Building @AllianceDAO (https://t.co/EjVNqGk2qA). Former co-founder @coinmetrics (acquired). Decentralizing finance.

How to get URL link on X (Twitter) App

https://twitter.com/clintehrlich/status/1702018060411093160hindustantimes.com/world-news/two…

https://twitter.com/Noahpinion/status/1590025032323203073

It's such a stupidly simple concept to grasp the differences here.

It's such a stupidly simple concept to grasp the differences here.

https://twitter.com/AdamLevitin/status/15509909676705546242/ 1️⃣ Let’s start with the odd fetish of some to retroactively label ETH, a 7-year-old asset, a security.

https://twitter.com/naval/status/12519547013707489281. The sooner full lockdowns are implemented the better. Sweden's top epidemiologist says as much.

https://twitter.com/QWQiao/status/11316326466505850892/ This transparency will not be easily accessible to all.

https://twitter.com/AriDavidPaul/status/1079582714217533440I call such claims "Trumpisms" -- not only b/c they appeal to populist sensibilities but more importantly b/c they're vague and non-specific.

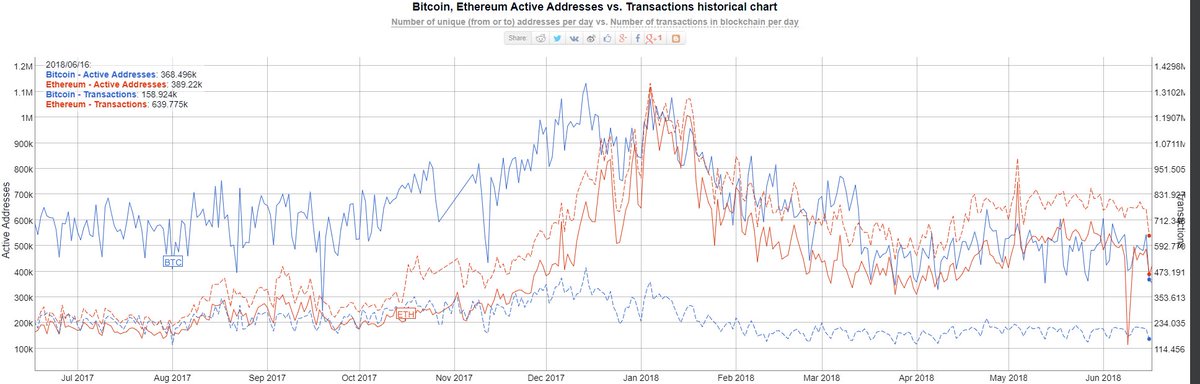

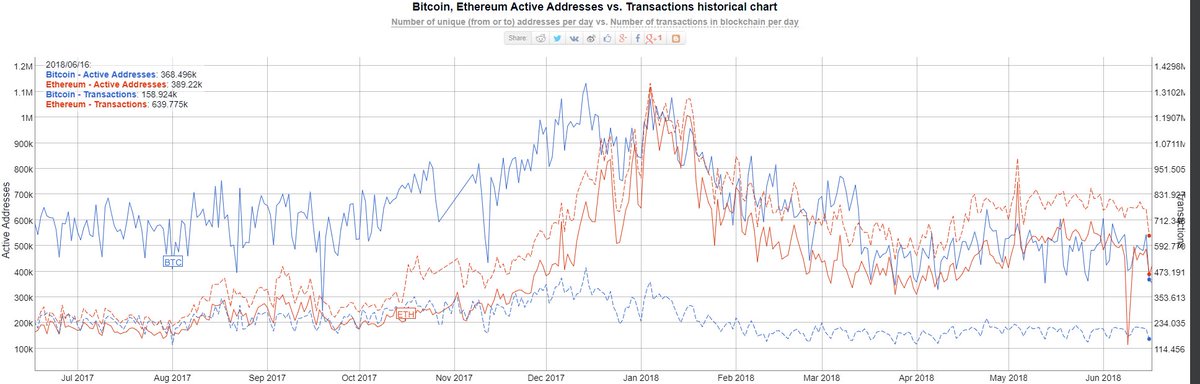

https://twitter.com/TuurDemeester/status/10787528380445327422/ For starters, BTC is not a meaningful SC or token issuance protocol today. ETH has perhaps 10-50x+ more contracts written and contract devs than BTC and 1000s of tokens.

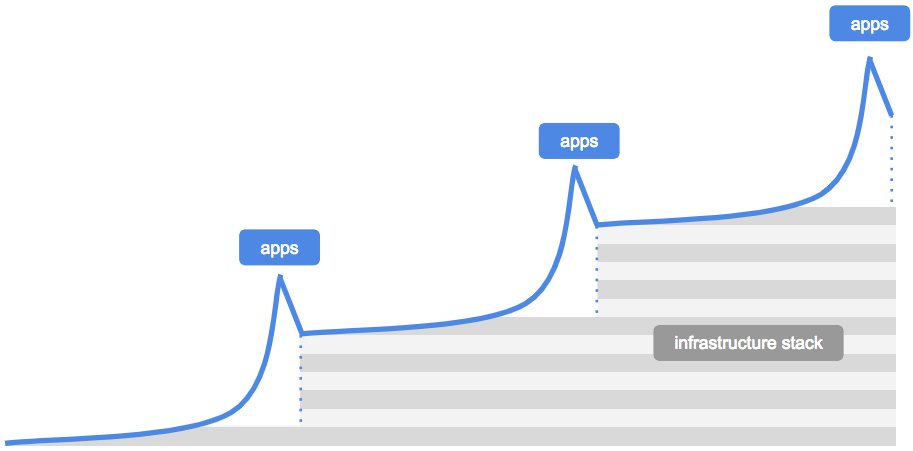

https://twitter.com/Ataraxia_Invest/status/10385360768503562242/ @DharmaProtocol is an "open finance" lending protocol. It lays the foundation for building user-facing crypto lending apps on top.

2/ In individual exit, costs are lower but not necessarily “low”.

External Tweet loading...

If nothing shows, it may have been deleted

by @taylorpearsonme view original on Twitter

3. On-chain tx vol has dropped likely b/c of chilled ICO environment (+ market crash). Can't ignore the broader market contexts.

External Tweet loading...

If nothing shows, it may have been deleted

by @BMBernstein view original on Twitter

2/

External Tweet loading...

If nothing shows, it may have been deleted

by @arjunblj view original on Twitter

2/ Many coins share the same fundamental properties of neo-gold. Let's call these "FPs". The exact FPs are not universally agreed upon but typically include the following:

External Tweet loading...

If nothing shows, it may have been deleted

by @arjunblj view original on Twitter