The Sobha Story: A Tale of Luck, Power, and Shady Connections!

A long but interesting story😱

PC Menon, Founder & Chairman of @SobhaLtd,

CM of Kerala @pinarayivijayan &

A Suspicious Man

A Thread🧵

Like & retweet for max reach!

#Sobha #Redflag https://t.co/wbWAbpcKeTtwitter.com/i/web/status/1…

A long but interesting story😱

PC Menon, Founder & Chairman of @SobhaLtd,

CM of Kerala @pinarayivijayan &

A Suspicious Man

A Thread🧵

Like & retweet for max reach!

#Sobha #Redflag https://t.co/wbWAbpcKeTtwitter.com/i/web/status/1…

@SobhaLtd, a gaint in indian Indian realty sector, has recently come under scrutiny due to raids after raids by Income Tax Deptt and ED.

Let's take a closer look at their journey, intertwined with politicians and dubious actors.

Let's take a closer look at their journey, intertwined with politicians and dubious actors.

The man below is the Founder of @SobhaLtd, From starting a small furniture business to feed his family post his father death.

In 1976, by his own account, Menon met an Omani soldier Sulaiman Mohammed Yahya al Adawi who had come to Kerala looking to buy a fishing boat.

In 1976, by his own account, Menon met an Omani soldier Sulaiman Mohammed Yahya al Adawi who had come to Kerala looking to buy a fishing boat.

This strange encounter culminated in Menon leaving home for Oman to try his hand at making a better living.

Luck favored him

Omani Civil war was in last stages, Menon & Al Adawi started interior decorations for palaces of monarchs incl the Sultans of Oman, Brunei, Bahrain, Qatar

Luck favored him

Omani Civil war was in last stages, Menon & Al Adawi started interior decorations for palaces of monarchs incl the Sultans of Oman, Brunei, Bahrain, Qatar

Even they managed to get the contract to do the interiors of the grand Sultan Qaboos Grand Mosque, a prestige project for the Omani ruler.

He and his wife Sobha were given Omani citizenship in 1995 as well.

He and his wife Sobha were given Omani citizenship in 1995 as well.

Post 2 decades, Menon and al Adawi decided to part ways, which is 50-50 partnership. Menon handed over 40% stake for free to Al Adawi.

To start new Adventure journey, Menon chose India.

but before that, he chose Dubai to settle down.

To start new Adventure journey, Menon chose India.

but before that, he chose Dubai to settle down.

Now, The Indian Journey!

He chose realty sector, and regd first firm in 1993 as Oman Builders. Later in 1995, he regd Sobha Developers, which was renamed in 2014 as "Sobha Limited" @SobhaLtd

Luck again is with Mr. Menon, where without experience, in 1999, managed to get a deal.

He chose realty sector, and regd first firm in 1993 as Oman Builders. Later in 1995, he regd Sobha Developers, which was renamed in 2014 as "Sobha Limited" @SobhaLtd

Luck again is with Mr. Menon, where without experience, in 1999, managed to get a deal.

This is not a small deal!

Deal is with @Infosys to build their Mysuru campus.

as per DRHP in 2006, more than 80% of their biz came from @Infosys

Interestingly, in an interview, Menon said that even he met Mr. Narayan Murti for the first time in 2008.

then how he recd contract?

Deal is with @Infosys to build their Mysuru campus.

as per DRHP in 2006, more than 80% of their biz came from @Infosys

Interestingly, in an interview, Menon said that even he met Mr. Narayan Murti for the first time in 2008.

then how he recd contract?

Meanwhile, Menon's associate, Madhu Nambiar, ventured into the software services industry with SRIT. The company expanded rapidly, acquiring contracts and entering different sectors. Menon eventually sold his stake in SRIT to Nambiar.

SRIT is the same firm which is associated with AI Camera scam unearthed in May-23

Which is related to PrakashBabu, who is the father-in-law of Pinarayi Vijayan’s son.

For more details on AI Camera Scam thenewsminute.com/article/firm-i…

Which is related to PrakashBabu, who is the father-in-law of Pinarayi Vijayan’s son.

