How to get URL link on X (Twitter) App

Story:

Story:

This book is about a lot of topics - philosophy of hospitality, leadership, management, progress, mentoring and great experience at work.

This book is about a lot of topics - philosophy of hospitality, leadership, management, progress, mentoring and great experience at work.

Here are the top 5 performing coins during this period:

Here are the top 5 performing coins during this period:

We need to focus on ETH because the scale of the sell-off is insane. Compared to BTC, ETH dropped significantly harder, and I’d like to show you where this is visible on the charts.

We need to focus on ETH because the scale of the sell-off is insane. Compared to BTC, ETH dropped significantly harder, and I’d like to show you where this is visible on the charts.

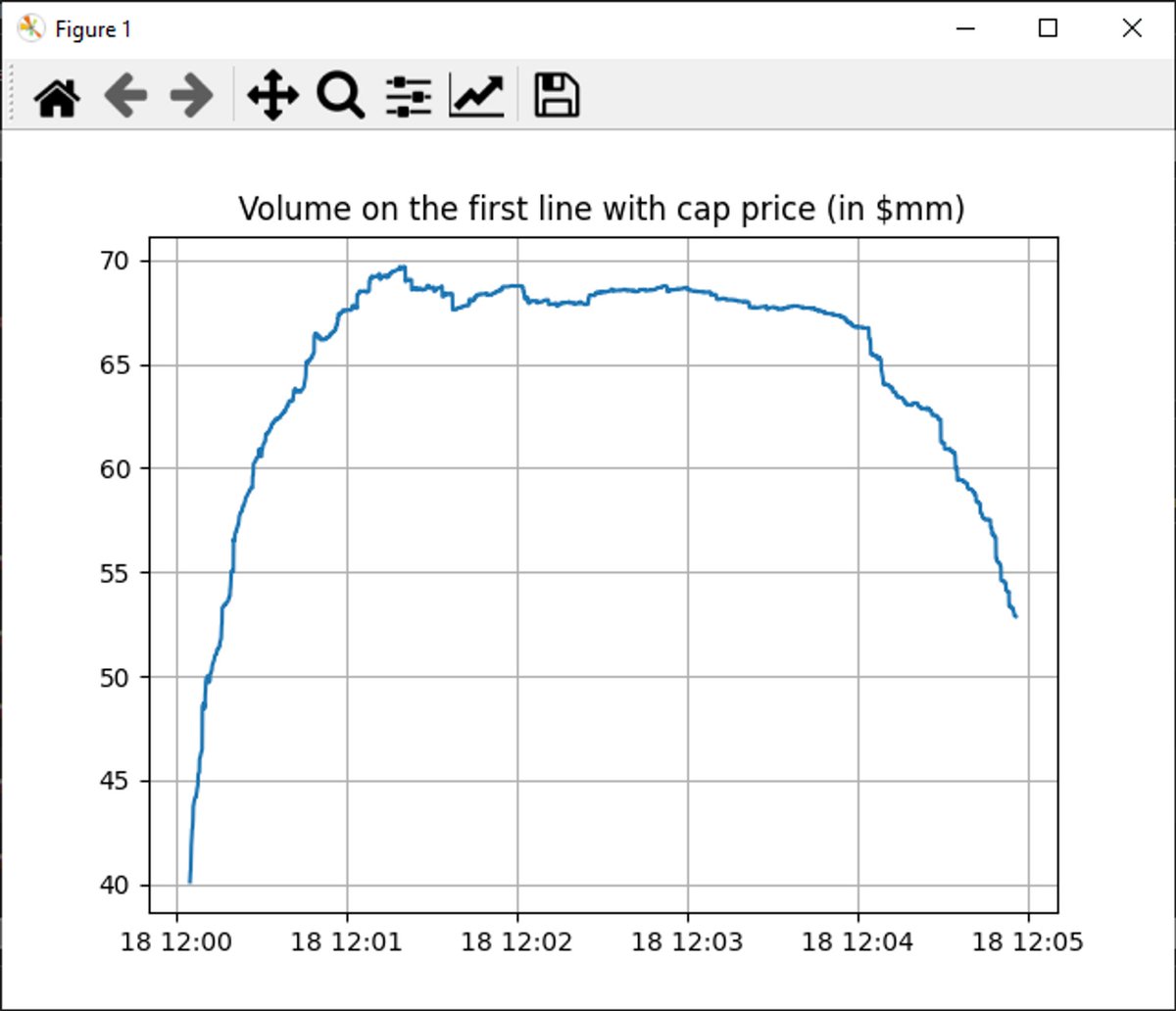

The first plot shows price action on centralized exchanges during the first 60 minutes post-listing. It’s crucial to analyze which exchange impacted the market most. Despite Binance being listed later than others, it had a big market impact and performed exceptionally well.

The first plot shows price action on centralized exchanges during the first 60 minutes post-listing. It’s crucial to analyze which exchange impacted the market most. Despite Binance being listed later than others, it had a big market impact and performed exceptionally well.

Firstly, when discussing this kind of dump, we need to determine where the pressure was greatest. We observed something crazy—Coinbase traders began selling aggressively almost an hour before the mega dump.

Firstly, when discussing this kind of dump, we need to determine where the pressure was greatest. We observed something crazy—Coinbase traders began selling aggressively almost an hour before the mega dump.

BTC on Upbit was priced under $65k, while we saw almost $95k on Binance— $30k difference between Korea and the rest of the world. That was absolutely crazy. We observed big sell pressure, with almost $7mm more in sell orders than buy orders. The next plot is the most important.

BTC on Upbit was priced under $65k, while we saw almost $95k on Binance— $30k difference between Korea and the rest of the world. That was absolutely crazy. We observed big sell pressure, with almost $7mm more in sell orders than buy orders. The next plot is the most important.

It can be seen that in time of bigger volatility BTC was reacting much faster that polymarket. The time difference is of course much, much bigger than block time.

It can be seen that in time of bigger volatility BTC was reacting much faster that polymarket. The time difference is of course much, much bigger than block time.

[2/43] I am going to split the topics into four parts: the book, SBF, FTX, and overall conclusions. All of the topics will be described with examples, quotes, and my own analysis and opinions.

[2/43] I am going to split the topics into four parts: the book, SBF, FTX, and overall conclusions. All of the topics will be described with examples, quotes, and my own analysis and opinions.

Firstly, let’s take a look at the macroscopic view of the market. On the histogram, we can see the changes from the highest price to the lowest price within the first couple of hours of June 10th (UTC). Big moves around the whole crypto space.

Firstly, let’s take a look at the macroscopic view of the market. On the histogram, we can see the changes from the highest price to the lowest price within the first couple of hours of June 10th (UTC). Big moves around the whole crypto space.

[2] I focus on CEX trading because there were more analyses related to the $PEPE and trading on DEXes, such as the great thread by @thiccythot_ which can bring you a lot of value in terms of understanding what happened on $PEPE. Highly recommended thread.

[2] I focus on CEX trading because there were more analyses related to the $PEPE and trading on DEXes, such as the great thread by @thiccythot_ which can bring you a lot of value in terms of understanding what happened on $PEPE. Highly recommended thread.https://twitter.com/thiccythot_/status/1654775743577038848

What do I mean by fake trade? It is a trade that you, as an other player in the market, cannot participate in, because it is an exchange's trade with itself. If you are not able to participate with this trade, it should not be included in the overall turnover.

What do I mean by fake trade? It is a trade that you, as an other player in the market, cannot participate in, because it is an exchange's trade with itself. If you are not able to participate with this trade, it should not be included in the overall turnover.