An intelligent response which reinforces the #FATCA (sorry fact) that that the real problem is US @CitizenshipTax. The Decision in Belgium underscores that the sole purpose of the FATCA IGAs is to ensure Americans cannot leave the USA and acquire rights denied to US residents.

https://twitter.com/DemsAbroadTax/status/1663536005700538375

As the @DemsAbroadTax statement states/implies this problem can be solved ONLY if the US joins the world in adopting residence as the criterion for @TaxResidency. Citizenship would no longer be relevant for taxation. But, this is NOT part of any legislative proposal.

A second solution would be “A Regulatory Fix For Citizenship Taxation” Which would define “individual” as resident. As published by @TaxNotes here … taxnotes.com/featured-analy…

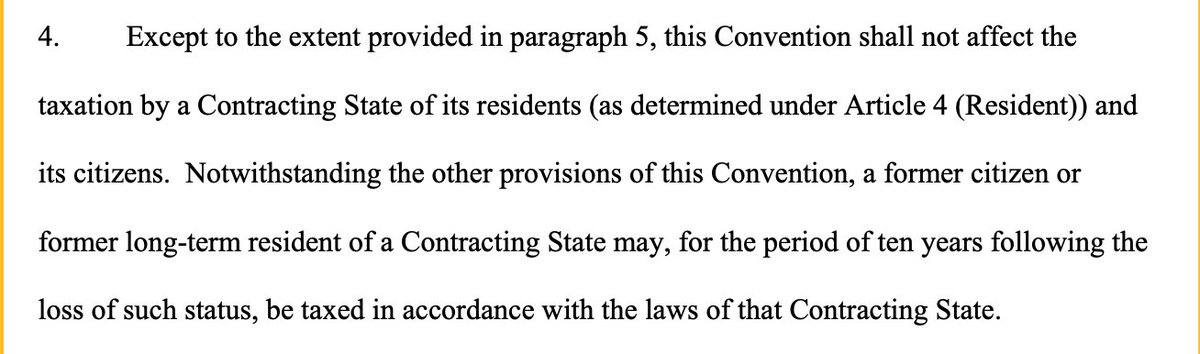

A third solution would be to suspend the tax treaty #savingclause which would allow #Americansabroad to become treaty nonresidents in an #FBAR and #FATCA world. Perhaps @TaxNotes would be interested in this upcoming article.

@TaxNotes So, the above tweets suggest three ways the US could respond to solve this #FATCA problem. Notice that the suspension of the #savingclause for #Americansabroad does not require any change in the US Internal Revenue Code or Treasury Regulations. #JustDoIt!

