We are happy to release the first results of a RCT of a US program that provided $1,000/month unconditionally for 3 years to 1,000 individuals in the treatment group, with a group of 2,000 people receiving $50/month serving as the control.

These are sizable transfers. 1/ 🧵

These are sizable transfers. 1/ 🧵

The program targeted individuals aged 21-40 living in low-income households. One might expect younger people to change their trajectories more in response to cash transfers because they have more life ahead of them and they are less likely to have savings at baseline. 2/

Before I get into the results, I want to highlight a few features of this study that make it unique:

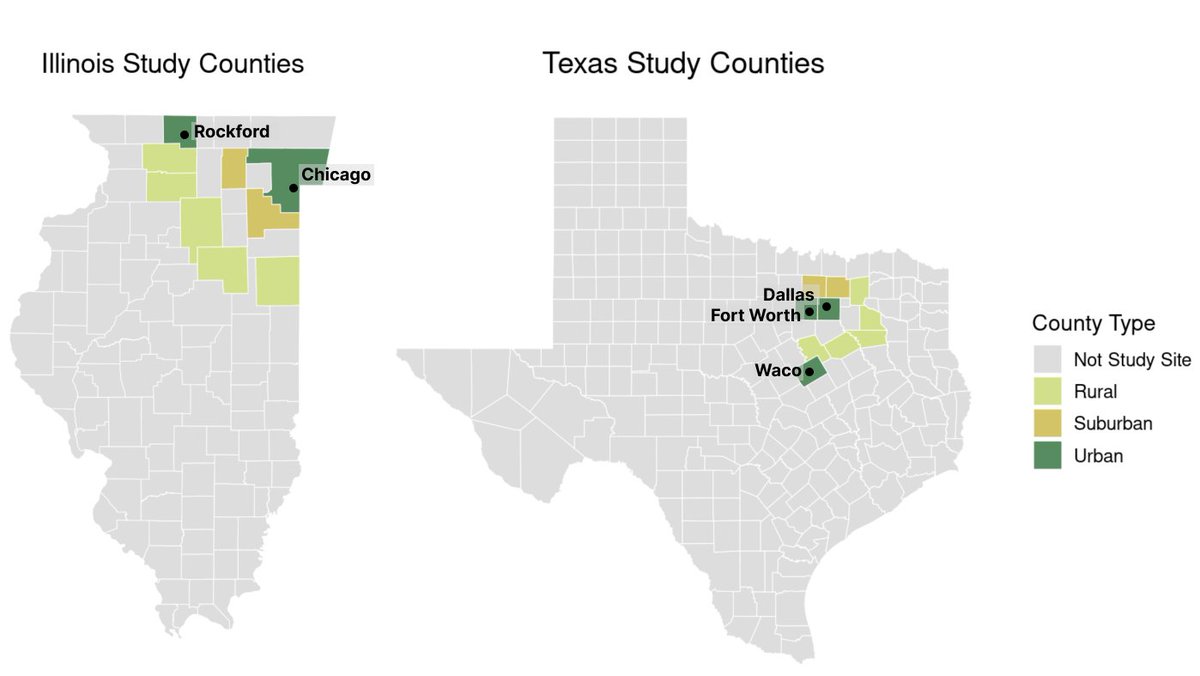

1) There are many evaluations of cash transfers in low-income settings. This is in the US, in several counties in IL and TX. 3/

1) There are many evaluations of cash transfers in low-income settings. This is in the US, in several counties in IL and TX. 3/

2) We gathered incredibly detailed data with very high response rates over a long period of time from enumerated surveys, online surveys, administrative records, and a custom mobile phone app. Differential attrition was low. 4/

3) The transfers are substantial, representing a ~40% increase from total household income at baseline, and they are sustained over a relatively long period of time. Further, the sample size was large enough to enable us to detect fairly small effects. 5/

4) The transfers were gifts from non-profit organizations and not taxable. Participants remained eligible for almost all other benefits.

Further, the program was targeted at low-income individuals but, once enrolled, participants could earn a high income and still receive $. 6/

Further, the program was targeted at low-income individuals but, once enrolled, participants could earn a high income and still receive $. 6/

This matters because many programs are means-tested, creating a disincentive to work. In our study, any impacts we observe are due to the pure income effect of having more money. 7/

5) Finally, it’s hard to overstate just how comprehensive the data we gathered was. This was an expensive program, so it’s worth it to gather really good data.

Here’s a list of all the topics we covered: 8/

Here’s a list of all the topics we covered: 8/

Today, I’m going to tell you about the effects of the transfers on employment outcomes.

And yes, I’ll tell you about the effects on labor supply - do people work a little less? - but also, if they do work less, what do they do with that time? 9/

And yes, I’ll tell you about the effects on labor supply - do people work a little less? - but also, if they do work less, what do they do with that time? 9/

In the eyes of a policymaker, not all activities are equal.

Policymakers may care whether people are doing things that increase their future productivity, like going back to school or starting a business. 10/

Policymakers may care whether people are doing things that increase their future productivity, like going back to school or starting a business. 10/

They could also care whether participants spend time taking care of children or elders or volunteering in their communities, because these activities could have positive spillover effects. 11/

At the same time, what people choose to do with the transfers provides some indication of what they themselves value.

If you are trying to improve well-being, and you see people prefer to have a bit more leisure rather than more consumption goods, that’s informative. 12/

If you are trying to improve well-being, and you see people prefer to have a bit more leisure rather than more consumption goods, that’s informative. 12/

So, what do we find?

First, we see a moderate labor supply effect. About 2 percentage points fewer people work in the treatment group than the control group as a result of the transfers.

People in the treatment group work about 1.3-1.4 hrs/week less. 13/

First, we see a moderate labor supply effect. About 2 percentage points fewer people work in the treatment group than the control group as a result of the transfers.

People in the treatment group work about 1.3-1.4 hrs/week less. 13/

This represents about a 4-5% decrease in income, excluding the transfers.

Interestingly, participants’ partners appear to reduce their labor supply by a comparable amount. 14/

Interestingly, participants’ partners appear to reduce their labor supply by a comparable amount. 14/

You can think of total household income, excluding the transfers, as falling by more than 20 cents for every $1 received. This is a pretty substantial effect. 15/

What did people do with their time instead? To answer this question, we measured time use in two ways.

First, on a randomly selected weekday and weekend day each month, we asked them to fill out a 24-hour time diary, using a custom mobile phone app: 16/

First, on a randomly selected weekday and weekend day each month, we asked them to fill out a 24-hour time diary, using a custom mobile phone app: 16/

Second, we asked people to answer survey questions adapted from the American Time Use Survey, in quarterly online surveys and in the enumerated baseline/midline/endline. 17/

Both measurements find a decrease in work hours.

In the mobile app, if you add up “market work” and “other income generating activities”, you get a noisily-estimated point estimate of -1.4 hours/week. The ATUS-style surveys show the same thing, more precisely estimated. 18/

In the mobile app, if you add up “market work” and “other income generating activities”, you get a noisily-estimated point estimate of -1.4 hours/week. The ATUS-style surveys show the same thing, more precisely estimated. 18/

These also both agree pretty well with survey questions that ask about work hours in the employment modules (where we get an estimate of -1.3 hours/wk). 19/

What goes up? In the mobile time diaries, the main effects appear to be on leisure, especially pooling across social and solitary leisure. 20/

Time spent in transportation also goes up (people are doing more things), but overall people appear to use the transfers for a variety of different purposes. Not much else moves in the time use surveys, other than maybe a small increase in time spent on finances. 21/

Okay, if people are working less, does quality of employment at least go up? Maybe they keep the good jobs and ditch the bad jobs?

And theoretically, participants receiving the transfers can afford to search longer for better-fitting jobs. Do the transfers help? 22/

And theoretically, participants receiving the transfers can afford to search longer for better-fitting jobs. Do the transfers help? 22/

This question required a lot of work to answer well, because there are a lot of dimensions along which a job could be considered “better”. 23/

E.g., is it flexible? Do you get to set your own schedule? Do you receive training? Do you face discrimination at work?

We asked an extremely comprehensive battery of questions about employment, capturing six dimensions of employment quality. 24/

We asked an extremely comprehensive battery of questions about employment, capturing six dimensions of employment quality. 24/

The details are in the paper, but we see null results for the index values of all the dimensions. We can reject that wages changed by more than 73 cents and can reject changes in the overall index of quality of employment of more than 0.028 standard deviations. 25/

Job quality did not change. It doesn’t matter if you restrict attention to those who changed jobs over the study period. Nada. 26/

But, it’s not all bad news.

One bright spot was entrepreneurship.

We see significant increases in what we pre-specified as “precursors” to entrepreneurial activity: entrepreneurial orientation and intention. 27/

One bright spot was entrepreneurship.

We see significant increases in what we pre-specified as “precursors” to entrepreneurial activity: entrepreneurial orientation and intention. 27/

We find null effects for whether or not a participant started or helped to start a business, but entrepreneurship is not for everyone (hence pre-specifying that we’d also consider entrepreneurial orientation and intention, as they represent more common intermediate outcomes). 28/

We also see some signs that younger participants invest more in education.

Since human capital investments make more sense for people who are younger, we pre-specified that we would do a subgroup analysis focusing on those who were in their 20s at the time of the transfers. 29/

Since human capital investments make more sense for people who are younger, we pre-specified that we would do a subgroup analysis focusing on those who were in their 20s at the time of the transfers. 29/

Among this group, about 2 percentage points more people enroll in post-secondary education. 30/

Given how many outcomes we are testing, we pre-specified that we would adjust for multiple comparisons, prioritizing some outcomes over others similar to Guess et al. (2023). Subgroup analyses get low priority in this exercise. 31/

So, this result that younger participants receive more education does not survive adjusting for the false discovery rate. Nonetheless, the point estimate is notable. 32/

There are more results in the paper.

Overall, the negative effects on labor supply do not appear to be offset by other productive activities, and we do not observe people getting better jobs over the 3-year duration of the program. 33/

evavivalt.com/wp-content/upl…

Overall, the negative effects on labor supply do not appear to be offset by other productive activities, and we do not observe people getting better jobs over the 3-year duration of the program. 33/

evavivalt.com/wp-content/upl…

It is still possible some may do so in the future and that there is heterogeneity in responses to the transfers.

And, of course, cash transfers can have other effects beyond those on employment. 34/

And, of course, cash transfers can have other effects beyond those on employment. 34/

Coauthor @smilleralert is releasing results today on the health effects of the transfers, in a few weeks we will hear from @AlexBartik on household finance, and we’ll have results on other outcomes from @elizabethrds and @dbroockman later.

More results are coming up. 35/

More results are coming up. 35/

@smilleralert @AlexBartik @elizabethrds @dbroockman Before signing off, I’d like to emphasize that these effects tell us something about participants’ preferences.

A policymaker may prefer people work more, due to spillover effects, but if participants really value leisure time and it improves well-being, that’s good to know. 36/

A policymaker may prefer people work more, due to spillover effects, but if participants really value leisure time and it improves well-being, that’s good to know. 36/

@smilleralert @AlexBartik @elizabethrds @dbroockman Since this study captures the pure income effect of giving cash, without any of the substitution effects that might occur with a means-tested program, it tells us how much people prefer more leisure on the margin, even without disincentives to work. 37/

@smilleralert @AlexBartik @elizabethrds @dbroockman And it perhaps gives us a hint of what we might expect in the future if income rises. 38/38

@smilleralert @AlexBartik @elizabethrds @dbroockman My abstract image cut out the title, so here it is again to help people find the paper. 😂

Paper: evavivalt.com/wp-content/upl…

Paper: evavivalt.com/wp-content/upl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh