Founder & CEO @besuper_ai - faster better AI adoption

Host @AIDailyBrief // Venture Partner @learncap

26 subscribers

How to get URL link on X (Twitter) App

2/ First the categories:

2/ First the categories:

𝟮/ 𝗧𝗵𝗲 𝗙𝘂𝘁𝘂𝗿𝗲 𝗶𝘀 𝗠𝘂𝗹𝘁𝗶𝗺𝗼𝗱𝗮𝗹 𝗕𝗮𝗯𝘆

𝟮/ 𝗧𝗵𝗲 𝗙𝘂𝘁𝘂𝗿𝗲 𝗶𝘀 𝗠𝘂𝗹𝘁𝗶𝗺𝗼𝗱𝗮𝗹 𝗕𝗮𝗯𝘆 https://twitter.com/ylecun/status/1656073592759623691

2/ 𝗣𝗿𝗼𝗱𝘂𝗰𝘁 𝗟𝗮𝘂𝗻𝗰𝗵𝗲𝘀 & 𝗨𝗽𝗱𝗮𝘁𝗲𝘀:

2/ 𝗣𝗿𝗼𝗱𝘂𝗰𝘁 𝗟𝗮𝘂𝗻𝗰𝗵𝗲𝘀 & 𝗨𝗽𝗱𝗮𝘁𝗲𝘀:https://twitter.com/inflectionAI/status/1653475948036259840

1. Data Analysis + Visualization - San Francisco Crime

1. Data Analysis + Visualization - San Francisco Crimehttps://twitter.com/backus/status/1652433895793516544

2/ The images above share the same prompt: "a film camera photo of a 1960s southern california beachside burger restaurant, hazy afternoon, sign that says "burger"

2/ The images above share the same prompt: "a film camera photo of a 1960s southern california beachside burger restaurant, hazy afternoon, sign that says "burger"

https://twitter.com/nonmayorpete/status/1648548301292072962?s=46&t=5Nl1EhwpFOmRdaVNr7DApg

https://twitter.com/ArtByJah/status/1646332233387503621

If you want to learn more about MiniGPT-4, here are a few resources.

If you want to learn more about MiniGPT-4, here are a few resources. https://twitter.com/garvinchen2/status/1647770046171844609

https://twitter.com/tikgiau/status/1647767975804452864

2/x

2/x https://twitter.com/NathanLands/status/1647864974323204096

2/x 𝗚𝗲𝗻𝗲𝗿𝗮𝗹 𝗡𝗲𝘄𝘀

2/x 𝗚𝗲𝗻𝗲𝗿𝗮𝗹 𝗡𝗲𝘄𝘀

2/x So what are we talking about?

2/x So what are we talking about?https://twitter.com/SigGravitas/status/1646117442031349761

2/x I've always said that @BreakdownNLW is about "big picture power shifts."

2/x I've always said that @BreakdownNLW is about "big picture power shifts."

https://twitter.com/tier10k/status/1615782198459646009

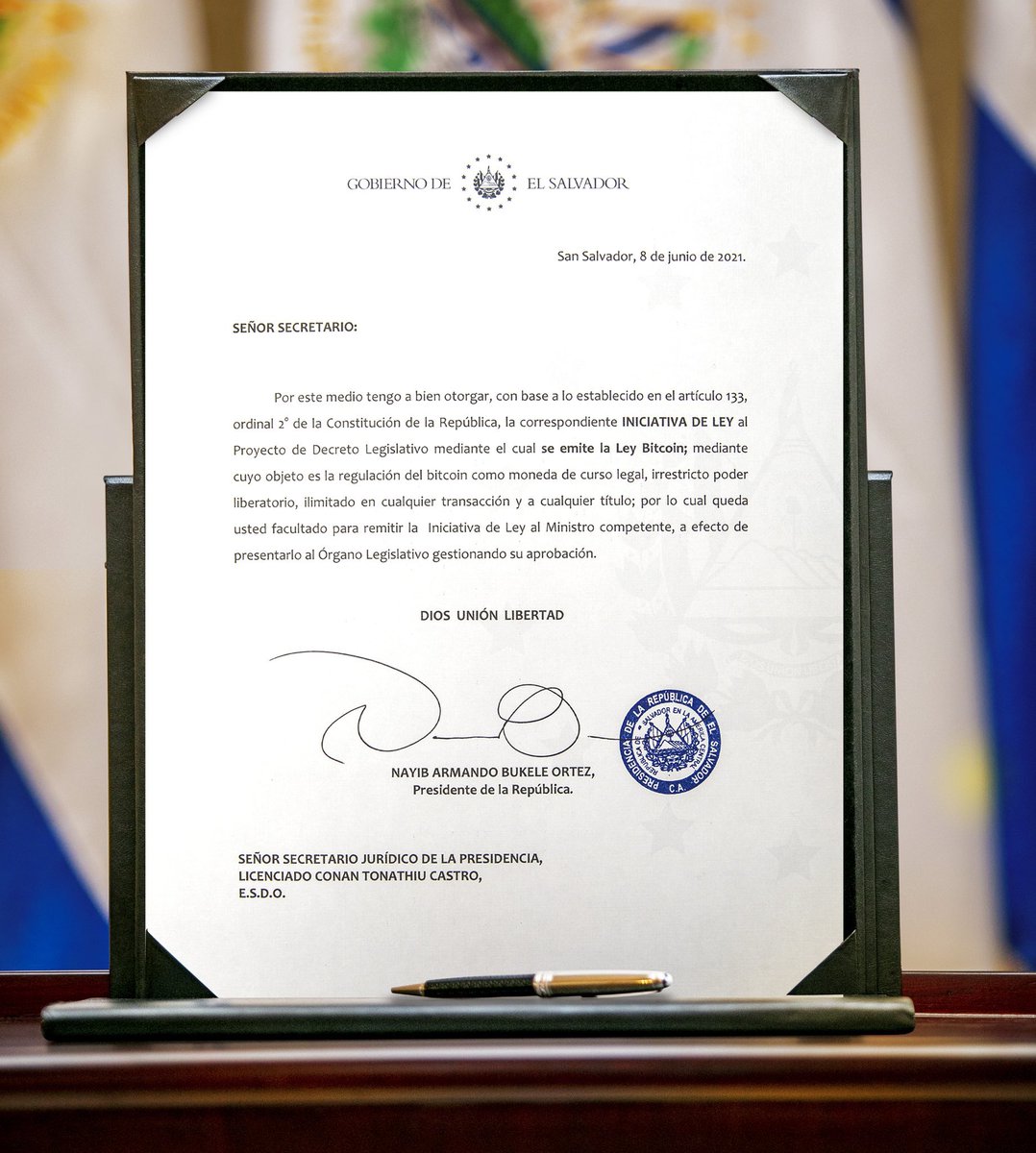

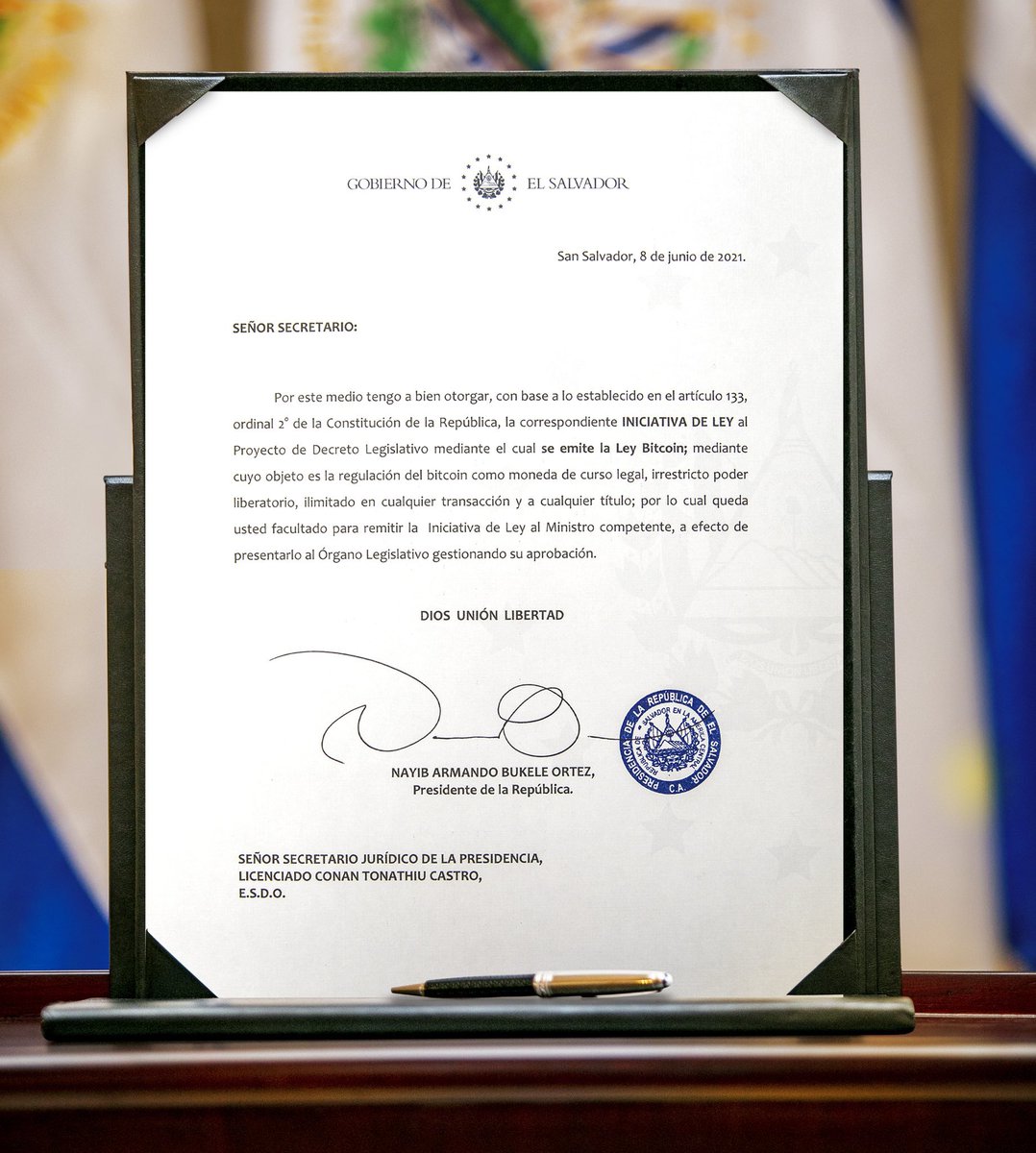

Bitcoin markets seem driven by big, structural narratives that create raison d’etre for new entrants to participate.

Bitcoin markets seem driven by big, structural narratives that create raison d’etre for new entrants to participate. https://twitter.com/nayibbukele/status/1401391067350581248

https://twitter.com/hansthered/status/1231268307614883840