They said it was impossible. After decades of #antitrust cases over #PredatoryPricing - selling below cost to kill or prevent competitors - the #ChicagoSchool of neoliberal #economists "proved" predatory pricing didn't exist, so courts could stop busting companies for it.

1/

1/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2023/05/19/fak…

2/

pluralistic.net/2023/05/19/fak…

2/

Predatory pricing - the economists explained - was illegal, but it was also imaginary. A mirage. No one would predatory price, because it was "irrational." Even if someone irrational enough to try it, they would fail. Stand down, American judges - predatory pricing is solved.

3/

3/

Chicago School economists - whose job (to quote @david_j_roth) is to find new ways to say "actually, your boss is right" - held enormous sway of the federal judiciary.

4/

4/

The billionaire-backed #ManneSeminars offered free "continuing education" junkets to judges - all-expense-paid luxury vacations salted with lengthy your-boss-is-right econ seminars. 40% of the US federal judiciary got their heads filled up at a Manne Seminar.

5/

5/

For monopolists and other predators, the Manne Seminar was an excellent return on investment. After attending a Manne Seminar, the average judge's legal decisions tipped decidedly in favor of #monopoly.

6/

6/

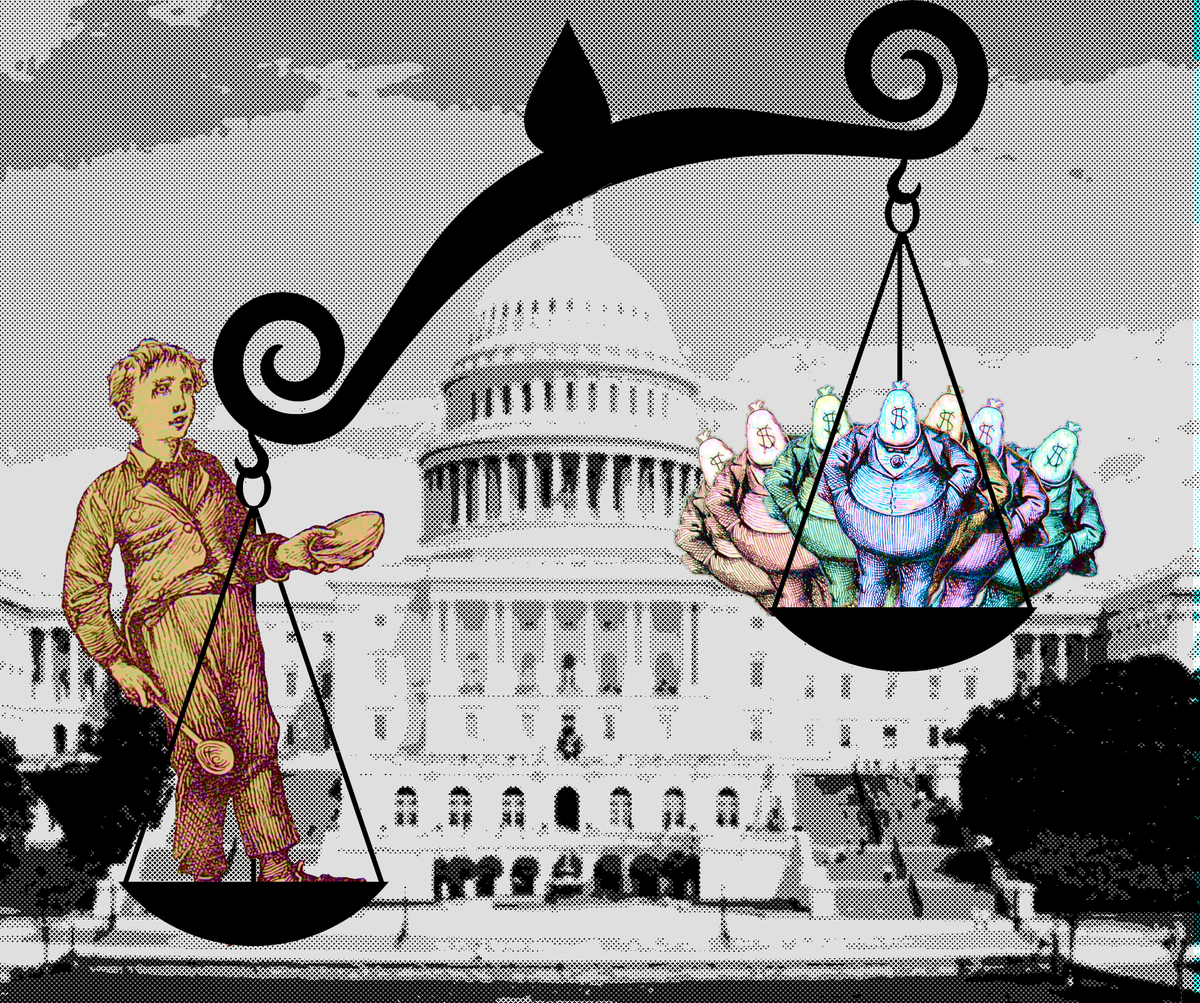

They operated on the Chicago bedrock assumption that monopolies are "efficient," and, where we see them in nature, we should celebrate them as the visible manifestation of the entrepreneurial genius of some Ayn Rand hero in a corporate boardroom:

pluralistic.net/2021/08/13/pos…

7/

pluralistic.net/2021/08/13/pos…

7/

A little knowledge is a dangerous thing. #PostChicago economists showed that predatory pricing was both possible and rampant, a "rational" and effective strategy for cornering markets, suppressing competition, crushing innovation and gouging on price.

8/

8/

But judges continued to craft tortuous, unpassable tests that any predatory pricing case would have to satisfy to proceed. Economics moved on, but predatory pricing cases continued to fail the trial-by-ordeal constructed by Chicago-pilled judges.

9/

9/

Which is a shame, because there are at least three ways that predatory pricing can be effective:

I. #CostSignalingPredation: A predator tricks competitors into thinking they've found a new way to cut their costs, which allows them to drop prices.

10/

I. #CostSignalingPredation: A predator tricks competitors into thinking they've found a new way to cut their costs, which allows them to drop prices.

10/

Competitors, fooled by the ruse, exit the market, not realizing that the predator is merely subsidizing their products' costs to trick them.

11/

11/

II. #FinancialMarketPredation: A predator tricks the competitors' *creditors* into thinking the predator has a new way to cut costs. The creditors refuse to loan the prey companies the money needed to survive the #PriceWar, and the prey drops out of the war.

12/

12/

III. #ReputationEffectPredation: A predator subsidizes prices in one region or one line of goods in order to trick prey into thinking that they'll do the same elsewhere: "Don't try to compete with us in Cleveland, or we'll drop prices like we did in Tampa."

13/

13/

These models of successful predation are decades old, and have broad acceptance within economics - outside of Chicago-style ideologues - but they've yet to make much of a dent in minds of the judges who hear Predatory Pricing cases.

14/

14/

While judges continue to hit snooze on awakening to this, a new kind of predator has emerged, with a new kind of predation: the #VenturePredator, a company backed by #VC, who make lots of high-risk bets they must cash out in ten years or less, ideally for a 100x+ return.

15/

15/

Writing in @JofCorpLaw, #MatthewWansley and #SamuelWeinstein - both of @CardozoLaw - lay out a theory of Venture Predation in clear, irrefutable language, using it to explain the recent bubble we sometimes call the #MillennialLifestyleSubsidy:

papers.ssrn.com/sol3/papers.cf…

16/

papers.ssrn.com/sol3/papers.cf…

16/

What's a Venture Predator? It's "a startup that uses venture finance to price below its costs, chase its rivals out of the market, and grab market share."

17/

17/

The predator sets millions or billions on fire for "rapid, exponential growth" to "create the impression that recoupment is possible" among future investors, like blue-chip companies that buy them out, or retail investors suckers who buy the IPO in hopes of monopoly pricing.

18/

18/

In other words, the Venture Predator constructs a pile of shit so large and impressive that investors are convinced that there must be a pony under there somewhere.

19/

19/

There's another name for this kind of arrangement: a #Bezzle, which #Galbraith described as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it."

20/

20/

Millennial Lifestyle Subsidy companies are bezzles. Uber, annihilated tens of billions of dollars on its bezzle.

21/

21/

In so doing, they destroyed the taxi industry and laid waste to public transit investment, demolishing labor protections and convincing people that impossible #SelfDriving #RoboTaxis were around the coner:

pluralistic.net/2021/02/16/rin…

22/

pluralistic.net/2021/02/16/rin…

22/

But while Uber, Inc lost billions of dollars, Uber's early investors and executives made out like bandits (or predators, I suppose). The founders were able to flog their shares on the secondary market long before the IPO. Same for the early investors, like Benchmark capital.

23/

23/

Since the company's IPO, its finances have steadily worsened, and the company has resorted to increasingly sweaty balance-sheet manipulation tactics and PR offensives to make it seem like a viable business:

pluralistic.net/2022/08/05/a-l…

24/

pluralistic.net/2022/08/05/a-l…

24/

But Uber can't ever recoup the billions it spent convincing the market that there was a pony beneath its pile of shit.

25/

25/

The app Uber uses to connect riders with the employees it misclassifies as contractors isn't hard to clone, and it's not hard for drivers or riders to switch from one app to another:

locusmag.com/2019/01/cory-d…

26/

locusmag.com/2019/01/cory-d…

26/

Nor can Uber prevent its rivals from taking advantage of the hundreds of millions of dollars it spent on "regulatory entrepreneurship" - changing the laws to make it easier to misclassify workers and operate unlicensed taxi services.

27/

27/

It's not clear whether Uber ever believed in robo-taxis, or whether they were just part of the bezzle. In any event, Uber's no longer in the robotaxi races.

28/

28/

After blowing $2.5B on self-driving cars, Uber produced a vehicle whose mean-distance-between-fatal-crashes was 0.5 miles. Uber had to pay another company $400M to take its self-driving unit off its hands:

pluralistic.net/2022/10/09/her…

29/

pluralistic.net/2022/10/09/her…

29/

Uber's prices rose 92% between 2018-21, while its driver compensation has plunged. The company is finding it increasingly difficult to passengers into cars, and drivers onto the road.

30/

30/

They have invented #AlgorithmicWageDisrimination, an exciting new field of labor-law violations, in order to trick drivers into thinking there's a pony under all that shit:

pluralistic.net/2023/04/12/alg…

31/

pluralistic.net/2023/04/12/alg…

31/

To Uber's credit, they have been a wildly innovative company, inventing many new ways to make the pile of shit bigger and the pony more plausible. Back when Uber and Lyft were locked in head-to-head competition, Uber employees created huge pools of fake Lyft rider accounts.

32/

32/

It used these to set up and tear down rides to discover what Lyft was charging and underprice them. Uber covertly operated the mics in drivers' phones to listen for the Lyft app's chimes: drivers who had both Lyft and Uber installed on their devices got (temporary) bonuses.

33/

33/

Uber won't ever recoup, but that's OK. The investors and execs made vast fortunes.

34/

34/

Now, normally, you'd expect company founders and other managers with large piles of stocks in a VC-backed company to be committed to the business's success, at least in the medium term, because their shares can't be liquidated until well after the company goes public.

35/

35/

But the "secondary market" for managers' shares has turned investors and managers into co-conspirators in the Venture Predation bezzle: "half of Series A and B deals now have some secondary component for founders." Thus founders can cash out ahead of the bezzle's end.

36/

36/

The trick with any bezzle is to skip town while the mark is still energetically digging through the shit, *before* the pony is revealed for an illusion.

37/

37/

Enter #crypto: during the #crypto bubble, VCs cashed out of their investments early through #InitialCoinOfferings and other forms of #SecuritiesFraud. The massive returns this generated were well worth the millions they sprinkled on #SuperbowlAds and bribes for #MattDamon.

38/

38/

But woe betide the VC who mistimes their exit. As #Wework showed, it's entirely possible for VCs to be left holding the bag if they get the timing wrong.

39/

39/

Wework blew $12b on predatory pricing - promising tenants at rivals' businesses moving bonuses or even a year's free rent, all to make the pile of shit look larger and thus more apt to contain a pony.

40/

40/

The company opened its co-working spaces as close as possible to existing shops, oversaturating hot markets and showing "growth" by poaching customers through deep subsidies, then pretending that those customers would stay when the subsidies evaporated.

41/

41/

But Wework's "product" was temporary hot-desks, occupied by people who could (and did) move at the drop of a hat.

42/

42/

To its competitors, its competitors' creditors, and credulous investors, it appeared that Wework had developed some kind of "efficiency advantage" - a secret sauce that let it sell a product at a price that was far below its rivals' costs.

43/

43/

But once Wework filed for its IPO, its S-1 - the form that discloses the company's finances - revealed the truth. Wework's only "advantage" was the bafflegab of its cult-like leader and the torrent of cash supplied by its VCs.

44/

44/

Wework's IPO was a disaster. After canceling a real IPO, the company eventually went public through a scammy #SPAC, saw its shares immediately tank, and continue to fall, as its balance-sheet is still blood-red with losses.

45/

45/

Another Venture Predator is #Bird, the company that flooded American cities with cheap, flimsy Chinese scooters, choking curbs and sidewalks. 25% of the gross revenues from *each scooter ride* had to be written off as depreciation on the scooter.

46/

46/

As a spokesBird told the @latimes: "There are very few unique companies for which you can build global scale really quickly and build a dominant market position before other people do, and for those rarefied companies scaling quickly matters more than short-term profits."

