DoubleLine CEO-CIO Jeffrey Gundlach presents "Not in My Neighborhood," Tuesday, Mar. 11, 2025 at 1:15pm PT.

Register on .

#economy #Fed #rates #inflation #growth #Trump #DOGE #bonds DoubleLine.com

Register on .

#economy #Fed #rates #inflation #growth #Trump #DOGE #bonds DoubleLine.com

Jeffrey Gundlach: Thanks for joining today's webcast.

We will discuss diversification away from all-U.S.-based assets, something I've been advising for years. Now the need seems more imminent.

We will discuss diversification away from all-U.S.-based assets, something I've been advising for years. Now the need seems more imminent.

Gundlach: I'm in favor of DOGE efforts to get America's fiscal house in order.

Gundlach: At the end of 2024, we started with a grossly overvalued risk markets, particularly equities.

It reminded me very much of year-end 2021.

Except for smaller caps, there were top decile valuations across the equities market entering 2025.

It reminded me very much of year-end 2021.

Except for smaller caps, there were top decile valuations across the equities market entering 2025.

Gundlach: Fixed income represented a spectrum. Very tight corporate bond spreads. CMBS was screening cheap on valuation relative to its history back to 1997.

Gundlach: Euro Zone up 12.4% through March 7. Unusually high outperformance.

In fixed income, that has outperformed major U.S. equity indices.

Worst perform for FI is floating rate given falling interest rates.

In fixed income, that has outperformed major U.S. equity indices.

Worst perform for FI is floating rate given falling interest rates.

Gundlach: Weaker dollar has fueled European equities.

Euro, yen are up against the dollar YTD.

Euro, yen are up against the dollar YTD.

Gundlach: Gold continues its bull market, even since it was down at 1800, now flirting with 3000/ounce.

I think gold will make it to 4000, perhaps will take longer than this year.

I think gold will make it to 4000, perhaps will take longer than this year.

Mr. Gundlach: The Bloomberg Agg is No. 5 out of 49 years in terms of performance.

Look at how out of context 2022 is. Off the charts vs. other experiences.

Look at how out of context 2022 is. Off the charts vs. other experiences.

Gundlach: Looking at the history of drawdowns for the Agg, these didn't last long, thanks to the secular decline in interest rates.

Gundlach: Yields going back 10 years: similar patterns of yields have topped out a couple years + ago

Gundlach: Copper/gold ratio no longer works after the end of the secular decline in rates.

Gundlach: The Tsy curve has de-inverted. 2s-10s show a meaningful de-inversion. That ordinarily is a tip off of imminent recession. We need to see the 12-month moving average to cross above the zero line. Should happen fairly soon. Suggests odds of recession going up. I would say 60% chance of recession in 2025.

Gundlach: Fed Funds and 12-month-hike expectations: Fed was way out of line before started cutting rates in September.

Also out of line with the 2-year Tsy yield

Also out of line with the 2-year Tsy yield

Gundlach: The Fed cuts have brought policy more in line with expectations. Maybe the Fed will cut once or 1.5 times this year. We'll have to see out the data develops.

Gundlach: DOGE cuts to jobs and waste could have a significant effect, pushing unemployment higher.

Gundlach: Expectations for few jobs over the next 6 months has gone straight up, taking out prior peaks going back more than 10 years.

Gundlach: Last such spike was in 2010-2011 when there was talk of government shutdowns, fears of recession (unrealized).

DoubleLine CEO Jeffrey Gundlach: Another disturbing if not new trend: every year, the U.S. is getting further into the deficit problems.

Gundlach: Hopefully, the administration makes progress eliminating these fraudulent programs.

Gundlach: Monthly Tsy coupon issuance going back to 2007 - the massive mountain of issuance under COVID has been almost matched by issuance over the past year.

Mr. Gundlach: Budget deficit as % of GDP vs. unemployment rate: once had high deficits to fight high unemployment. Now we run high deficits as a percentage of GDP even with low unemployment.

Gundlach: I've never supported everything the Trump admin does. I don't like the tax cuts. I do support DOGE.

Gundlach: The Fed keeps saying we're making progress on inflation. But Core Inflation is far above the target.

Gundlach: The most troubling slide for the Fed: month-over-month CPI has been rising monotonically.

Food as well.

Energy is better contained, but not the last couple of months.

Food as well.

Energy is better contained, but not the last couple of months.

Gundlach: Core CPI's most recent reading month over month was really bad.

Used cars and trucks are back to rising.

Owners equivalent rent is slowing down.

Used cars and trucks are back to rising.

Owners equivalent rent is slowing down.

Gundlach: Export and import prices were very inflationary, then paid back in 2023-2024, but now they're rising again.

And that's before the imposition of any tariffs

And that's before the imposition of any tariffs

Gundlach: The on-again, off-again saga of tariffs seems to change every hour. Trump likes to troll people, I guess

Gundlach: University of Michigan consumer inflation expectations have shot up. Maybe people think tariffs will do this. Maybe they will

Gundlach: Bloomberg Commodity Index has shown some sign of life, thanks of copper and gold, not energy. this is not good for the inflation outlook.

