Minister of Finance and Corporate Affairs. MP (RS) representing Karnataka, views personal, RTs no endorsement.

5 subscribers

How to get URL link on X (Twitter) App

Heart-breaking scenes in several parts of TN. People are threatened for organising #bhajans, feeding the poor, celebrating with sweets even as we wish to watch Hon. PM @narendramodi participate in #Ayodhya. Cable TV operators are told that there is a likely power-shut down during the live telecast. This is I.N.D.I Alliance partner DMK’s anti-Hindu efforts.

Heart-breaking scenes in several parts of TN. People are threatened for organising #bhajans, feeding the poor, celebrating with sweets even as we wish to watch Hon. PM @narendramodi participate in #Ayodhya. Cable TV operators are told that there is a likely power-shut down during the live telecast. This is I.N.D.I Alliance partner DMK’s anti-Hindu efforts.

https://twitter.com/narendramodi/status/14700003668259184662. “ஶ்ரீ காசி விஸ்வநாத் தாம்” திட்டத்தை துவக்கிவைக்கிறார்.

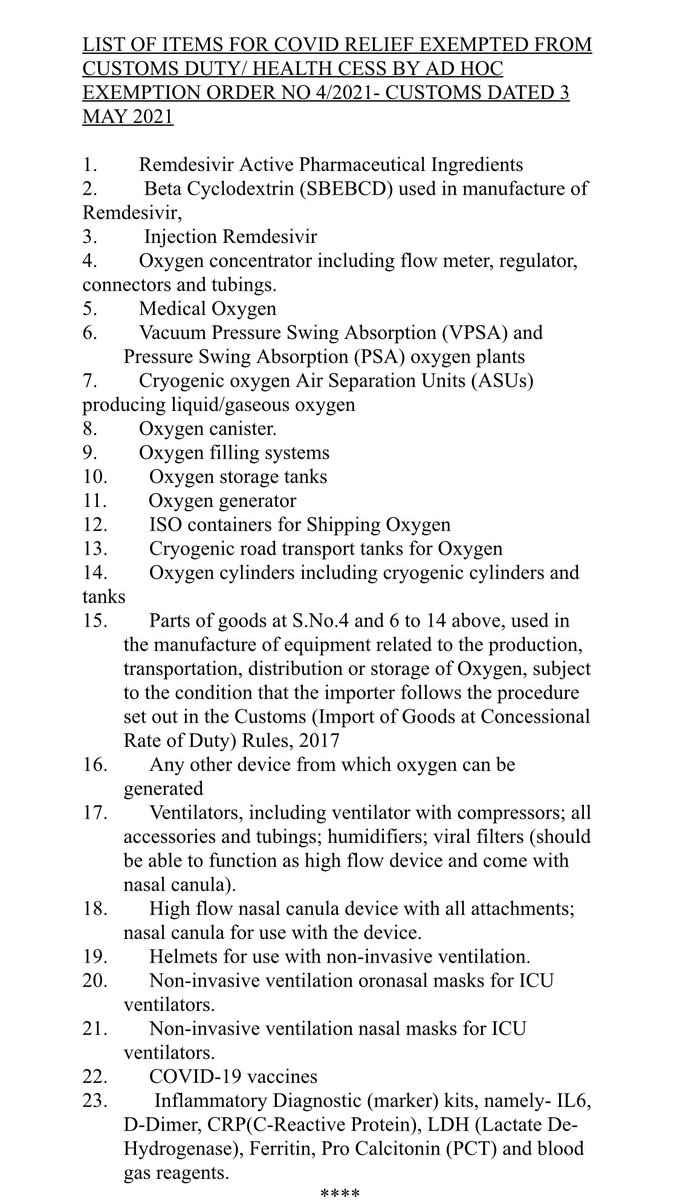

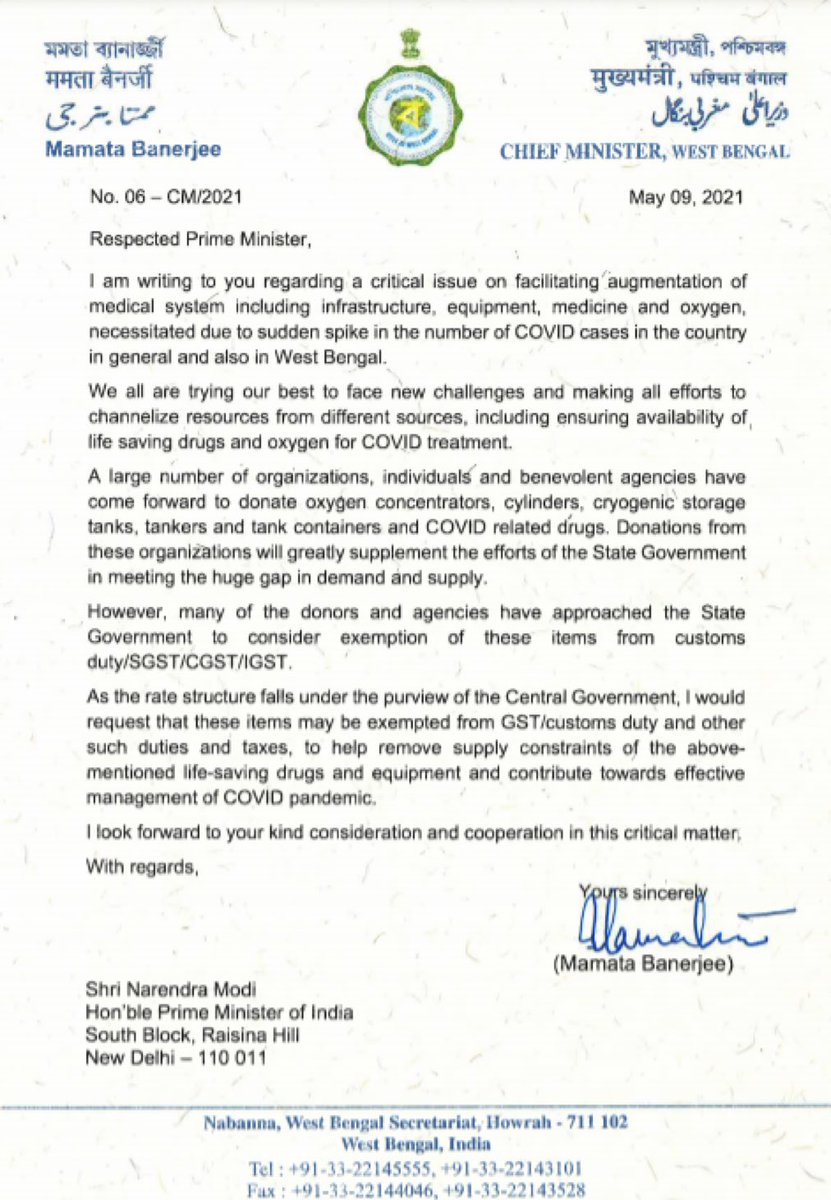

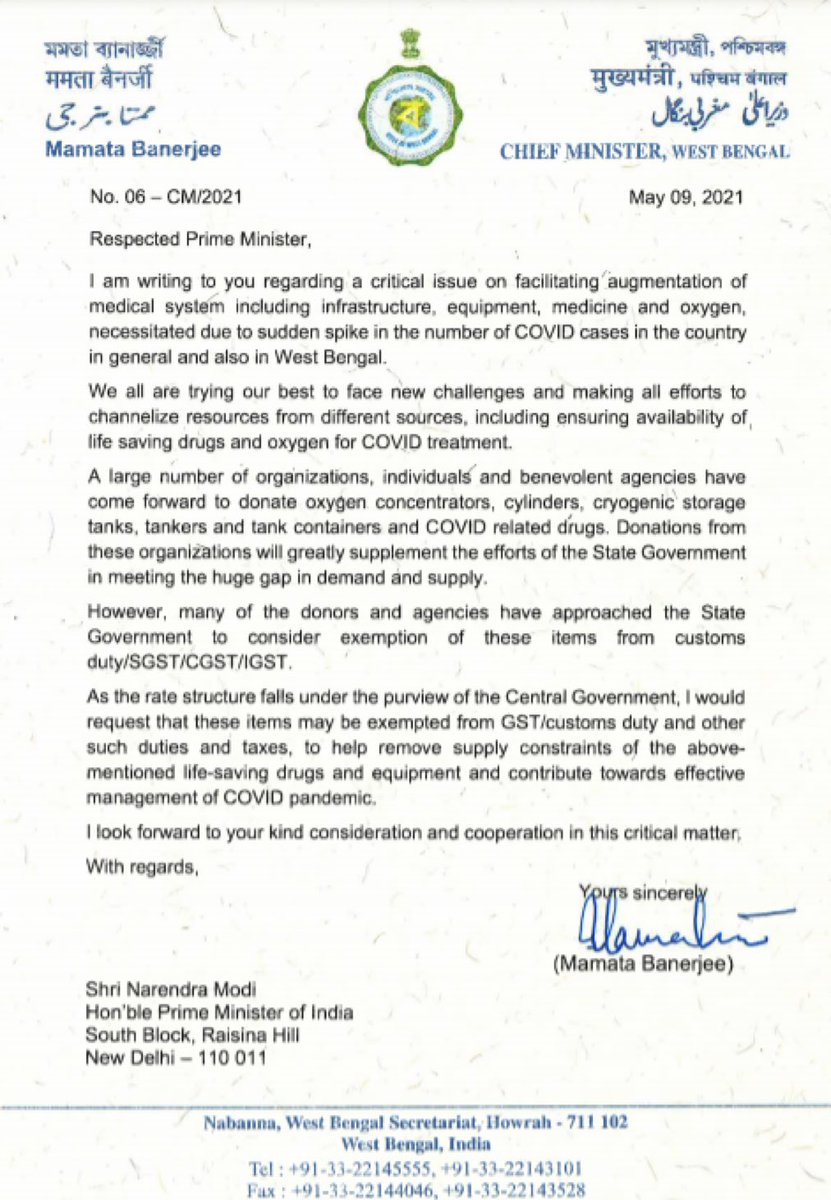

2/ A list of items for COVID relief granted exemption from IGST for imports was issued on 3rd May’21. These were given exemption from Customs Duty/health cess even earlier.

2/ A list of items for COVID relief granted exemption from IGST for imports was issued on 3rd May’21. These were given exemption from Customs Duty/health cess even earlier.