Fund Manager of Family Office / Long term #BTC holder / $TSLA Investor since 14’ / Formerly - Hedge Fund Trader & Senior Analyst - NFA / Subscribe!

How to get URL link on X (Twitter) App

Good to see 1 to 3 month cohort starting to increase as the buyers added between 30k to 48k. 3 to 6 month is slowly aging into the 30k to 40k, still capturing 50k to 64.8k areas. Important to see this group hold steady in the next few months.

Good to see 1 to 3 month cohort starting to increase as the buyers added between 30k to 48k. 3 to 6 month is slowly aging into the 30k to 40k, still capturing 50k to 64.8k areas. Important to see this group hold steady in the next few months.

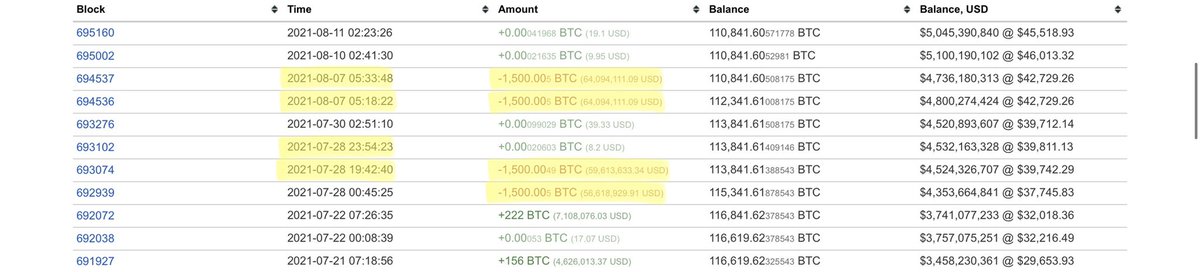

This 🐳 lightly accumulated 753 #BTC starting at 50k on May 15th, at the start of the huge pullback. Additional purchases were made at 44.7k, 44.1k, with large buys going all the way down to 29.6k.

This 🐳 lightly accumulated 753 #BTC starting at 50k on May 15th, at the start of the huge pullback. Additional purchases were made at 44.7k, 44.1k, with large buys going all the way down to 29.6k.

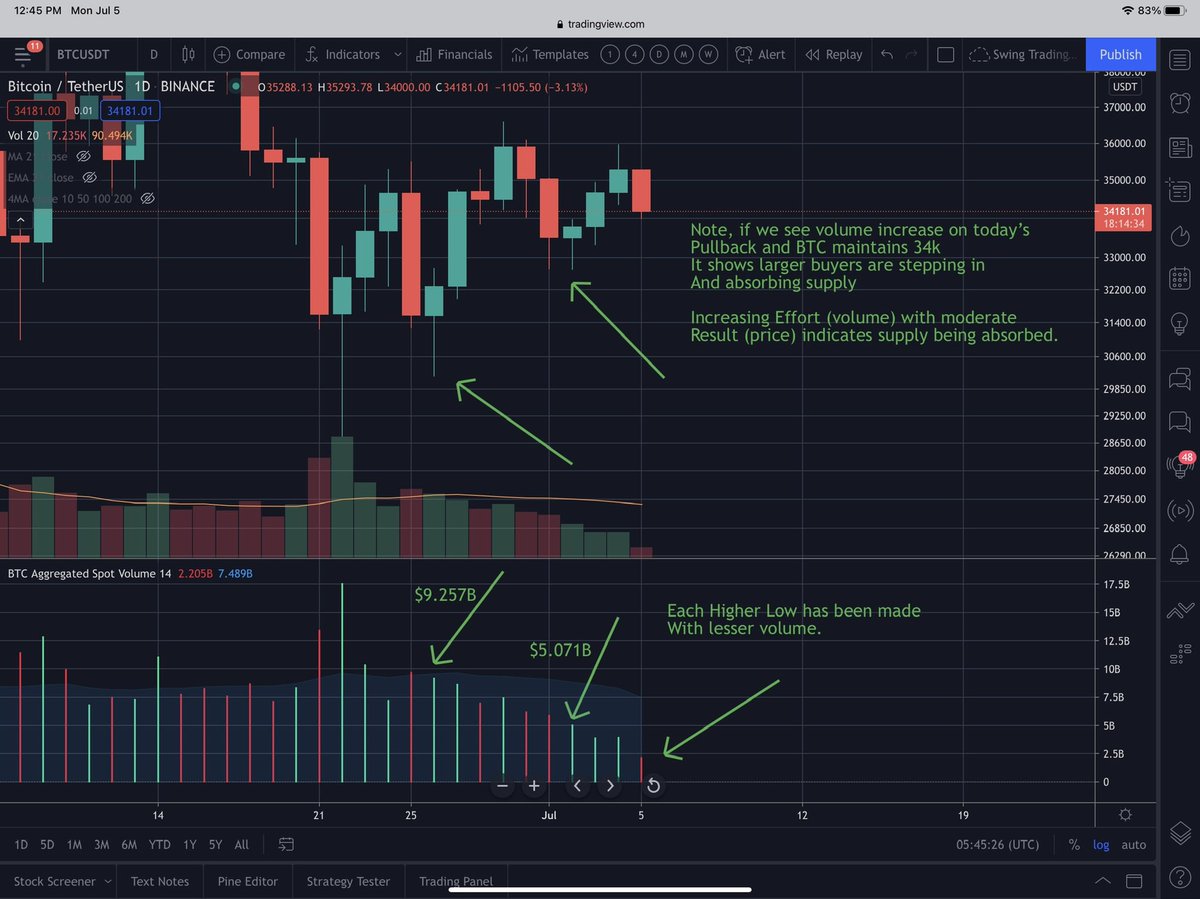

This weeks price action formed the Higher Low at 32.7k, with less volume, a positive signal indicating further supply exhaustion.

This weeks price action formed the Higher Low at 32.7k, with less volume, a positive signal indicating further supply exhaustion.