Gundlach: That's in recognition of gold as a storehouse of value that is outside the financial system which is in a state of flux.

Gundlach: U.S. Trade Balance deficit now at -$156 billion.

This is a potential disruption to the U.S. exceptionalism.

This is a potential disruption to the U.S. exceptionalism.

Gundlach: Average tariff rates on U.S. imports used to be much higher as recently as the 1950s. They appear to be headed up again.

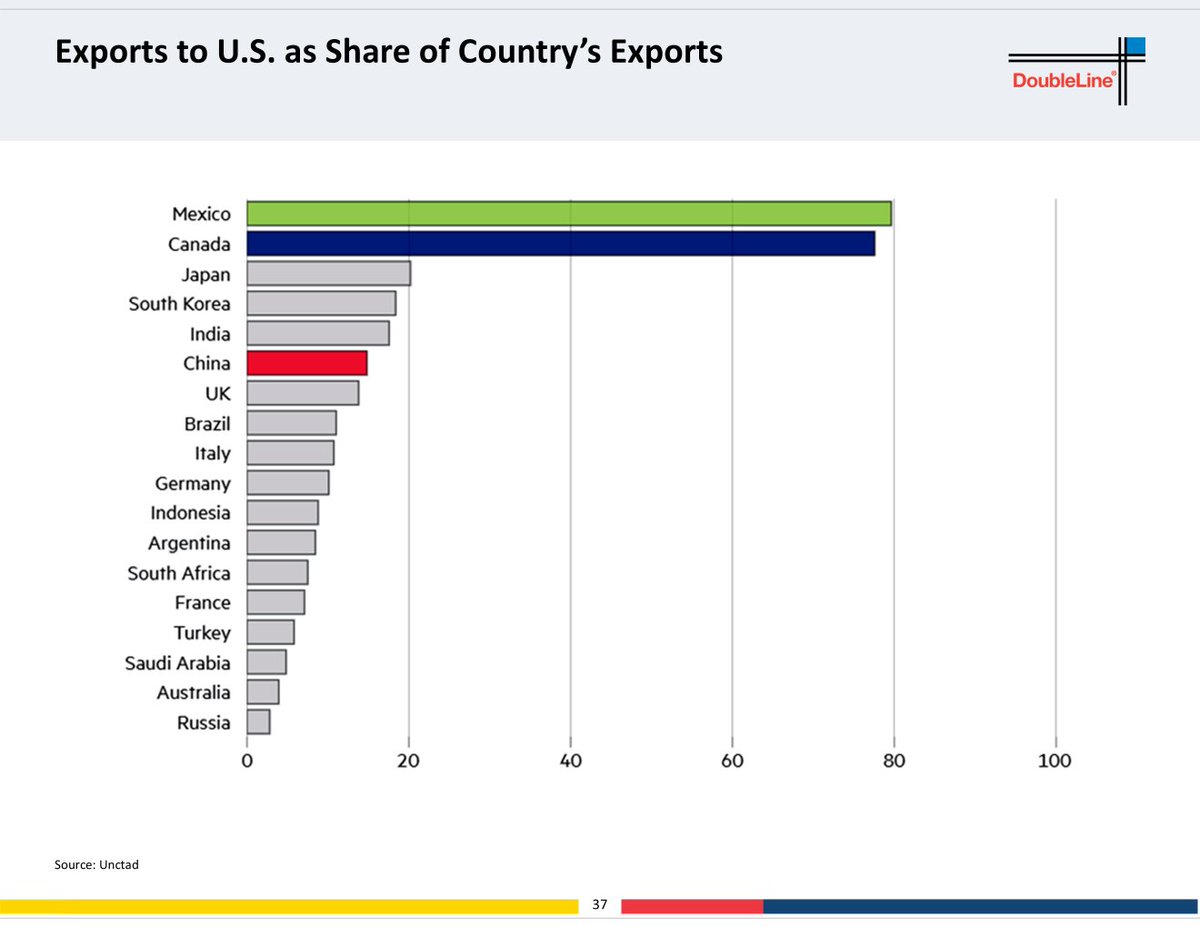

Gundlach: Mexico has 80% of exports to U.S., 70%+ for Canada. Trump has a point about seeking reciprocity between the U.S. and these trade partners.

Gundlach: Spreads across fixed income sectors: change from Dec. 2024 vs. yesterday March 10.

Most sectors have come in a little bit, but not all that much.

With the Treasury rally, many of the sectors have given up some of their spread tightening.

Most sectors have come in a little bit, but not all that much.

With the Treasury rally, many of the sectors have given up some of their spread tightening.

Gundlach: HY corporates haven't been weak. They just haven't been able to keep up with the Tsy market.

Gundlach: HY CCC-BB differential suggests the CCC have been coming in, but still relatively wide vs. history.

Gundlach: Higher default rates on bank loans isn't surprising, given the Fed's rate-raising campaign has left floating rate debt harder for corporate borrowers to service.

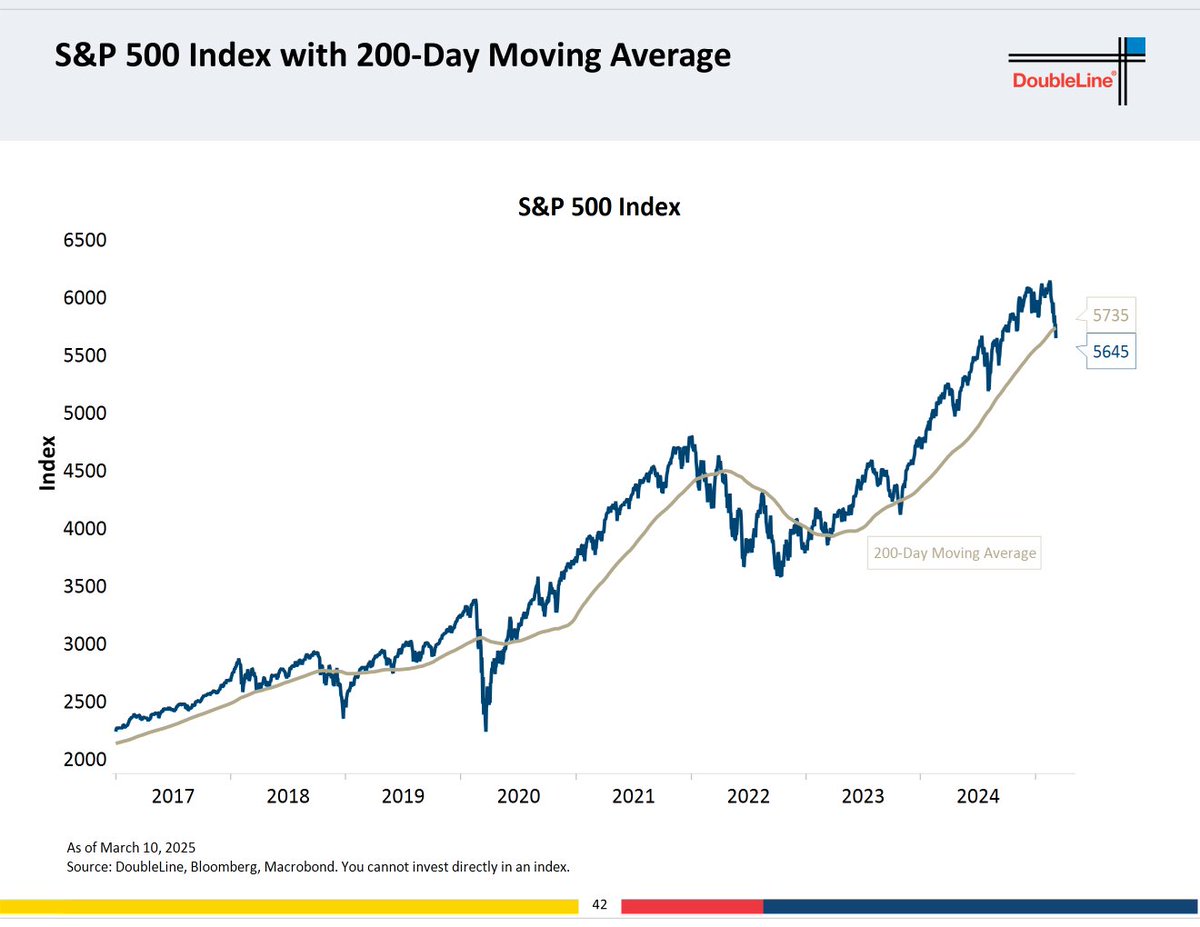

Gundlach: S&P 500 had been way above its 200 day moving average. It is now below the 200 DMA.

S&P 500 still appears to have momentum to the downside.

S&P 500 still appears to have momentum to the downside.

Gundlach: The problem has been the top companies by market cap represented an excessively large slice of the S&P 500 market cap.

That's why I recommended equal-weighted index strategies.

That's why I recommended equal-weighted index strategies.

Gundlach: U.S. stocks vs. the rest of the world: this time of mega-cap outperformance, overvaluation feels like the Nifty 50 stock mania of the 1970s.

Gundlach: I reiterate my recommendation of 3.5 years ago in favor of European stocks and other ex-U.S. stocks for one's equity allocation.

Gundlach: Net investment into the United States: form about $3 trillion years ago to more than $20 trillion. that helps the U.S. outperform ex-U.S. markets. With European countries needing to re-industrialize that could lead to these flows to reverse. That could mean years, maybe decades, of European stock outperformance vs. U.S. stocks.

Gundlach: We no longer have a secular declining interest rate environment. This is a very different context than what the U.S. enjoyed since the early 1980s.

Gundlach: When you plot U.S. stocks to EM stocks against the trade-weighted dollar, you see EM should outperform with further declines in the dollar.

• • •

Missing some Tweet in this thread? You can try to

force a refresh