Market Regime Update

1. Assets rebounded this week, with stocks, bonds, and gold all up on the week. Commodities showed mixed performance, with significant losses during the start of the week weighing on performance.

1. Assets rebounded this week, with stocks, bonds, and gold all up on the week. Commodities showed mixed performance, with significant losses during the start of the week weighing on performance.

2. Recent #treasury strength continued the recent chop in the market, i.e., moving counter to the recent one-month trend. Below, we show the composition of total treasury market returns over the last month:

3. As we can see above, treasuries across the curve continue to show weakness as nominal #GDP continues to show resilience. At the same time, #equity markets continue to show lopsided performance over the past month, primarily driven by valuations rising:

4. The combination of these moves has improved the odds of a rising #growth market regime over the last month. These changes continue to keep the distribution of market regime probabilities as highlighted below:

5. Our non-linear trend process has worked well in navigating these conflicting market regime dynamics. Updates on these signals are shared below:

https://twitter.com/prometheusmacro/status/1664795484580372481

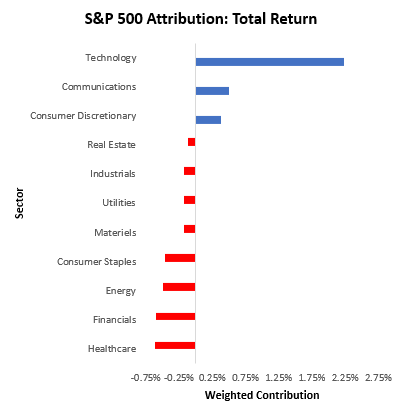

6. Finally, while S&P 500 trend strength remains strong, we think it is important to recognize that there is significant dispersion within the index. Below, we show equity-sector trend signals.

• • •

Missing some Tweet in this thread? You can try to

force a refresh