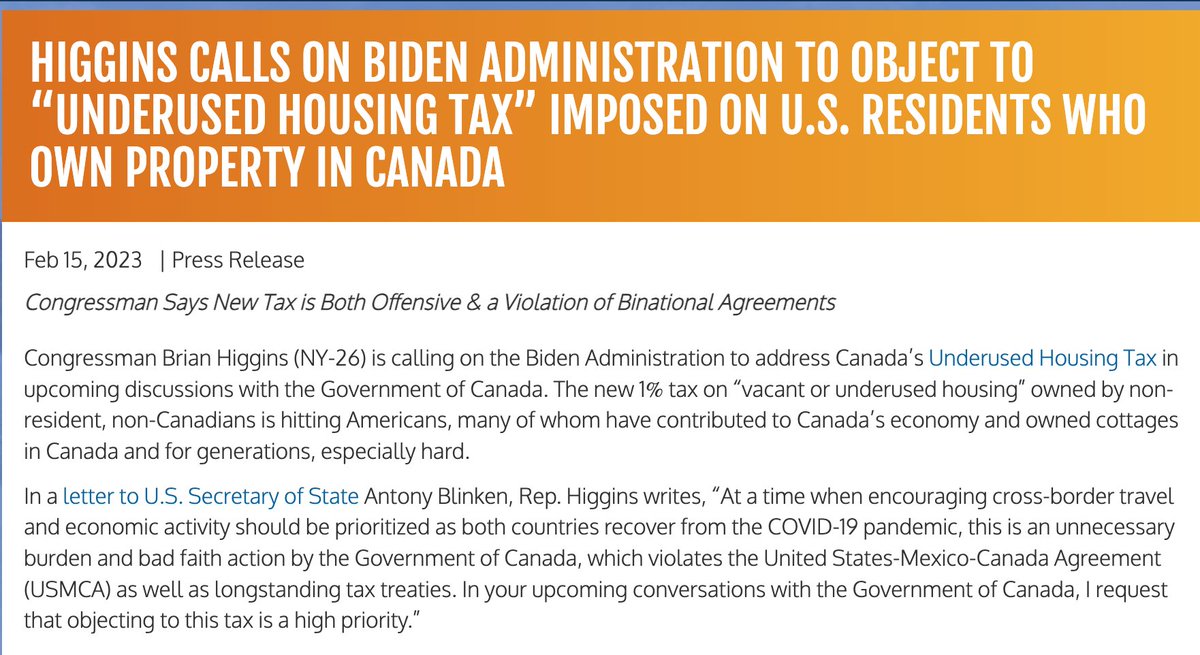

It’s likely #GDPR will renew the discussion for #FATCA “same country exemption“. SCE would likely increase the work for FFIs. It also deflects from the problem of @CitizenshipTax. It’s time to confront whether the US can claim residents of other countries as U.S. tax residents

Now let’s consider options for Belgium. #FATCA is that to send data to IRS violates Belgium law. But to not send data to IRS violates FATCA IGA which is US law. So, how does Belgium avoid violating the laws of either country? What follows are my suggestions …

The key is to never have reportable data. #FATCA IGA does not require reporting of “depository’ accounts < $50,000 USD. So (1) restrict US citizens to “depository” accounts (2) program computers to close account at the moment (based on exchange rate) balance reaches $49,999.

Second way to avoid having reportable accounts is to simply close all accounts of US citizens. Probably makes the most sense. But Europeans have a legal right (apparently) to a bank account. Perhaps create a separate #FATCA institution for US citizens (with special rules).

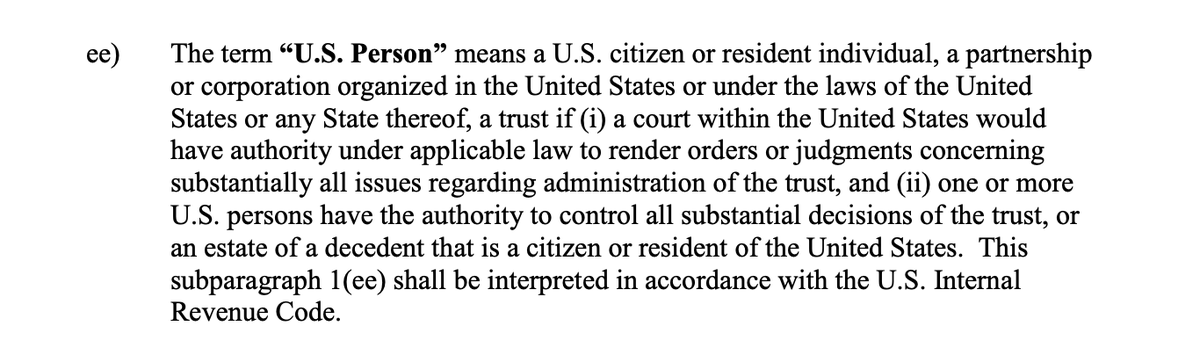

Third way for Belgium to avoid conflict between #FATCA + #GDPR: avoid having US citizens residing in Belgium. Harsh, but hey, Belgium relinquished it’s sovereignty to the USA by agreeing to #FATCA and the #savingclause in the US/Belgium tax treaty. (What were they thinking?)

A fourth way for Belgium to avoid conflict between #FATCA + #GDPR: Belgium ceases to be a foreign country relative to USA. It could become a US territory. (Crazy yes, but demonstrates how @CitizenshipTax can be used to "colonize" other countries and lower standard of rights.)

A country that (1) signs tax treaty with US that includes #savingclause (giving US right to always tax @USCitizenAbroad living in treaty country) + (2) signs #FATCA IGA (giving US sole right to define who is US citizen) has ceded total sovereignty to US. home.treasury.gov/system/files/1…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter