Shepherding illiquid assets by day, liquid assets by night. Personal views. 🇮🇳

9 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/gordonmax/status/1057726837625884674?s=21

https://twitter.com/gordonmax/status/10986514054416547841/ The initial thesis was based on a strong player emerging from a crisis. Both operators and tower cos had consolidated. Infratel had and still has the balance sheet to withstand a few challenging years

https://twitter.com/gordonmax/status/1057726826418716672?s=21

https://twitter.com/gordonmax/status/11645568963317964872/ If capital is required for provisions then the bank is already trading at a post-money valuation which means the real economic mcap is already lower by the amount required for provisions

https://twitter.com/gordonmax/status/11583910914035998722/ BM has renovation demand and ‘trading-up’ demand which takes away some of the cyclicality, has the ability to build distribution which if done right adds to the “moat” and lends itself to the optionality of being asset light

https://twitter.com/focusedcompound/status/11490317631105187841/ Many years ago when valuing a thermal power plant I decided to use a 2 stage DCF. Higher discount rate for the riskier construction period and lower discount rate for the more stable operating period. Imagine my surprise when the resultant value was obnoxiously high!

https://twitter.com/paraschopra/status/11256496471736606721/ Investors tend to think of investing as a formula (like physics) because its simpler to visualise: Good mgmt+good biz+industry tailwinds = good investment outcome. But business is like biology. There is evolution, mutation, reaction, reflexivity, etc which cannot be modeled

https://twitter.com/ProsaicView/status/11183731970182225942/ The economics of free markets don’t seem to apply to aviation. Given its visibility, employability and historical govt ownership, they keep getting bailed out. Plus some elements of a lifestyle biz keeps bringing new entrants.

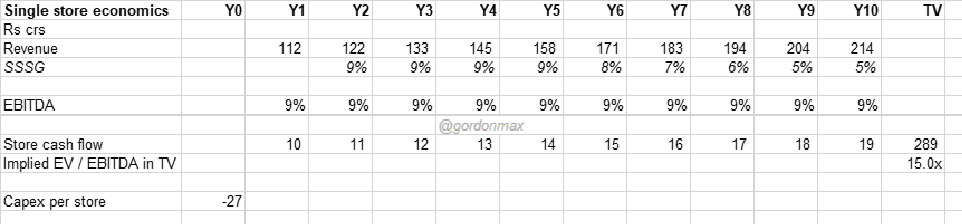

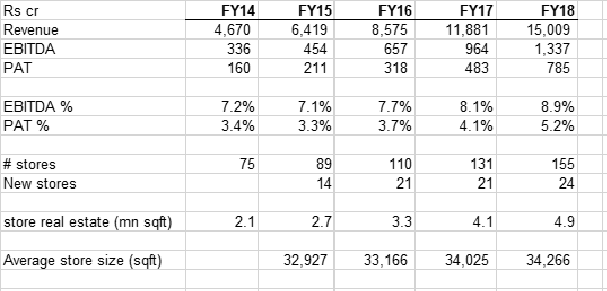

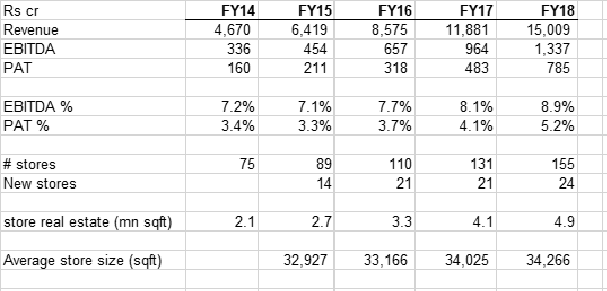

@prosperotree 2/ With the avg store data I attempted to value a single store. Revenue is avg store sqft x Avg rev/sqft from tweet (1) – gives a FCF stream. Obviously many assumptions made

@prosperotree 2/ With the avg store data I attempted to value a single store. Revenue is avg store sqft x Avg rev/sqft from tweet (1) – gives a FCF stream. Obviously many assumptions made