Why is the stock market ripping?

#Team42, we joined Real Vision’s @RaoulGMI and @maggielake last week to discuss #Liquidity , #Debt Monetization, #Recession, & more.

In case you missed it, here are seven highlights from what many are calling “the best RV Daily Briefing yet”:

#Team42, we joined Real Vision’s @RaoulGMI and @maggielake last week to discuss #Liquidity , #Debt Monetization, #Recession, & more.

In case you missed it, here are seven highlights from what many are calling “the best RV Daily Briefing yet”:

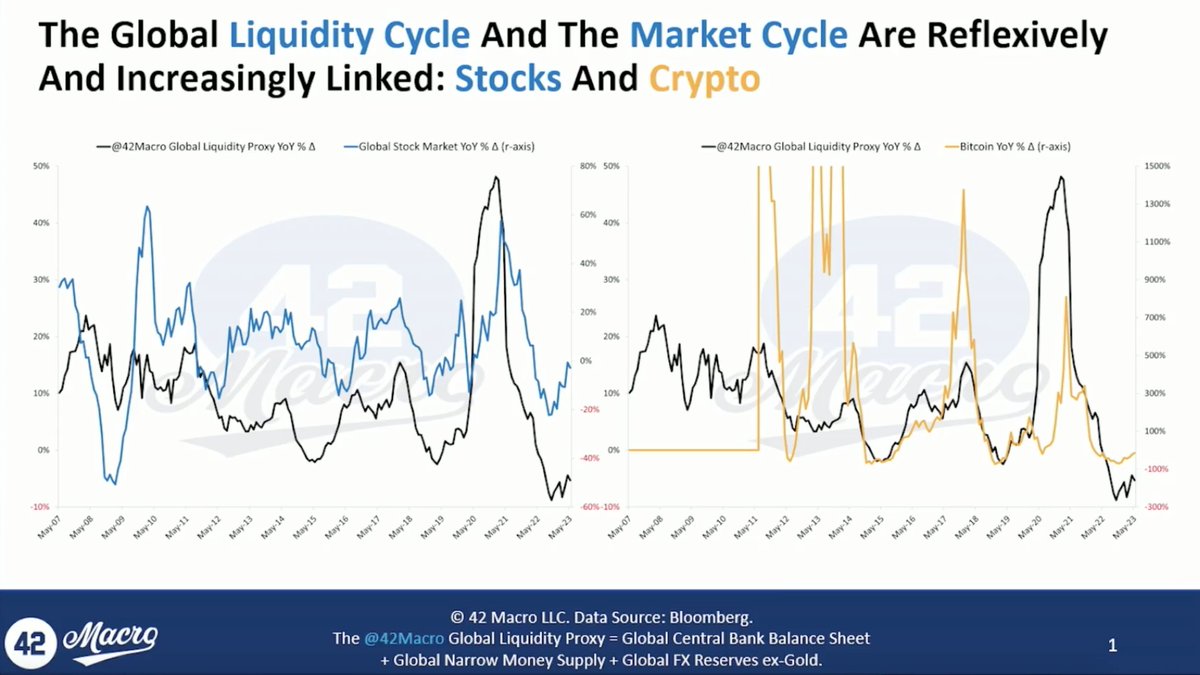

1) Liquidity Drives Asset Markets

Although we believe the stock market will continue to squeeze bears well into the fall, poor liquidity conditions will likely drag asset markets down this summer.

Although we believe the stock market will continue to squeeze bears well into the fall, poor liquidity conditions will likely drag asset markets down this summer.

Additionally, we are not sure we've seen this market cycle's ultimate lows because we did not price in a recession last year.

What we priced in, in our opinion, was a change in the Liquidity Cycle.

What we priced in, in our opinion, was a change in the Liquidity Cycle.

The markets will eventually need to price in the credit cycle downturn associated with the liquidity drain we’ve experienced in 2021 - 2022.

We expect that to start in Q4 2023 - Q1 2024.

We expect that to start in Q4 2023 - Q1 2024.

2) Understanding and Monitoring Liquidity

Changes in liquidity, driven by factors like central bank policy and the activities of commercial banks, can significantly impact asset markets.

Changes in liquidity, driven by factors like central bank policy and the activities of commercial banks, can significantly impact asset markets.

We've tested this extensively: our proxy for liquidity has a 97% correlation with the S&P 500 since 2009 and an 89% correlation with #bitcoin since inception.

Over the short & medium term, we expect liquidity to fall w/ the return of the US to the international capital markets.

