So team #RE100 were in town today. And while it's a needed & valuable thing to get corporate buy‑in on renewables, no one benefits ultimately when the sales pitch amounts to a shell game.

(skip to 3:30 for start of actual interview) 1/x

(skip to 3:30 for start of actual interview) 1/x

Now we're only talking breakfast radio, so a touch light & frothy, but that's *exactly* the audience that needs to understand the fact that #RE100 is not actual low carbon. It's "marketing" 💯% renewables. The approach requires use of fossil fuels. 2/x thebreakthrough.org/index.php/voic…

And they certainly didn't take the opportunity to delve into any inconvenient detail on the more serious AM bulletin. Why not treat the audience with some respect?

Here for posterity, but also available at the source below. 3/x abc.net.au/radio/sydney/p…

Here for posterity, but also available at the source below. 3/x abc.net.au/radio/sydney/p…

The people already onside (continue to) think it's easier than it actually is. It's not easy.

Those distrustful of the whole thing just become even more sceptical …if that's even possible.

Bottomline it's not helping on the culture war side of things. 4/x

Those distrustful of the whole thing just become even more sceptical …if that's even possible.

Bottomline it's not helping on the culture war side of things. 4/x

An inside view can be found here, from the perspective of the corporates. And it does make sense from their perspective. If I was in their shoes, I'd do exactly what they are doing. 5/x

https://twitter.com/simonahac/status/1055234996884058112

First, they are buying a hedge against current & future electricity prices. It's a no brainer. And there's PR gold thrown in for good measure.

