FinTwit meets SparkNotes | Threads: Macroeconomics, investing fundamentals, interviews. No financial advice. Support: https://t.co/3Lbfys9j7u

7 subscribers

How to get URL link on X (Twitter) App

Many of the insights gathered in this thread were inspired by @PensionCraft's video:

Many of the insights gathered in this thread were inspired by @PensionCraft's video:

(2/41) This thread summarizes a recent interview with @FedGuy12 and @MoneyMorningAU.

(2/41) This thread summarizes a recent interview with @FedGuy12 and @MoneyMorningAU.

Many refer to the rise in the US Dollar as a double edged sword or even a wrecking ball.

Many refer to the rise in the US Dollar as a double edged sword or even a wrecking ball.

@LynAldenContact This thread summarizes a recent interview with @LynAldenContact and @MikeIppolito_.

@LynAldenContact This thread summarizes a recent interview with @LynAldenContact and @MikeIppolito_.

Let's start off by discussing multiple compression.

Let's start off by discussing multiple compression.

2/38

2/38

Inflation expectations are the rate that people, businesses and investors expect prices to rise in the future.

Inflation expectations are the rate that people, businesses and investors expect prices to rise in the future.

This thread summarizes Ray Dalio's famous video:

This thread summarizes Ray Dalio's famous video:

This thread is a summary of @PensionCraft's video on Youtube:

This thread is a summary of @PensionCraft's video on Youtube:

Following WWII, the US enjoyed 25 years of strong economic growth and price stability.

Following WWII, the US enjoyed 25 years of strong economic growth and price stability.

Who are Option Market Makers (MM) and why are they so important?

Who are Option Market Makers (MM) and why are they so important?

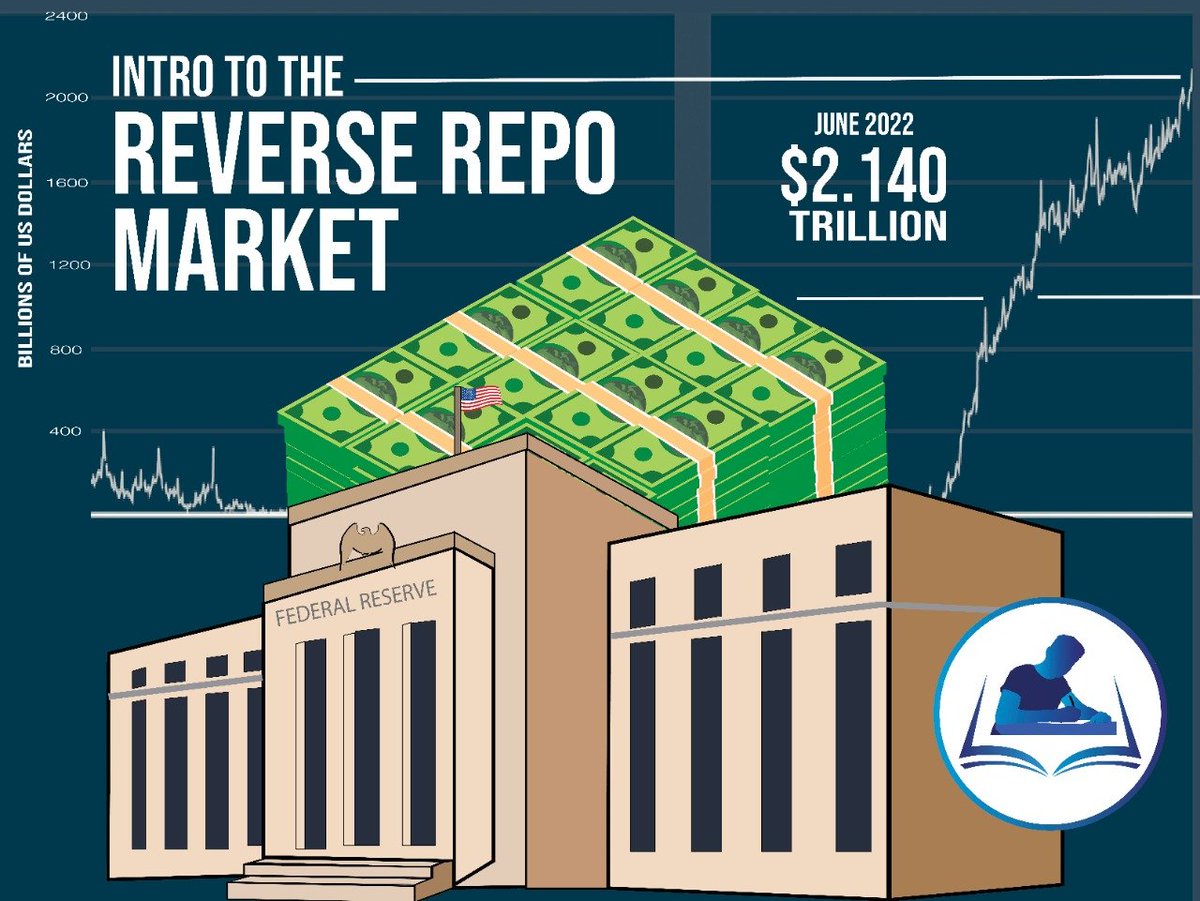

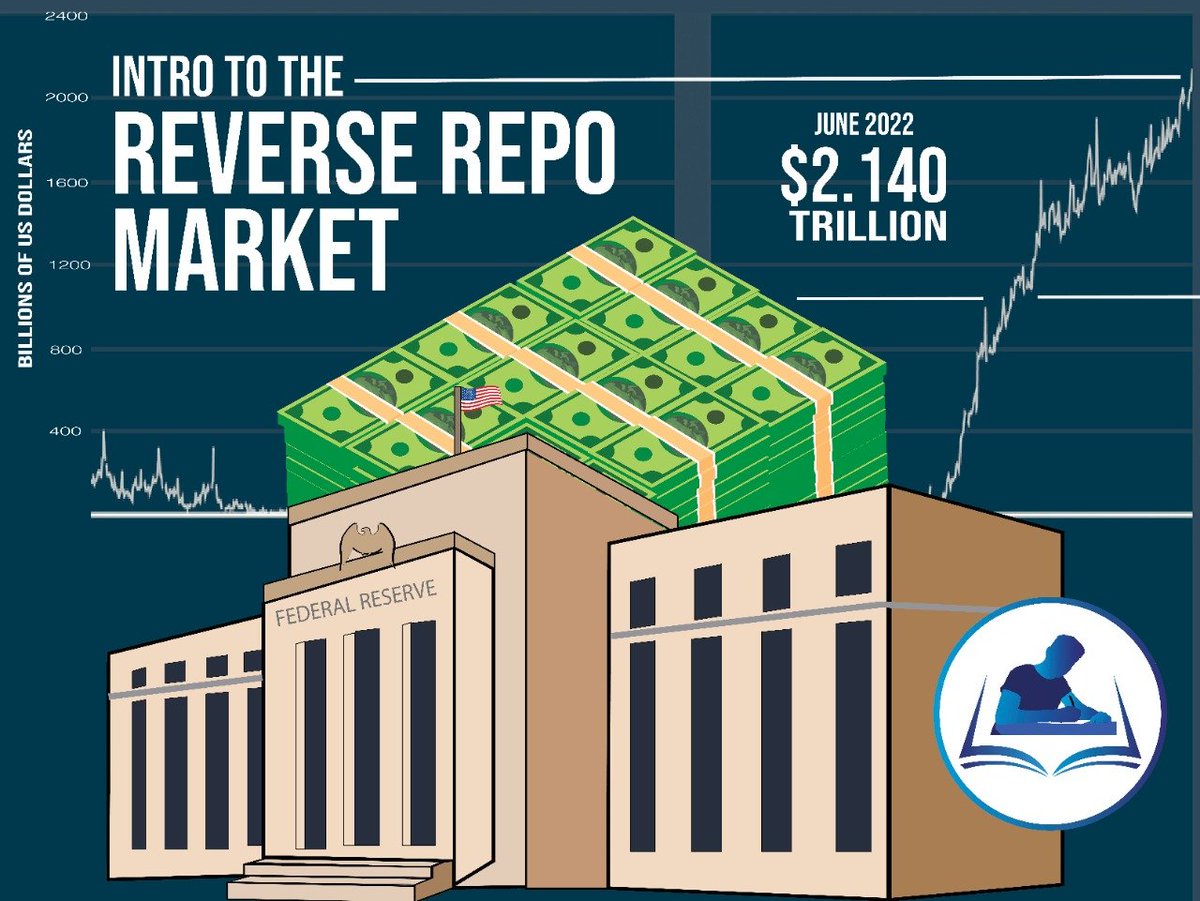

The Federal Reserve begins its quantitative tightening (QT) program on June 1st.

The Federal Reserve begins its quantitative tightening (QT) program on June 1st.

Cathie Wood is joined by Nancy Lazar, Piper Sandler's Chief Global Economist.

Cathie Wood is joined by Nancy Lazar, Piper Sandler's Chief Global Economist.

@MacroAlf @WallStreetSilv The Euro has been falling considerably, now down to 2017 lows.

@MacroAlf @WallStreetSilv The Euro has been falling considerably, now down to 2017 lows.

What is a Stablecoin?

What is a Stablecoin?

@7Innovator @saxena_puru Puru Saxena is an investor in the high-growth technology space.

@7Innovator @saxena_puru Puru Saxena is an investor in the high-growth technology space.https://twitter.com/saxena_puru/status/1520149632009248768?s=20&t=_KemEEQRyZRkQWFjuT1vIQ

🏢💲 What is the Federal Reserve?

🏢💲 What is the Federal Reserve?

You can view Powell's discussion live through this link:

You can view Powell's discussion live through this link:

Worst Take of the Week

Worst Take of the Week

📚 Topics Covered:

📚 Topics Covered: