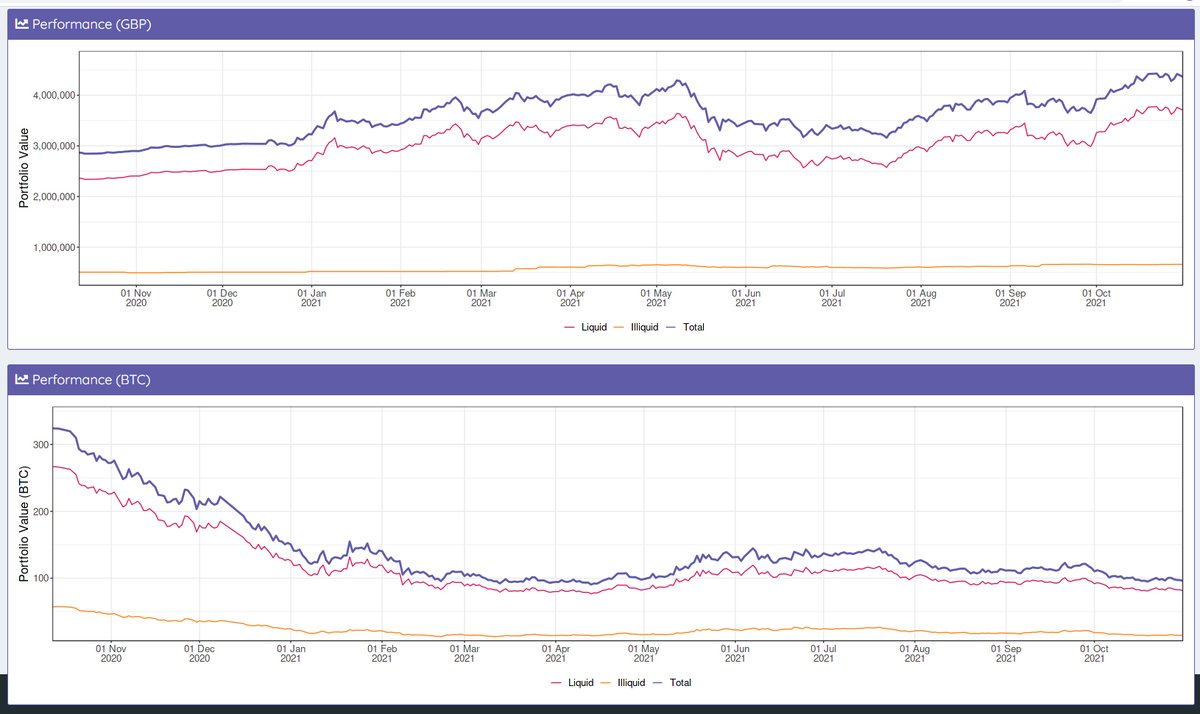

Boomer, Brit, pioneer City quant investor, in #btc since 0920, not trading but actively timing #hodl to maximise stack

How to get URL link on X (Twitter) App

https://twitter.com/basismarkets/status/1466191097865121792I am not making any representations or investment actions about this token. People must DYOR and I know this will be anathema to many maxis.