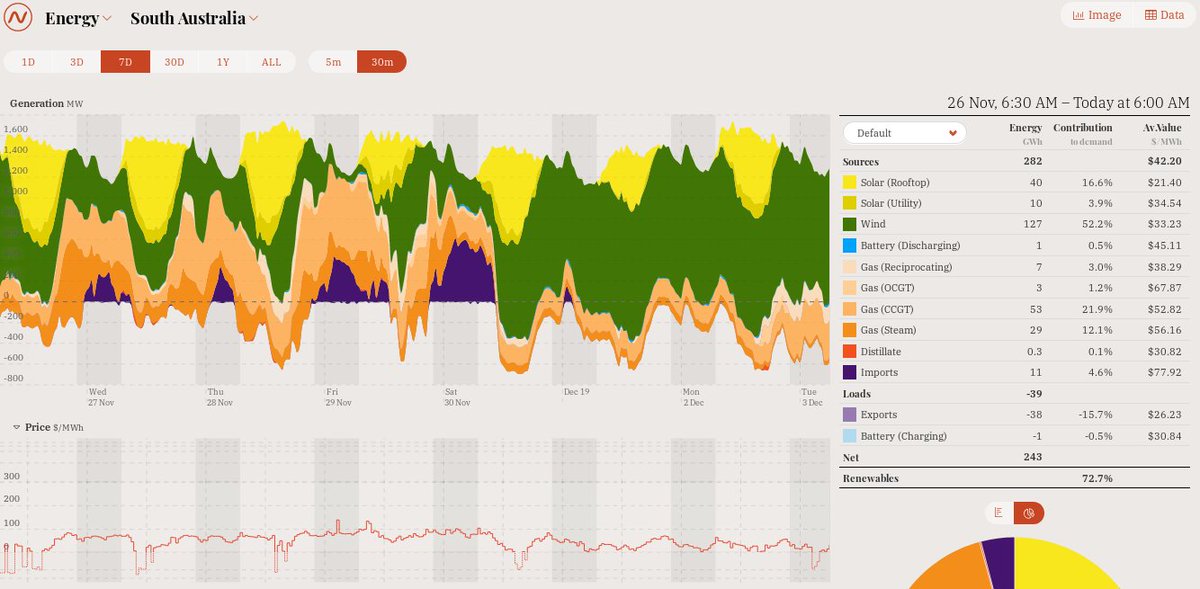

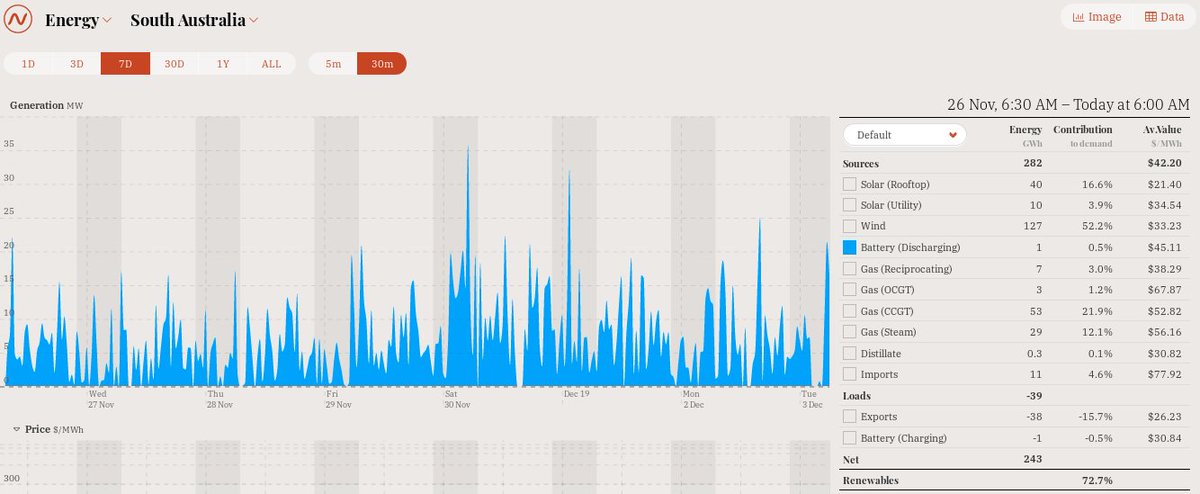

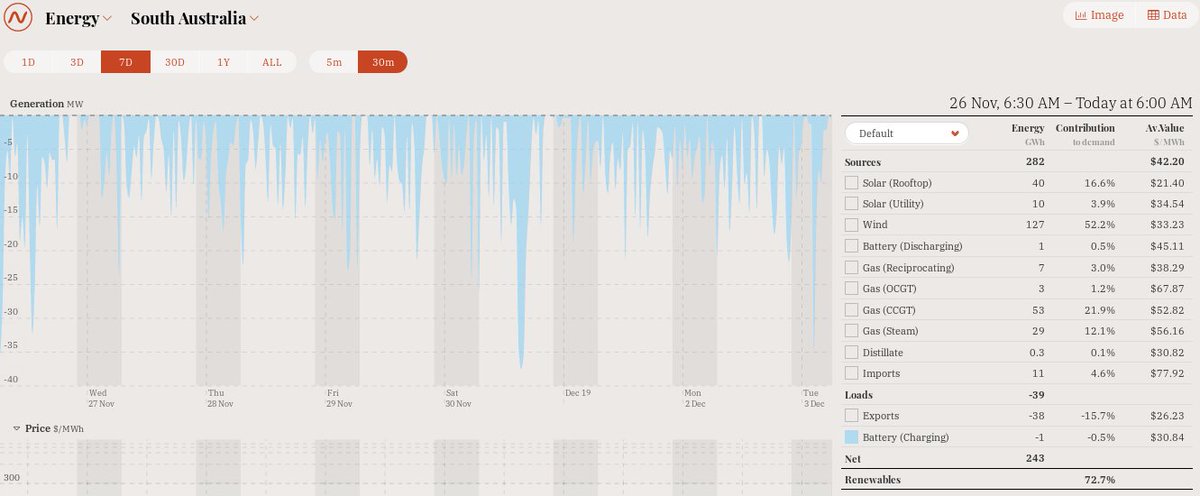

But there's a but, and it looks like this… 6/x

But there's a but, and it looks like this… 6/x

As more intermittent & variable renewables become more of the mix that minimum baseload demand drops. This is effectively the level that the combined coal plant output needs to dial down too. And some will leave the market early. 7/x

https://twitter.com/JonDeeOz/status/1054586256594632704

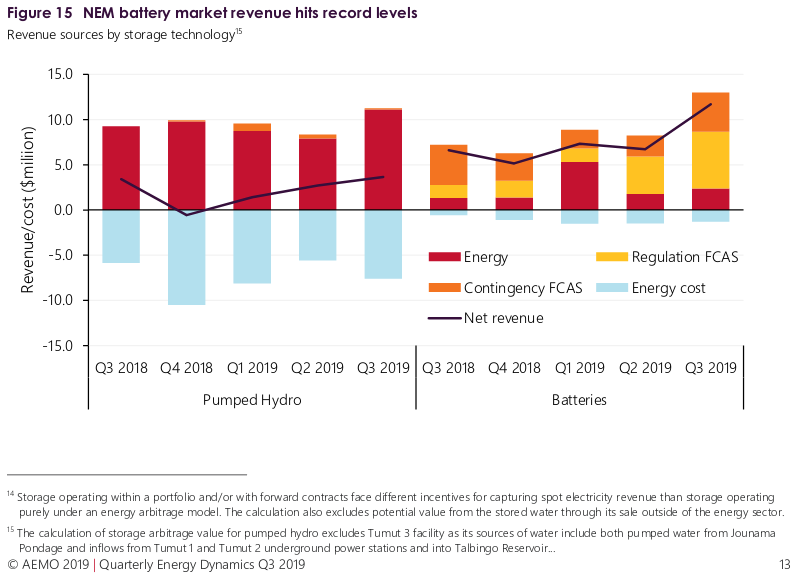

Which seems like a good thing at first, as coal does need to go; however in that load duration curve from earlier, the *peak* residual demand won't drop much, and the firm dispatchable source that fills that gap will almost certainly be …Gas. 8/x

Which will force prices up for everyone, except those corporates having already used their purchasing power to nail down a nice #RE100 pricing hedge.

If you think the whole electricity prices drama now is a problem, just wait. 9/x

If you think the whole electricity prices drama now is a problem, just wait. 9/x

We are in need of a *better* plan. One that pulls it all apart & deals with all the moving parts.

And there's no quick & easy way to the right answer; it's certainly above the pay grade of the Marketing department. 10/x fastcompany.com/90251085/googl…

And there's no quick & easy way to the right answer; it's certainly above the pay grade of the Marketing department. 10/x fastcompany.com/90251085/googl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh