Contrarian investor focused on the uranium 🐂 market. Write ups, interviews and more at ➡️ https://t.co/7pEBExCINq

Tweets not investment advice.

How to get URL link on X (Twitter) App

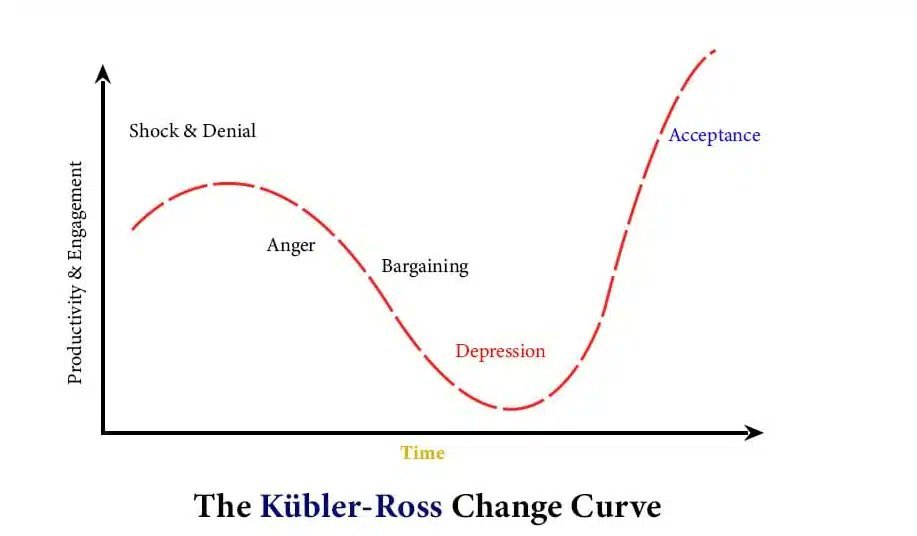

For me, one of the most consistent models to measure market sentiment has been the Kübler-Ross model of grief. I consistently analyze and track sentiment data for this sector and it can help identify important turns. Sentiment often follows the emotions displayed in this model.

For me, one of the most consistent models to measure market sentiment has been the Kübler-Ross model of grief. I consistently analyze and track sentiment data for this sector and it can help identify important turns. Sentiment often follows the emotions displayed in this model.

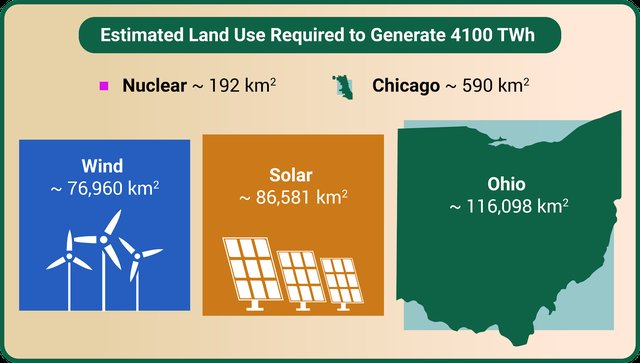

@ChrisCuomo 2: The land needed for the construction and running of a nuclear power plant makes for a far smaller footprint compared to solar and wind energy. Combine this with the fact that far less raw materials are needed to build a nuclear power plant compared to a solar or wind farm.

@ChrisCuomo 2: The land needed for the construction and running of a nuclear power plant makes for a far smaller footprint compared to solar and wind energy. Combine this with the fact that far less raw materials are needed to build a nuclear power plant compared to a solar or wind farm.