Travelling observer of the funny business of Life (and the many ways humans try to cope with it).

How to get URL link on X (Twitter) App

But the most notable finding has been the resurgence of China as a major mining hub which – despite the government ban in June 2021 – is reported to host 21.11% of the world's total hashrate.

But the most notable finding has been the resurgence of China as a major mining hub which – despite the government ban in June 2021 – is reported to host 21.11% of the world's total hashrate.https://twitter.com/dystopiabreaker/status/1526053459367145472This seems to be a natural law:

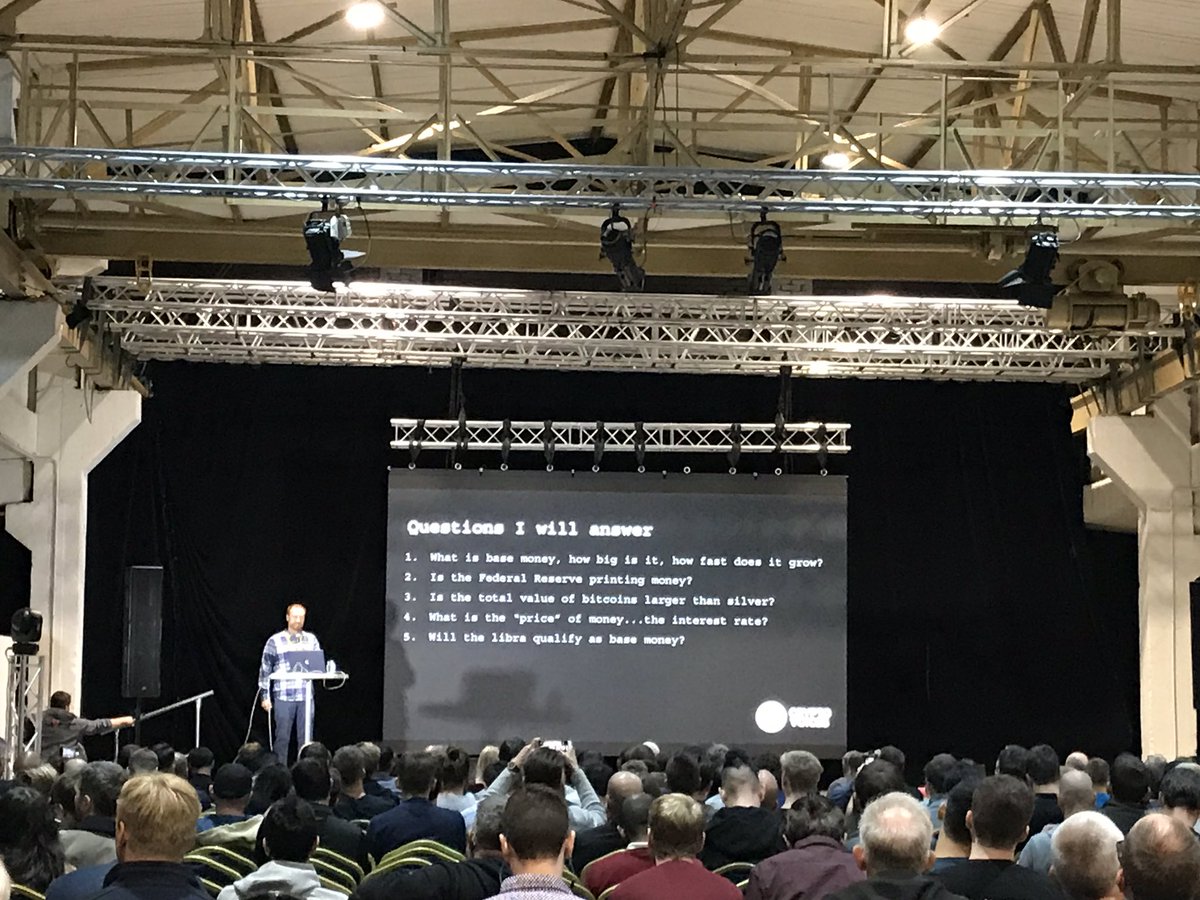

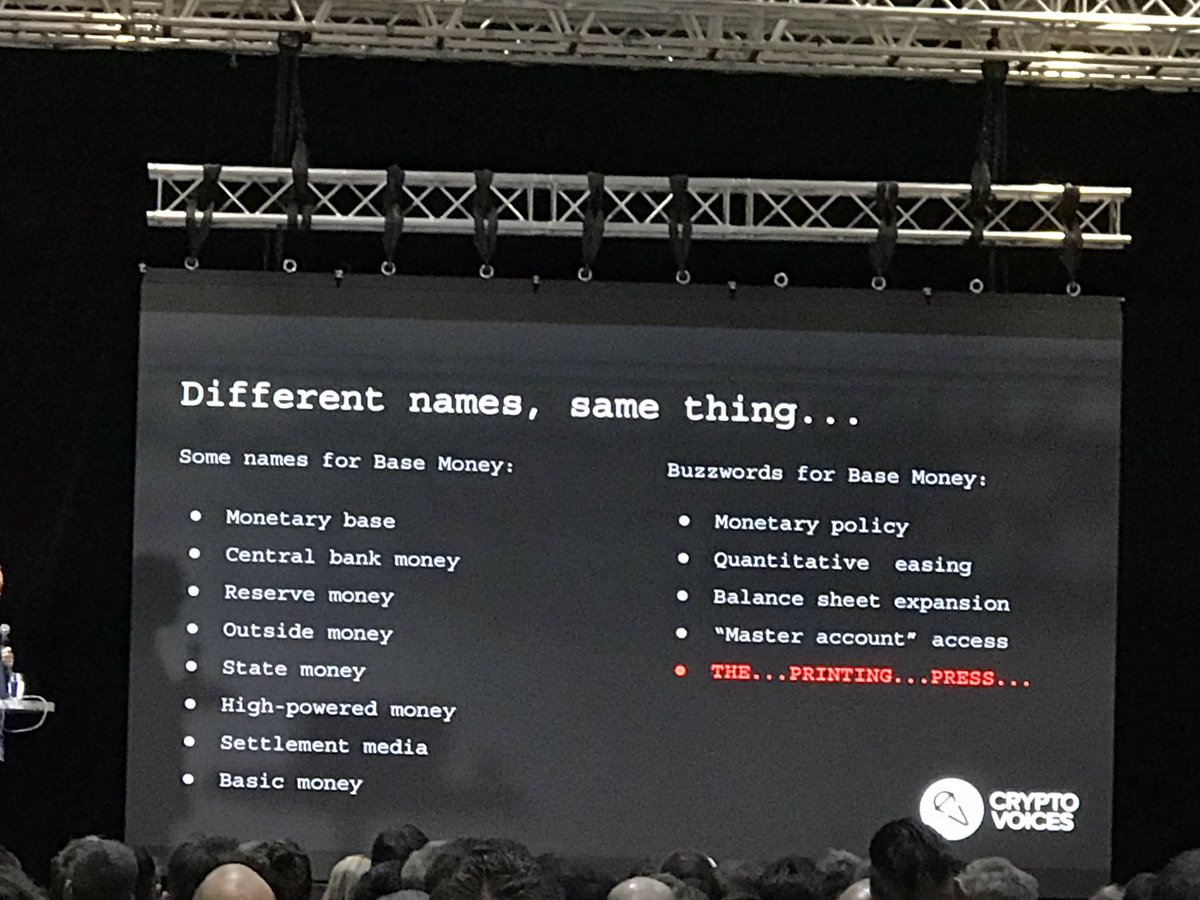

First, some terminology: there are many names + buzzwords for base money, but they all mean the same: the monetary base.

First, some terminology: there are many names + buzzwords for base money, but they all mean the same: the monetary base.

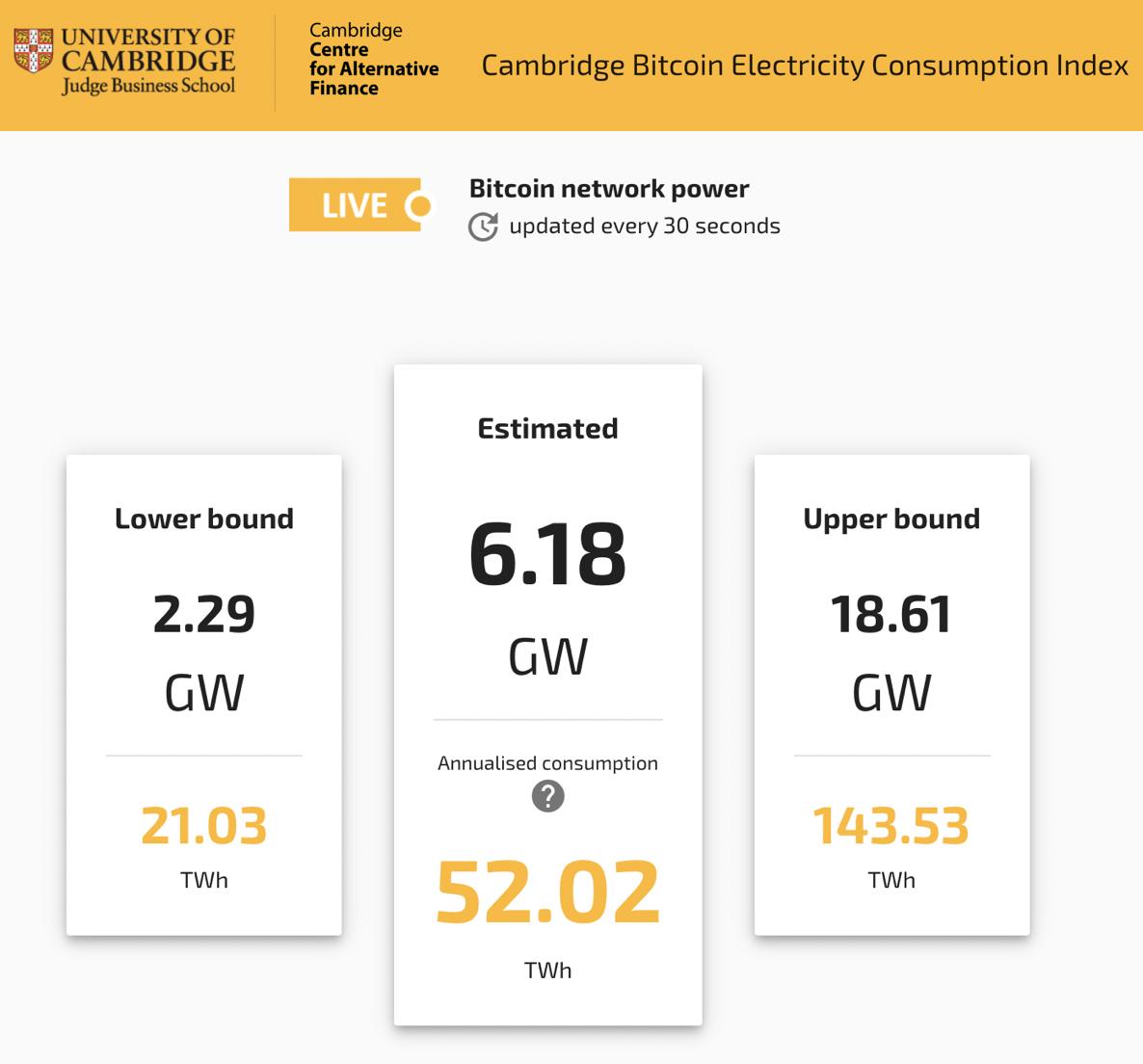

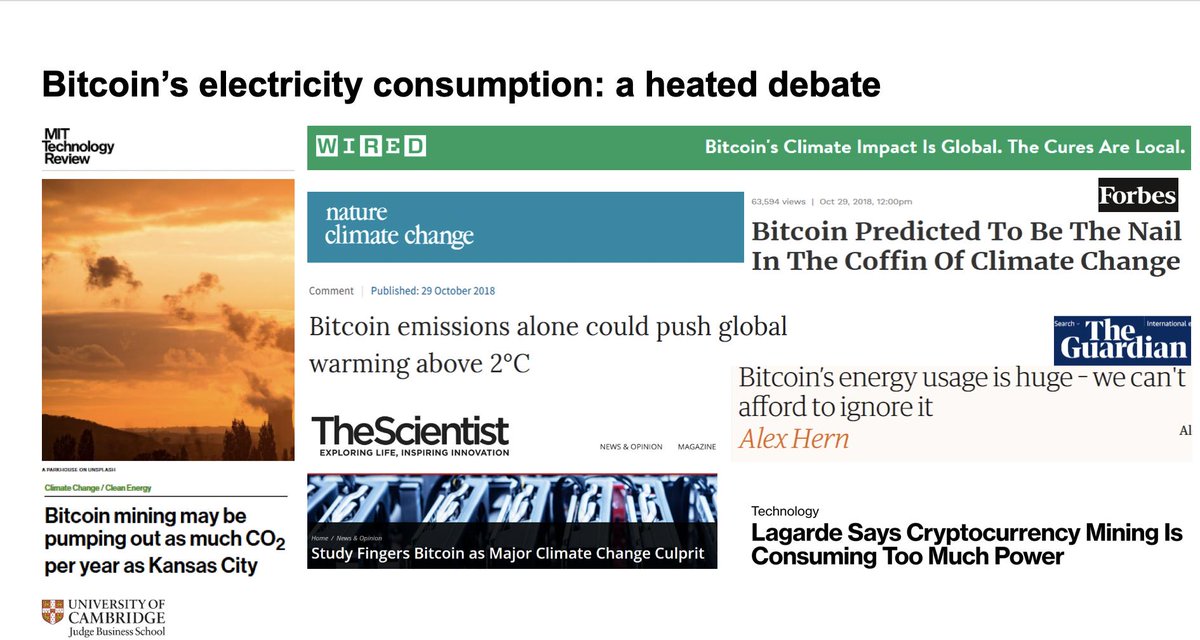

2) The CBECI is a pilot project created and maintained by the @CambridgeAltFin in response to growing concerns over the sustainability and environmental impact of Bitcoin mining.

2) The CBECI is a pilot project created and maintained by the @CambridgeAltFin in response to growing concerns over the sustainability and environmental impact of Bitcoin mining.

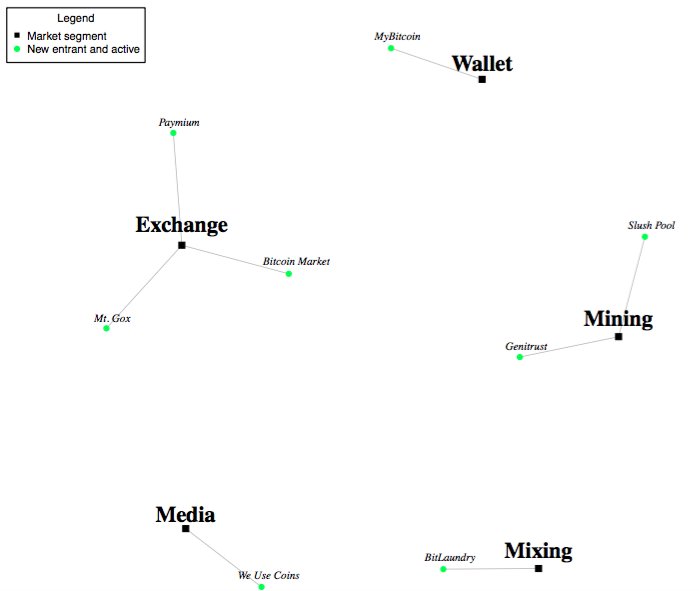

https://twitter.com/mrauchs/status/10761538950832332822/ Today we'll have a look at ... users (see Section 2)!