#BTC 🟠 $ETH 🦇🔊 analyst | Activist Investing | Philosophy | TELEGRAM: https://t.co/jyZ5njbGhC

How to get URL link on X (Twitter) App

@glassnode #Bitcoin % Supply in Profit hit a new cycle low.

@glassnode #Bitcoin % Supply in Profit hit a new cycle low.

But to be fair, this crash is significant because it has brought #Bitcoin down to the level in sync with previous cycle bottoms.

But to be fair, this crash is significant because it has brought #Bitcoin down to the level in sync with previous cycle bottoms.

In a secular bearmarket, the "only only" mentality gets tested then shattered. People will ask "how is this possible?", we saw a hint of this when #BTC fell below previous cycle top $20k.

In a secular bearmarket, the "only only" mentality gets tested then shattered. People will ask "how is this possible?", we saw a hint of this when #BTC fell below previous cycle top $20k.

In the 2017 cycle, after #BTC passed the previous ATH of $1k, there were 7 corrections that are >25% (3 of them are >35%), except for the last one, the first 6 were all good buying opportunities. After the 6th correction, BTC went from $6k -> $19k ATH.

In the 2017 cycle, after #BTC passed the previous ATH of $1k, there were 7 corrections that are >25% (3 of them are >35%), except for the last one, the first 6 were all good buying opportunities. After the 6th correction, BTC went from $6k -> $19k ATH.

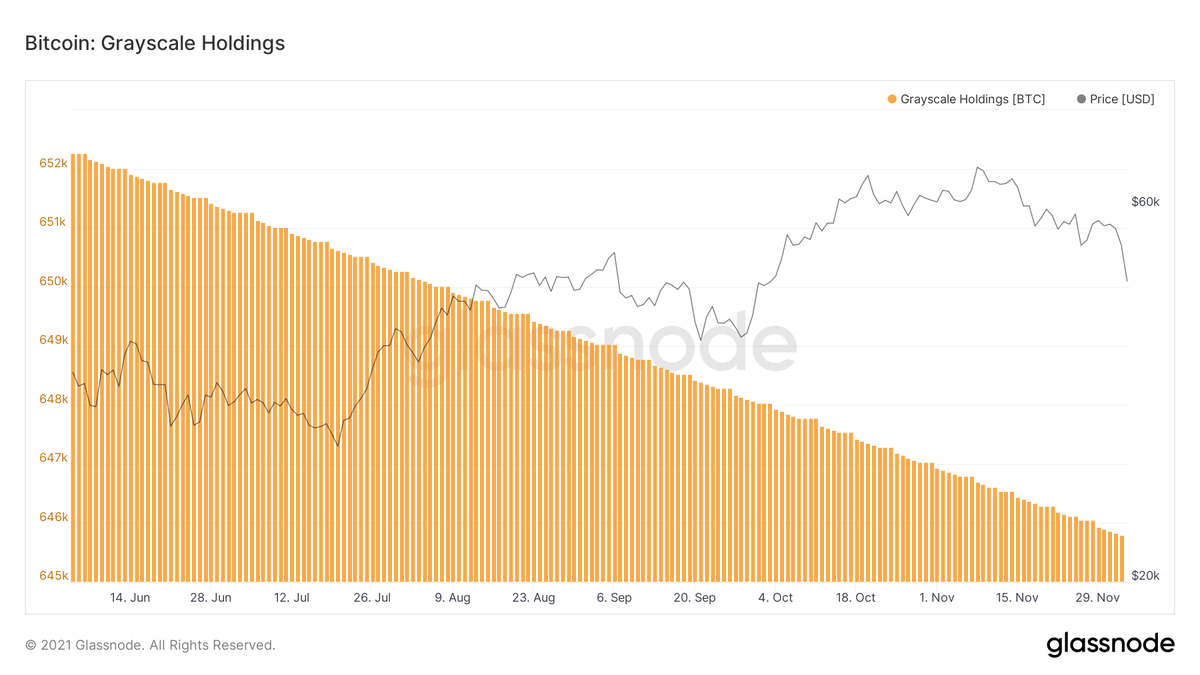

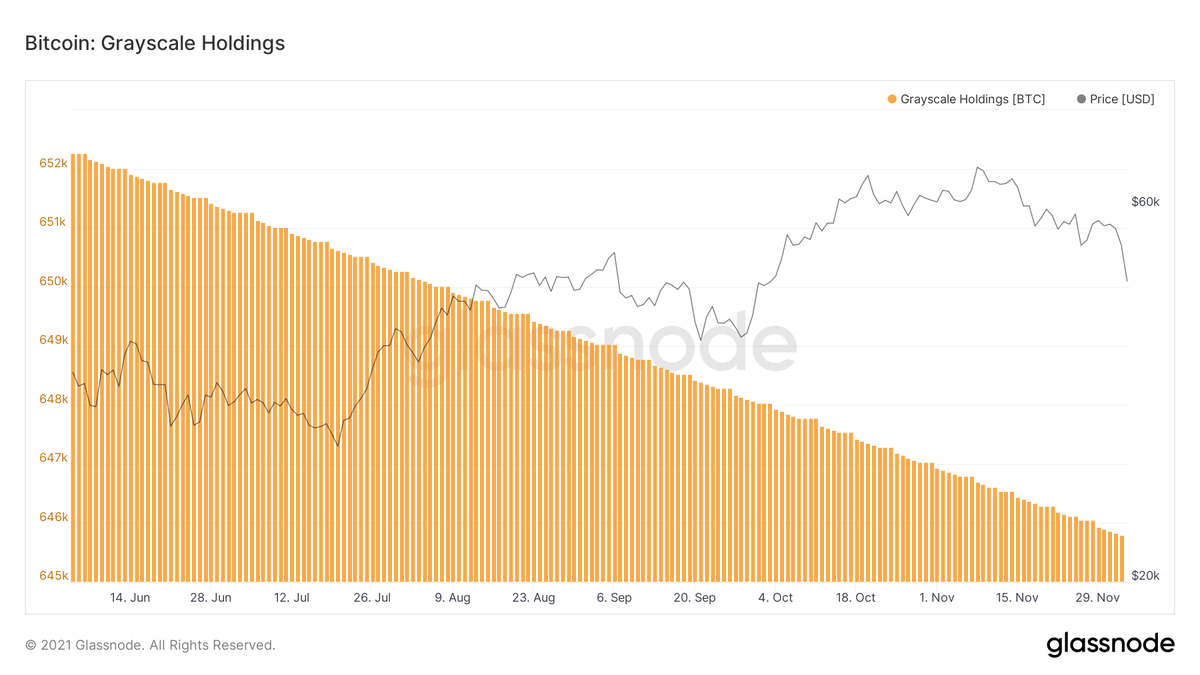

In contrast, last December, #Grayscale was buying BTC aggressive due to their trust premium.

In contrast, last December, #Grayscale was buying BTC aggressive due to their trust premium.