients

•Majority of the company’s business comes from MNCs and large Indian companies. They provide vehicles based on the requirement of the client.

•They have long term agreements with these clients for 1-3 years. So they have good visibility on revenues

•Majority of the company’s business comes from MNCs and large Indian companies. They provide vehicles based on the requirement of the client.

•They have long term agreements with these clients for 1-3 years. So they have good visibility on revenues

8. Capex

•The company does not need to undertake a lot of capex as a majority of their vehicles are leased on a per trip basis.

•Of the vehicles they do own, they get 100% loan for a term of 5 years. They operate the vehicle for 8 years after which it is disposed of as

•The company does not need to undertake a lot of capex as a majority of their vehicles are leased on a per trip basis.

•Of the vehicles they do own, they get 100% loan for a term of 5 years. They operate the vehicle for 8 years after which it is disposed of as

maintenance costs and breakdowns increase a lot post that.

•They have AMCs with the OEMs incase of breakdown of vehicles. Driver just has to call the helpline and the nearest service center will take care of everything. So it saves them a lot of time.

•They have AMCs with the OEMs incase of breakdown of vehicles. Driver just has to call the helpline and the nearest service center will take care of everything. So it saves them a lot of time.

9. Tailwinds

•The sector is seeing major tailwinds as the government is pushing the Make in India initiative. More MNCs and Indian companies have been opening up factories in India.

•Imports from China are reducing and an increase in domestic manufacturing will help the

•The sector is seeing major tailwinds as the government is pushing the Make in India initiative. More MNCs and Indian companies have been opening up factories in India.

•Imports from China are reducing and an increase in domestic manufacturing will help the

logistics industry grow rapidly.

•The government is also pushing for better road infrastructure which results in better productivity for logistics companies. The management has said that they have 15-18% increase in kilometers driven

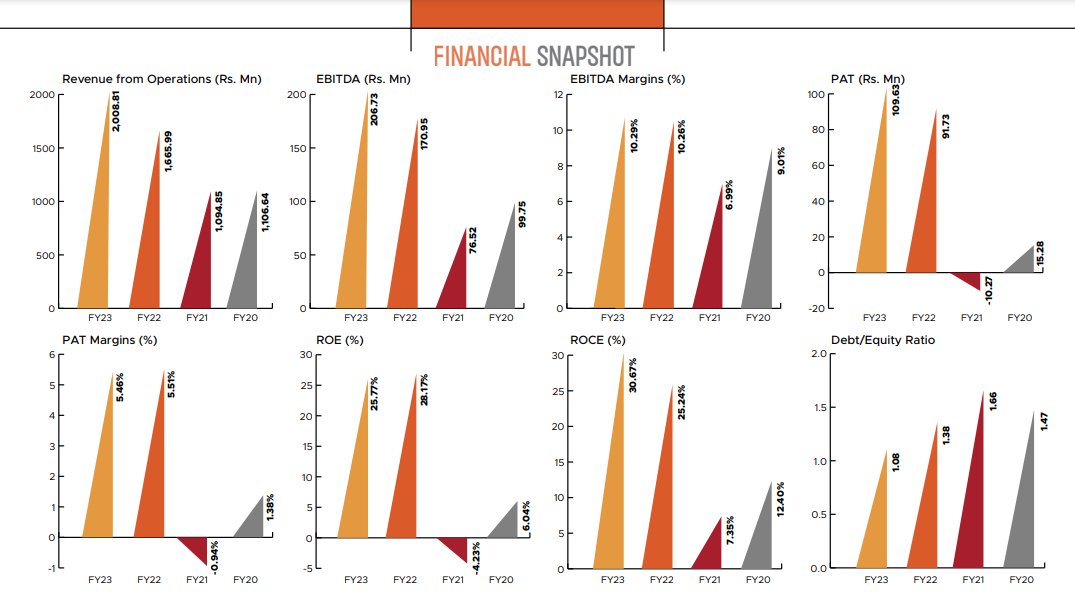

10. Financials

•The government is also pushing for better road infrastructure which results in better productivity for logistics companies. The management has said that they have 15-18% increase in kilometers driven

10. Financials

Join the Micro Cap Club:

bit.ly/3zYY8OS

bit.ly/3zYY8OS

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter