Senior Economist, Canadian Centre for Policy Alternatives @CCPA

For the lawyers: Opinions expressed on twitter are my own. RTs are not endorsements.

How to get URL link on X (Twitter) App

The NDP proposals provide roughly the same across all income groups at roughly $500 a taxfiler. Its roughly double that for those making 14K to 31K, but worse at the high end, who pay more due to the re-introduction of fairer taxation for capital gains.

The NDP proposals provide roughly the same across all income groups at roughly $500 a taxfiler. Its roughly double that for those making 14K to 31K, but worse at the high end, who pay more due to the re-introduction of fairer taxation for capital gains.

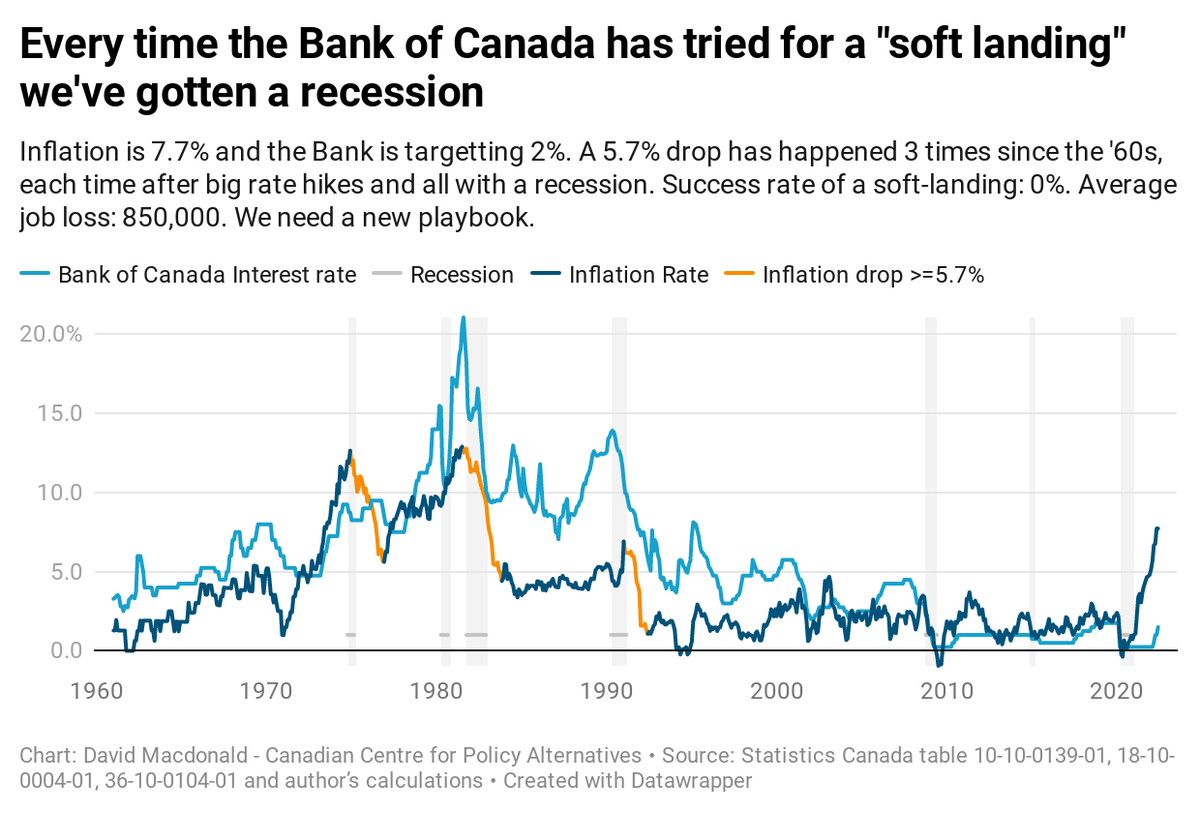

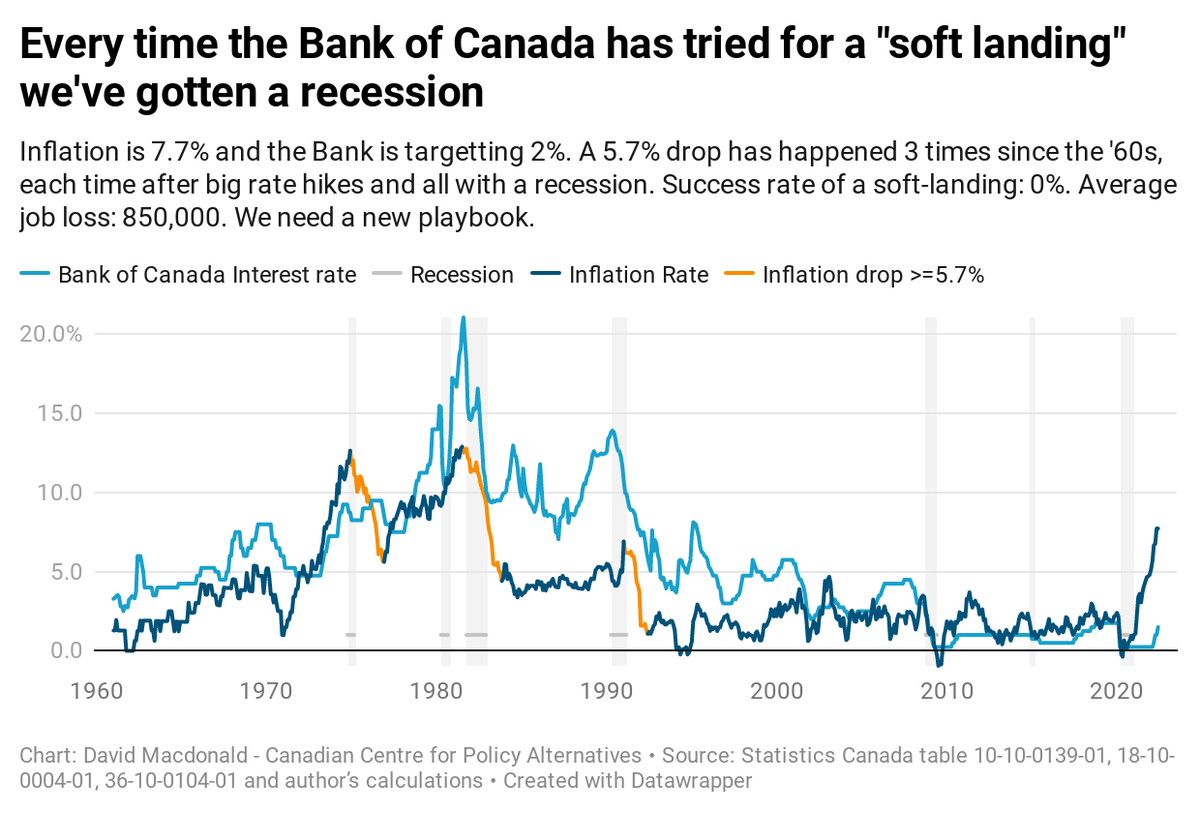

Trouble is that private sector debt levels are wayyy higher today at 225% of GDP. IN 1990s, debt stood at 140% of GDP. So you get much more bang for your buck per % point increase (in all the wrong ways). Cdn economic growth has gotten addicted to private debt. 2/x

Trouble is that private sector debt levels are wayyy higher today at 225% of GDP. IN 1990s, debt stood at 140% of GDP. So you get much more bang for your buck per % point increase (in all the wrong ways). Cdn economic growth has gotten addicted to private debt. 2/x

In modern Canadian history, going back to 1961, there have been 3 periods when CPI has fallen by at least 5.7 points (7.7-2): 1974-76, 1981-83 and 1991-92. In every instance of a reduction of this magnitude, it was always accompanied by a recession. 2/x

In modern Canadian history, going back to 1961, there have been 3 periods when CPI has fallen by at least 5.7 points (7.7-2): 1974-76, 1981-83 and 1991-92. In every instance of a reduction of this magnitude, it was always accompanied by a recession. 2/x

The CPC is promising a refundable tax credit of up to $6k to reimburse parents for a portion of fee costs and to end the Child Care Expense Deduction.

The CPC is promising a refundable tax credit of up to $6k to reimburse parents for a portion of fee costs and to end the Child Care Expense Deduction.