For more details on AI Camera Scam thenewsminute.com/article/firm-i…

Time to reveal the Suspicious man

"Mundayil Aboobacker Pharis"- Average student from Koyilandi, Kozhikode.

in 80's-90's, he headed to chennai, but when he retrned, he accompanies with luxury cars.

but noone knows what he did at that time.

He bacame the partner of Menon in india

"Mundayil Aboobacker Pharis"- Average student from Koyilandi, Kozhikode.

in 80's-90's, he headed to chennai, but when he retrned, he accompanies with luxury cars.

but noone knows what he did at that time.

He bacame the partner of Menon in india

Lucky man Menon met another lucky man Pharis in early 2000's.

When Pharis already into an international scam with TT Durai, CEO of one singapore NGO, and helped in siphoning off money from foundation.

When Pharis already into an international scam with TT Durai, CEO of one singapore NGO, and helped in siphoning off money from foundation.

Pharis’ firm Forte Systems registered in Nevada was paid 3.3 mn Singapore$ for projects that never completed.

When the scam came to light, the Singapore govt arrested Durai and his associates but Pharis escaped since he was in India. The group had skimmed 12 mn Singapore $.

When the scam came to light, the Singapore govt arrested Durai and his associates but Pharis escaped since he was in India. The group had skimmed 12 mn Singapore $.

After that, Pharis became land aggregator and joined hands with Mr. Menon.

Between 2005 and 2009 alone, close to 1500 acres of land in Kerala and Karnataka were bought by Pharis-linked 85 companies and associates and in turn bought by Sobha Developers at very high rates.

Between 2005 and 2009 alone, close to 1500 acres of land in Kerala and Karnataka were bought by Pharis-linked 85 companies and associates and in turn bought by Sobha Developers at very high rates.

These land include wetland of Kerala to paddy fields in Puzhakkal.

Pharis used to buy land at cheap rates, then convert them for construction purpose.

But how Pharis became so influential?

His digital footprint is non-existent. But his loyalty to Kerala CM @pinarayivijayan is 🤝

Pharis used to buy land at cheap rates, then convert them for construction purpose.

But how Pharis became so influential?

His digital footprint is non-existent. But his loyalty to Kerala CM @pinarayivijayan is 🤝

But how he is connected with Mr. @pinarayivijayan?

- This started in 2004, where Pharis offered 2Cr to magazine "Deepika" and in 3 yr took full control over that.

Which is inturn used to create propaganda for @pinarayivijayan oust VS Achuthanandan and lead the party

- This started in 2004, where Pharis offered 2Cr to magazine "Deepika" and in 3 yr took full control over that.

Which is inturn used to create propaganda for @pinarayivijayan oust VS Achuthanandan and lead the party

Pharis has attended the weddings of Pinarayi’s children as special guest

Recently, When Pharis father died, Pinarayi made a quiet visit to Koyilandi & stayed there two hours.

This influence of CM helped him to blaw, illegal land aggregation and selling to technobuild for 522 Cr

Recently, When Pharis father died, Pinarayi made a quiet visit to Koyilandi & stayed there two hours.

This influence of CM helped him to blaw, illegal land aggregation and selling to technobuild for 522 Cr

