📈 Trading Education | Indian Markets 🧠 Price Action • Risk • Psychology 🚫 No tips • No hype 👇 Start learning trading the right way

5 subscribers

How to get URL link on X (Twitter) App

Donchain Channel is a very interesting Trend Following Tool which looks as shown below. The UPPER LINE is called UPPER BOUNDARY and the LOWER LINE is called LOWER BOUNDARY. Trades can be set up in two manners

Donchain Channel is a very interesting Trend Following Tool which looks as shown below. The UPPER LINE is called UPPER BOUNDARY and the LOWER LINE is called LOWER BOUNDARY. Trades can be set up in two manners

ACCUMULATION - MARKUP - DISTRIBUTION - MARK DOWN

ACCUMULATION - MARKUP - DISTRIBUTION - MARK DOWN

The price initially bounces but soon it traps and falls below the zone takes of the SL and then the trader puts a question mark on his capabilities to trade. See firstly there is nothing wrong in trading with zones I personally trade with zones but the mistake here is..

The price initially bounces but soon it traps and falls below the zone takes of the SL and then the trader puts a question mark on his capabilities to trade. See firstly there is nothing wrong in trading with zones I personally trade with zones but the mistake here is..

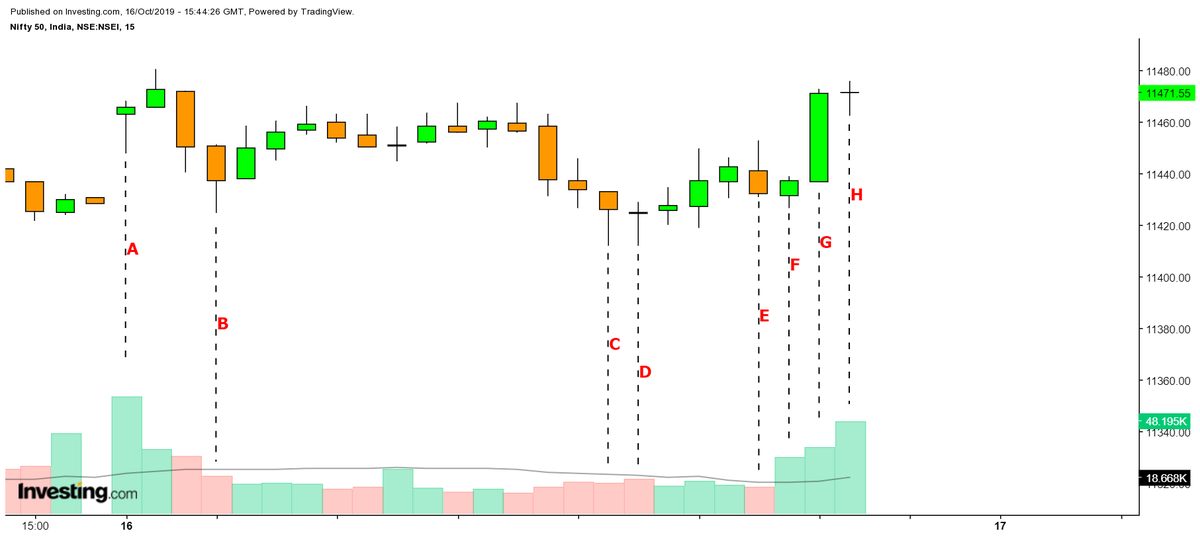

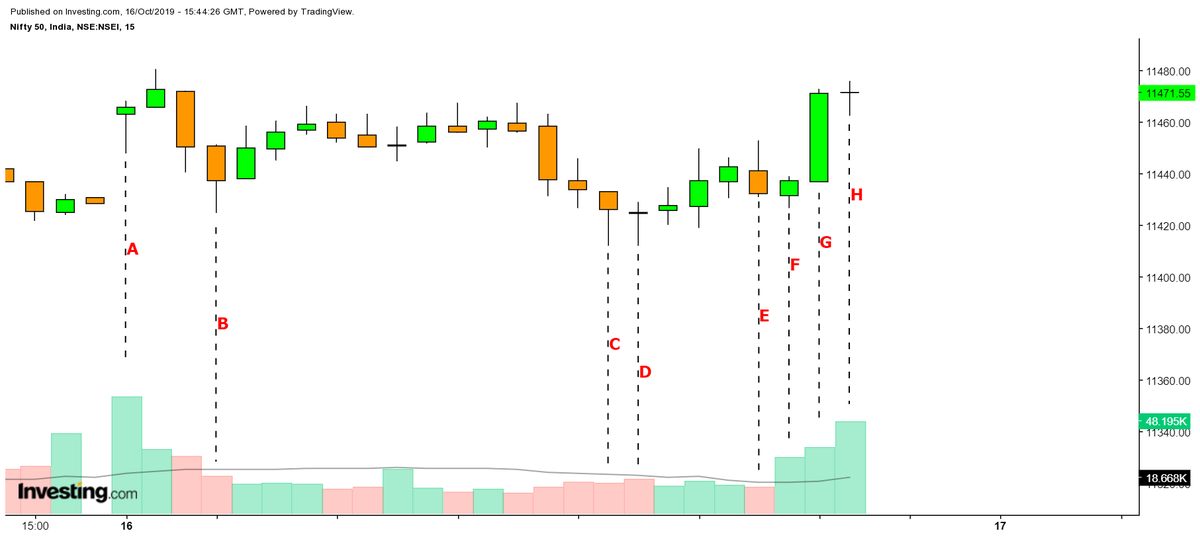

POINT-A: The day started with an UP-BAR and that too combined with GAP-UP which locked most of the traders who held SHORT trades from last trading session but remember this move was not enough because who has more money will always over-rule and thus SMART HANDS initiated "SELL"

POINT-A: The day started with an UP-BAR and that too combined with GAP-UP which locked most of the traders who held SHORT trades from last trading session but remember this move was not enough because who has more money will always over-rule and thus SMART HANDS initiated "SELL"