Over the short & medium term, we expect liquidity to fall w/ the return of the US to the international capital markets.

We do not believe we have reached a durable positive inflection in the liquidity cycle yet.

Liquidity bottomed in October, but we haven't met those conditions yet in terms of getting an unimpeded rise in liquidity.

Liquidity bottomed in October, but we haven't met those conditions yet in terms of getting an unimpeded rise in liquidity.

3) Central banks and the concept of debt monetization

Debt monetization is when a government issues bonds and the central bank purchases them, thus increasing the money supply.

This mechanism can prevent the public sector from crowding out the private sector.

Debt monetization is when a government issues bonds and the central bank purchases them, thus increasing the money supply.

This mechanism can prevent the public sector from crowding out the private sector.

“Crowding out” happens when the government borrows so much that it drives up interest rates, making borrowing more expensive for businesses and individuals.

We believe the central banks are currently playing a Debt Monetization game.

We believe the central banks are currently playing a Debt Monetization game.

However, we do not believe central banks are purposely causing economic deterioration to monetize public sector interest payments.

Instead, we believe they are responding as crises occur.

Instead, we believe they are responding as crises occur.

4) The Liquidity Cycle

Our research shows there’s a three and 1/2-year cycle in global liquidity, with approximately two ½ years from trough to peak.

Assuming the most recent trough occurred last fall, we expect the cycle's peak to occur sometime in the first half of 2025.

Our research shows there’s a three and 1/2-year cycle in global liquidity, with approximately two ½ years from trough to peak.

Assuming the most recent trough occurred last fall, we expect the cycle's peak to occur sometime in the first half of 2025.

Similar to Raoul, we’re bullish in terms of the destination.

We just differ on the path to get there and believe there will be pain in asset markets along the way.

We just differ on the path to get there and believe there will be pain in asset markets along the way.

5) The drivers of the global liquidity cycle

To forecast global liquidity, we analyze the YoY change of a group of proven leading indicators, including equity market performance, real 10-year yield, real effective USD exchange rate, OECD CLI, core CPI, & the unemployment rate.

To forecast global liquidity, we analyze the YoY change of a group of proven leading indicators, including equity market performance, real 10-year yield, real effective USD exchange rate, OECD CLI, core CPI, & the unemployment rate.

All of those factors combined imply that:

Short Term: no liquidity

Medium Term: falling liquidity

Long Term: potential for rising liquidity

Although we expect the liquidity environment to be positive in 2024, we expect a period of 2022-style liquidity conditions along the way.

Short Term: no liquidity

Medium Term: falling liquidity

Long Term: potential for rising liquidity

Although we expect the liquidity environment to be positive in 2024, we expect a period of 2022-style liquidity conditions along the way.

6) Recession Expectations

We believe the recession will commence in Q4 2023 or Q1 2024 and will overwhelm whatever favorable liquidity conditions are present at the time.

We believe the recession will commence in Q4 2023 or Q1 2024 and will overwhelm whatever favorable liquidity conditions are present at the time.

When the economy goes into recession, and people start losing jobs, risk assets decline (the median S&P decline in a recession is -24%).

Even if liquidity is increasing, there can still be corrections. And we expect that will happen at some point over the next year.

Even if liquidity is increasing, there can still be corrections. And we expect that will happen at some point over the next year.

The maximum drawdowns of the S&P 500 and #bitcoin during the Liquidity Cycle upturns experienced since 2009 are -34% and -74%, respectively.

7) When will this rally end?

We still believe most investors have the recession playbook on too early. The economy will likely stay resilient until sometime around Q4 2023 - Q1 2024.

We still believe most investors have the recession playbook on too early. The economy will likely stay resilient until sometime around Q4 2023 - Q1 2024.

History shows that the stock market is NOT forward-looking heading into recession – largely because it is busy squeezing bears.

Rather, it tends to peak on a coincident basis with the peak of the Employment Cycle.

Rather, it tends to peak on a coincident basis with the peak of the Employment Cycle.

That's a wrap!

If you found this thread helpful:

1. Go to 42macro.com/appearances to unlock actionable, hedge-fund caliber investment insights

2. RT this thread and follow @42Macro and @42MacroWeather

3. Have a great day!

If you found this thread helpful:

1. Go to 42macro.com/appearances to unlock actionable, hedge-fund caliber investment insights

2. RT this thread and follow @42Macro and @42MacroWeather

3. Have a great day!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter