This is a non-trivial issue though, so `lil tweet storm… 1/×

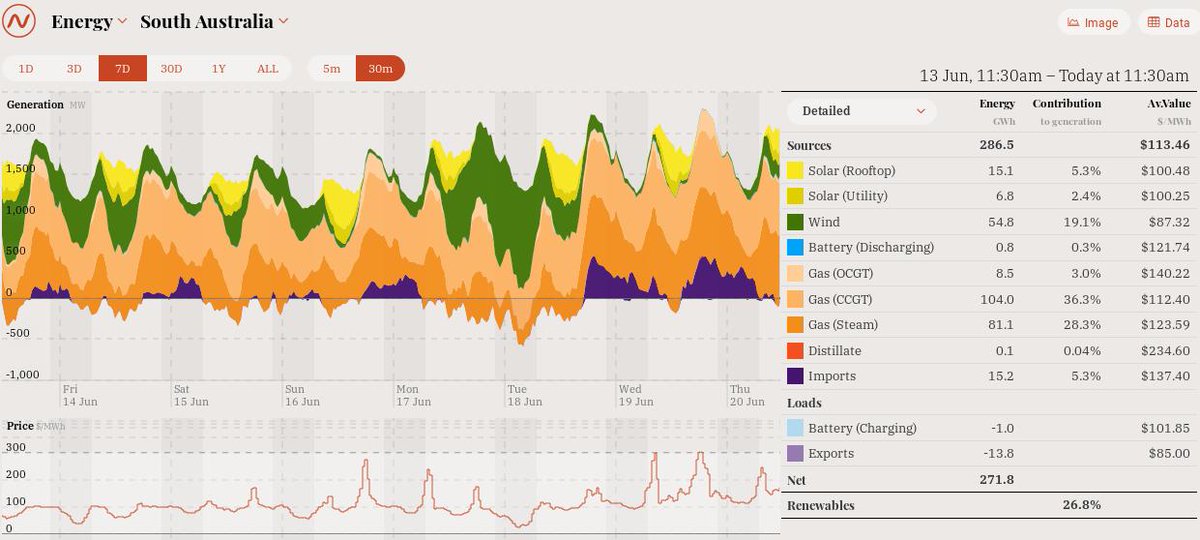

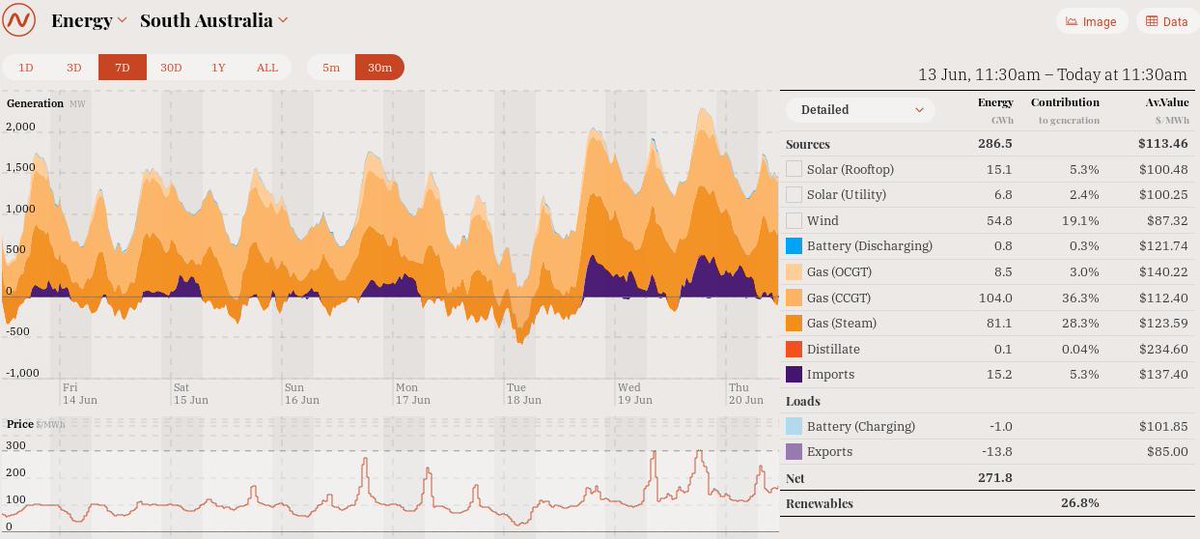

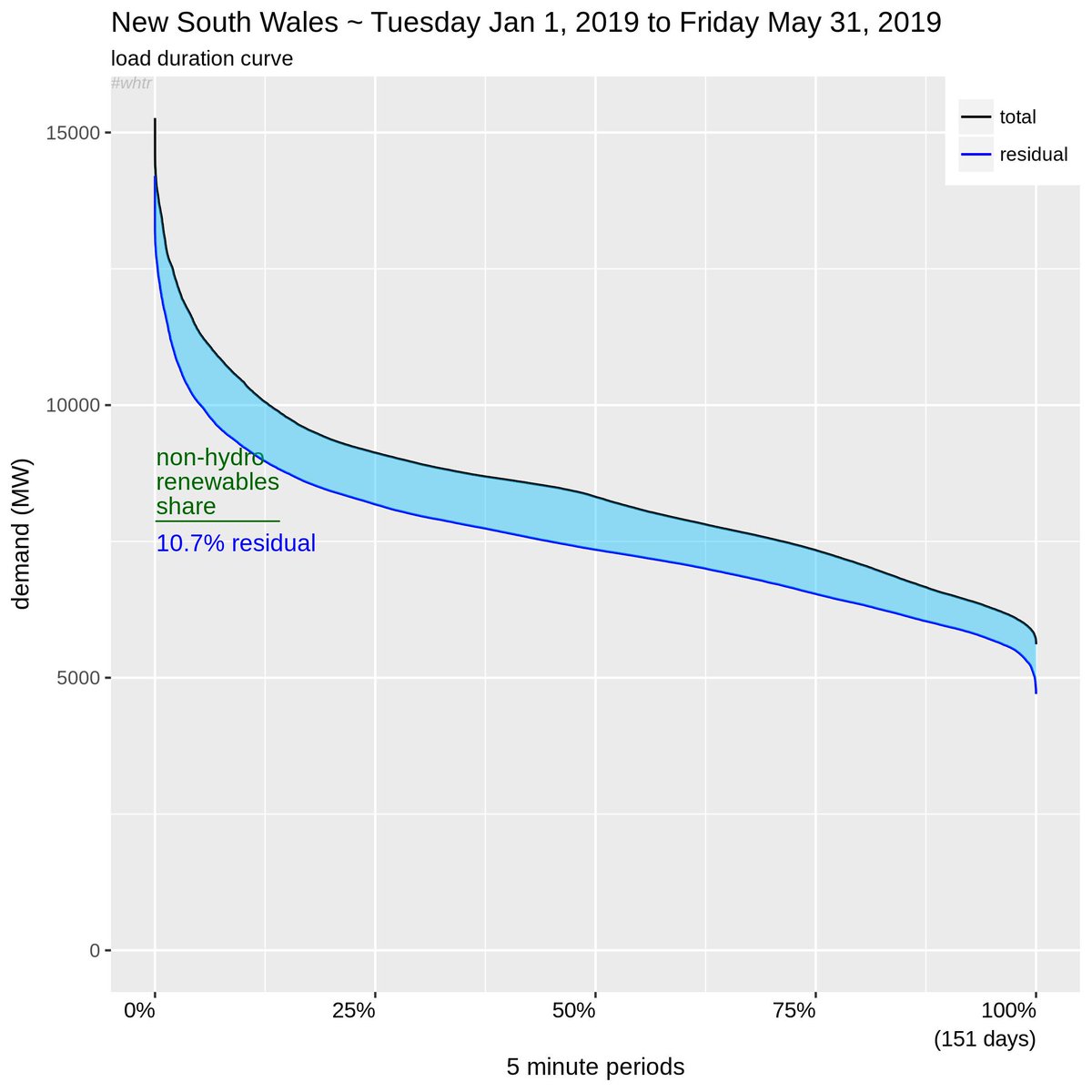

Now look at the current, existing data in SA or California. 2/×

This is obviously the opposite of the large chunks of time-shifted energy we need practically. 3/×

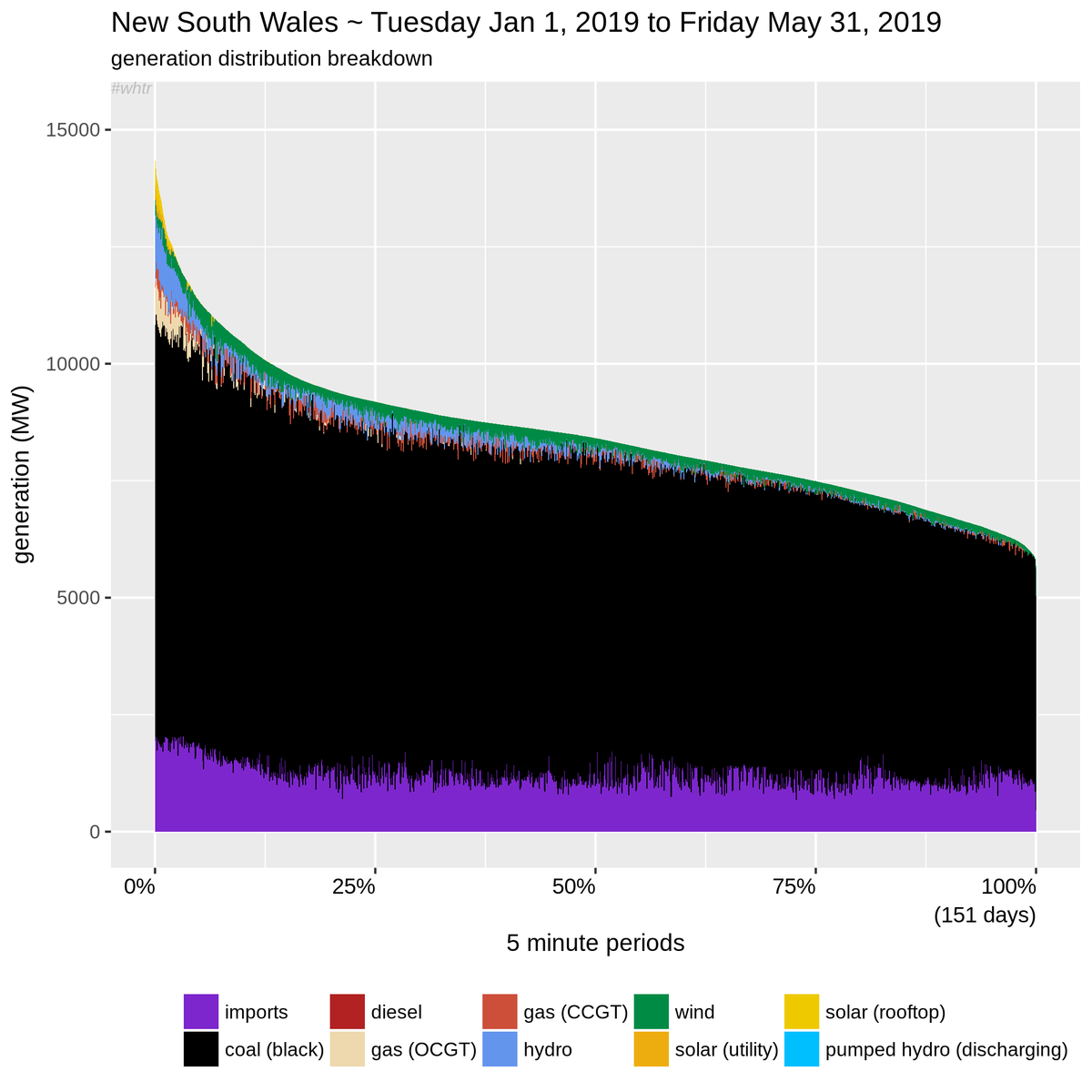

Maybe. But the implications of larger storage installed is daunting. The first, say 10% of the stored energy = profit. 5/×

This is how arbitrage, with its zero sum nature, begins to in effect backfire. 6/×

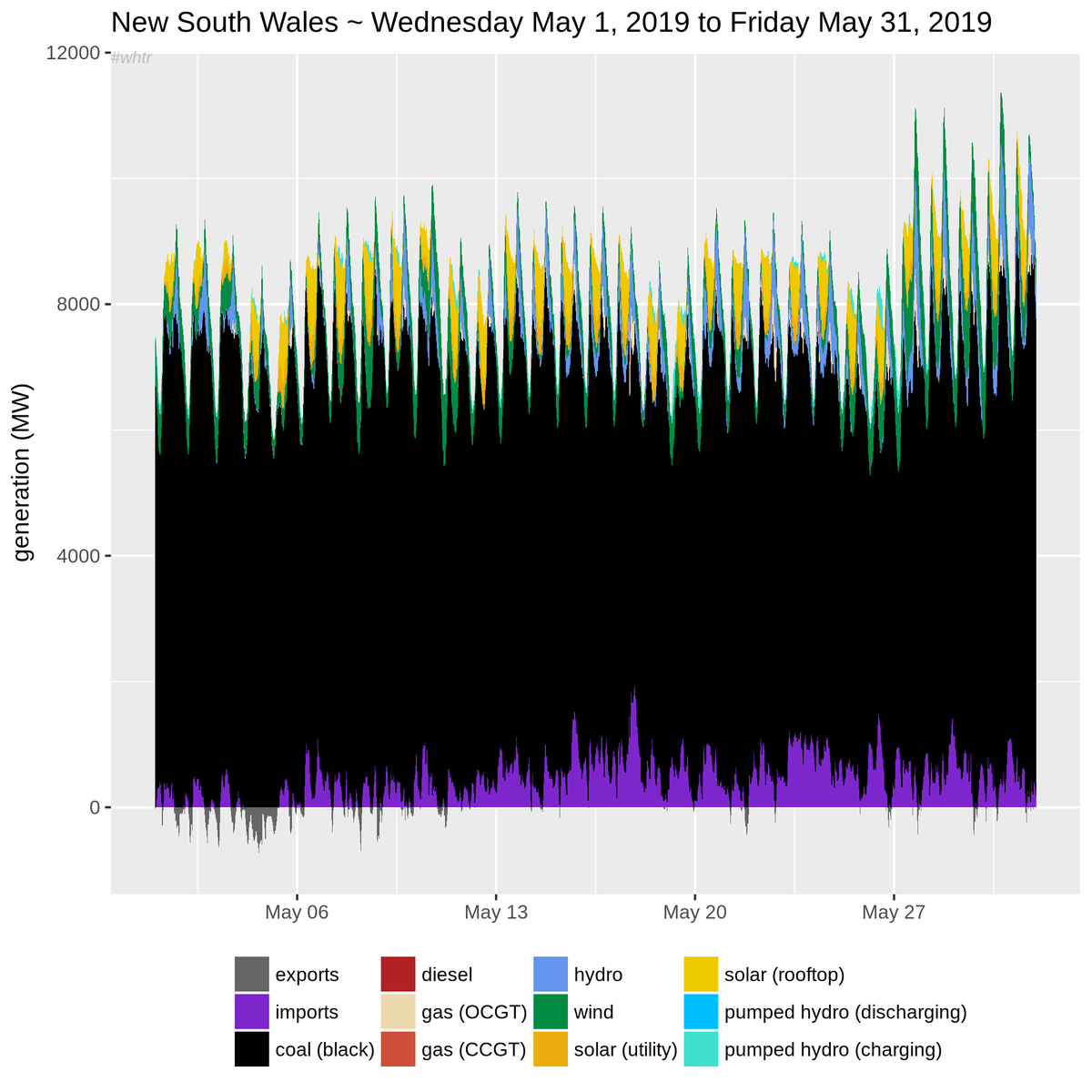

So now Snowy 2.0 (see * previously).

Think about that for a moment. It's important. 8/×

Already the first signs of this happening. But the gas/diesel plants are staying.] 9/×

There's been discussion of running a system with VRE deliberately curtailed in part because this minimises storage requirements (hi @DavidOsmond8!). The pricing effects on solar/wind farms? Not great. 10/×

Worth a PhD thesis or 3 I suspect. 11/×

Second extra point: the game theory of OCGTs vs CCGTs. A GE gas plant in California will close early, site to become storage facility… but it's not a peaker.12/×