On CPI

1. CPI #Inflation increased by 0.12% in May, surprising consensus expectations of 0.1%. This print contributed to a sequential deceleration in the quarterly trend relative to the yearly trend.

1. CPI #Inflation increased by 0.12% in May, surprising consensus expectations of 0.1%. This print contributed to a sequential deceleration in the quarterly trend relative to the yearly trend.

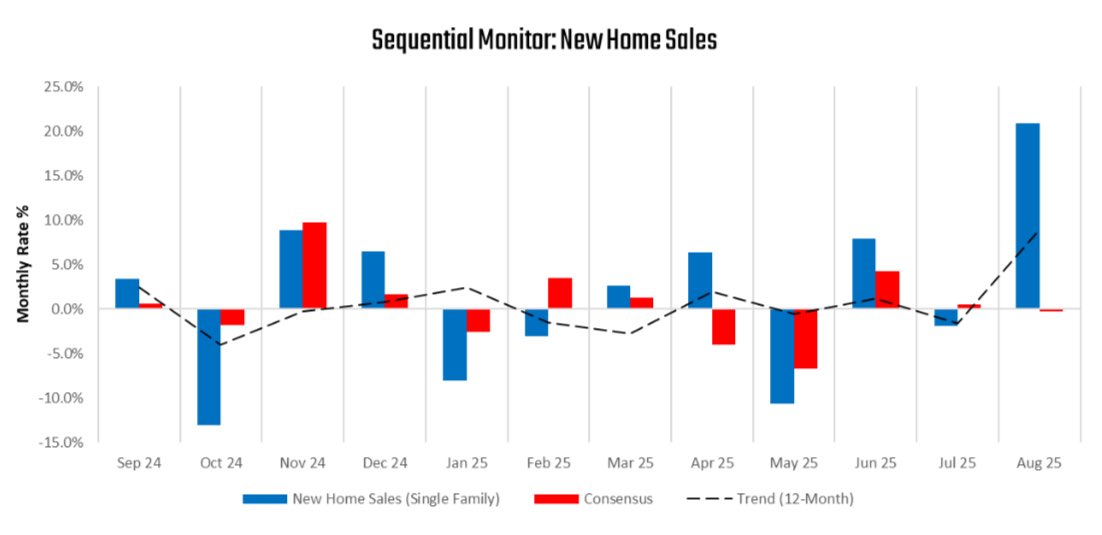

2. Above we show the monthly evolution of the data relative to its 12-monthly trend and consensus expectations.

3. At the subcomponent level, the primary drivers of this print were #Motor fuel (-0.2%), #Energy Services (-0.05%), Transportation Commodities Less Motor Fuel (0.11%), #Shelter (0.19%), & #Transportation Services (0.05%). Below, we show the top 10 drivers of the monthly change:

4. Over the last year, Food at Home (0.5%), #Food Away from Home (0.4%), #Motor fuel (-0.71%), #Shelter (2.77%), & #Transportation Services (0.61%). have been the primary drivers of the 4.13% CPI #inflation. We show this below:

5. Alongside these big-picture drivers, we think it is important to note that we are seeing deflation in a few areas of the economy now. The industries currently seeing deflation are Fuel Oil, Motor fuel, Education & Communication Commodities, and Alcoholic Beverages.

6. We think it is important to note that excluding #food and energy, i.e., core CPI, was up 0.40% this month— implying a 4.9% annualized rate for core inflation. This data is far removed from the #Fed’s objective.

7. We've already highlighted what the implications of this move have meant for Treasuries.

https://twitter.com/prometheusmacro/status/1669272975357493249?s=20

8. Overall, we reiterate that inflationary dynamics continue to create a challenging dynamic for Treasuries, and the disinflationary pricing that supported 60/40 portfolio in H1 2023 is likely to dissipate in H2 2023 as markets come to terms with potential #inflation entrenchment

• • •

Missing some Tweet in this thread? You can try to

force a refresh