Seahawks & Bears. Red Wine preferred. Fundamentals but trade bio's. Golf when I can find the ball. Focus on IoT/Cloud/new technologies investing

How to get URL link on X (Twitter) App

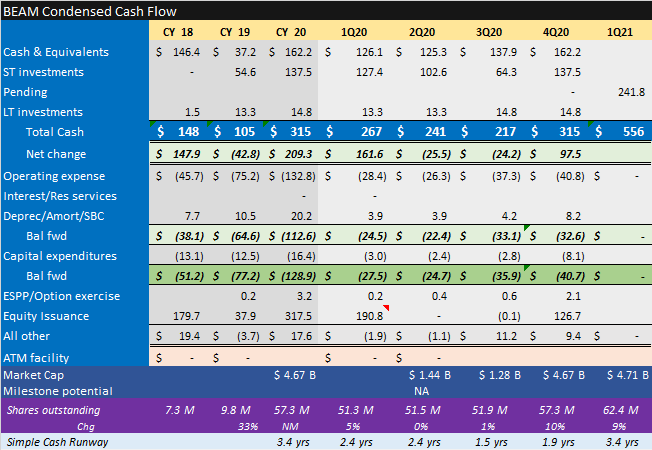

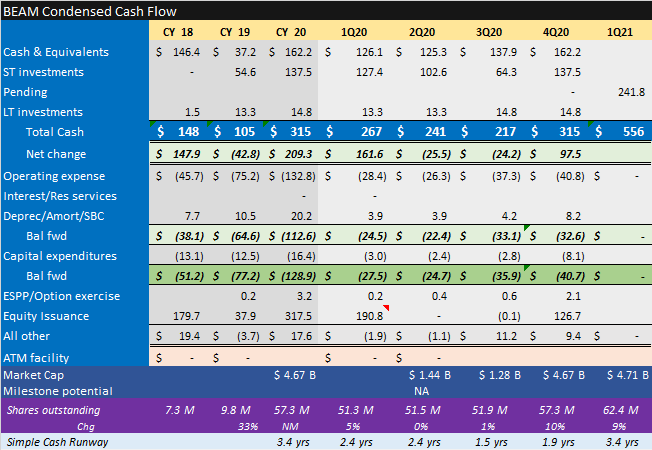

$BEAM focus on platform, delivery and manufacturing is enabled by share price and ability to source funds without huge dilution

$BEAM focus on platform, delivery and manufacturing is enabled by share price and ability to source funds without huge dilution

Cowen states that though the prelim data on $SNY collab was unimpressive, they are cautiously optimistic. My fcst was pushed out several years consistent with $BLUE issues and probability that more issues will crop up for $CRSP and $SGMO programs.

Cowen states that though the prelim data on $SNY collab was unimpressive, they are cautiously optimistic. My fcst was pushed out several years consistent with $BLUE issues and probability that more issues will crop up for $CRSP and $SGMO programs.

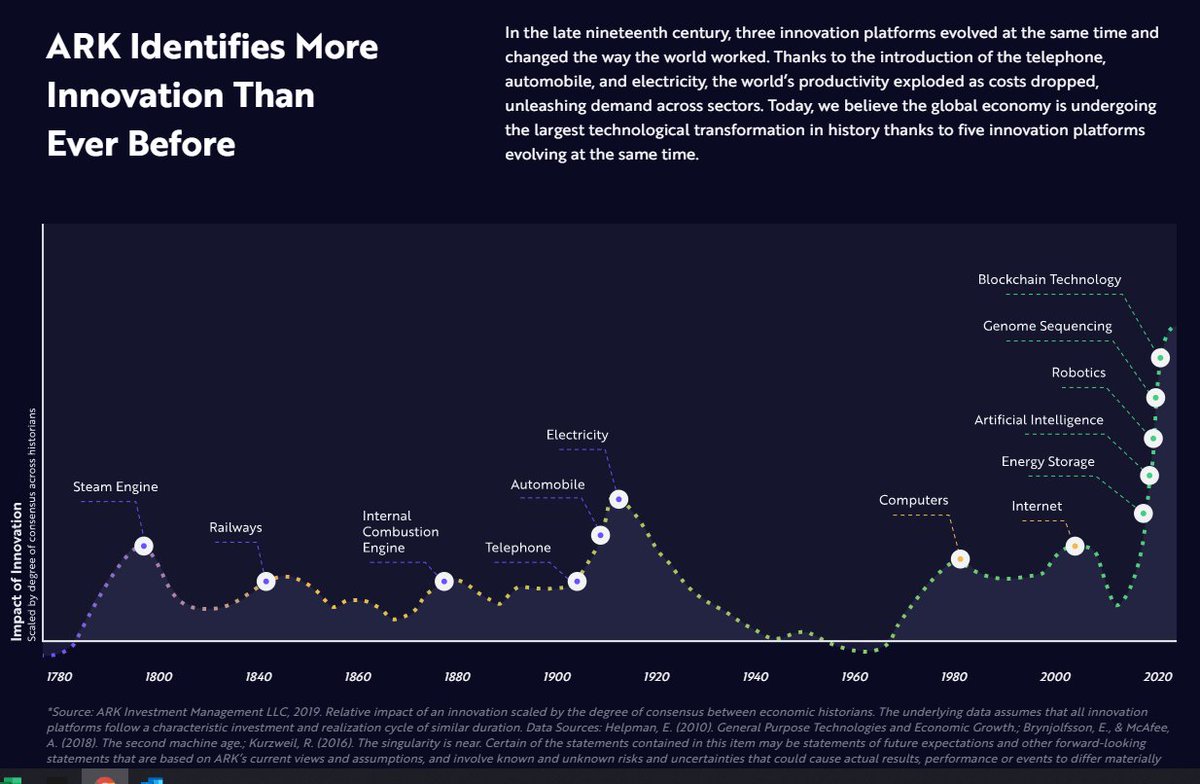

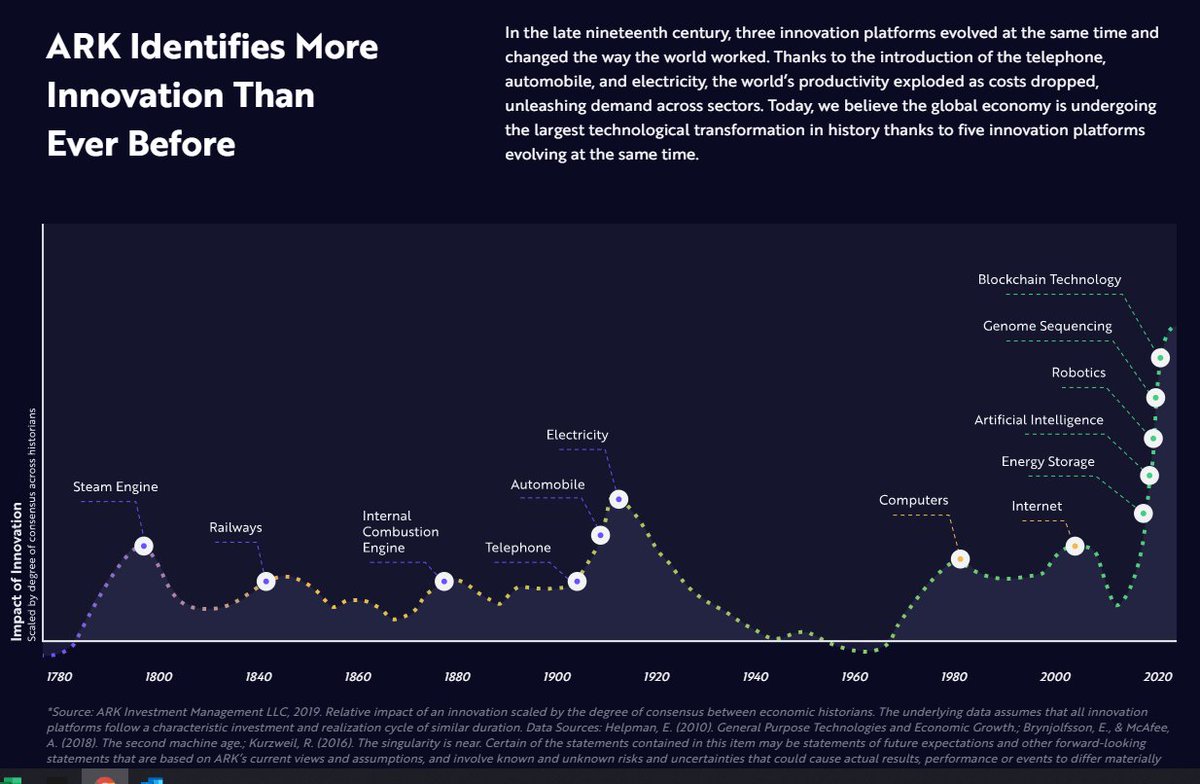

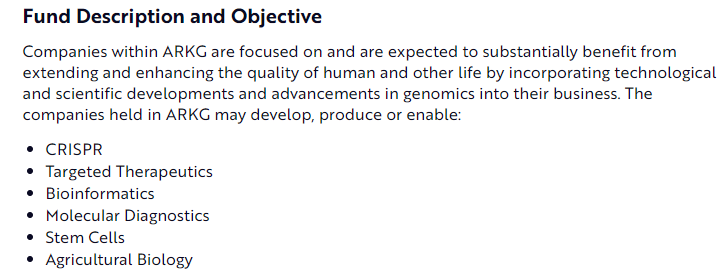

The $ARKG fund description is a good place to start. This has changed recently to a #CRISPR theme but started more with the sequencing cost declines which would drive diagnostics adoption and precision medicine

The $ARKG fund description is a good place to start. This has changed recently to a #CRISPR theme but started more with the sequencing cost declines which would drive diagnostics adoption and precision medicine

This being a 10 year chart, it doesn't show how long $SGMO has been around but it does show virtually no trading volume and a 3 yr ceiling on the price as they were in early development stage while trying to get ill-chosen indications into pre/clinic 2/

This being a 10 year chart, it doesn't show how long $SGMO has been around but it does show virtually no trading volume and a 3 yr ceiling on the price as they were in early development stage while trying to get ill-chosen indications into pre/clinic 2/