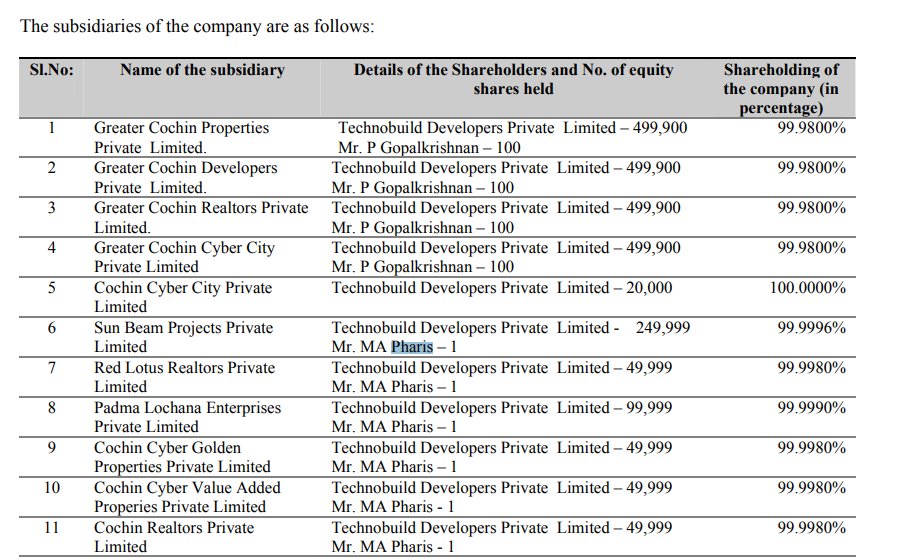

Now Who owns Technobuild?

Technobuild is a company set up to buy land.

Director include - Kuntegowda Kempegowda and Mahesh Kumar Chauhan

But To ur surprise, Technobuild has the exact same address as that of Sobha Developers’ original registered address.

Technobuild is a company set up to buy land.

Director include - Kuntegowda Kempegowda and Mahesh Kumar Chauhan

But To ur surprise, Technobuild has the exact same address as that of Sobha Developers’ original registered address.

Now how they used to do transaction?

Sobha Developers forms a strategic partnership with Technobuild to buy land.

Pharis’ Parrot Grove Pvt Ltd registered in Chennai, enters into another strategic partnership with Technobuild.

Parrot tfd shares in each co to technobuild over time

Sobha Developers forms a strategic partnership with Technobuild to buy land.

Pharis’ Parrot Grove Pvt Ltd registered in Chennai, enters into another strategic partnership with Technobuild.

Parrot tfd shares in each co to technobuild over time

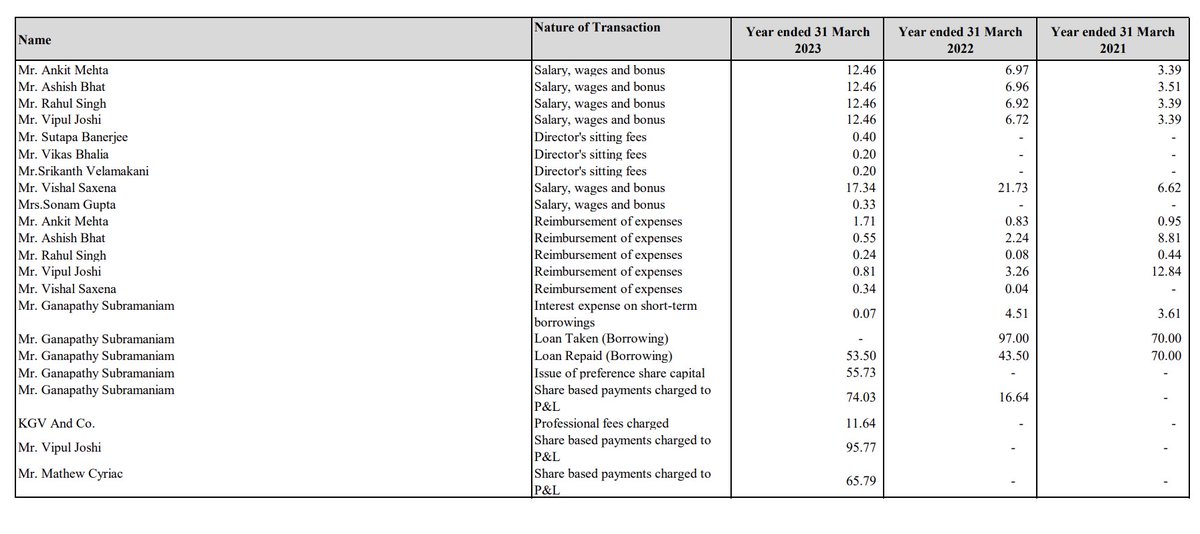

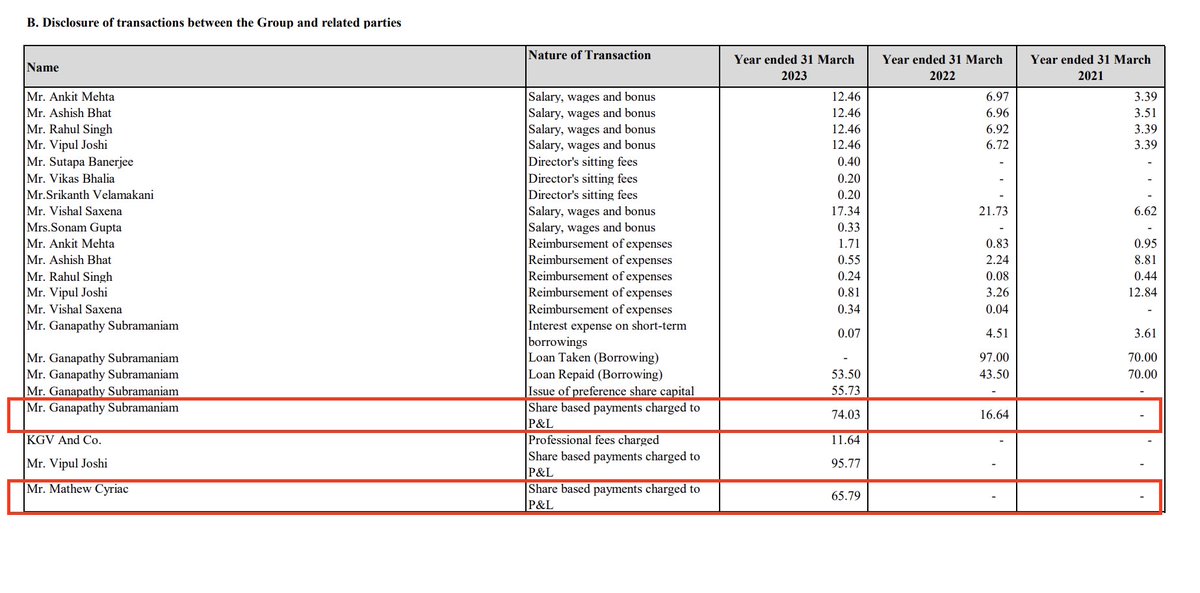

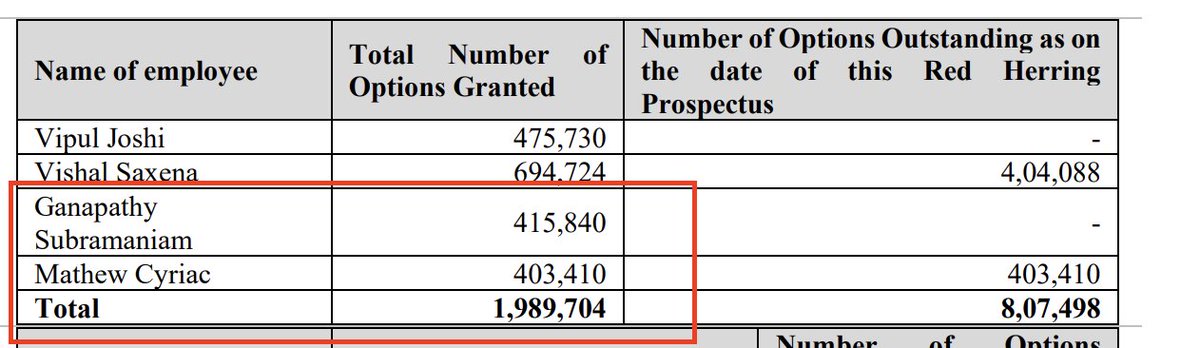

Recent FY22 Annual report-

Technobuild as Related Party

Technobuild referred as land agreegator group

In the yr FY22 also, company made land advance of 819.9 Cr

Technobuild as Related Party

Technobuild referred as land agreegator group

In the yr FY22 also, company made land advance of 819.9 Cr

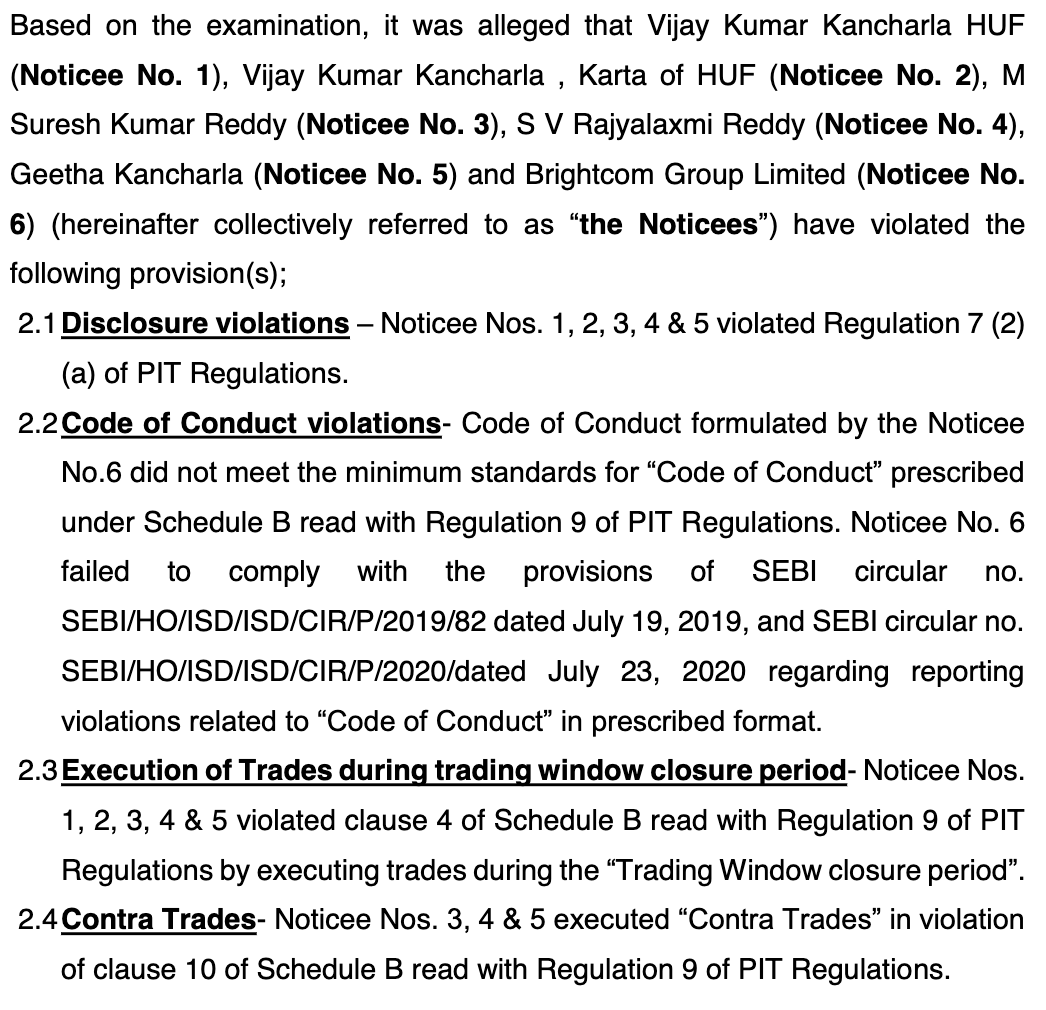

Even DRHP in 2006 include pharis holding 1 shares in 6 seemingly benami comapnies, which they might used to transfer land

Pharis - Current and past Directorship and web of companies associated

Almost ~2500 Companies have same address at that place

Many Directors are same in these interlinked companies

Even Sobha Group’s MD Jagadish Nangineni also have directorship is linked to that.

Almost ~2500 Companies have same address at that place

Many Directors are same in these interlinked companies

Even Sobha Group’s MD Jagadish Nangineni also have directorship is linked to that.

It is clear that Pharis and the Sobha Group are deeply interlinked and entrenched in murky business dealings.

Pharis is also part of inner circle of @pinarayivijayan

Sobha is also in business with Karnataka deputy Chief Minister DK Shivakumar

Pharis is also part of inner circle of @pinarayivijayan

Sobha is also in business with Karnataka deputy Chief Minister DK Shivakumar

Since 2017 the ED has raided the properties and offices of Sobha, Shivakumar and Cafe Coffee Day.

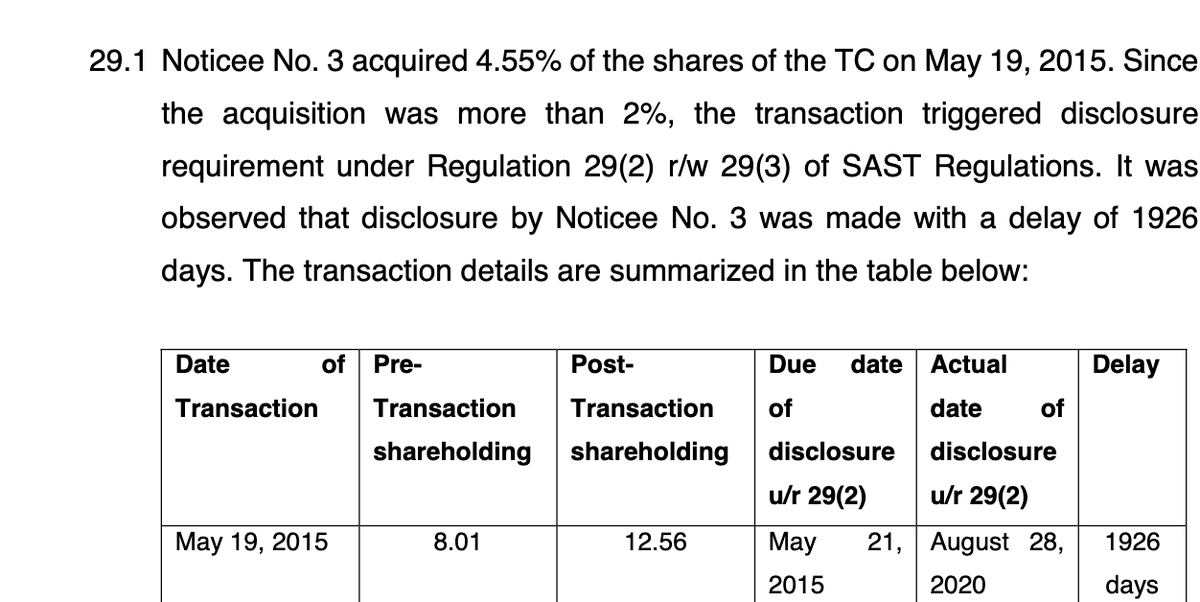

In Aug-22, Sobha settled case with SEBI with penalty of 2.95 Cr thehindubusinessline.com/markets/transa…

In Aug-22, Sobha settled case with SEBI with penalty of 2.95 Cr thehindubusinessline.com/markets/transa…

@sobhalimited with PC Menon is linked with Pharis and @pinarayivijayan !

in recent years there are lot of ED and IT raid on the office of Sobha

Still there are pending receivables and indirect connections

Source - @thelede_in @sandhyaravishan

takethelede.in/a-chief-minist…

in recent years there are lot of ED and IT raid on the office of Sobha

Still there are pending receivables and indirect connections

Source - @thelede_in @sandhyaravishan

takethelede.in/a-chief-minist…

@sobhalimited @pinarayivijayan @thelede_in @sandhyaravishan Unlock the secrets of business success 🌍Don't settle for surface-level information, become an informed investor with @BeatTheStreet10

Join us for exclusive insights that go beyond stock prices. Let's make every investment count! 💪💰

Like RT Follow

Join us for exclusive insights that go beyond stock prices. Let's make every investment count! 💪💰

Like RT Follow

https://twitter.com/beatthestreet10/status/1674968853984493577?s=46&t=lxGNq4katlPW1-fr1vEp1Q

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter