How to get URL link on X (Twitter) App

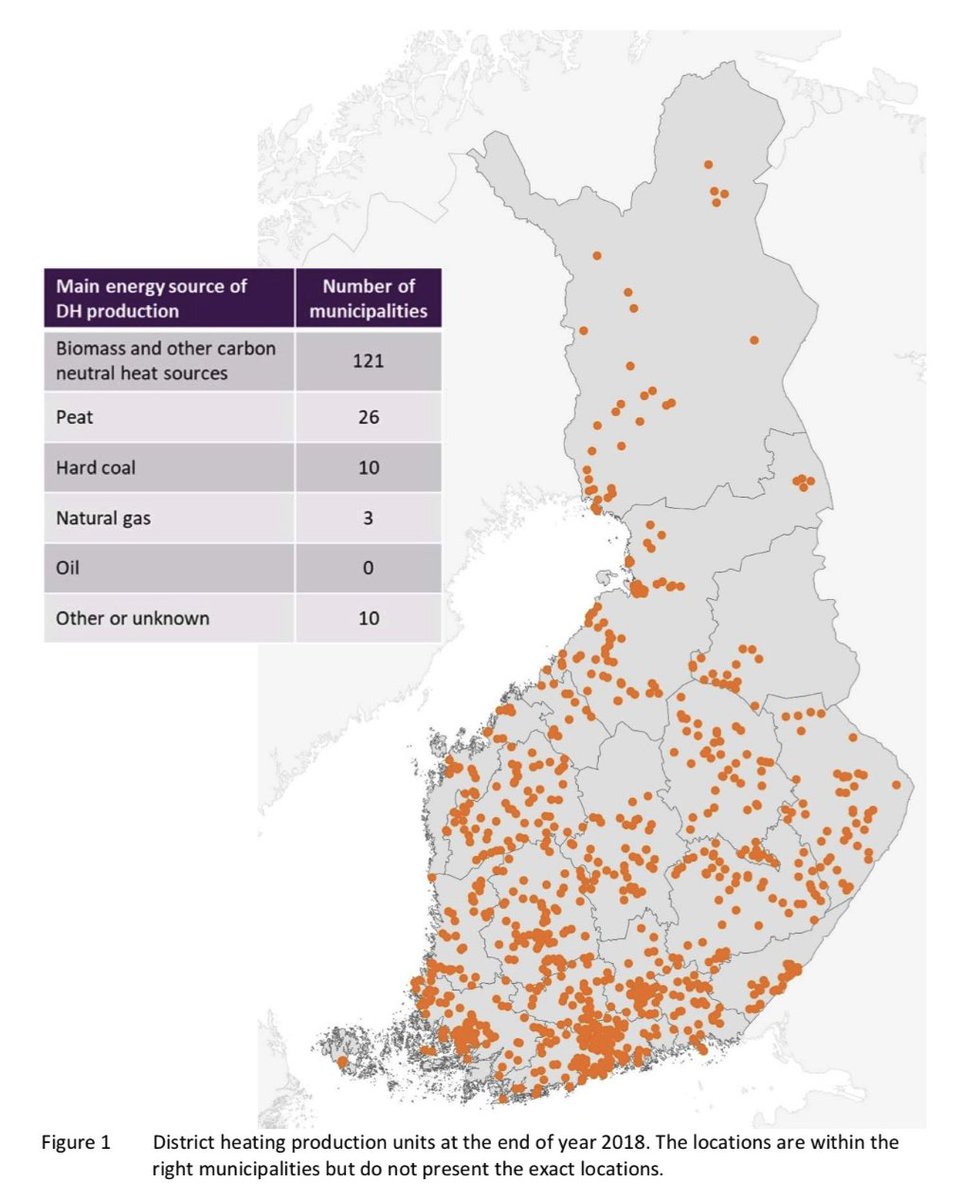

Finland is a cold country with a critical need for reliable heating solutions 🥶

Finland is a cold country with a critical need for reliable heating solutions 🥶

The UAE emerged on the global #bitcoin mining map in early 2023 when @MarathonDH announced a JV with Zero Two, the digital asset arm of Abu Dhabi's sovereign wealth fund.

The UAE emerged on the global #bitcoin mining map in early 2023 when @MarathonDH announced a JV with Zero Two, the digital asset arm of Abu Dhabi's sovereign wealth fund.

Iceland has a long history of bitcoin mining. Thanks to its cheap electricity and entrepreneurial locals, it was one of the first countries outside China to see industrial-scale bitcoin mining emerge.

Iceland has a long history of bitcoin mining. Thanks to its cheap electricity and entrepreneurial locals, it was one of the first countries outside China to see industrial-scale bitcoin mining emerge.

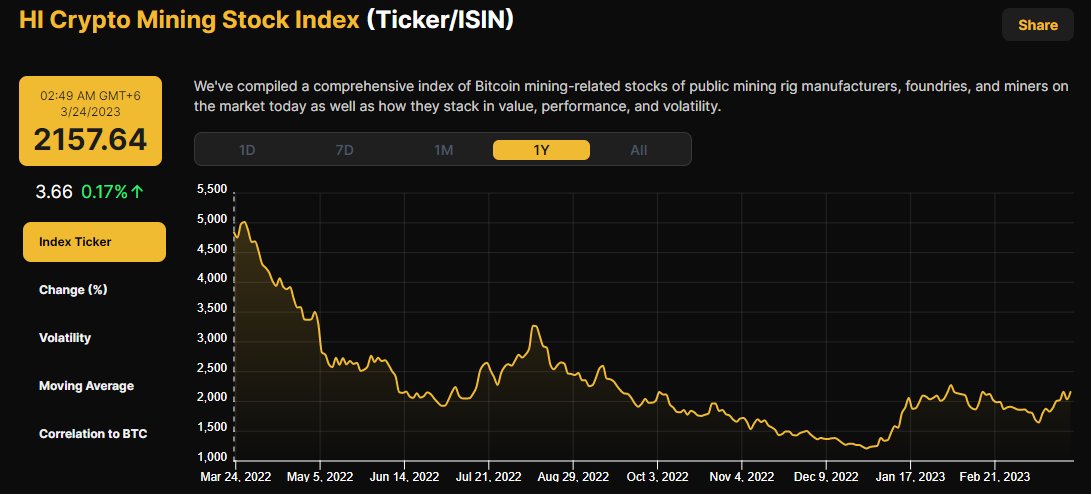

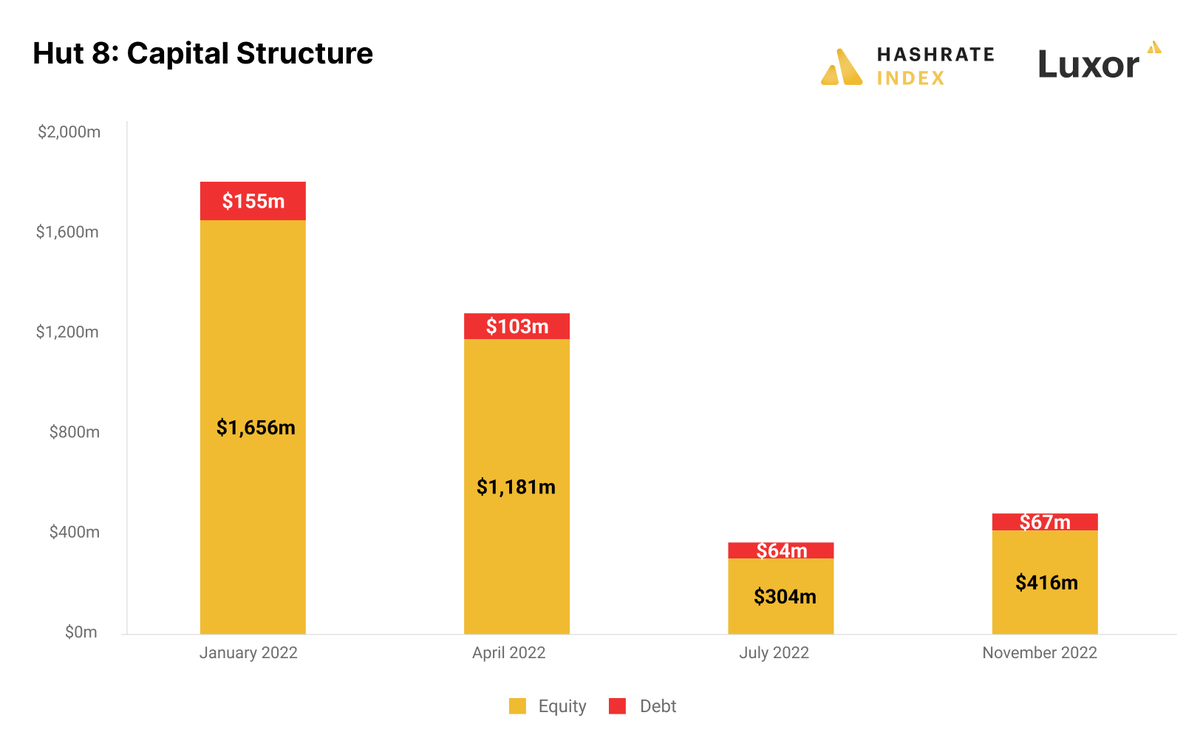

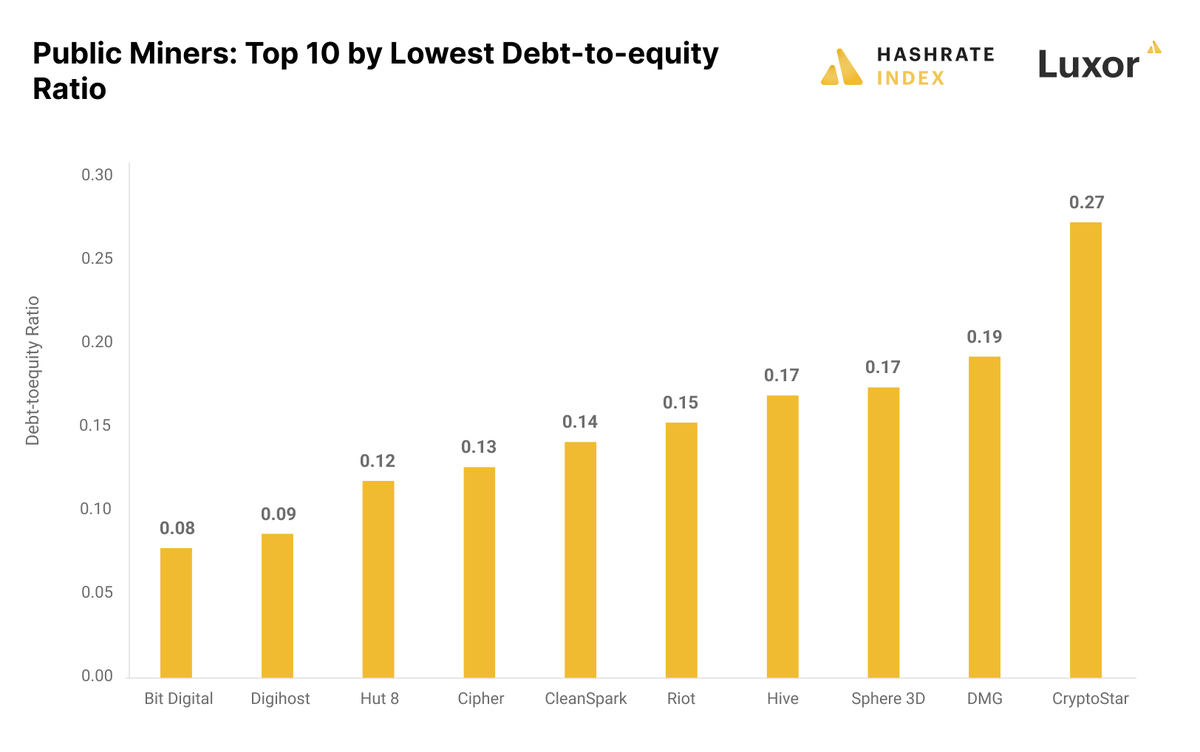

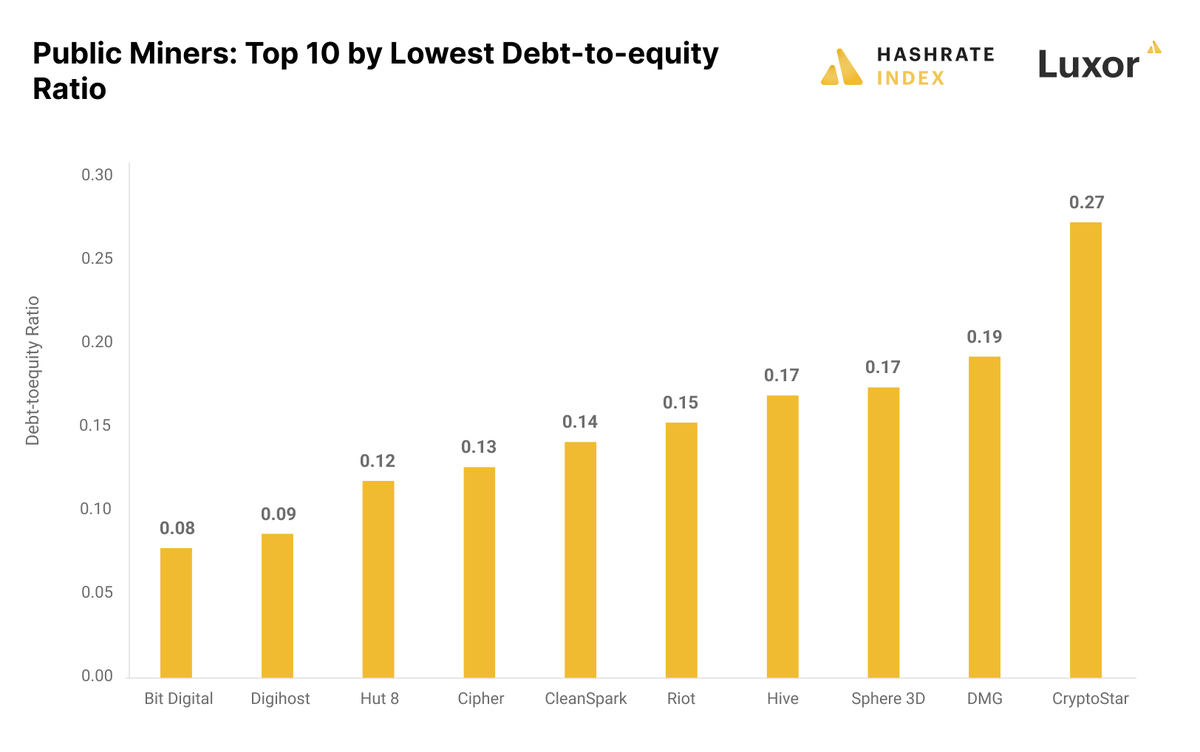

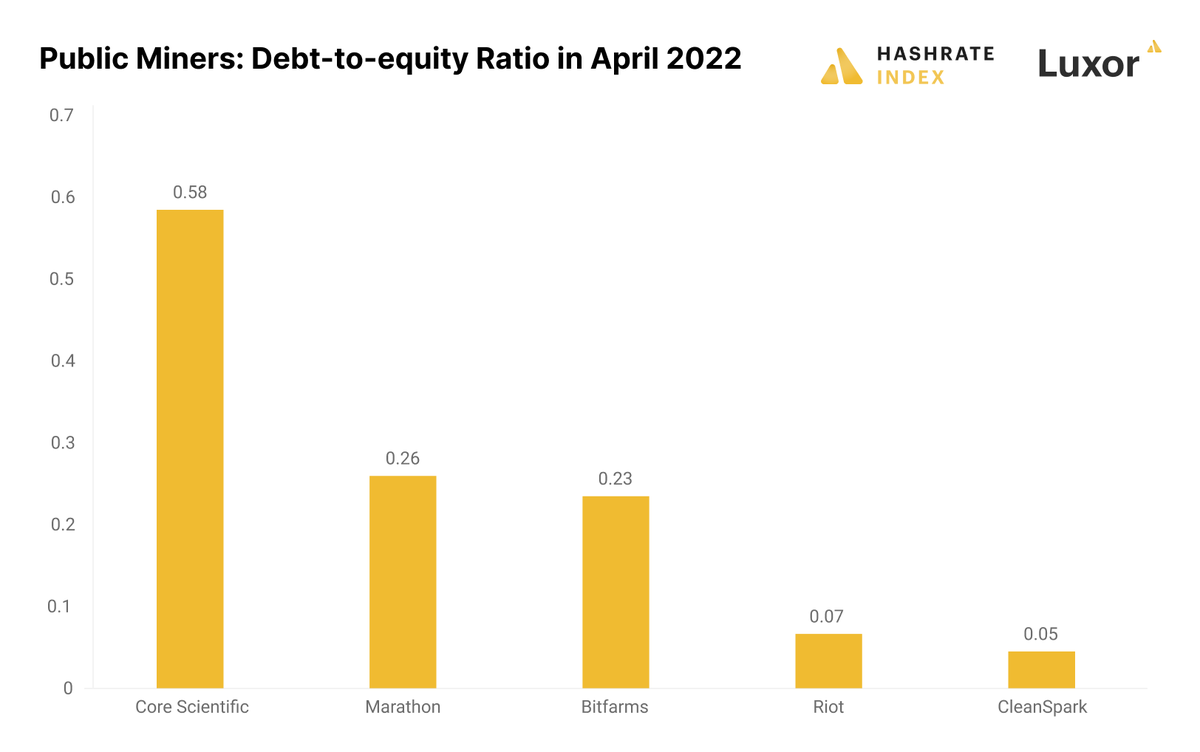

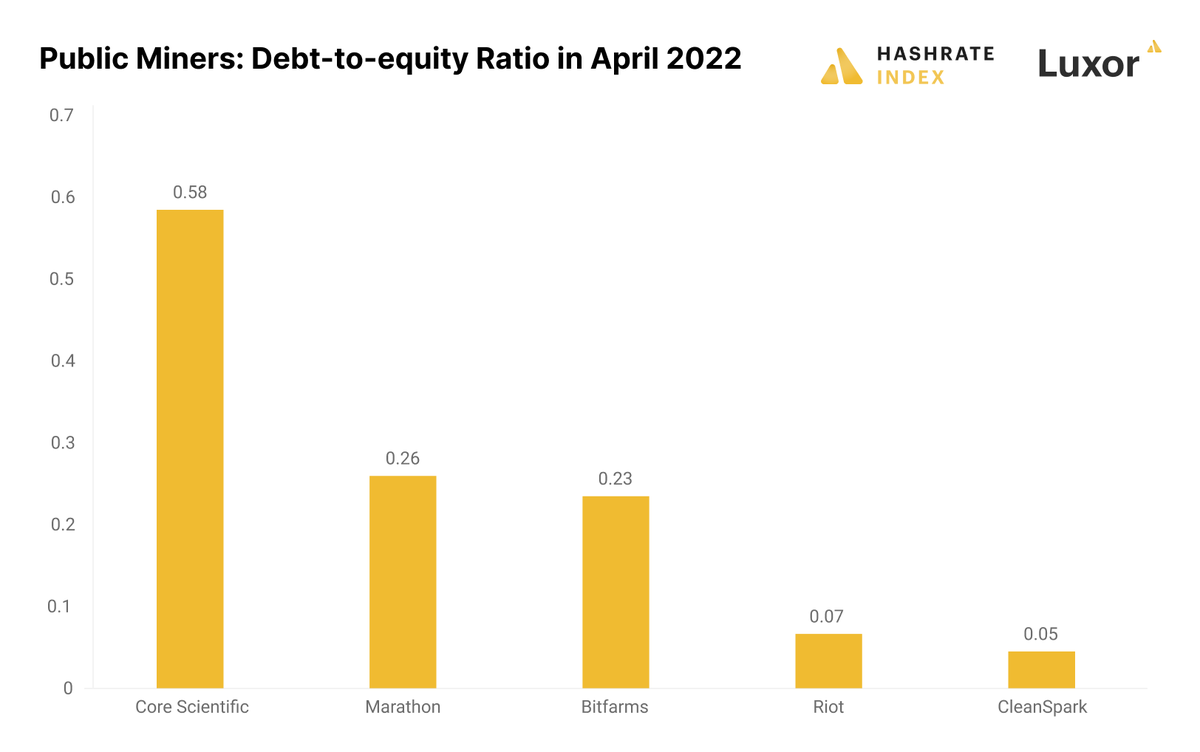

Nothing is more critical during a bear market than having a solid balance sheet. A common trait among all the struggling public #bitcoin miners is high debt loads, particularly machine-and-bitcoin collateralized debt.

Nothing is more critical during a bear market than having a solid balance sheet. A common trait among all the struggling public #bitcoin miners is high debt loads, particularly machine-and-bitcoin collateralized debt.

First of all, Bitfarms reduced its debt substantially in Q3, as well as minimizing costs.

First of all, Bitfarms reduced its debt substantially in Q3, as well as minimizing costs.

Nothing is more important in a bear market than having a healthy balance sheet.

Nothing is more important in a bear market than having a healthy balance sheet.

Bitcoin mining might be the most unfairly maligned industry on earth. It straddles two bold ideas which are deeply offensive to the Davos technocrats which govern western nations: the first, that a global sound money system is possible and desirable;

Bitcoin mining might be the most unfairly maligned industry on earth. It straddles two bold ideas which are deeply offensive to the Davos technocrats which govern western nations: the first, that a global sound money system is possible and desirable;

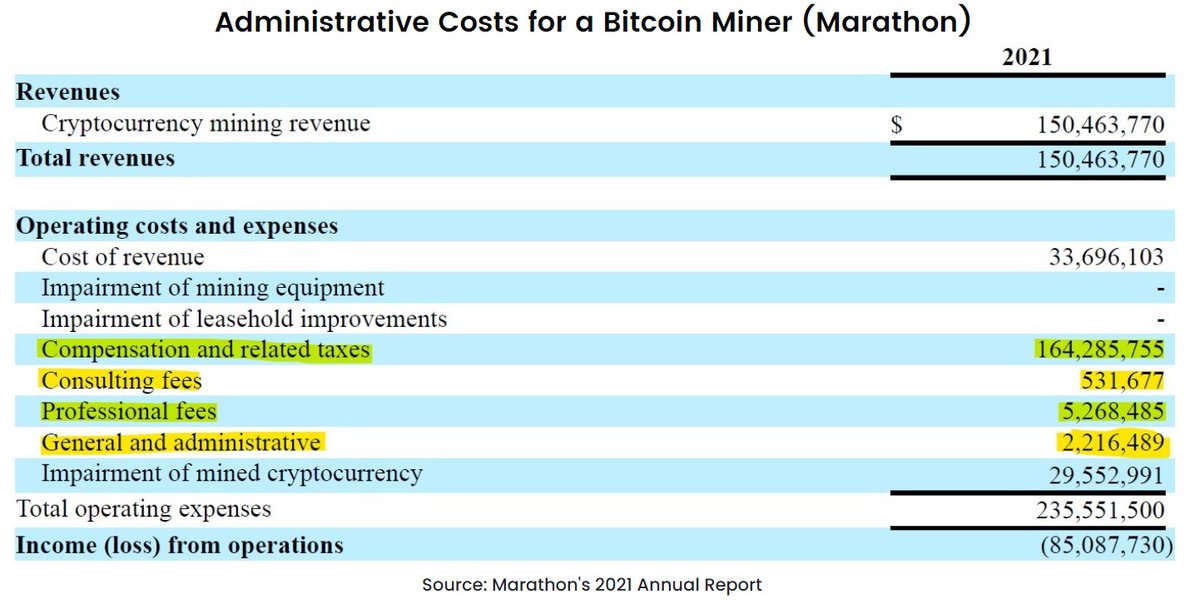

What I define as administrative costs are often referred to as “Selling, General, and Administrative Expenses (SG&A)” in financial statements. It describes the expenses incurred by a company not directly tied to generating revenue, like executive salary and stock compensation.

What I define as administrative costs are often referred to as “Selling, General, and Administrative Expenses (SG&A)” in financial statements. It describes the expenses incurred by a company not directly tied to generating revenue, like executive salary and stock compensation.

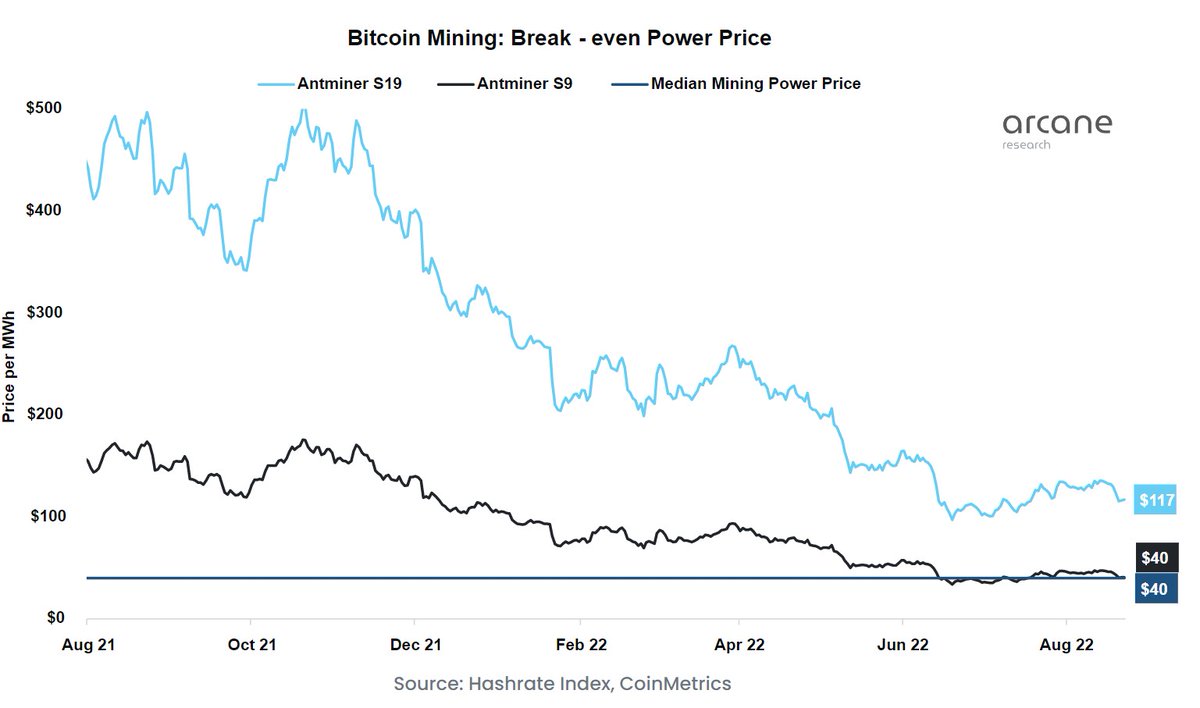

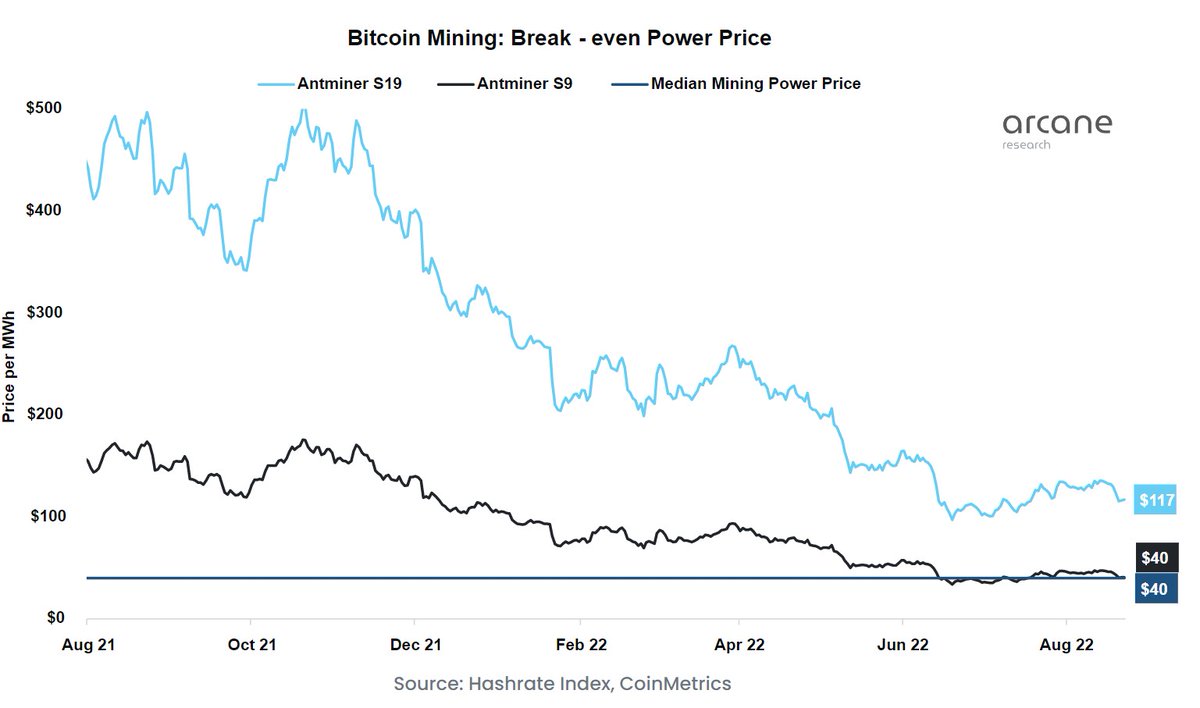

The most precise way of measuring bitcoin mining profitability is to look at miners' break-even power prices. The break-even power price is the revenue per MWh of energy fed into a bitcoin mining machine. It's shown in the chart above.

The most precise way of measuring bitcoin mining profitability is to look at miners' break-even power prices. The break-even power price is the revenue per MWh of energy fed into a bitcoin mining machine. It's shown in the chart above.

https://twitter.com/ArcaneResearch/status/14939625970241208332/ I estimate the Georgian crypto mining industry to draw 125 MW, of which 100 MW is dedicated to #bitcoin. This should give Georgia 0.71% of Bitcoin's hashrate.