47/

47/

Bird was another company that could never recoup, whose executives and investors could only cash out if they could maintain the faint hope of the pony underneath its pile of shitty scooters. It drove the company to some genuinely surreal lengths.

48/

48/

For example, in 2018, I reported on the existence of a kit that let you buy an impounded Bird scooter for pennies and retrofit it to run without an app, so you could take it anywhere:

boingboing.net/2018/12/08/fli…

49/

boingboing.net/2018/12/08/fli…

49/

Then I got a threat from #LindaKwak, Bird's Senior Counsel, claiming that publishing a link to a a product you install by unscrewing one board and inserting another was a violation of #Section1201 of the #DMCA - an *astonishingly* stupid claim:

eff.org/document/bird-…

50/

eff.org/document/bird-…

50/

It was also an astonishingly stupid claim to make to *me*, a career activist with 20 years experience fighting #DMCA1201, a decades-old professional affiliation with @EFF, and a giant megaphone:

boingboing.net/2019/01/11/fli…

51/

boingboing.net/2019/01/11/fli…

51/

But Bird was palpably desperate to keep its bezzle going, and Kwak - an employment lawyer with undeniable deficits in her understanding of copyright and cyber-law - was their champion

52/

52/

Fascinatingly, one thing Bird *didn't* worry about was competition from Uber and Lyft, who piled into the #escooter market.

53/

53/

Bird circulated a (leaked) pitch-deck reassuring investors that Uber/Lyft weren't gunning for them, because they "“won't subsidize prices" as they prepared for their IPOs, which involved disclosing their finances to their investors.

54/

54/

Bird's investors either lost money or made small-dollar returns, but they were outfoxed by Bird founder Travis VanderZanden, a superpredator who cashed out $44m in shares just as the VCs were piling in.

55/

55/

Venture Predation is another stinging rebuttal to the Chicago School's blithe dismissal of Predatory Pricing as an illusion.

56/

56/

Private firms - of the sort that VCs back - whose boards are made up of founders and VCs who stand to benefit from the pile-of-shit gambit are perfectly capable of spending huge fortunes to make Predatory Pricing work.

57/

57/

VCs make a practice of repeatedly co-investing in businesses together, which fosters the kind of trust that allows for these gambits to be played again and again.

58/

58/

For later stage, pony-thirsty investors who get stuck holding the bag, the lure of monopoly profits is both powerful and plausible - after 40 years of antitrust neglect, monopolies are the kinds of things one can both attain and defend.

59/

59/

(Think of #PeterThiel's maxim, "competition is for losers," or #WarrenBuffett's terrifying priapisms induced by the mere thought of businesses with "wide, sustainable moats.")

60/

60/

In a world of Facebook and Google, dreaming of monopolies isn't irrational - it's aspirational.

VCs are ideally poised to play the Venture Predation gambit. They are risk-tolerant and need to cash out over short timescales.

61/

VCs are ideally poised to play the Venture Predation gambit. They are risk-tolerant and need to cash out over short timescales.

61/

What's more, VCs' longstanding boasts of their ability to identify companies who have invented new, super-efficient ways to do boring things like "rent out office space" or "provide taxis" gives the pile-of-shit pony-pitch a plausible ring.

62/

62/

The Venture Predator gambit isn't just a form of plute-on-plute violence in which billionaires fleece millionaires. Like any anticompetitive scam, Venture Predators are able to pick winners in the marketplace.

63/

63/

Rather than getting the taxi or the office rental service or the scooter that serves you best, you get the scammiest version.

64/

64/

Workers who caught in the scam also suffer - the authors describe a cab driver who leases a car to drive for Uber, based on the early subsidies, only to find themselves unable to make payments once the bezzle ends and Uber starts clawing back the driver's wages.

65/

65/

Then there's the societal cost: during the decade-plus when Uber was pissed away the Saudi royals' billions, cities dismantled public transit, even as people made decisions about where to live and work based on the presumption that Uber charged a fair, sustainable price.

66/

66/

The authors propose a bunch of legislative fixes for this, but warn none of them are likely to get through Congress or the Manne-pilled judiciary. But they do hold out hope for a proposed #SEC rule "requiring large, private companies to make basic financial disclosures."

67/

67/

Image:

Eli Duke (modified)

flickr.com/photos/elisfan…

CC BY-SA 2.0

creativecommons.org/licenses/by-sa…

eof/

Eli Duke (modified)

flickr.com/photos/elisfan…

CC BY-SA 2.0

creativecommons.org/licenses/by-sa…

eof/

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter