How to get URL link on X (Twitter) App

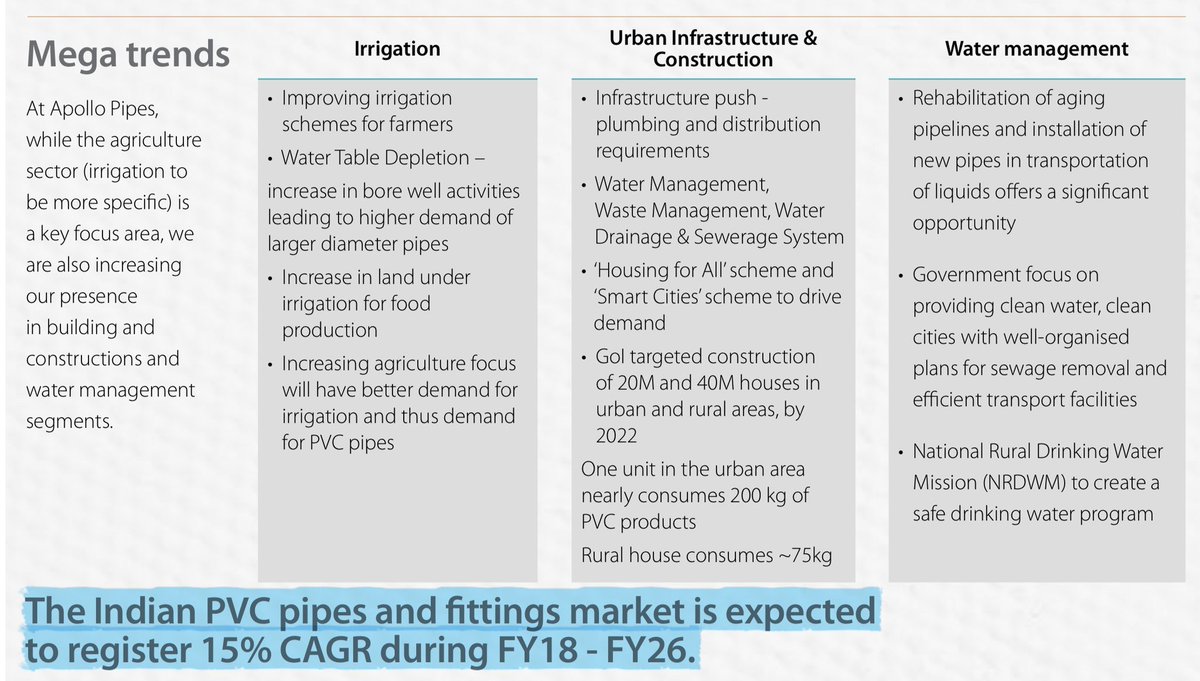

Major Growth Drivers-

Major Growth Drivers-

Huge opportunity Size for Action Construction Equipments...👌👍

Huge opportunity Size for Action Construction Equipments...👌👍

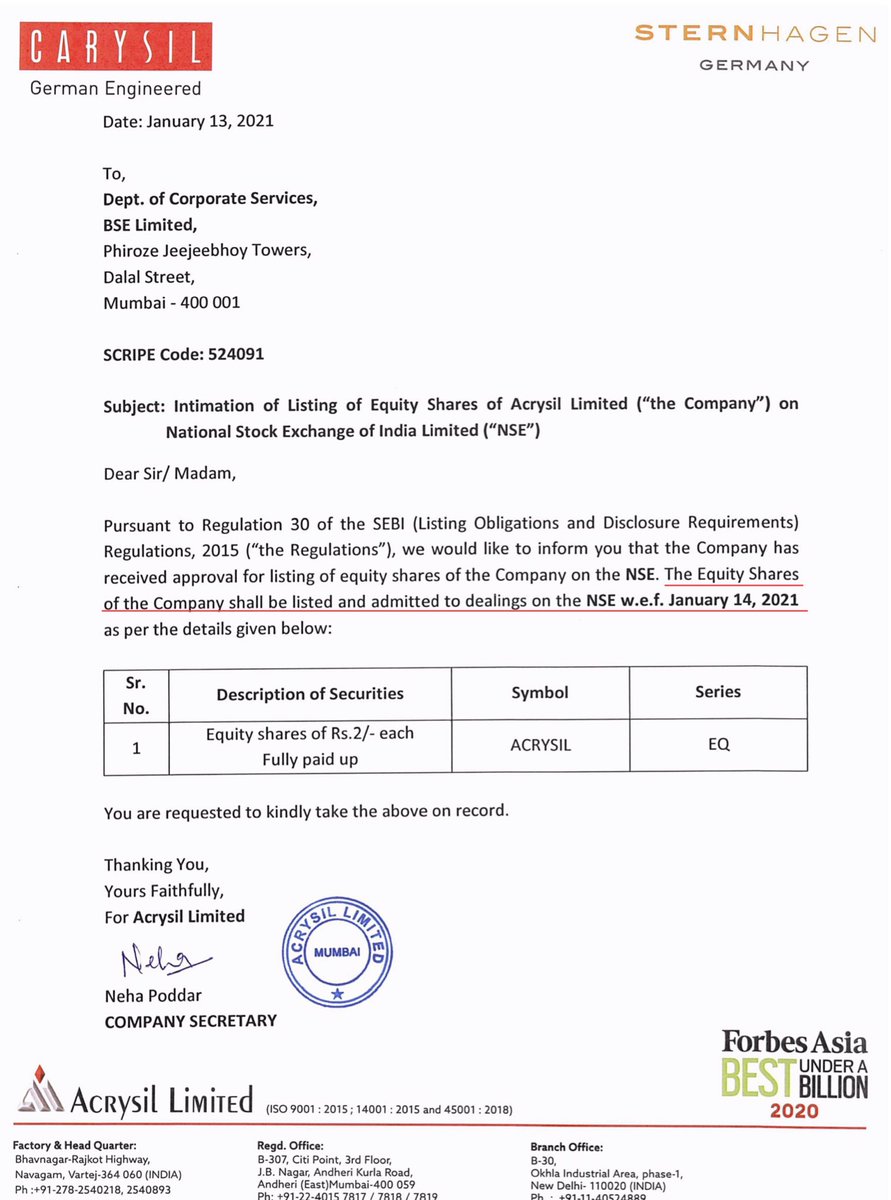

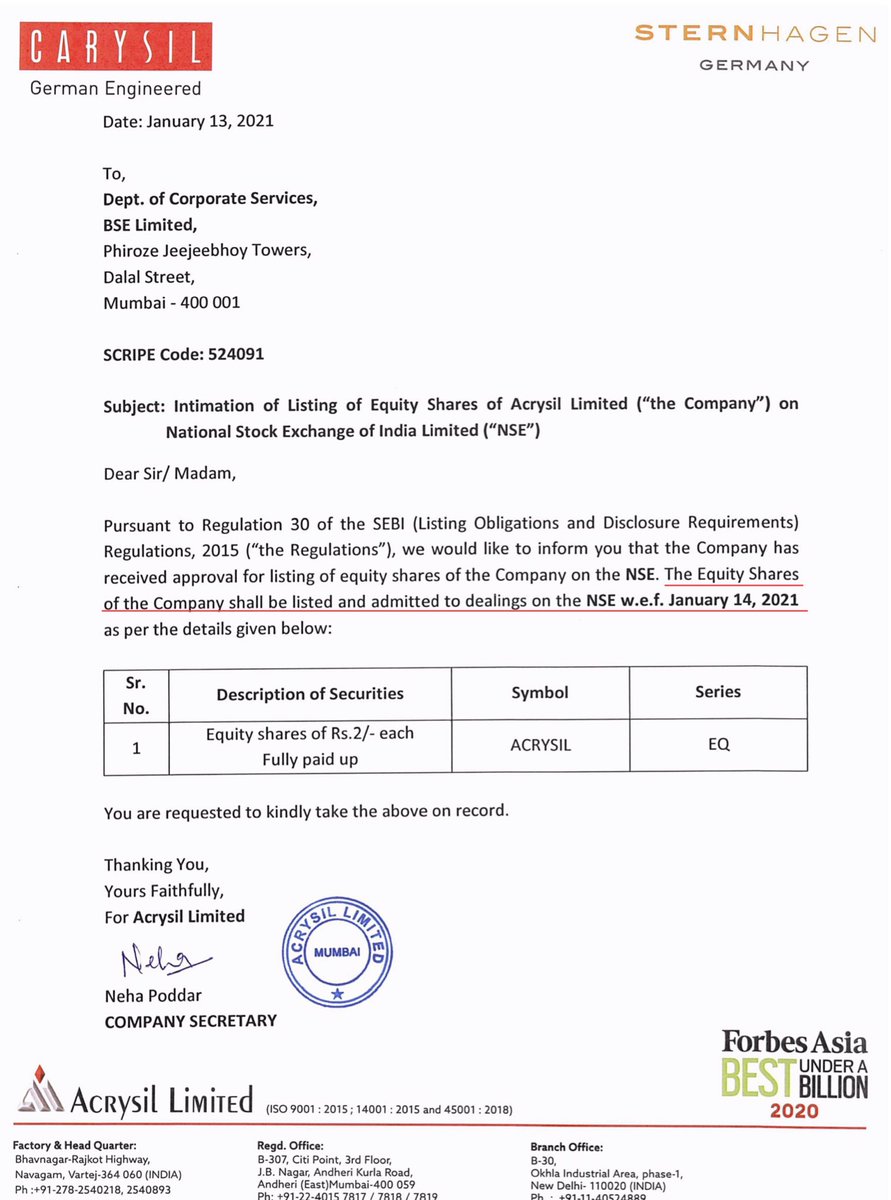

https://twitter.com/krishchess/status/1333064541601554434#Acrysil Ltd to list on NSE..Big Positive 👍👌