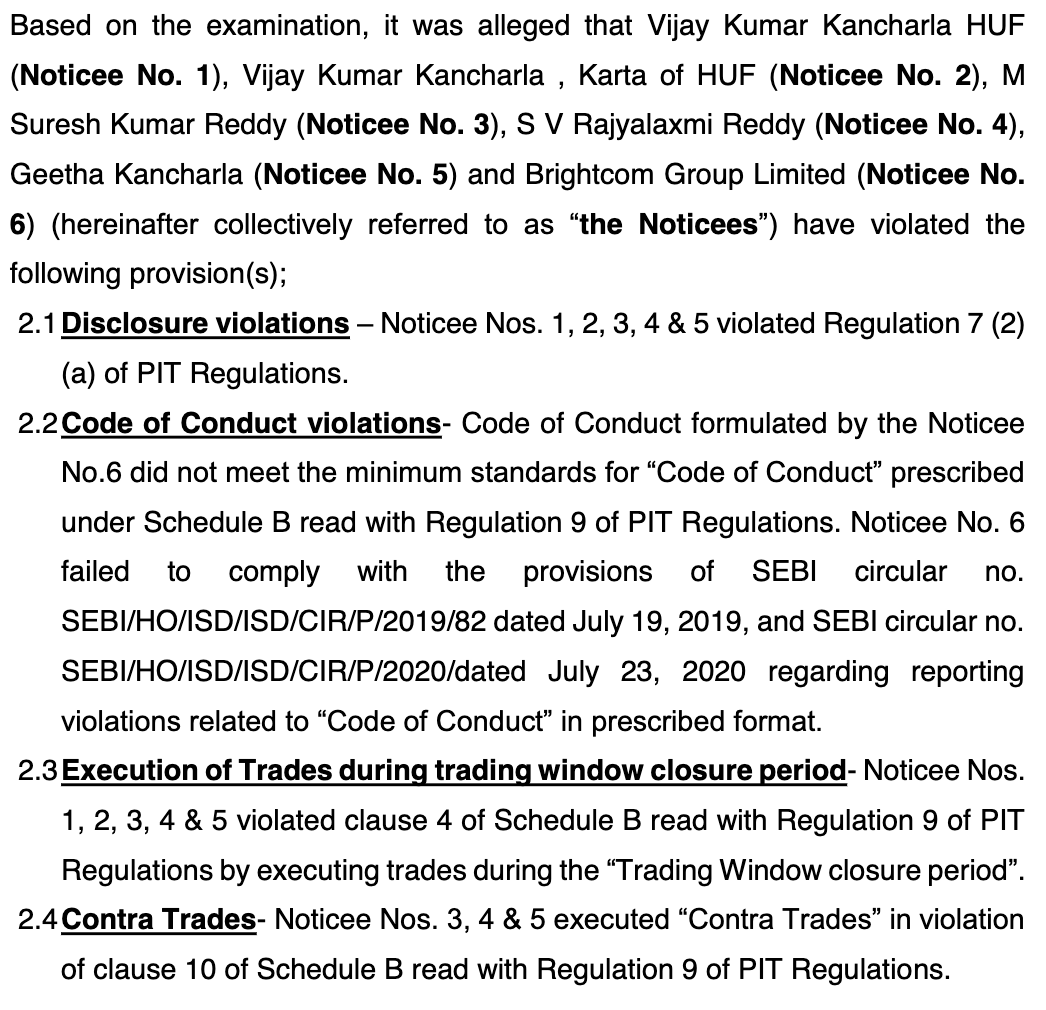

⚠️SEBI has imposed a penalty of INR 20L 💰 on Sangam India for delayed ⏰disclosures with respect to Promoter Share Transactions ⛳️❌

A Thread 🧵

#SangamIndia #SEBI #redflag #corporategovernance

A Thread 🧵

#SangamIndia #SEBI #redflag #corporategovernance

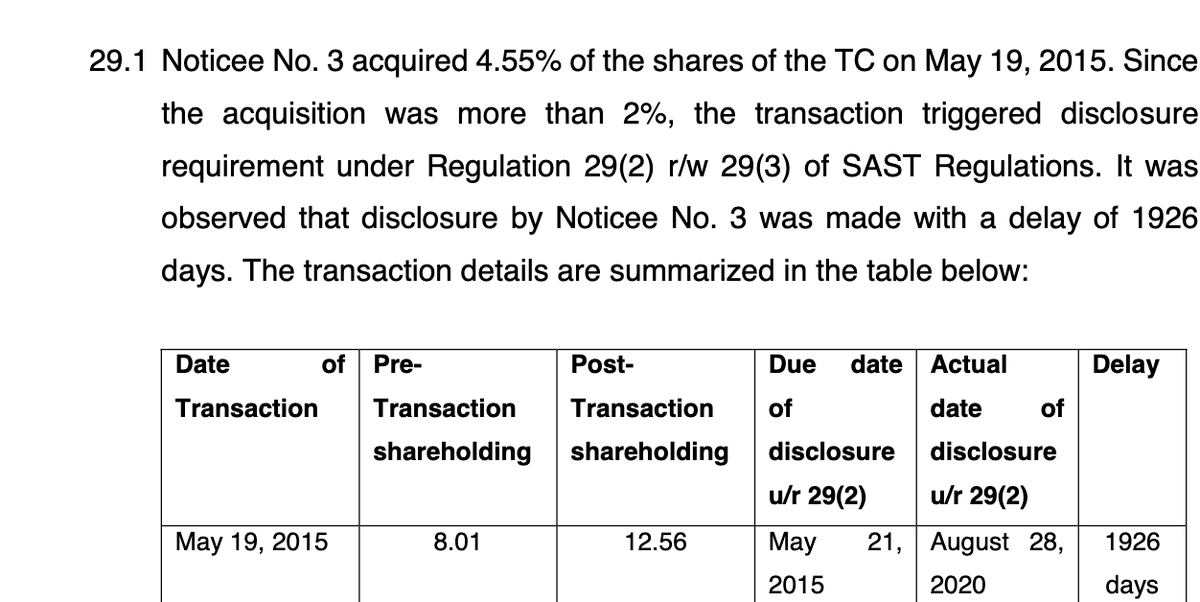

2. The inter-se promoter transaction of more than 5% in FY17 was also disclosed with delay of 1200 days

4. The promoters did another inter-se transaction of 12.17% in Aug-19 but this was also disclosed with delay of 400+ days

Link to SEBI order

sebi.gov.in/enforcement/or…

sebi.gov.in/enforcement/or…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter