How to get URL link on X (Twitter) App

A level 2 explanation:

A level 2 explanation:

Home Buying

Home Buying

6 reasons to go:

6 reasons to go:

2. The Strand (near Radio Club). Large rooms and a nice rooftop restaurant (Harbour view). Breakfast is generally included in your room fare.

2. The Strand (near Radio Club). Large rooms and a nice rooftop restaurant (Harbour view). Breakfast is generally included in your room fare.

There are however reasons to buy a higher cover today.

There are however reasons to buy a higher cover today.https://twitter.com/ActusDei/status/1633998920224219136First, flexibility. In insurance you sign up for a multi-year payment plan. Next year you could lose your job or you have some stress in your finances. Your agent will still ask for the premium. Surrendering a plan attracts huge charges. This is a major issue in insurance.

Middle class habits do not change overnight. Bengaluru based Rohan Chandrashekhar still drives a hatchback worth Rs 7 lakh and shops online from mid-segment clothes brands. Ghaziabad based Shubham Garg said he upgraded to a bigger home, but his lifestyle hasn't changed much.

Middle class habits do not change overnight. Bengaluru based Rohan Chandrashekhar still drives a hatchback worth Rs 7 lakh and shops online from mid-segment clothes brands. Ghaziabad based Shubham Garg said he upgraded to a bigger home, but his lifestyle hasn't changed much.

https://twitter.com/amitmantri/status/1630528866820448256I respectfully disagree with the timing issue and PMS having more exposure to small cap. We have focused on 3 and 5 yr - long enough and the best we can do with the patchy data out there (ideally we would've liked rolling returns

There isn't much of an argument for investing in Portfolio Management Services. They have largely grown over the past few years on the back of hefty fees and expenses. This is slowly changing. #Sebi banned upfront commissions in PMS and introduced direct plans only in 2020.

There isn't much of an argument for investing in Portfolio Management Services. They have largely grown over the past few years on the back of hefty fees and expenses. This is slowly changing. #Sebi banned upfront commissions in PMS and introduced direct plans only in 2020.

Says Sebi not looking to disintermediate brokers with regulations such as upstreaming money to clearing corporations. Huge client funds lying with brokers is a risk.

Says Sebi not looking to disintermediate brokers with regulations such as upstreaming money to clearing corporations. Huge client funds lying with brokers is a risk.

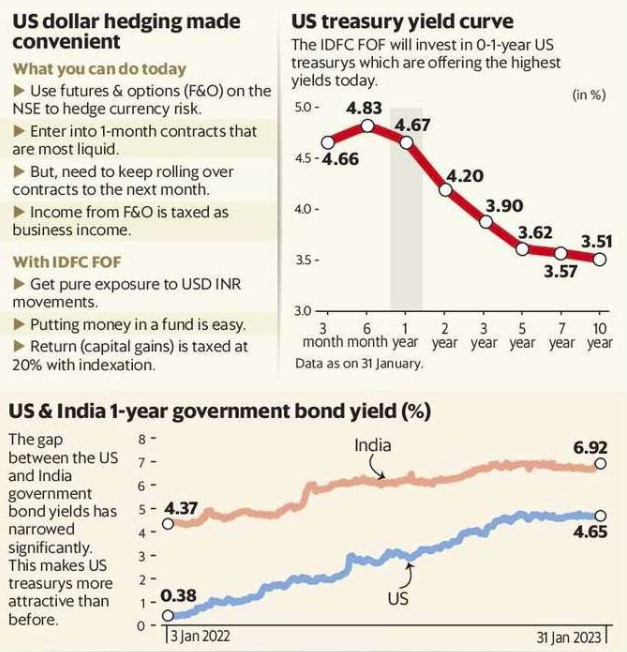

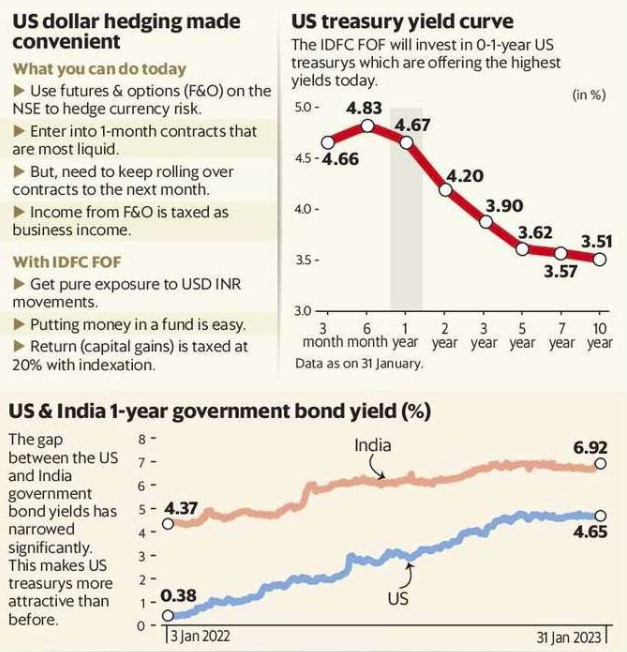

First, when the US Fed hikes rates, everything (stocks, bonds, gold) goes down. Only the yields on US treasuries go up. But for Indians there was no straightforward way to benefit from rising treasury yields. From next month, there will be.

First, when the US Fed hikes rates, everything (stocks, bonds, gold) goes down. Only the yields on US treasuries go up. But for Indians there was no straightforward way to benefit from rising treasury yields. From next month, there will be.

Quite simply, until Indore Municipality came out with a public issue on Feb 14th 2023, municipal bond issues were few and far between. They were also 'privately placed' - offered to select investors. The minimum face value (until Oct 2022) for private placement was Rs 10 lakh.

Quite simply, until Indore Municipality came out with a public issue on Feb 14th 2023, municipal bond issues were few and far between. They were also 'privately placed' - offered to select investors. The minimum face value (until Oct 2022) for private placement was Rs 10 lakh.

In today's era of rising rates, this is a free lunch for banks. The lunch was a tiny snack in 2020-21 when rates were cut. Moving money to an FD wasn't that rewarding. You got maybe 1-2% more. Today, that free lunch is a buffet. Savings rates are half of FD rates of even 1 year.

In today's era of rising rates, this is a free lunch for banks. The lunch was a tiny snack in 2020-21 when rates were cut. Moving money to an FD wasn't that rewarding. You got maybe 1-2% more. Today, that free lunch is a buffet. Savings rates are half of FD rates of even 1 year.

Indian market was in doldrums after the 2018 IL&FS meltdown while the Nasdaq was booming. So the fintechs used tech to democratize investing through India's Liberalized Remittance Scheme (LRS). Middle class investors were now able to enter a domain of the rich - global investing

Indian market was in doldrums after the 2018 IL&FS meltdown while the Nasdaq was booming. So the fintechs used tech to democratize investing through India's Liberalized Remittance Scheme (LRS). Middle class investors were now able to enter a domain of the rich - global investing